Market Overview

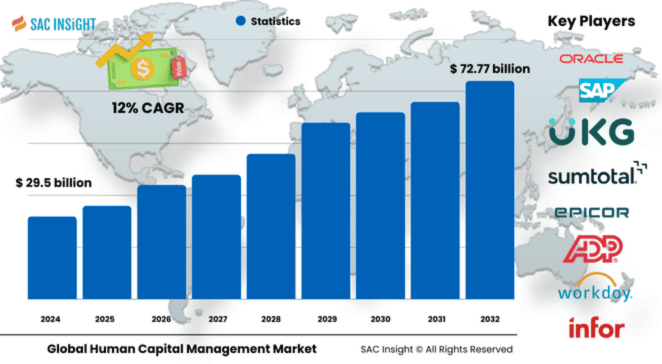

The global human capital management (HCM) market size was valued at US$ 29.5 billion in 2024 and is on track to reach about US$ 72.77 billion by 2032, expanding at an estimated 12.0% CAGR from 2025-2032. This market growth is propelled by three structural shifts: the mass migration from on-premise to cloud HR platforms, rapid infusion of AI into core HR workflows, and a post-pandemic surge in remote and hybrid work that demands digital-first employee experiences. First-hand industry insights confirm that organizations are funnelling record budgets into payroll automation, skills analytics, and employee-centric self-service portals. SAC Insight evaluation also shows the U.S. human capital management market alone is poised to clear US$ 24 billion by 2032 as enterprises race to modernize legacy HR stacks.

Summary of Market Trends & Drivers

• AI-driven talent acquisition, generative-AI chatbots, and predictive workforce analytics are becoming baseline requirements rather than premium add-ons.

• Cloud subscription models are widening access for mid-market firms, while large enterprises double down on multi-country payroll consolidation and compliance automation.

• Heightened focus on employee well-being and diversity, equity, and inclusion (DEI) is steering investments toward engagement apps, continuous listening tools, and data-driven pay-equity audits.

Key Market Players

Global leadership rests with a tight cohort of full-suite vendors and specialized challengers. Multinationals such as SAP, Workday, Oracle, ADP, and UKG command significant market share through end-to-end platforms that blend core HR, payroll, and analytics. Meanwhile, agile players, including Ceridian, Cegid, BambooHR, and a growing bench of AI-native start-ups, are carving out niches in generative-recruiting, continuous performance, and sector-specific HCM modules. Continuous M&A activity, particularly around AI and payroll localization, keeps competitive intensity high.

Key Takeaways

• The Global Human Capital Management (HCM) Market size (2024): USD$ 29.5 billion

• Projected value (2032): USD$ 72.77 billion at a 12% CAGR

• North America holds ≈ 41% market share, with Europe and Asia-Pacific following closely.

• Software dominates with ~67% revenue share; services post the fastest growth as firms seek implementation and managed payroll support.

• Cloud deployments already account for over 60% of new bookings, reflecting the pivot away from on-premise systems.

• AI-enabled recruiting, skills mapping, and pay-equity analytics top the current investment agenda.

Market Dynamics

Drivers

• Escalating demand for for unified, cloud-based HR suites that cut manual effort and improve data accuracy.

• Proliferation of AI and robotic process automation, slashing time-to-hire and boosting payroll accuracy.

• Growing regulatory complexity—privacy, tax, DEI—pressuring companies to adopt compliance-ready HCM tools.

Restraints

• Data-security and sovereignty concerns, especially in highly regulated sectors, slow cloud migration.

• Integration headaches with legacy ERP and point solutions inflate project timelines and budgets.

Opportunities

• Rising appetite for skills-based workforce planning unlocks new revenue streams in skills taxonomies and learning marketplaces.

• Untapped small- and mid-size enterprise (SME) segment in emerging economies seeking affordable, mobile-first HCM Market solutions.

Challenges

• Talent shortages in HR-tech implementation and change-management consulting limit rollout speed.

