Market Overview

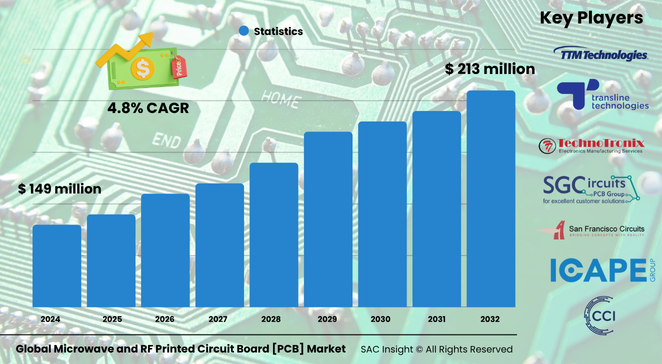

The global microwave and RF PCB market size was roughly valued at just under US$ 149 million in 2024 and, according to SAC Insight's deep market evaluation, is set to climb to about US$ 213 million by 2032, expanding at an average 4.8 % CAGR. First-hand industry insights point to surging demand for high-frequency circuitry across 5G radios, advanced driver-assistance systems, and connected medical devices.

In the United States microwave and RF PCB market alone, market analysis indicates revenue could advance from roughly US$ 3.29 billion in 2024 to nearly US$ 4.72 billion by 2032 as telecom, defense, and EV platforms upgrade to ultra-low-loss substrates. Miniaturisation pressures, flexible form factors, and additive manufacturing are reshaping design rules and spurring steady market growth.

Summary of Market Trends & Drivers

• 5G roll-outs, radar upgrades, and massive IoT deployments are accelerating high-frequency design wins, lifting demand for low-loss laminates and multi-layer build-ups.

• Automotive electrification and ADAS features are migrating millimetre-wave radar and wireless battery-management onto RF boards, widening use cases.

• Manufacturers are investing in semi-additive processes and AI-assisted design tools to meet tighter impedance and thermal windows while trimming scrap.

Key Market Players

Established fabricators such as TTM Technologies, RAYMING Technology, and MCL dominate market share by pairing large-scale capacity with in-house material science. Niche specialists—Transline, Candor Industries, Technotronix, and Sunshine Global Circuits—compete on quick-turn prototypes, rigid-flex know-how, and aerospace qualifications. Strategic moves centre on capacity expansions in North America and Asia, partnerships with laminate suppliers, and vertical integration of testing services to secure long-term 5G and defense contracts.

Key Takeaways

• Global market size (2024): about USD$ 148.6 million

• Projected global market size (2032): roughly USD$ 212.8 million at a 4.8 % CAGR

• 5G infrastructure already captures more than 60 % of new RF PCB demand

• RF PCBs command the largest type-based market share, near 45 %

• Hybrid boards are the fastest-growing type on compact 5G and satellite payloads

• Flexible and rigid-flex designs are posting double-digit market growth as wearables and avionics shrink form factors

Market Dynamics

Drivers

• Rapid 5G deployment and rising base-station density require high-frequency, low-loss interconnects.

• ADAS, EV powertrains, and V2X communications boost millimetre-wave PCB content per vehicle.

• IoT proliferation pushes compact RF modules into consumer, medical, and industrial devices.

Restraints

• High material and process costs deter smaller fabricators.

• Supply-chain tightness for copper foil, PTFE, and advanced glass weave can extend lead times.

• Design complexity increases re-spin rates and lengthens qualification cycles.

Opportunities

• Semi-additive and laser direct-imaging lines unlock finer features for Ultra-HDI boards.

• Defense modernisation budgets expand demand for radiation-tolerant, high-reliability microwave PCBs.

• Sustainability programmes reward low-waste additive manufacturing and halogen-free laminates.

Challenges

• Skilled-labour shortages raise engineering costs and slow capacity ramps.

• Ever-higher frequencies (>40 GHz) stretch current test, inspection, and plating capabilities.

• Regulatory conformity testing grows stricter, raising entry barriers for new entrants.

Regional Analysis

North America leads current revenue on the back of 5G densification, sizeable aerospace budgets, and an advanced materials ecosystem, while Asia-Pacific delivers the fastest percentage gains thanks to smartphone production and government-backed 5G roll-outs.

• North America – 35 % share; strong defense and EV activity sustains premium pricing.

• Asia-Pacific – 30 % share; rapid telecom build-out and electronics manufacturing scale drive volume.

• Europe – 20 % share; automotive radar and satellite programmes underpin demand.

