Market Overview

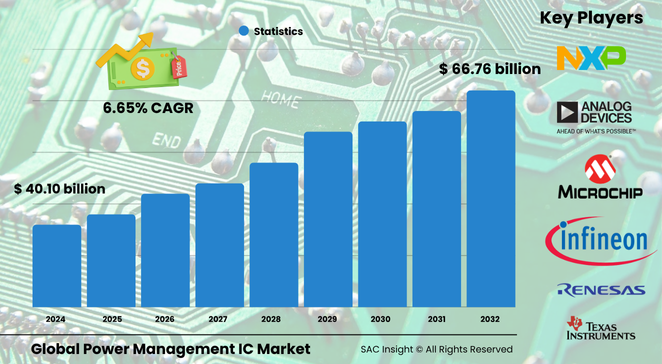

The power management IC market size is valued at roughly US$ 40.10 billion in 2024 and is projected to climb to about US$ 66.76 billion by 2032, reflecting an average 6.65 % CAGR. First-hand industry insights highlight three clear growth engines: relentless demand for efficient mobile devices, accelerating electrification of vehicles, and stricter energy-efficiency rules across major economies. SAC Insight's deep market evaluation shows the United States power management IC market alone could outpace global market growth as EV rollouts, data-center expansion, and IoT adoption intensify power-management requirements.

Summary of Market Trends & Drivers

• Shrinking device footprints and multi-function integration push developers toward single-chip PMIC solutions with advanced fast-charging and safety features.

• Vehicle electrification and ADAS proliferation turn automotive electronics into the fastest-growing end-user segment, spurring investments in high-voltage battery-management ICs.

• Market trends also favor gallium-nitride and silicon-carbide power devices, which unlock higher switching frequencies and lighter thermal budgets.

Key Market Players

Global leadership rests with a blend of diversified semiconductor houses and niche specialists. Firms such as Texas Instruments, Analog Devices, Infineon Technologies, STMicroelectronics, onsemi, NXP Semiconductors, Renesas Electronics, ROHM, Microchip Technology, Diodes Incorporated, Semtech, and Evelta Electronics collectively shape product roadmaps. They compete on power density, package size, and intelligent telemetry while pursuing mergers, strategic silicon foundry allocations, and co-design programs with top smartphone and EV makers.

Competitive dynamics increasingly revolve around vertical integration and strategic material bets. Early adopters of wide-bandgap devices, reference-design partnerships, and system-level software support are carving out greater market share as designers seek turnkey power platforms rather than discrete regulators.

Key Takeaways

• Current global market size (2024): roughly USD$ 40.10 billion

• Projected global market size (2032): about USD$ 66.76 billion at a 6.65 % CAGR

• Asia Pacific commands just under 44 % market share, powered by massive consumer-electronics manufacturing hubs and local EV champions

• Voltage regulators remain the revenue anchor, but battery-management ICs log the quickest market growth as electric-mobility scales

• DC-DC converters are poised for the highest power-source CAGR thanks to rising point-of-load architectures in servers and telecom gear

• Wide-bandgap adoption, intelligent power sequencing, and integrated telemetry define the next innovation wave

Market Dynamics

Drivers

• Persistent push for longer battery life, rapid charging, and compact form factors in smartphones, wearables, and laptops

• Surge in EV, hybrid, and plug-in sales requiring precise battery-cell monitoring and thermal control

• Expanding renewable-energy storage and smart-grid projects that need high-efficiency conversion and monitoring

Restraints

• Integration complexity and higher R&D expenditure when adding advanced features such as AI-based power optimization

• Commodity pricing pressure on legacy linear regulators, squeezing margins for low-end suppliers

• Supply-chain volatility for specialty substrates and wide-bandgap wafers

Opportunities

• Smart-home and industrial IoT nodes that demand ultra-low-power PMICs with energy-harvesting capabilities

• Automotive zonal-architecture shift creating demand for high-density, high-temperature power modules

• Fast-charging standards (USB-C PD, Qi2) opening incremental attach rates for integrated protocol controllers

Challenges

• Meeting globally fragmented EMC, safety, and energy-efficiency regulations without inflating bill-of-materials cost

• Ensuring cybersecurity of PMBus-enabled power rails in mission-critical systems

• Balancing heat dissipation limits with ever-smaller enclosures in premium consumer gadgets

Regional Analysis

Asia Pacific dominates power-management IC industry demand due to dense consumer-electronics supply chains, aggressive EV incentives in China and India, and government backing for semiconductor fabs. North America follows, driven by Silicon Valley device design-wins, large data-center footprints, and renewable-energy investments. Europe leverages stringent carbon targets and a robust automotive sector to sustain steady market growth.