• Ongoing economic uncertainty prompts some firms to delay large-scale HR transformation projects.

Regional Analysis

North America leads thanks to early cloud adoption, high HR-tech spend per employee, and stringent compliance mandates. Europe follows, driven by GDPR-aligned workforce analytics and widespread automation of payroll across multilingual environments. Asia-Pacific is the fastest-growing region as digital transformation programmes and expanding gig economies create fresh demand for scalable HCM suites.

• North America: Cloud leadership, AI-heavy roadmaps, strong focus on DEI metrics.

• Europe: Compliance-first mindset, surge in hybrid-work scheduling tools.

• Asia-Pacific: Double-digit market growth, mobile-centric HR apps for distributed workforces.

• Latin America: Steady uptake of SaaS payroll amid complex tax regimes.

• Middle East & Africa: Momentum from localization mandates (e.g., Saudisation) and public-sector digitisation.

Segmentation Analysis

By Component:

• Software – Anchor revenue stream, expanding AI feature sets.

Software remains the engine of market growth as companies automate recruitment, payroll, and performance reviews within a single platform.

• Services – Fastest-growing, fuelled by implementation and managed payroll.

Firms lean on consulting partners to configure, integrate, and maintain HCM stacks, especially in multi-country rollouts.

By Deployment:

• Cloud – Majority share, prized for scalability and lower upfront costs.

Subscription pricing and quarterly feature releases make cloud the default choice for new deployments.

• On-premise – Niche strongholds in highly regulated sectors.

Financial services, government, and healthcare still favour on-premise for data-control reasons, though hybrid models are emerging.

By Enterprise Size:

• Large Enterprises – Complex global needs, heavy investment in analytics.

Multinationals require deep configurability, multi-currency payroll, and advanced compliance dashboards.

• SMEs – Rapid adopters of plug-and-play SaaS suites.

Cost-effective, mobile-first platforms help smaller firms professionalize HR without big IT overhead.

By End-use Industry:

• IT & Telecom – Talent-intensive, high churn; leading adopter of AI-based recruiting.

• BFSI – Compliance-driven, prioritizes secure payroll and risk analytics.

• Healthcare – Fastest CAGR, propelled by workforce scheduling and credential tracking.

• Retail – Seeks mobile scheduling and high-volume onboarding for seasonal staff.

• Government, Manufacturing, Education, and Others – Growing interest in unified HR-finance platforms.

Industry Developments & Instances

• Apr 2024: A top HCM vendor launched a generative-AI assistant that automates payroll queries and compliance checks in real time.

• Oct 2024: A leading payroll provider acquired a global workforce-management specialist to deepen scheduling and time-tracking capabilities.

• Mar 2025: A major cloud suite expanded its talent-intelligence hub, unifying internal and external skills data for strategic workforce planning.

• Jun 2025: A regional HR consultancy partnered with a SaaS HCM start-up to accelerate mid-market cloud migrations across Asia.

Facts & Figures

• Cloud deals now represent ~65% of all new HCM Market contracts, up from 48% in 2021.

• AI-powered résumé screening can cut time-to-hire by up to 35%, improving recruiter productivity.

• Approximately 97% of large organisations plan to boost HR-tech budgets by 2026, with 47% prioritising AI modules.

• Integrated payroll-plus-time solutions can reduce payroll errors by over 50%, according to recent field studies.

• Remote work has lifted self-service portal log-ins by nearly 60% since 2020, underscoring demand for employee-centric UX.

Analyst Review & Recommendations

Our market analysis indicates the HCM Market is shifting from transactional HR record-keeping to predictive, skills-centric talent orchestration. Vendors that pair cloud-native architectures with explainable AI, embedded compliance, and consumer-grade user interfaces will outpace slower rivals.

For buyers, the near-term priority is a phased migration that secures quick wins—payroll accuracy, recruiter efficiency—while laying the data foundation for skills analytics and strategic workforce planning. Expect double-digit market growth to continue through 2032 as HR moves firmly into the boardroom spotlight.