Market Overview

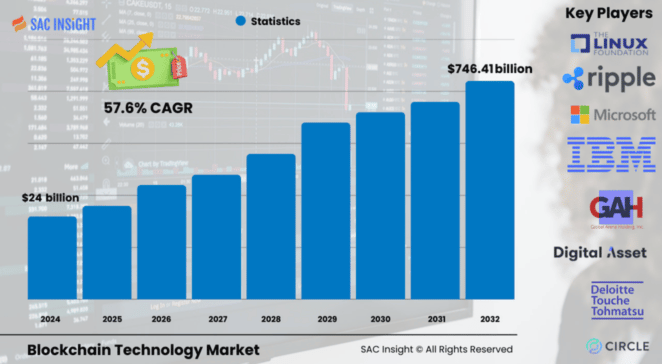

The blockchain technology market size stood at US$ 24 billion in 2024 and is projected to climb to about US$ 746.41 billion by 2032, registering an a CAGR of nearly 57.6% over 2025‑2032. SAC Insight analysis also shows a decisive post‑pandemic rebound in enterprise IT budgets, with blockchain pilots moving into full production across finance, supply‑chain, and public‑sector workflows. The U.S. blockchain market is on track to surpass US$ 1,259.57 billion by 2032, reflecting aggressive adoption by financial institutions, cloud providers, and federal agencies.

SAC Insight industry insights highlight three structural forces behind this exceptional market growth:

• A rapid shift toward digital, border‑agnostic payments that depend on tamper‑proof ledgers.

• Escalating cyber‑risk that is pushing enterprises to adopt immutable, transparent data layers.

• A maturing ecosystem of Blockchain‑as‑a‑Service (BaaS) offerings that cut deployment time and cost.

Summary of Market Trends & Drivers

• BaaS momentum: Subscription‑based platforms are turning complex distributed‑ledger builds into quick, cloud‑native rollouts.

• Tokenisation & DeFi: Growing interest in asset tokenisation, stablecoins, and decentralised finance is widening the addressable user base.

• Digital‑identity push: Rising identity fraud is accelerating demand for blockchain‑secured credentialing across healthcare, travel, and government portals.

Key Market Players

The competitive landscape features global blockchain technology market majors and specialised ledger providers alike. Dominant vendors deliver full‑stack platforms, while a vibrant cohort of start‑ups focuses on niche layers such as zero‑knowledge proofs, NFT infrastructure, and supply‑chain traceability. Together, these firms set the tempo for innovation through rapid product refreshes, open‑source contributions, and strategic partnerships with cloud hyperscalers. A few headline names command notable market share thanks to extensive partner networks, robust patent portfolios, and proven large‑scale deployments across banking, telecom, and public services.

Key Takeaways

• Blockchain technology industry value (2024): US$ 24 billion

• Projected value (2032): US$ 746.41 billion at 57.6% CAGR

• North America leads with approximately 35% market share; Asia‑Pacific posts the fastest gains.

• BaaS is the quickest‑growing component, fuelled by cloud spending and SME demand.

• Private blockchains dominate revenue today, but hybrid models are closing the gap.

• Cloud deployment delivers the highest incremental market growth due to scalability and lower upfront cost.

Market Dynamics

Drivers

• Surge in cross‑border digital payments and remittances requiring low‑fee, real‑time settlement.

• Escalating data‑breach costs spurring investment in cryptographic ledger security.

• Government initiatives and regulatory sandboxes encouraging blockchain pilots in public services.

Restraints

• Shortage of skilled blockchain architects and auditors slows enterprise roll‑outs.

• High initial integration cost for legacy‑heavy industries such as utilities and manufacturing.

Opportunities

• Tokenised carbon credits and ESG reporting platforms present green‑tech revenue streams.

• Central‑bank digital currency (CBDC) projects open doors for specialised consulting and infrastructure plays.

Challenges

• Interoperability gaps between disparate ledger protocols complicate multi‑chain strategies.

• Evolving compliance frameworks require continuous upgrades to privacy and identity modules.

Regional Analysis

• North America: retains the largest blockchain technology market share thanks to a dense concentration of technology vendors, venture capital, and early‑stage enterprise pilots.

• Europe: follows, buoyed by proactive digital‑currency regulation and cross‑border supply‑chain use cases.

• Asia‑Pacific: led by manufacturing powerhouses and vibrant crypto adoption, is the fastest‑growing region.

