Market Overview

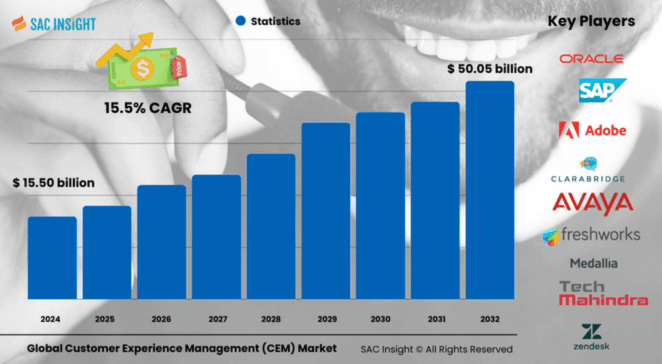

The customer experience management (CEM) market size is valued at around US$ 15.50 billion in 2024 and is projected to climb at US$ 50.05 billion by 2032, expanding at a 15.5% CAGR over 2025‑2032. First‑hand industry insights point to three converging forces behind this market growth: brands racing to unify data from every customer touch point, a surge in AI‑driven analytics that convert feedback into real‑time action, and mounting pressure to deliver seamless omnichannel journeys that protect loyalty in a volatile economy. SAC Insight evaluation also highlights rapid cloud adoption among small and mid‑sized enterprises (SMEs) and sustained upgrades by large enterprises seeking predictive insights. The U.S. CEM market is expected to top US$ 16.75 billion by 2032, powered by heavy investments in AI, speech analytics, and proactive service automation.

Summary of Market Trends & Drivers

AI, machine learning, and natural‑language analytics are shifting CEM from rear‑view reporting to forward‑looking prediction, enabling brands to fix pain points before churn occurs. Voice‑of‑Customer programs are moving from siloed surveys to always‑on data streams pulled from call centers, social media, and web interactions. Data‑privacy regulations (GDPR, CCPA, etc.) are raising the bar for secure, consent‑based personalization, favoring vendors with strong governance frameworks.

Key Market Players

The competitive field features established enterprise software leaders alongside cloud‑native specialists. Global CEM market vendors known for broad CEM suites include Adobe, SAP, Oracle, IBM, and Genesys, each leveraging deep analytics and robust ecosystems. Fast‑growing challengers such as Zendesk, Freshworks, and Medallia compete through intuitive user experiences and rapid time‑to‑value, while niche innovators focus on sentiment analytics, journey orchestration, and AI‑powered chat.

Key Takeaways

• 2024 customer experience management market value: ≈ USD$ 15.50 billion

• 2032 projection: ≈ USD$ 50.05 billion, 15.5% CAGR

• North America commands ~43% market share; Asia‑Pacific is the fastest‑growing region.

• Text analytics holds ~41% of analytical‑tool revenue, reflecting the need to mine unstructured feedback.

• Call centers remain the leading touch point (~31%), but web and mobile channels are closing the gap.

• On‑premises still accounts for ~54% of deployments, yet cloud solutions post the quickest gains.

Market Dynamics

Drivers

• Explosive digital engagement and rising customer expectations for 24/7, omnichannel service

• AI‑enabled analytics that convert raw interactions into actionable, predictive insights

• Strong ROI demonstrated by reduced churn, higher wallet share, and faster issue resolution

Restraints

• Persistent concerns over data security and privacy compliance, especially in regulated industries

• Integration complexity when legacy CRM, ERP, and contact‑center systems operate in silos

Opportunities

• Healthcare, BFSI, and utilities adopting CEM to support value‑based care, personalized banking, and proactive outage management

• AR/VR‑assisted remote support and training to cut service costs while boosting satisfaction

Challenges

• Shortage of analytics talent capable of translating dashboards into frontline action

• Internal substitutes—niche point tools for feedback, A/B testing, or tag management—can fragment budgets and slow enterprise‑wide adoption

Regional Analysis

North America leads thanks to early technology uptake and high per‑capita digital spending, while Asia‑Pacific records the steepest market growth on the back of smartphone penetration and government‑backed digital‑economy programs.

