Market Overview

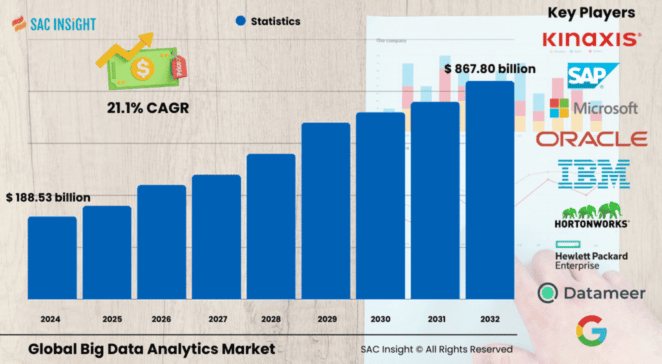

The big data analytics market size was valued at US$ 188.53 billion in 2024 and is projected to reach roughly US$ 867.80 billion by 2032, advancing at a 21.1% CAGR over 2026-2032. First-hand industry insights highlight three powerful tailwinds: an explosion of machine-generated data, rapid enterprise cloud migration, and the race to embed generative AI into everyday decision-making. SAC Insight evaluation shows predictive analytics commanding over 32% of 2024 revenue as businesses shift from hindsight to real-time intelligence. Although specific figures for the U.S. market size by 2032 are limited, the region is anticipated to maintain strong momentum buoyed by early adoption across finance, healthcare, and e-commerce.

Summary of Market Trends & Drivers

• Generative AI is moving from pilot projects to production, accelerating data discovery and visualization workloads.

• Edge-enabled analytics is trimming latency for IoT and 5G applications, especially in manufacturing and smart cities.

• Heightened regulatory focus on data privacy is steering investment toward secure, in-platform governance rather than fragmented add-ons.

Key Market Players

Global big data analytics market competitiveness is intense, with cloud hyperscalers and analytics specialists alike vying for market share. Leaders such as Amazon Web Services, International Business Machines, Oracle, SAP SE, Microsoft, and Salesforce continue to widen their platforms by folding in AI-driven automation and industry-specific accelerators. A second tier—including Tableau, Sisense, ThoughtSpot, Zoho, and Mu Sigma—differentiates through self-service interfaces, vertical templates, and price-flexible deployment models, keeping the innovation cycle brisk.

Key Takeaways

• Market value (2024): US$ 188.53 billion

• Projected value (2032): US$ 867.80 billion at a 21.1% CAGR

• North America leads with about 31.75% market share; Asia-Pacific posts the fastest growth

• Predictive analytics holds the largest product share at 32.56%

• Data discovery and visualization is the top application, while supply-chain analytics gains strategic urgency

• Generative AI and edge computing are the standout technology catalysts for market growth

Market Dynamics

Drivers

• Continuous surge in structured and unstructured data volumes, boosted by 5G, IoT sensors, and streaming media

• Proven ROI from real-time customer analytics and fraud detection in BFSI, retail, and telecom

• Strategic cloud partnerships that bundle infrastructure, BI tools, and managed services for quicker deployments

Restraints

• Persistent concerns over data breaches and compliance burdens raise the cost of ownership

• Shortage of skilled data engineers and scientists slows enterprise-wide scale-up

Opportunities

• Industry-specific analytics—healthcare outcome prediction, energy load balancing, smart-grid optimisation—remain under-penetrated

• Small and medium enterprises adopting pay-as-you-go cloud analytics, opening a high-volume mid-market

Challenges

• Integrating legacy data silos with modern, scalable architectures without disrupting core operations

• Ensuring explainability of AI models to satisfy emerging governance standards

Regional Analysis

The big data analytics market in North America dominates today thanks to robust cloud infrastructure, early AI adoption, and strong cybersecurity budgets. Europe follows, driven by stringent data-sovereignty rules that favor advanced governance solutions. Asia-Pacific is the quickest climber; expanding smartphone use, social-commerce platforms, and government digitalization programs are spurring double-digit market growth.