• Latin America: Steady uptake in energy & utilities and cross‑border payments.

• Middle East & Africa: Early‑stage pilots in oil & gas logistics and government digital services.

Segmentation Analysis

By Component

• Blockchain‑as‑a‑Service (BaaS) – fastest‑rising, subscription‑friendly.

Enterprises gravitate toward plug‑and‑play BaaS to avoid hefty infrastructure spend and speed up proof‑of‑concept deployments.

• Platform/Solution – stable growth, enterprise‑grade toolkits.

Established frameworks (e.g., Hyperledger‑based stacks) underpin mission‑critical applications in banking, telecom, and public records.

By Type

• Private – revenue leader, permissioned control.

Firms choose private ledgers for transaction privacy, high throughput, and regulatory compliance.

• Hybrid – rapid CAGR, balanced governance.

Hybrid models blend public transparency with private control, gaining favour in healthcare and real estate.

• Consortium – collaboration‑centric.

Industry alliances leverage shared infrastructure to streamline trade finance and insurance processing.

• Public – significant growth in asset tokenisation and NFTs.

Open networks power decentralised apps, digital collectibles, and community governance.

By Deployment

• Proof of Concept – largest share, risk‑mitigation stage.

Firms validate business value before scaling.

• Production – highest CAGR as pilots graduate.

Live, revenue‑generating networks expand across supply chains and identity systems.

• Pilot – bridge between concept and scale.

Short‑cycle pilots refine performance metrics and compliance readiness.

By Application

• Payments – dominant use case, cost‑efficient settlement.

Blockchain cuts intermediaries, accelerates transfers, and lowers fees.

• Digital Identity – fastest CAGR, fraud mitigation.

Secure, user‑controlled credentials reshape onboarding and travel verification.

• Supply‑Chain Management – transparency & anti‑counterfeit.

End‑to‑end traceability for pharmaceuticals, food, and luxury goods.

• Smart Contracts – automated, trust‑less execution.

Code‑based agreements reduce legal overhead in trade and insurance.

• Internet of Things – secure device‑to‑device data exchange.

Ledger‑backed telemetry fortifies industrial IoT networks.

By Industry

• BFSI – market anchor, cost and risk reduction.

Banks deploy distributed ledgers for KYC, trade finance, and clearing.

• Retail & Consumer Goods – highest forecast CAGR.

Provenance tracking and loyalty tokenisation elevate customer trust.

• Government, Energy & Utilities, Healthcare, Manufacturing, Telecom, Travel & Transportation – each scaling blockchain for transparency, efficiency, and data integrity.

Industry Developments & Instances

• Apr 2024: Major ledger provider and global consulting firm unveil audit‑ready blockchain layer for generative‑AI outputs.

• Aug 2023: Cloud titan partners with digital‑asset custodian to launch secure infrastructure for token management.

• Oct 2022: Leading IT services firm updates CBDC‑ready ledger suite, covering issuance through settlement.

• Aug 2022: Managed‑blockchain service adds support for Ethereum and Hyperledger Fabric, simplifying node operations.

• Apr 2022: Semiconductor manufacturer releases energy‑efficient ASIC for proof‑of‑work networks, cutting power draw by ~20%.

• Jan 2023: Cloud provider teams with layer‑1 platform to streamline node deployment for enterprises and governments.

Facts & Figures

• ~80% of Fortune 2000 companies are running or planning blockchain pilots.

• BaaS projects account for 35% of new enterprise blockchain spend in 2024.

• Average cross‑border payment fee falls by up to 70% on blockchain rails.

• Identity fraud losses exceeded US$ 50 billion globally in 2023, accelerating ledger‑based ID projects.

• Private blockchains process >2,000 TPS on average, meeting high‑volume enterprise needs.

• Carbon‑credit tokenisation initiatives could unlock US$ 100 billion in new market value by 2030.

Analyst Review & Recommendations

SAC Insight evaluation indicates blockchain is moving from experimental hype to indispensable digital infrastructure. Vendors that couple secure, interoperable platforms with industry‑specific services will outpace pure‑play protocol providers. Enterprises should prioritise hybrid architectures to balance transparency and control, invest in cross‑chain interoperability, and cultivate in‑house cryptographic skills. Given the projected market growth, early movers in tokenised assets, CBDCs, and identity frameworks are positioned for outsized returns through 2032.