Market Overview

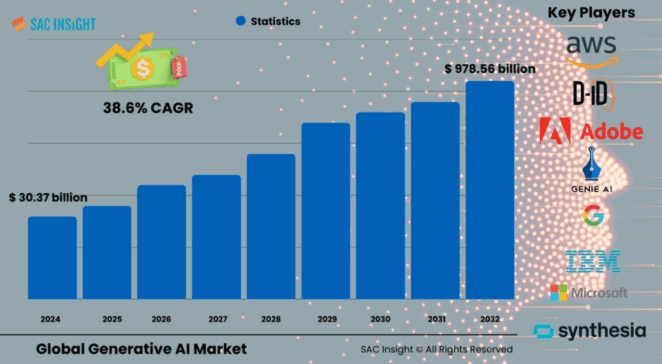

The generative AI market size was valued at about US$ 30.37 billion in 2024 and, according to our SAC Insight analysis, is on track to reach US$ 978.56 billion by 2032, expanding at an average CAGR of 38.6% during the forecast period. First-hand industry insights point to three structural tailwinds: rapid cloud adoption that lowers the cost of large-scale model training, surging demand for multimodal content across marketing, gaming, and enterprise workflows, and a steady flow of venture funding that is shortening the innovation cycle. The U.S. generative AI market alone is forecast to top ~US$ 220 billion by 2032, underpinned by a robust developer ecosystem and aggressive enterprise pilot programs.

Summary of Market Trends & Drivers

• Cloud-first deployment and "model-as-a-service" offerings are accelerating time-to-value for both start-ups and incumbents.

• Breakthroughs in transformer and diffusion architectures are widening the addressable use-case pool from text and images to video, 3-D, and synthetic data generation.

• Heightened focus on workflow automation—from code generation to medical imaging triage—is propelling market growth across verticals.

Key Market Players

Global generative AI market leadership is concentrated among diversified tech giants and fast-scaling specialists. Established hyperscalers provide the compute backbone and pre-trained foundation models, while focused innovators push the envelope in avatar creation, synthetic video, and domain-specific large language models. Companies profiled in the report include Adobe, Amazon Web Services, D-ID, Genie AI, Google, IBM, Microsoft, MOSTLY AI, Nvidia, Rephrase.ai, and Synthesia.

A second tier of regional champions is emerging in Europe and Asia–Pacific, often pairing proprietary data assets with domain expertise—healthcare imaging in Germany, conversational commerce in Japan, and industrial design in South Korea—to carve out defensible niches and capture market share.

Key Takeaways

• Market value (2024): ~US$ 30.37 billion

• Projected value (2032): ~US$ 978.56 billion at a 38.6% CAGR

• Software dominates with ~64.2% of 2024 revenue; cloud-based services are the fastest-growing slice

• Transformers command ~42% market share among technologies, but diffusion networks show the quickest uptake for high-fidelity imaging

• Media & entertainment leads end-use adoption, but BFSI records the highest incremental spending growth

• North America retains ~42.29% regional share, yet Asia–Pacific posts the fastest double-digit expansion through 2032

Market Dynamics

Drivers

• Proliferation of foundation-model APIs that let app builders plug generative functions into products within days rather than months.

• Rising enterprise appetite for synthetic data to overcome privacy barriers in healthcare, finance, and autonomous driving.

• Continuous improvement in GPU and custom AI silicon, slashing model training times and inference costs.

Restraints

• Ongoing concerns over data leakage, IP ownership, and model hallucination limit full-scale deployment in regulated industries.

• Shortage of skilled ML engineers and prompt-engineering talent slows implementation for late adopters.

Opportunities

• Verticalized models (e.g., legal drafting, drug discovery, semiconductor design) present lucrative white-space for specialized vendors.

• Generative AI copilots embedded in productivity suites open a recurring-revenue channel via seat-based pricing.

Challenges

• Evolving global and regional AI governance frameworks could introduce compliance overhead and market fragmentation.

• Energy consumption of large-scale training runs raises sustainability and cost-of-ownership questions.

Regional Analysis

• North America currently sets the pace thanks to deep capital markets, a dense research network, and early enterprise adoption.

• Europe follows, buoyed by strong public funding and a focus on responsible-AI standards, while Asia–Pacific is the growth engine, fueled by government incentives and a massive developer base.

