Market Overview

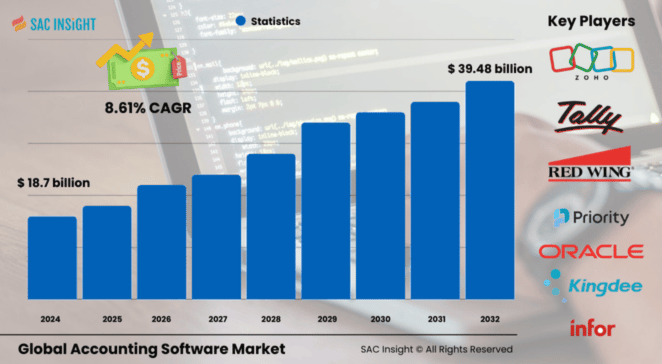

The accounting software market size is currently valued at US$ 18.7 billion (2024) and is projected to reach US$ 39.36 to 39.48 billion by 2032, registering an 8.61% CAGR from 2026‑2032. First‑hand industry insights highlight three structural drivers: rapid cloud migration across small and mid‑sized enterprises (SMEs), a growing need for real‑time financial visibility, and steady advances in artificial‑intelligence‑powered automation that cut reconciliation time and human error. SAC Insight evaluation shows that pandemic‑era remote‑work practices have permanently raised expectations for anytime, anywhere access to ledgers and dashboards. The U.S. accounting software market is forecast to top roughly US$ 13.41 billion by 2032, underpinned by high SaaS adoption and a dense ecosystem of fintech integrations.

Summary of Market Trends & Drivers

• Cloud‑first rollouts and subscription pricing are replacing perpetual licenses, improving affordability for SMEs.

• Embedded AI—ranging from automated bank feeds to predictive cash‑flow analytics—is becoming a core differentiator, not a premium add‑on.

• Rising e‑commerce volumes and digital‑tax mandates in Asia‑Pacific are accelerating uptake of plug‑and‑play accounting suites that streamline compliance.

Key Market Players

Global accounting software market market share is concentrated among long‑standing enterprise vendors—Oracle (NetSuite), Microsoft, SAP, Intuit, Sage, and Xero—that leverage deep product portfolios and partner channels. A second tier of specialists such as Infor, Epicor, Zoho, and Acumatica is carving out space with vertical templates, usage‑based billing, and low‑code extensibility aimed at fast‑growing mid‑market firms.

Key Takeaways

• Market value (2024): USD$ 18.7 billion

• Projected value (2032): USD$ 39.36 to 39.48 billion at an 8.61% CAGR

• Cloud deployments already account for ~65% market share and continue to expand.

• North America leads with about 35% share, but Asia‑Pacific posts the fastest market growth, exceeding 10% CAGR.

• AI‑enabled features—automated expense coding, anomaly detection, conversational reporting—are the most requested upgrades in recent RFPs.

• Vendor consolidation is accelerating as large platforms acquire niche workflow apps to round out end‑to‑end finance stacks.

Market Dynamics Drivers

• Automation imperative: Businesses seek to cut manual bookkeeping, driving demand for AI‑driven bank reconciliation, invoice matching, and payroll.

• Cloud economics: Subscription models lower upfront costs and provide elastic scalability, appealing to both startups and global enterprises.

• Regulatory digitization: E‑invoicing and real‑time tax reporting rules in Europe, Latin America, and Asia force companies to modernize ledgers.

Restraints

• Data‑security concerns: Fear of breaches slows adoption in heavily regulated sectors such as healthcare and government.

• Integration complexity: Legacy ERP environments and bespoke spreadsheets create migration hurdles that inflate implementation timelines.

Opportunities

• Industry‑specific templates: Tailored chart‑of‑accounts and compliance packs for sectors like hospitality and construction open new revenue streams.

• Fintech partnerships: Embedding payments, lending, and cash‑management modules inside accounting workflows adds high‑margin services.

Challenges

• Talent shortage: A limited pool of cloud‑savvy accountants and finance IT specialists can delay digital transformation projects.

• Pricing pressure: Freemium entrants and open‑source alternatives push established vendors to defend margins while expanding functionality.

Regional Analysis

• North America remains the largest market thanks to early SaaS adoption and strong venture funding for fintech add‑ons.

• Asia‑Pacific, however, is the growth engine: government cloud initiatives, a booming SME sector, and digital‑tax reforms are driving double‑digit gains.

• Europe follows closely, propelled by stringent e‑invoicing mandates and GDPR‑aligned security features.

• North America: High cloud penetration, mature partner ecosystem, strong demand for multi‑entity consolidation.

