Market Overview

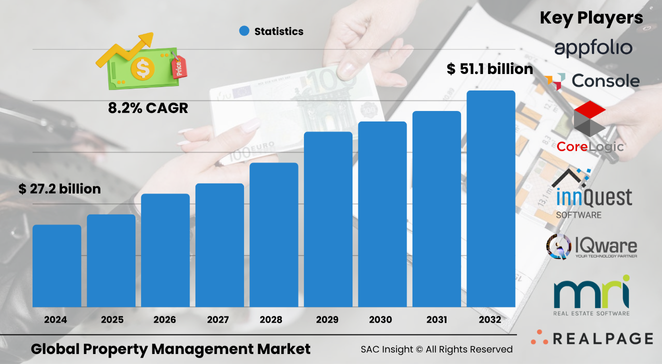

The global property management market size is estimated at roughly US$ 27.24 billion in 2024 and is set to grow to about US$ 51.16 billion by 2032, reflecting a robust 8.2 % CAGR. SAC Insight's deep market evaluation highlights three growth catalysts: accelerating urbanization that multiplies rental stock, first-hand industry insights showing landlords standardising on cloud platforms to cut vacancy cycles, and AI-driven lease analytics that turn raw data into higher net operating income. The U.S. property management market alone could climb from nearly US$ 9 billion in 2024 to around US$ 14.3 billion by 2032 as coworking, build-to-rent, and logistics assets all demand real-time oversight.

Summary of Market Trends & Drivers

• Mobile-first dashboards and touchless tenant portals are now baseline expectations, pushing vendors to layer in predictive maintenance and voice assistance.

• Smart-city policies across Asia Pacific are spurring demand for IoT-enabled energy dashboards and net-zero reporting, reshaping market growth paths.

• Rising investor appetite for mixed-use and vacation rentals widens the addressable base for modular software bundles that scale from a single condo to a global portfolio.

Key Market Players

The global property management market share remains concentrated among software specialists and diversified enterprise vendors. Firms such as Oracle, IBM, SAP, Yardi, RealPage, AppFolio, and Trimble anchor large portfolios with end-to-end suites covering lease abstraction, accounting, and facility workflows. Fast-growing challengers—Hemlane, Doorloop, Re-leased, and Rentec Direct—win smaller owners with intuitive UX, pay-as-you-grow pricing, and embedded payments.

Competitive dynamics revolve around vertical integration and data moats. Legacy giants bundle AI chatbots, 3D virtual tours, and ESG dashboards, while upstarts partner with fintechs to offer flexible rent, credit reporting, and insurance. Strategic M&A—RealPage/On-site Managers and Entrata/Rent Dynamics—signals an arms race for resident financial services that deepen lifetime value.

Key Takeaways

• Current global market size (2024): about US$ 27.24 billion

• Projected global market size (2032): US$ 51.16 billion at an 8.2 % CAGR

• Lease management software posts the highest segment CAGR as automated abstraction and compliance analytics go mainstream

• Commercial property type accounts for the largest revenue slice, propelled by logistics hubs and coworking demand

• Asia Pacific delivers the fastest regional market growth on the back of smart-city investments and institutional capital inflows

• Generative-AI add-ons—chatbots, smart document creation, and virtual staging—are becoming must-have differentiators

Market Dynamics

Drivers

• Urban population growth and higher rental penetration increase demand for professional oversight and integrated market analysis tools

• Adoption of AR/VR virtual tours, AI chatbots, and automated reporting elevates tenant experience and lowers churn

• Energy-efficiency mandates push owners to deploy software that tracks usage and qualifies for green-building incentives

Restraints

• Complex tenant-rights legislation and data-privacy rules raise compliance burdens, particularly for small property managers

• Budget constraints at aging assets slow technology refresh cycles and limit software adoption

Opportunities

• Generative-AI lease drafting and resident self-service portals streamline operations and open premium upsell lanes

• Sustainability dashboards and carbon-footprint benchmarks position vendors as strategic partners for ESG-minded investors

Challenges

• High repair costs at older buildings strain budgets and delay platform roll-outs

• Fragmented regional regulations complicate multi-country deployments and slow market growth for global portfolios

Regional Analysis

North America leads on revenue thanks to mature multifamily REITs, short-term-rental platforms, and a strong prop-tech funding pipeline. Asia Pacific posts the quickest gains as governments back smart-city and co-living projects, while Europe advances on the strength of energy-performance regulations and social-housing digitalisation.