• Latin America – 10 % share; telecom upgrades and emerging medical device clusters expand slowly.

• Middle East & Africa – 5 % share; early-stage 5G and defense electronics projects create niche requirements.

Segmentation Analysis

By Type

• RF PCB – Workhorse of high-volume telecom and IoT.

RF boards represent roughly 45 % of total demand, powered by Wi-Fi 6, Bluetooth Low Energy, and sub-6 GHz 5G. Stable loss profiles and cost-efficient FR-4/low-DK blends keep them attractive for consumer devices.

• Microwave PCB – Precision option for radar and satellite links.

Accounting for about 35 % of market revenue, microwave boards leverage PTFE or ceramic substrates to handle 10–40 GHz signals in defense, aerospace, and automotive radar.

• Hybrid PCB – Best of both worlds.

Roughly 20 % share and climbing; engineers co-fabricate RF layers with digital control layers to shrink footprint in 5G small-cells, EV inverters, and wearables.

By Application

• Automobile – Core growth engine.

Vehicle radar, wireless battery-management, and infotainment lift PCB content per car; ADAS adoption alone is raising microwave PCB volumes by more than 60 % over five years.

• Medical – High-margin niche.

MRI coils, wireless monitors, and surgical robots rely on RF boards to ensure low noise and biocompatibility, with remote-care adoption driving double-digit unit gains.

• Others (Telecom, Aerospace, Defense) – Steady backbone.

Base stations, satellites, and secure radios maintain constant demand for high-reliability, high-frequency boards.

By Material

• RT/Duroid – Premium microwave staple.

Low-loss tangent materials dominate defense radar and satellite payloads despite high cost.

• PTFE – Widely used for Flexible processing and consistent dielectric properties make PTFE blends popular in 5G macro radios.

• FR-4 / High-frequency substrates – Cost-balanced workhorses.

Enhanced-glass FR-4 and glass-reinforced polyimide serve mixed-signal designs below 10 GHz.

• Flexible materials – Design enablers.

Polyimide films support foldable phones and phased-array antennas where tight bend radii are critical.

By Frequency Range

• Low ( – Legacy radio and IoT endpoints; price sensitive.

• Mid (1–10 GHz) – 5G sub-6 GHz sweet spot; bulk of new volume.

• High (10–40 GHz) – Automotive radar, point-to-point backhaul; fastest growth.

• Very High (>40 GHz) – Emerging mmWave 5G, satcom user terminals; early adoption phase.

By Configuration

• Single-layer – Simplest layouts for cost-driven IoT tags.

• Double-sided – Entry-level mixed-signal boards with modest RF performance.

• Multi-layer – 8+ layers combine RF, power, and digital routing for base stations and EV powertrains.

• Blind/buried vias – Space-saving interconnects enable Ultra-HDI antennas and phased arrays.

By Manufacturing Process

• Subtractive – Mainstream etch-back for RF-ready FR-4.

• Additive – Copper build-up improves line-width control and reduces waste.

• Semi-additive – Combines both for sub-50 µm traces in next-gen smartphones.

• Laser direct imaging – Fine-line accuracy for 60 GHz antenna arrays.

Industry Developments & Instances

• November 2024 – A leading fabricator commissioned a 35 % capacity boost dedicated to Ultra-HDI microwave boards for U.S. defense contracts.

• March 2024 – Multiple 5G OEMs signed exclusive supply deals with RF PCB providers, trimming network deployment cycles by 75 %.

• July 2023 – AI-assisted design suites cut prototype spins by half, slashing time-to-market for mmWave modules.

• May 2023 – Additive manufacturing lines reported 60 % scrap reduction, improving gross margins despite copper price spikes.

Facts & Figures

• Over 60 % of new 5G radio designs now specify ultra-low-loss laminates.

• Miniaturisation has driven a 50 % jump in demand for rigid-flex boards since 2020.

• Approximately 75 % of IoT devices integrate some form of RF PCB.

• Automotive radar adoption lifted microwave PCB shipments by roughly 40 % in the past five years.

• Semi-additive processes improve line-width control by up to 30 % versus traditional etch-back.

Analyst Review & Recommendations

Market growth through 2032 hinges on balancing cost with rising performance targets. Fabricators that invest in semi-additive lines, in-house material R & D, and AI-driven design support will capture outsized share as frequencies climb and form factors shrink. Strategic partnerships with laminate suppliers and telecom primes can secure volume commitments, while cross-training engineers on mmWave test and reliability standards will mitigate talent shortages and speed time-to-qualification.