Market Overview

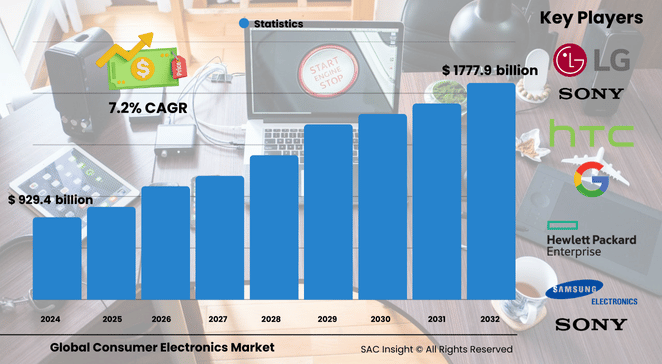

The global consumer electronics market size was valued at US$ 929.46 billion in 2024 and is projected to reach US$ 1,777.91 billion by 2032, reflecting a 7.225% CAGR over the 2024-2032 forecast window. This upward market growth stems from rising disposable incomes, rapid 5G and IoT rollouts, and a sharp pivot toward smart, energy-efficient devices. First-hand industry insights indicate that smartphones, wearables, and connected home appliances continue to anchor demand, while e-commerce platforms broaden access to premium and entry-level models alike. SAC Insight's deep market evaluation shows the U.S. market remains an innovation hub, and its share is expected to expand steadily through 2032 on the back of 5G upgrades and high early-adoption rates.

Summary of Market Trends & Drivers

• Premiumisation meets affordability: Flagship launches with AI-enhanced cameras and foldable displays coexist with aggressively priced entry models that target first-time buyers in emerging economies.

• Connected-home ecosystems: Voice-controlled assistants, smart televisions, and energy-aware appliances are converging into seamless platforms that lock in brand loyalty.

• Sustainability mandate: Manufacturers are cutting power consumption, extending product life cycles, and integrating recycled materials as consumers reward eco-friendly choices.

Key Market Players

Global market share is concentrated among diversified giants and fast-moving regional specialists. Firms such as Samsung Electronics, Apple, LG, Sony, Panasonic, Huawei, Lenovo, Dell Technologies, and HP shape competitive dynamics through high-velocity product refreshes, in-house chip development, and ecosystem tie-ins. Meanwhile, rising challengers including Xiaomi, Oppo, and Micromax leverage online flash sales and localized software features to gain ground in price-sensitive markets. Strategic alliances—ranging from semiconductor co-design to cloud-gaming partnerships—underscore the sector’s race to differentiate on experience rather than hardware alone.

Key Takeaways

• Current global market value (2024): USD$ 929.46 billion

• Projected value (2032): USD$ 1,777.91 billion at a 7.225% CAGR

• Smartphones held 51.6% market share in 2024, cementing their role as the core revenue engine

• Offline retail retained 55% share thanks to hands-on demos and instant fulfillment, but online channels post double-digit gains

• Asia Pacific led with 38.08% of global revenue in 2024; North America followed at just over 20%

• First-hand industry insights highlight AI-on-device chips and circular-economy design as next-wave differentiators

Market Dynamics

Drivers

• Rising disposable income in emerging economies is expanding the addressable buyer base for mid- to high-end gadgets.

• 5G and Wi-Fi 7 rollouts increase demand for bandwidth-hungry devices and drive replacement cycles.

• E-commerce penetration, flash sales, and influencer marketing accelerate purchasing decisions.

Restraints

• Supply-chain volatility, particularly for advanced semiconductors, can delay launches and inflate costs.

• High import duties in certain regions dampen adoption of premium categories.

Opportunities

• Refurbished and trade-in programs appeal to budget-conscious consumers and advance sustainability goals.

• Health-focused wearables and AI-enabled hearing devices open new revenue streams.

Challenges

• E-waste regulations tighten, forcing makers to rethink materials and end-of-life logistics.

• Intensifying patent litigation raises barriers for smaller entrants and can stall innovation.

Regional Analysis

Asia Pacific dominates the landscape, powered by urbanization, a tech-savvy youth cohort, and robust domestic manufacturing. North America follows, buoyed by early adopter behavior and high average selling prices, while Europe’s stringent eco-design directives spur demand for energy-efficient models. Latin America and the Middle East & Africa show rising momentum as mobile broadband expands.

• Asia Pacific – Fastest expansion, strong local brands, and government push for smart manufacturing

• North America – Premium segment strength, rapid 5G adoption, and thriving subscription services

• Europe – Sustainability-driven upgrades and growing appetite for smart-home bundles

• Latin America – E-commerce boom and price-sensitive demand for multi-function smartphones

• Middle East & Africa – Gradual shift from feature phones to affordable 4G/5G devices, aided by infrastructure rollouts

Segmentation Analysis

By Product

• Smartphones – Core revenue pillar

Intensifying reliance on mobile payments, social media, and on-device AI keeps smartphones at the center of consumer spending. Frequent model refreshes and bundled data plans drive repeat purchases.

• Laptops/Notebooks – Work-from-anywhere staple

Lightweight designs, extended battery life, and dedicated AI accelerators make notebooks essential for hybrid work and online learning, supporting sustained double-digit unit growth.

• Smart Televisions – Living-room command centers

Larger screens, mini-LED backlighting, and integrated streaming hubs fuel upgrades; interoperable smart-home dashboards strengthen vendor ecosystems.

• Wearables (smartwatches, earbuds) – High-growth adjunct

Health tracking, contactless payments, and seamless device handoff boost adoption across age groups, with premium audio earbuds gaining particular traction.

• Home Appliances (refrigerators, washers, ACs) – Efficiency-first evolution

Connected, energy-rated white goods gain favor as households prioritize lower utility bills and remote monitoring.

By Sales Channel

• Offline – Experience-driven dominance

In-store demos, same-day pickup, and trusted after-sales support keep brick-and-mortar ahead in value terms, especially for big-ticket items.

• Online – Convenience and comparison power

AI-based recommendations, virtual try-ons, and aggressive festival discounts push online share up every year, particularly in price-sensitive segments.

Industry Developments & Instances

• January 2025 – Samsung unveiled Vision AI1, embedding adaptive AI across its flagship TVs and displays to optimize picture quality and user interaction.

• December 2024 – Lenovo introduced the AMD-powered ThinkPad T14s Gen 6, the first x86 laptop claiming 50 TOPS of on-device AI performance, targeting creative professionals.

• August 2024 – A leading electronics maker launched a modular smartphone with user-replaceable camera and battery packs, extending product life and reducing e-waste.

Facts & Figures

• Offline stores captured 55% of global revenue in 2024 despite e-commerce surge.

• Smartphones accounted for 51.6% of total market revenue in 2024.

• Asia Pacific generated 38.08% of global sales in 2024, outpacing North America’s 20%+.

• Global average replacement cycle for smartphones shortened to 27 months in 2024 from 30 months in 2023.

• Wearables shipments crossed 350 million units in 2024, up 12% year on year.

Analyst Review & Recommendations

The consumer electronics arena is shifting from raw specifications to holistic user experiences built around AI, connectivity, and sustainability. Brands that pair cutting-edge silicon with robust software support and transparent recycling programs will stand out. To capture upcoming market share, incumbents should deepen regional alliances to secure components, expand trade-in ecosystems, and invest in energy-efficient design that meets tightening regulations. Keeping innovation cycles brisk yet sustainable is the surest path to long-term leadership in this rapidly evolving market.