• Asia Pacific – Largest revenue base, led by China, Japan, South Korea, and India

• North America – High design activity and rapid EV adoption underpin strong demand

• Europe – Automotive electrification and smart-grid upgrades propel market growth

• Latin America – Emerging opportunity as regional handset and appliance makers localize supply

• Middle East & Africa – Niche uptake in telecom infrastructure and solar projects

Segmentation Analysis

By Product Type

• Voltage Regulators – Essential, stable share.

Voltage regulators hold the lion’s share as virtually every electronic board needs precise rail control. Simpler design-in and low electromagnetic noise keep them ubiquitous.

• Battery Management ICs – Fastest-growing.

Rapid EV ramp-ups and longer smartphone endurance targets put advanced battery fuel-gauging and cell-balancing ICs in the spotlight. Designers prefer integrated protection and monitoring to shrink board space.

• Motor Control ICs – Steady industrial and automotive demand.

Brushless-DC motors in HVAC, drones, and power tools require robust motor-driver PMICs. Efficiency mandates and predictive-maintenance analytics drive upgrades to smarter controllers.

• Multi-channel ICs – Rising with SoC complexity.

High-performance processors and AI accelerators draw multiple voltage domains; multi-channel PMICs synchronize sequencing and telemetry, lowering total cost.

• Others (LED Drivers, Reset ICs, Power-Gate Controllers) – Niche yet indispensable.

Specialized lighting, safety, and start-up logic functions sustain consistent demand in appliances and industrial equipment.

By End-user

• Consumer Electronics – Core demand engine.

Smartphones, tablets, wearables, and AR/VR headsets consume the bulk of units, chasing slimmer designs and all-day battery life.

• Automotive – Highest CAGR.

Battery-electric platforms and ADAS stacks need high-voltage regulation, redundant safety features, and thermal resilience, pushing PMIC content per vehicle upward.

• Industrial – Automation backbone.

Factory-floor robotics, PLCs, and energy-management systems favor high-efficiency, wide-temperature-range PMICs for reliability.

• Telecommunication – Power-hungry nodes.

5G base stations, edge servers, and optical modules require point-of-load conversion with minimal heat dissipation.

• Healthcare – Growing portable diagnostics.

Wearable patches and handheld imaging devices lean on ultra-low-leakage PMICs to maximize operating time between charges.

• Others – Computing and networking acceleration.

High-density AI servers and network switches adopt digital-control PMICs for tight voltage tolerances and telemetry.

By Power Source

• AC-DC – Mature but sizable.

Wall adapters, white goods, and industrial power supplies rely on AC-DC stages; higher power-factor efficiency keeps innovation alive.

• DC-DC – Highest projected CAGR.

Distributed power architectures in data centers, EV battery packs, and telecom gear boost the need for compact, high-frequency buck-boost converters.

Industry Developments & Instances

• July 2024 – Renesas and AMD released a space-qualified PMIC bundle for edge-AI satellites, tightening integration for harsh environments.

• May 2024 – Yageo acquired a 20.23 % stake in uPI Semiconductor for US$ 162 million to strengthen AI and HPC power-delivery portfolios.

• May 2024 – ROHM and SemiDrive co-developed a smart-cockpit reference design combining advanced PMICs with automotive SoCs.

• March 2024 – Infinix unveiled the Cheetah X1 PMIC, enabling all-round fast-charge profiles across eight use cases for its NOTE 40 handset lineup.

• December 2023 – Infineon expanded its dual-channel gate-driver family, targeting battery-powered drones and light EVs.

Facts & Figures

• Asia Pacific held about 43.9 % global market share in 2023.

• Linear regulators still account for more than one-quarter of revenue despite efficiency trade-offs.

• Integrated switching regulators can cut board space by up to 40 % compared with discrete designs.

• Fast-charging smartphones now ship with PMICs capable of managing 100 W + power flow.

• Automotive battery-management IC shipments are expected to grow at over 12 % annually through 2030.

• Wide-bandgap (GaN, SiC) devices could represent nearly 15 % of PMIC material spend by 2032.

Analyst Review & Recommendations

Power-management IC market analysis shows a decisive shift toward intelligent, highly integrated solutions that balance efficiency, thermal limits, and cybersecurity. Suppliers that combine wide-bandgap expertise with robust software stacks for telemetry and adaptive control will outpace average market growth. We recommend prioritizing reference-design ecosystems for EV and ultra-mobile devices, securing long-term substrate supply, and expanding digital power-conversion IP to capture the next wave of data-center and automotive demand.