• Europe: Compliance‑driven upgrades, rapid rollout of e‑invoicing across the EU, rising interest in ESG‑ready reporting.

• Asia‑Pacific: Fastest expansion; SMEs in China, India, and ASEAN adopt mobile‑first accounting apps and low‑cost SaaS.

• Latin America: Growth supported by mandatory electronic tax reporting and expanding fintech infrastructure.

• Middle East & Africa: Gradual uptake led by UAE and Saudi Arabia, where VAT adoption pushes businesses toward digital ledgers.

Segmentation Analysis

By Deployment

• Cloud‑based – Majority share, flexible scaling

Cloud solutions dominate because they slash maintenance costs and enable real‑time collaboration. Companies can spin up new entities or modules within hours, a key advantage for high‑growth firms.

• On‑premise – Legacy footprint, niche demand

On‑prem deployments persist in highly regulated or bandwidth‑constrained environments where data residency or latency is critical, but the segment is steadily shrinking.

By Organization Size

• Small & Medium Enterprises – Fastest adoption

SMEs favor subscription pricing and pre‑configured workflows that minimize IT overhead. The segment’s appetite for simple, mobile‑friendly interfaces fuels vendor innovation. These smaller firms often leapfrog directly to SaaS,

skipping traditional desktop software, and thus drive a sizable portion of new license growth.

• Large Enterprises – Complex integrations

Large corporations need robust multi‑currency, multi‑entity consolidation and deep ERP integrations. While growth is slower, contract sizes are larger and renewal rates high.

By Type

• ERP Suites – End‑to‑end control, widest footprint Integrated

ERP modules tie accounting to inventory, procurement, and HR, appealing to firms that need unified data across departments.

• Spreadsheets & Custom Tools – Transitional solutions

Still used for bespoke reporting or in very small firms, but gradually replaced as affordable SaaS alternatives mature.

• Tax Management – Compliance‑driven growth

Specialized tax engines are expanding quickly as governments tighten digital‑filing requirements and businesses seek automated compliance.

By Component

• Software – Core revenue driver

Licenses and subscriptions represent the bulk of market revenue, boosted by value‑added AI and analytics features.

• Services – Implementation & managed support

Consulting, training, and managed services are rising in tandem with cloud migrations, ensuring correct configuration and ongoing optimization.

By End‑use Industry

• BFSI – Highest security demands

Banks and insurers invest heavily in audit trails and encryption, setting the pace for advanced compliance features.

• IT & Telecom – Early adopters

Tech firms favor API‑rich platforms that integrate seamlessly with DevOps and subscription‑billing systems.

• Government & Public Sector – Digitization push National and municipal bodies modernize ledgers to improve transparency and meet e‑procurement mandates.

• Other verticals—retail, manufacturing, healthcare, and construction—follow similar patterns, with vertical templates accelerating deployment.

Industry Developments & Instances

• June 2024: Sustainability consultancy thinkPARALLAX teams with a leading carbon‑accounting platform to integrate ESG metrics into core ledgers.

• April 2024: FreshBooks announces “FreshBooks Payments,” embedding Stripe Connect to streamline receivables for SMEs.

• March 2023: Focus Softnet launches FocusLyte, a cloud suite targeting midsize businesses with subscription billing.

• January 2023: Halfpricesoft rolls out an upgraded ezAccounting package, bundling payroll and general‑ledger functions at no extra cost.

• March 2022: GTreasury partners with Infor to embed cash‑ and risk‑management tools within Infor’s ERP stack.

Facts & Figures

• Cloud solutions command ~65% market share and are gaining two percentage points annually.

• AI‑powered features can cut month‑end close time by up to 40%, according to vendor benchmarks.

• Over 70% of new SME implementations in 2024 requested native mobile apps for receipt capture and approvals.

• North America captured US$ 6.5 billion in revenue during 2024, while Asia‑Pacific logged US$ 4.8 billion.

• More than 35% of users now integrate their accounting platform with at least three other SaaS tools (e‑commerce, CRM, payroll).

Analyst Review & Recommendations

SAC Insight's accounting software market analysis indicates a decisive shift toward AI‑enhanced, cloud‑native suites that marry core bookkeeping with embedded payments and compliance. Vendors that package vertical templates, open APIs, and usage‑based pricing will outpace the field. For new entrants, targeting under‑served micro‑businesses in Asia‑Pacific with mobile‑first offerings presents the clearest path to market growth. Established players should double down on cybersecurity and low‑code extensibility to retain enterprise accounts and defend market share through 2032.