Market Overview

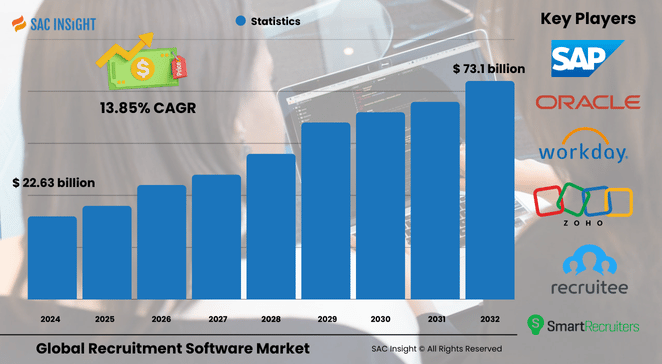

The global recruitment software market size was initially valued at roughly US$ 2.38 billion, with other references suggesting an estimate of around US$ 22.63 billion in 2024. By 2032, the market is projected to reach about US$ 73.1 billion, expanding at a 13.85% CAGR over the 2025-2032 forecast window. First-hand industry insights point to three structural accelerators: organizations automating high-volume hiring, a steady shift towards cloud-hosted applicant tracking, and AI-based analytics that identify best-fit candidates quickly. SAC Insight's deep market evaluation also shows a rebound from pandemic-era hiring freezes, as remote and hybrid models push demand for video interviewing, chatbot screening, and skills-based matching.

The U.S. recruitment software market is on course to top nearly US$ 21.4 billion by 2032, reflecting a strong demand for end-to-end digital hiring suites.

Summary of Market Trends & Drivers

• Surge in cloud-native applicant tracking and mobile-first candidate portals shortens time-to-hire while widening global talent pools.

• AI-powered résumé parsing, bias-mitigation tools, and predictive retention scoring reshape recruiter workflows.

• Rising gig and contingent workforces drive demand for flexible, compliance-ready onboarding modules with payroll and background-check APIs.

Key Market Players

Front-running vendors combine large installed bases with rapid feature roll-outs. Enterprise-focused suites from Oracle, SAP SuccessFactors, and ADP lead on depth and global reach, while Zoho, iCIMS, and Cornerstone OnDemand compete on ease of deployment and SME-friendly pricing. Service integrators such as Accenture and Cognizant bundle implementation, analytics, and change-management support, ensuring smooth adoption in complex HR landscapes.

Key Takeaways

• Initial market value (2024): closer to US$ 2.38 billion, with other estimates near USD$ 22.63 billion

• Projected value (2032): roughly USD$ 73.1 billion at a 13.85% CAGR

• North America commands about 35% market share, with the U.S. capturing close to 83% of regional revenue

• Software accounts for nearly 59% of total spend, led by cloud-based ATS platforms

• Large enterprises represent just over half of global demand, but SME adoption is climbing fast due to subscription pricing

• AI-enabled interview automation and skills analytics stand out as the fastest-growing feature clusters

Market Dynamics

Drivers

• Heightened need to cut hiring cycle times and improve candidate experience through automation and self-service tools

• Proliferation of remote and hybrid work models that rely on video interviewing, digital assessment, and virtual onboarding

• Growing corporate emphasis on data-driven diversity, equity, and inclusion metrics

Restraints

• Budget constraints in smaller organizations still relying on manual or spreadsheet-based recruiting workflows

• Concerns around data privacy, algorithmic bias, and local labor-law compliance, especially in heavily regulated sectors

Opportunities

• Expansion of AI-driven skills marketplaces matching internal talent with project work, reducing external hiring spend

• Rising interest in blockchain-based credential verification to curb résumé fraud and speed background checks

Challenges

• Integrating modern recruitment suites with aging HRIS or payroll systems, particularly in large multinationals

• Shortage of in-house analytics skills to fully exploit predictive hiring dashboards and retention models

Regional Analysis

North America retains the revenue lead thanks to early cloud adoption, an active VC-backed HR-tech ecosystem, and strong demand for DEI analytics. Europe follows, propelled by GDPR-compliant talent platforms and government-supported upskilling initiatives. Asia-Pacific is the fastest-growing region as digital-native start-ups and BPO providers in China, India, and Southeast Asia ramp up recruitment volumes.

