Market Overview

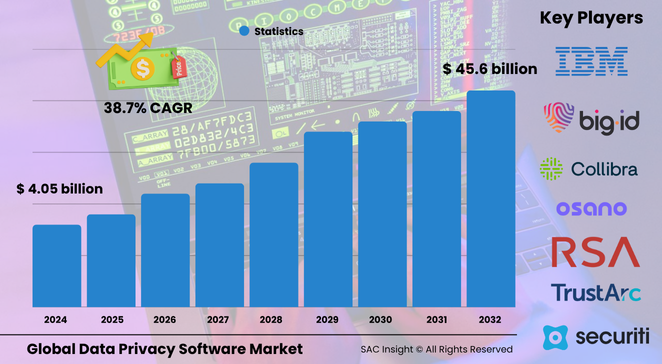

The data privacy software market size is valued at about US$ 4.05 billion in 2024 and is projected to reach nearly US$ 45.69 billion by 2032, registering a brisk 38.75 % CAGR. First-hand industry insights point to an urgent need for automated compliance, rising IoT endpoints that multiply risk, and heavier penalties that force board-level attention. SAC Insight’s deep market evaluation indicates the United States data privacy software market alone could climb from today’s modest base to roughly US$ 17.19 billion by 2032 as state-level rules expand beyond California.

Summary of Market Trends & Drivers

• AI-enabled classification and policy engines are replacing rule-based workflows, cutting incident resolution times by more than half while keeping pace with fast-changing regulations.

• Cloud-first rollouts dominate new deployments, reflecting remote work models and the appeal of subscription pricing that scales with data volume.

• High-profile breaches continue to shape purchasing behaviour; boards now link privacy posture to brand equity and M&A valuation, accelerating market growth.

Key Market Players

The competitive landscape is led by agile specialists and diversified software giants. OneTrust, TrustArc, BigID, Securiti, and AvePoint drive rapid feature releases focused on consent orchestration and automated deletion. IBM, Microsoft, Oracle, and SAP leverage broad security portfolios to embed privacy controls into existing analytics and collaboration suites, widening their market share among large enterprises. Strategic priorities revolve around low-code policy builders, regional hosting options, and partnerships with cyber-insurers that reward certified deployments.

Key Takeaways

• Current global data privacy software market size (2024): USD$ 4.05 billion

• Projected global market size (2032): USD$ 45.69 billion at a 38.75 % CAGR

• Cloud deployment already captures the largest share and holds the fastest expected CAGR through 2032

• Compliance management remains the core application, yet risk analytics is the rising star as firms seek predictive insights

• The healthcare industry shows the strongest sector-specific growth thanks to stricter patient-data rules and ransomware threats

• US market poised for US$ 17.19 billion by 2032 as federal and state frameworks tighten

Market Dynamics

Drivers

• Expansion of IoT and 5G ecosystems generates unprecedented volumes of personal data, intensifying the need for automated privacy controls.

• Tougher global regulations—GDPR, CCPA, LGPD, PIPL—drive mandatory investments and sustain market growth.

Restraints

• Limited in-house expertise at small and medium enterprises hampers full-scale adoption despite falling software costs.

• Fragmented regional rules create integration complexity for multinationals, extending deployment timelines.

Opportunities

• Embedded AI and machine learning engines offer vendors recurring revenue from adaptive policy packs and continuous risk scoring.

• Privacy-as-code platforms allow DevSecOps teams to bake controls into application pipelines, opening a greenfield segment.

Challenges

• Overlapping functionality with traditional cybersecurity suites can blur buying centres and slow decision cycles.

• Proving measurable ROI beyond regulatory fines remains difficult, particularly for budget-constrained industries.

Regional Analysis

North America commands the largest market share thanks to early adopter enterprises, a dense vendor ecosystem, and a patchwork of state laws that elevate compliance pressure. Asia-Pacific posts the fastest CAGR as China, India, and ASEAN economies roll out national data-protection acts, while Europe maintains steady demand under GDPR refinements.

