Market Overview

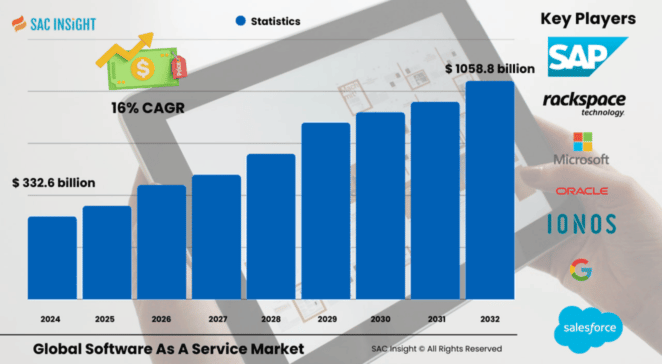

The global software as a service market size was valued at approximately US$ 332.67 billion in 2024 and is on track to reach nearly US$ 1,058.85 billion by 2032, expanding at a 16.0% CAGR from 2025-2032. First-hand industry insights highlight three structural forces behind this market growth: a rapid shift to cloud-first IT strategies, mounting demand for AI-enabled automation, and subscription-based revenue models.

SAC Insight's deep market evaluation shows the U.S. leading innovation with roughly 17,000 active SaaS firms and a revenue pool expected to top US$ 450 billion by 2032 as digital transformation budgets keep climbing.

Summary of Market Trends & Drivers

• Businesses are embracing multi-cloud and hybrid-cloud architectures to avoid vendor lock-in and comply with data-sovereignty rules, propelling new SaaS deployments.

• The rise of micro-SaaS—high-margin, niche applications built on low overhead and automation—underscores the market’s agility and signals fresh investment avenues.

• Generative AI is being embedded across CRM, ERP, and collaboration suites, slashing manual workloads and personalizing user experiences at scale.

Key Takeaways

• 2024 SaaS market value: USD$ 332.67 billion

• 2032 projection: USD$ 1,058.85 billion at a 16.0% CAGR

• Software accounted for about 84% of 2024 revenue; services are the fastest-gaining component as firms seek implementation expertise.

• CRM retained the largest application market share, while content, collaboration & communication solutions show the highest forecast CAGR.

• Private cloud deployments dominate today, but hybrid strategies are the clear growth engine through 2032.

• SMEs are widening adoption thanks to pay-as-you-go pricing, even as large enterprises maintain budgetary clout.

Key Market Players

Global SaaS leading companies such as Adobe, Microsoft, Salesforce, and Google set the competitive tempo with continuous product refreshes, sizable R&D budgets, and strategic M&A that extend platform capabilities into analytics, low-code development, and cybersecurity. A strong second tier—including IBM, Oracle, SAP, Cisco, Atlassian, VMware, and ServiceNow—leverages deep enterprise relationships and vertical expertise to capture market share in regulated sectors like BFSI and healthcare. Emerging challengers from Asia-Pacific and Europe focus on localized compliance and price-sensitive segments, ensuring a dynamic competitive landscape.

Market Dynamics

Drivers

• Cost-effective scalability and reduced IT overhead compared with on-premises software.

• Increased remote and hybrid work patterns elevating demand for cloud-native collaboration and security.

• Continuous product innovation in AI, analytics, and low-code development platforms.

Restraints

• Rising concerns over data privacy, sovereignty, and cross-border compliance.

• SaaS misconfigurations—linked to 63% of recent security incidents—undermine user confidence.

• Vendor lock-in anxiety prompting some firms to delay full migration.

Opportunities

• Growth of SaaS superapps bundling multiple mini-apps and monetization channels in a single interface.

• Rapid uptake of vertical SaaS for healthcare, education, and fintech—segments that demand regulatory compliance and domain-specific workflows.

• Expansion in emerging markets where smartphone penetration outpaces legacy IT infrastructure.

Challenges

• Intensifying talent shortage for cloud security and DevOps specialists.

• Heightened regulatory scrutiny around AI-generated content and data residency.

• Competitive pressure on pricing as micro-SaaS and open-source alternatives proliferate.

Regional Analysis

North America remains the revenue leader owing to deep cloud infrastructure spend, a robust startup ecosystem, and strong enterprise appetite for digital innovation. Europe is closing the gap as GDPR-aligned solutions gain trust, while Asia-Pacific posts the fastest market growth on the back of mobile-first economies and supportive government cloud programs. An opportunity exists in refining the U.S. revenue pool estimates to fully represent the projected CAGR figures.

• North America – Early adopter advantage, mature ecosystem, continued AI investment

• Europe – Strict data-privacy rules drive demand for compliant SaaS platforms

• Asia-Pacific – Highest CAGR; mobile commerce, fintech, and e-learning spur uptake

• Latin America – Cloud-native startups and competitive pricing boost penetration

• Middle East & Africa – Smart-city initiatives and public-sector digitization fuel incremental demand

Segmentation Analysis

By Component

• Software – Dominant revenue generator

Software holds most of the market share because turnkey cloud applications for CRM, ERP, and HRM are easy to deploy, scale, and update without heavy capital outlay.