• North America – Cloud maturity and AI spend keep the region at the forefront

• Europe – Data-privacy mandates and multilingual compliance modules spur uptake

• Asia-Pacific – Expanding IT services and gig platforms fuel double-digit market growth

• Latin America – Formalizing labor markets and e-commerce hiring lift demand

• Middle East & Africa – Diversification drives adoption in the Gulf; youth demographics support growth in Africa

Segmentation Analysis

By Deployment Model

• On-premises – Preferred in heavily regulated environments

On-prem solutions are vital for organizations with strict data-sovereignty demands, notably government agencies and financial institutions that require full control of candidate records.

• SaaS Based – Mainstream choice for flexibility and scale

Subscription-based, cloud-hosted suites dominate new installations, offering automatic updates, mobile access, and rapid regional roll-outs without large upfront capital outlays.

By Component

• Software – Core revenue engine

Applicant tracking, candidate relationship management, and AI screening modules together capture nearly 59% of spending, driven by continuous feature innovation and API-ready architectures.Software empowers recruiters to parse thousands of résumés, schedule interviews, and tap advanced analytics from a single dashboard, slashing manual workload and boosting hiring quality.

• Services – Growing layer of value-added support

Implementation, integration, and managed services account for the balance as enterprises seek expert guidance on workflow design, data migration, and user training.

Consulting partners help businesses configure workflows, embed compliance checks, and measure success metrics, ensuring technology investments translate into tangible productivity gains.

By Enterprise Size

• Large Enterprises – Automation at scale

With complex global hiring needs, large companies invest heavily in integrated suites that centralize workflows, enforce policy, and surface predictive insights.

• Small and Medium-Sized Enterprises – Fastest-rising segment

SMEs flock to pay-as-you-go platforms that cut paperwork and present a polished employer brand without extensive IT overhead.

By Vertical

• Manufacturing – Skills-matching for technical roles

Automated screening and shift-planning tie-ins help fill skilled-trade vacancies efficiently while maintaining compliance across plants

• Healthcare – Credential-focused hiring

Platforms that verify licenses and track continuing education reduce risk and speed staffing for critical positions.

• Hospitality – High-volume seasonal recruitment

Mobile-friendly job postings and auto-scheduling streamline bulk hiring for hotels, restaurants, and travel operators.

• BFSI – Secure, audit-ready workflows

Robust permissions and audit trails satisfy regulatory scrutiny while AI matching curbs bias in sensitive financial roles.

• Education and Others – Digital outreach for diverse talent

Universities and non-profits leverage video interviews and social sourcing to attract qualified staff globally.

Industry Developments & Instances

• July 2024 – Workday and Salesforce introduced an AI-driven employee service agent linking HR data with service workflows to elevate employee experience.

• April 2024 – Ceipal rolled out a healthcare-specific platform combining applicant tracking with credential management and automated invoicing.

• March 2024 – SmartRecruiters launched an AI upgrade that boosts candidate engagement scores and embeds recruitment analytics into hiring manager dashboards.

• September 2024 – Oracle added an AI-powered skills inventory to its cloud HCM suite, enabling richer talent insights and internal mobility mapping.

Facts & Figures

• Automated applicant tracking can trim hiring cycle time by up to 60% according to market analysis.

• Cloud adoption among large organizations jumped from 65% in 2020 to 72% in 2021, sustaining market growth momentum.

• Video interviewing volume climbed nearly 50% over the past decade, underscoring the shift to remote hiring.

• Software captures about 58.6% of global market share, while SaaS accounts for the bulk of new deployments.

• Large enterprises represent roughly 54% of total revenue, but SME demand is accelerating at more than 15% annually.

Analyst Review & Recommendations

Momentum in recruitment software shows no signs of slowing. Vendors that marry intuitive UX with enterprise-grade analytics and tight integrations will outpace rivals. Buyers should prioritize platforms that offer open APIs, built-in compliance, and AI models transparent enough to withstand audit. Over the next five years, expect heightened consolidation as larger HCM providers scoop up niche innovators to deliver end-to-end talent ecosystems—leaving customers with richer functionality and fewer integration headaches.