• North America: Mature omnichannel strategies and aggressive AI investment

• Europe: Strong privacy rules driving secure, consent‑based personalization

• Asia‑Pacific: Double‑digit expansion (≈ 17% CAGR) fueled by e‑commerce booms in China and India

• Latin America: Growing call‑center outsourcing and mobile‑first consumer base

• Middle East & Africa: Contact‑center modernization and smart‑city initiatives underpin steady adoption

Segmentation Analysis

By Analytical Tool

• Text analytics – dominant, insight‑rich.

Text analytics captures roughly 41% of revenue by extracting sentiment and intent from reviews, chats, and social posts. Brands rely on it to prioritize product fixes and tailor campaigns.

• Speech analytics – fast climber.

With ~18% CAGR, speech analytics mines call recordings for emotion and compliance cues, guiding agent coaching and next‑best‑action prompts.

• Web analytics & content management – critical for journey optimization.

These tools track click paths and content engagement, enabling personalized web experiences that lift conversion.

By Touch Point Type

• Call centers – largest slice (~31%).

Despite self‑service growth, live voice remains pivotal for complex issues, driving demand for workforce management and real‑time agent assist.

• Web services – high‑growth (~17% CAGR).

Responsive sites and apps that blend video, chat, and knowledge bases are now baseline expectations, pushing continuous UX upgrades.

By Deployment

• On‑premises – still preferred for data sovereignty (~54% share).

Large enterprises in finance and government keep sensitive data in‑house, valuing customization and control.

• Cloud – momentum builder.

Ease of integration, subscription pricing, and rapid feature rollout make cloud the default for SMEs and digital‑native brands, expanding at ~18% CAGR.

By Organization Size

• Large enterprises – majority revenue (>60%).

Complex operations and global footprints necessitate enterprise‑grade CEM to harmonize marketing, sales, and service data.

• SMEs – fastest‑growing cohort.

Government digital‑SME programs and affordable SaaS models lower entry barriers, letting smaller firms tap predictive lead scoring and tailored outreach.

By End‑use

• Retail – top adopter (~24.5% share).

Omnichannel shoppers expect consistent pricing, inventory, and loyalty perks, making CEM integral to differentiation.

• BFSI – high‑growth (~17% CAGR).

Banks and insurers deploy analytics to detect churn signals, personalize offers, and satisfy stringent service‑level targets.

• Healthcare, IT‑Telecom, Manufacturing, Government, Energy & Utilities – rising focus on patient/member experience, self‑service portals, and proactive maintenance.

Industry Developments & Instances

• Mar 2024: A leading software vendor rolled out generative‑AI modules that auto‑compose personalized web content at scale.

• Nov 2023: A major bank partnered with an AI powerhouse to embed large‑language models in its virtual assistant, boosting first‑contact resolution.

• Sep 2023: A cloud CRM provider unveiled bidirectional ERP connectors, unifying financial and customer data for friction‑free service.

• Feb 2023: A global airline outsourced rebooking workflows to a tech BPO firm, blending human empathy with AI‑guided recommendations to lift CSAT.

Facts & Figures

• Text analytics adoption surged 12% year‑on‑year in 2024 as firms mined unstructured feedback.

• 54% of enterprises report ROI payback on CEM investments within 18 months.

• Companies with mature CEM programs achieve 5–10% higher customer‑lifetime value than peers.

• AI‑driven self‑service deflects up to 30% of Tier‑1 support calls, saving millions in operating costs.

• Mobile app engagement rises 22% when in‑app feedback loops are tied to real‑time journey orchestration.

Analyst Review & Recommendations

Our market analysis shows CEM shifting from optional enhancement to core revenue engine. The customer experience management market vendors that blend secure data pipelines with explainable AI will win trust and wallet share. Buyers should prioritize platforms capable of unifying journey data, automating insight‑to‑action, and complying with evolving privacy laws. Expect consolidation as suite vendors snap up point‑tool innovators to deliver end‑to‑end value across every customer moment.