• Services – Fastest-growing slice

Consulting, integration, and managed services are climbing as enterprises seek to fine-tune configurations, embed security, and maximize ROI.

By Application

• Customer Relationship Management (CRM) – Largest share

Companies lean on CRM to unify sales, marketing, and service data, unlocking AI-driven insights and personalized engagement.

• Enterprise Resource Planning (ERP) – Core operating backbone

Modern ERP in SaaS form cuts maintenance costs and provides real-time visibility into finance, supply chain, and inventory.

• Human Capital Management – Expanding steadily

Cloud-based HR suites automate talent acquisition, payroll, and analytics, supporting global workforces.

• Content, Collaboration & Communication – Highest forecast CAGR

Video conferencing, real-time document editing, and asynchronous chat are indispensable for hybrid teams, spurring rapid subscription growth.

• BI & Analytics – Data-driven momentum

Self-service dashboards and predictive modeling help organizations make faster decisions and spot opportunities.

• Others – Niche but essential

Specialized tools for governance, risk, and operations round out enterprise stacks.

By Deployment

• Private Cloud – Current preference for control and security

Highly regulated sectors keep data close while still enjoying SaaS convenience.

• Public Cloud – Ubiquitous foundation

Public IaaS platforms provide elastic capacity and cost efficiency for most horizontal apps.

• Hybrid Cloud – Breakout growth

Blending on-prem and cloud resources lets firms migrate at their own pace and stay compliant.

By Enterprise Size

• Large Enterprises – Budget and complexity champions

These organizations favor multi-cloud, platform-as-a-service, and deep integrations to manage global operations.

• SMEs – Fastest uptake

Subscription pricing and minimal infrastructure needs make SaaS the default choice for smaller teams seeking scale.

By Industry

• BFSI – Highest revenue contributor

Banks and insurers rely on SaaS for customer insights, fraud detection, and regulatory reporting.

• IT & Telecom – Leading early adopters

Providers leverage SaaS to enhance service delivery and network operations.

• Retail & Consumer Goods – Omnichannel imperative

E-commerce acceleration drives demand for inventory visibility and personalized marketing.

• Healthcare – Top CAGR outlook

Telehealth, electronic health records, and AI diagnostics push cloud adoption.

• Education – Digital learning surge

Learning management systems support remote and hybrid classrooms.

• Manufacturing – Smart factory integration

Cloud-based MES and supply-chain SaaS link plants with partners.

• Others – Travel, hospitality, and media expand usage for customer experience and asset management.

Industry Developments & Instances

• December 2024 – A medical-imaging specialist launched an integrated SaaS platform that unifies advanced visualization and AI-driven diagnostics for enterprise health networks.

• November 2024 – A zero-trust security tie-up extended endpoint protection into multi-vendor SaaS environments.

• July 2024 – A core-banking collaboration introduced turnkey SaaS for electronic money institutions across Europe.

• December 2024 – A financial reporting vendor integrated over 100 cloud and on-prem apps to automate compliance workflows.

• October 2024 – A cloud pioneer unveiled a dedicated government cloud suite for secure, low-code application development.

• September 2024 – A cybersecurity firm acquired SaaS threat-detection assets to bolster AI-powered security operations.

• May 2023 – A master-data provider migrated its solutions to a major hyperscaler to speed customer deployments.

• February 2023 – A leading cloud vendor rolled out componentized banking services to streamline retail and corporate offerings.

Facts & Figures

• Around 73% of organizations actively used SaaS applications in 2023, and the share continues to rise.

• Micro-SaaS ventures report profit margins between 70-80% due to lean operations and automation.

• Hybrid-cloud investment plans jumped to 86% of U.S. enterprises in 2024, reflecting an urgent need for flexibility.

• 63% of SaaS security incidents stem from misconfigurations, underscoring the value of managed configuration services.

• Europe counts 65% enterprise SaaS penetration, double the figure recorded five years ago.

• Venture funding for SaaS startups exceeded US$ 50 billion in 2021, fueling an active M&A pipeline.

• European SMEs show 43% adoption of cloud-based business apps, creating a significant long-tail opportunity.

Analyst Review & Recommendations

The SaaS landscape is shifting from broad, one-size-fits-all suites towards domain-specific, AI-enhanced platforms that deliver measurable business outcomes. Established vendors should double down on open APIs and compliance tooling to lock in enterprise accounts, while new entrants can win by targeting micro-SaaS niches and embedding generative AI for differentiated experiences. Addressing configuration security, investing in hybrid-cloud orchestration, and expanding managed-service bundles will be the keys to sustaining healthy market share as adoption accelerates through 2032.