• North America – Largest revenue base, propelled by stringent state-level statutes and heavy tech investment

• Europe – Mature GDPR enforcement continues to drive upgrades, especially in finance and retail

• Asia-Pacific – Fastest growth; new mandates and surging digital adoption spark first-time purchases

• Middle East & Africa – Gradual acceleration as telecom modernisation and cross-border data flows expand

• South America – Growth linked to Brazil’s LGPD roll-out and increased cloud uptake among banks and retailers

Segmentation Analysis

By Deployment

• Cloud – Scalability, lower capex, dominant share.

Cloud subscriptions allow firms to add privacy modules at the speed of data expansion, making them the default choice for distributed workforces.

• On-premises – Control-centric, niche but stable.

Regulated sectors and public agencies still favour on-site stacks to meet residency rules and integrate with legacy security tools.

By Application

• Compliance Management – Cornerstone function, widest adoption.

Dashboards map data flows to legal obligations, automating record-keeping and audit trails.

• Risk Management – Fastest-growing slice.

Predictive scoring and “what-if” simulations help CISOs prioritise remediation and justify spend.

• Reporting & Analytics – Visibility boost.

Visual query tools translate raw logs into executive-level metrics, demonstrating progress to boards and regulators.

• Others – Data discovery, consent portals.

Specialised modules cover advertising opt-outs, children’s data, and algorithmic transparency.

By Enterprise Type

• Large Enterprises – Deep pockets, global footprints.

Cross-border operations demand granular rule libraries and multilingual interfaces, driving premium licence sales.

• SMEs – Emerging demand curve.

Simplified SaaS bundles and managed-service offerings lower entry barriers for resource-strained firms.

By Industry

• BFSI – Volume of sensitive financial records sustains constant upgrades and third-party risk audits.

• IT & Telecommunication – Data-intensive networks and carrier billing push quick adoption of real-time monitoring.

• Government – Citizen-identity projects and e-gov portals heighten focus on sovereignty and encryption.

• Manufacturing – Growing digital twins and supply-chain data raise exposure, prompting pilot deployments.

• Retail – Omnichannel loyalty programmes create rich personal datasets that require consent orchestration.

• Healthcare – Highest CAGR as electronic health records and tele-medicine drive zero-tolerance data policies.

• Others (Education and beyond) – Student-data safeguards and remote learning spur initial investments.

Industry Developments & Instances

• November 2023 – Protiviti partnered with a risk-platform provider to deliver integrated governance suites to Indian enterprises.

• July 2023 – TrustArc unveiled a verification service aligned with the new EU-US data-transfer framework.

• April 2023 – AvePoint broadened its Microsoft 365 data-management alliance across key Asia-Pacific markets.

• October 2022 – Securiti launched a unified Data Control Cloud covering multi-cloud and SaaS environments.

• September 2022 – BigID introduced automated cross-store deletion to streamline right-to-be-forgotten requests.

Facts & Figures

• AI-driven privacy tools can trim breach detection time by up to 30 % compared with manual workflows.

• Nearly 95 % of global businesses now rank privacy as a primary brand-trust factor.

• Cloud deployments represent more than 60 % of 2024 licence revenue and are expected to exceed 75 % by 2032.

• Average fine for non-compliance in mature markets tops US$ 3.4 million, doubling since 2021.

• Over 43 billion IoT devices are forecast to be active by 2025, intensifying demand for real-time privacy controls.

Analyst Review & Recommendations

Market analysis confirms privacy is shifting from a regulatory checkbox to a strategic differentiator. Vendors that combine low-code automation, AI-based risk analytics, and region-specific hosting will outpace average market growth. Buyers should prioritise platforms with open APIs that integrate easily with security operations and data-governance stacks, ensuring future-proof compliance as global rules tighten.