• North America – Early adopter landscape, led by financial services and healthcare digitization

• Europe – Growth anchored in GDPR-aligned analytics and manufacturing digitization

• Asia-Pacific – Highest CAGR as enterprises in China, India, and Japan harness AI for customer engagement

• Latin America – Rising cloud spend in Brazil and Mexico fuels analytics rollouts

• Middle East & Africa – Digital transformation and 5G rollout create new data lakes for utilities and telecoms

Segmentation Analysis

By Component

• Software – Core revenue engine, boosted by self-service BI and AI-powered data prep. Software packages—from credit-risk models to workforce analytics—remain the linchpin for turning raw data into action, making this sub-segment the primary growth locus.

• Hardware – Critical for on-prem and hybrid deployments demanding high-performance compute. Enterprises balancing data-sovereignty rules with performance needs are investing in dedicated servers, SSD arrays, and accelerators, especially for AI training workloads.

• Services – Expanding as companies seek advisory, managed analytics, and model-ops support. Consulting and managed services address skill gaps and speed up time-to-value, particularly for SMEs entering advanced analytics for the first time.

By Enterprise Type

• Large Enterprises – Maintain the biggest spending power, driven by omnichannel customer strategies. Global corporations leverage big data platforms to harmonize marketing, supply chain, and risk functions across regions.

• Small & Medium Enterprises – Fastest CAGR as cloud subscriptions lower entry barriers. SMEs adopt affordable, pay-per-use analytics to refine digital marketing and improve cash-flow forecasting.

By Application

• Data Discovery & Visualization – Top share thanks to intuitive dashboards that democratize insights. Drag-and-drop exploration tools empower business users to spot performance gaps and seize opportunities without code.

• Advanced Analytics – Rapidly scaling on the back of AI-driven predictive maintenance and churn modeling. Enterprises use machine learning pipelines to forecast demand, personalize offers, and optimize resource allocation.

• Others – Data preparation and cataloging close the loop on governance and quality. Automated lineage tracking and metadata enrichment cut manual overhead and reduce compliance risk.

By Vertical

• BFSI – Largest spender, relying on analytics for fraud mitigation and hyper-personalized banking. Financial institutions integrate real-time datasets to refine credit scoring and improve customer retention.

• Healthcare & Life Sciences – High-growth segment using predictive models for patient outcomes and drug discovery. Hospitals and pharma firms exploit big data to streamline clinical trials and optimize staffing.

• Retail – Leverages omnichannel insights to boost basket size and improve inventory turns. Retailers analyze clickstream and POS data for dynamic pricing and demand forecasting.

• Telecom/Media, Energy & Utilities, Government, Automotive, and Others – Each intensifies analytics use cases from network optimization to tax fraud detection, underscoring broad market applicability.

Industry Developments & Instances

• March 2024 – Zoho launched twin Saudi data centers to ensure data sovereignty for regional clients.

• December 2024 – ClickHouse entered a five-year pact with a leading cloud provider to turbo-charge real-time analytics throughput.

• October 2024 – Oracle added generative AI features to its HeatWave service, simplifying on-the-fly queries across hybrid clouds.

• August 2024 – KNIME secured fresh funding to expand enterprise AI governance and model-ops tools.

• March 2023 – A major Asia-Pacific consortium teamed blockchain with IoT edge analytics to boost secure sensor communication.

Facts & Figures

• Roughly 2.5 quintillion bytes of new data are generated daily worldwide.

• Predictive analytics accounted for 32.56% of total market revenue in 2024.

• North America captured approximately 31.75% of global market share in 2024.

• Data discovery and visualization comprised the leading application segment in 2023.

• The supply-chain management application registered a double-digit share, reflecting logistics digitization.

• Generative AI adoption is expected to reach 80% of enterprises by 2026, up from under 5% in 2023.

Analyst Review & Recommendations

The big data analytics landscape is shifting from tool-centric deployments to integrated, outcome-driven platforms. Vendors that embed generative AI, edge-ready architectures, and in-platform governance will capture outsized market growth. For new entrants, modular, cloud-native solutions tailored for SMEs offer the quickest route to scale. Incumbents should double down on automated model monitoring and vertical accelerators to sustain authority and trust as data privacy expectations tighten.