• North America – Largest market share, propelled by coworking, logistics, and single-family rentals

• Europe – Growth tied to green-lease standards and large social-housing portfolios

• Asia Pacific – Fastest CAGR, driven by urbanisation and IoT-ready smart buildings

• Latin America – Rising institutional interest in build-to-rent supports software roll-outs

• Middle East & Africa – New free-zone cities and tourism assets spark demand for integrated platforms

Segmentation Analysis

By Component

• Software – Core revenue engine.

Cloud-native dashboards integrate accounting, maintenance, and analytics, offering owners live visibility and faster decision loops.

• Services – Critical wraparound.

Implementation, training, and managed-service contracts help under-resourced owners extract full value from platforms.

By Location

• Urban – Highest adoption.

Dense rental stock and professional landlords require automated rent collection and remote inspections to scale profitably.

• Suburban – Growing quickly.

Build-to-rent and single-family portfolios seek mobile inspection apps and flexible payment plans to attract tenants moving out of city cores.

• Rural – Niche but rising.

Vacation cabins and agricultural sites use lightweight modules to manage seasonal demand and compliance.

By Property Type

• Commercial – Revenue leader.

Complex leases, CAM reconciliations, and ESG disclosure rules make advanced analytics indispensable for offices, retail, and warehouses.

• Residential – Volume play.

Multifamily operators prioritise user-friendly resident portals, maintenance chatbots, and rent-flex tools to boost retention.

• Industrial & Logistics – Fast-growing.

High-turn dock scheduling and asset-tracking integrations drive adoption in distribution centres.

• Government & Military, Vacation Homes, Mixed-Use, Special-Purpose – Tailored niches.

Each demands custom workflows—from security clearances to short-stay booking engines—driving modular platform design.

By End User

• Property Managers & Agents – Largest slice.

They rely on integrated marketing, screening, and accounting to handle multi-site portfolios efficiently.

• Investors/Developers & Owners – Data-driven planners.

Dashboards that forecast cash flow and renovation ROI inform capital allocation and refinancing decisions.

• Housing Associations & Government Agencies – Compliance-focused.

They prioritise maintenance tracking, subsidy reporting, and resident engagement tools.

• Tenants/Residents, Facility Managers, Franchise Operators, Others – Ecosystem stakeholders.

Each group benefits from self-service portals, automated alerts, and transparent communication channels.

Industry Developments & Instances

• October 2024 – Oracle Property Manager added automated SFFAS 54 accounting and integrated PO payment tracking to streamline federal lease compliance

• October 2024 – Yardi and Engrain enabled interactive SightMap visuals on RentCafe sites, boosting conversion for multifamily clients

• August 2024 – RealPage partnered with Flex to embed split-rent payments in LOFT, enhancing resident affordability and retention

• July 2024 – Trimble deepened its GIS alliance with Esri, automating green-infrastructure workflows for property owners

• February 2024 – Wood Partners divested its 38 000-unit management arm to Greystar, illustrating consolidation among large U.S. operators

• November 2023 – RealPage acquired On-site Managers for roughly US$ 250 million, expanding its leasing workflow suite

• July 2023 – Entrata bought Rent Dynamics to integrate resident credit-reporting and financial-wellness services

Facts & Figures

• Lease management tools are projected to post double-digit growth, adding nearly US$ 9 billion in new revenue by 2032

• North America could command over 30 % global market share through the forecast period

• AI chatbots cut average maintenance ticket resolution times by up to 35 % in pilot deployments

• Virtual-tour adoption rose above 60 % of new multifamily listings in 2024, up from 28 % pre-pandemic

• Energy-tracking modules help owners trim utility costs by 8-12 % annually, boosting NOI and asset value

• More than 70 % of new prop-tech funding rounds in 2024 targeted integrated payment and resident-experience features

Analyst Review & Recommendations

The property management market is pivoting from point solutions to holistic ecosystems that merge leasing, maintenance, finance, and ESG reporting in one pane of glass. Vendors that layer generative-AI services on top of reliable core workflows will outpace average market growth. We recommend prioritising open APIs to ease prop-tech integration, investing in predictive analytics that cut downtime, and packaging flexible payment options to meet residents’ evolving expectations. Competition will hinge on data depth, tenant experience, and the ability to translate insights into measurable asset performance.