• North America: Dominant share, driven by cloud spend and VC investment.

• Europe: High regulatory clarity and strong automotive, fintech, and pharma demand.

• Asia–Pacific: Fastest CAGR, with China, Japan, South Korea, and India scaling AI hubs.

• Latin America: Early but accelerating uptake in e-commerce and media localization.

• Middle East & Africa: Gradual adoption, led by smart-city and energy-sector pilots.

Segmentation Analysis

By Component

• Software – ~64.2% share, backbone of most deployments.

Generative AI platforms, developer toolkits, and model hubs drive the bulk of revenue as enterprises license or fine-tune pre-built models rather than start from scratch.

• Service – fastest CAGR through 2032.

Managed training, prompt engineering, and compliance auditing services help companies close capability gaps and accelerate go-live.

By Technology

• Transformers – benchmark architecture, majority share.

Self-attention mechanisms excel at language, code, and multimodal reasoning, making transformers the de-facto standard for foundation models.

• Diffusion Networks – rapid climber.

Step-wise denoising yields photorealistic images and videos, making diffusion the go-to for creative studios and marketing teams.

• Generative Adversarial Networks (GANs) – mature but still vital.

GANs remain popular for synthetic image generation and data augmentation where training speed matters, with a noted 74% share in 2023.

• Variational Auto-Encoders – niche research and anomaly detection.

VAEs retain relevance for low-latency edge scenarios and probabilistic sampling tasks.

By End-Use

• Media & Entertainment – dominant share in 2024.

Studios and game developers rely on generative tools for scriptwriting, asset creation, and real-time localization.

• BFSI – fastest spending growth.

Banks deploy large language models for fraud detection, synthetic data generation, and hyper-personalized advisory chatbots.

• IT & Telecom, Healthcare, Automotive & Transportation, Gaming, Others all show rising investment as use cases mature.

By Application

• Natural Language Processing – cornerstone application.

Chatbots, summarization, and multilingual support anchor enterprise demand.

• Computer Vision – surging adoption.

Synthetic imagery for medical scans, retail inventory, and autonomous systems reduces labeling costs and bias.

• Content Generation, Predictive Analytics, Robotics & Automation add incremental layers of market growth.

By Model

• Large Language Models – dominant footprint.

LLMs power everything from code completion to customer service automation.

• Image & Video Generative Models – high-growth niche.

Marketers and design teams embrace text-to-video and style-transfer tools.

• Multi-modal Models – next frontier.

Unified text-image-audio systems enable richer interactive experiences.

By Customer Type

• App Builders – primary revenue driver.

Product teams integrate generative AI to differentiate UX and boost retention.

• Model Builders – critical innovation layer.

Specialists refine and optimize foundation models, feeding the broader ecosystem.

Industry Developments & Instances

• Nov 2024: A global cloud provider launched a partner program to accelerate sector-specific generative AI pilots.

• Oct 2024: A creative-software leader expanded its generative suite to video editing, enabling text-to-clip workflows.

• Sep 2024: Two enterprise giants partnered to embed domain-tuned LLMs into ERP and CRM stacks.

• Jun 2024: A consulting powerhouse committed US$ 1 billion over three years to scale responsible generative AI solutions.

• Apr 2024: A semiconductor firm announced a US$ 3.6 billion investment in next-gen AI accelerators aimed at diffusion models.

Facts & Figures

• Transformers account for ~42% of 2024 technology revenue.

• Software captures ~64.2% market share, while services clock the fastest CAGR.

• Media & entertainment contributes dominant spending, but BFSI outpaces others at >36% CAGR.

• North America holds ~42.29% of global revenue, with Asia–Pacific posting >27% annual growth.

• Average model-training cost has fallen ~60% since 2022 thanks to specialized AI hardware.

Analyst Review & Recommendations

Generative AI is shifting from experimental demos to production-grade systems embedded deep inside enterprise workflows. Vendors that combine high-performance models with transparent governance tooling and vertical domain expertise will outpace general-purpose platforms. We recommend that technology buyers pilot use cases with clear ROI—such as marketing asset generation or code copilots—before scaling. For suppliers, the sweet spot lies in curated, domain-specific models that reduce hallucinations and accelerate compliance sign-off. With continued model efficiency gains and a robust funding pipeline, the market's long-term growth trajectory remains firmly intact.