Key Market Insights

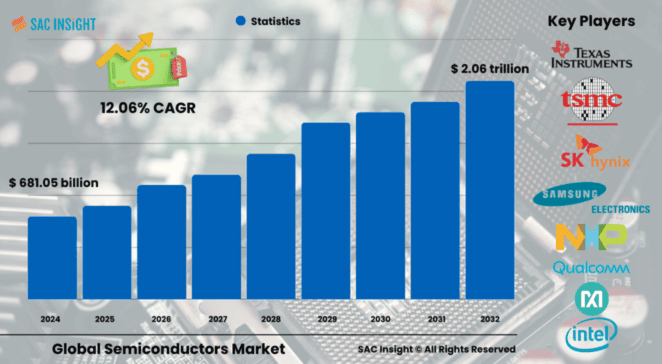

The global semiconductor market size was valued at US$ 681.05 billion in 2024 and is projected to reach roughly US$ 2.06 trillion by 2032, registering a 12.06% CAGR during the forecast period. First-hand industry insights indicate that demand is accelerating as AI, IoT, and advanced data-center architectures push the limits of compute density, power efficiency, and connectivity. SAC Insight evaluation shows Asia Pacific retains the largest market share at just over 50%, while the U.S. Semiconductor market is on track to top USD$ 258 billion by 2032 thanks to renewed fabrication investment, robust consumer electronics take-up, and strategic on-shoring incentives.

SUMMARY OF MARKET TRENDS & DRIVERS

Surging orders for integrated circuits that power cloud and edge AI workloads, coupled with widening 5G and Wi-Fi 7 deployments, headline current market trends. At the same time, government subsidies, tax credits, and strategic stockpiling are shortening supply chains and fueling market growth despite lingering geopolitical friction.

KEY MARKET PLAYERS

The semiconductor market Leading companies continue to set the pace through capital-intensive node shrinks, packaging breakthroughs, and strategic mergers. Firms such as Samsung Electronics, Intel, Broadcom, Taiwan Semiconductor, NVIDIA, Qualcomm, SK Hynix, Micron Technology, NXP Semiconductors, Texas Instruments, and Toshiba collectively account for the bulk of wafer starts worldwide. Their technology roadmaps now center on 3 nm and below, advanced EUV lithography, chiplet architectures, and AI-optimized accelerators, all aimed at raising compute per watt while controlling bill-of-materials cost. A growing cohort of fab-light and specialty suppliers—from MEMS sensor innovators to RF front-end specialists—are gaining traction by focusing on high-margin niches such as automotive ADAS, power electronics, and ultra-low-power edge AI. Together, these players shape an intensely competitive ecosystem that rewards speed-to-yield and ecosystem partnerships as much as outright transistor density.

KEY TAKEAWAYS

• 2024 market value: US$ 681.05 billion

• 2032 projection: US$ 2.06 trillion, 12.06% CAGR (2025-2032)

• Asia Pacific commands 50.9% market share, propelled by deep fabrication capacity and vertical supply chains

• Integrated circuits remain the revenue engine and are set to cross US$ 1.2 trillion by 2032

• The U.S. semiconductor market will approach US$ 258 billion by 2032, supported by fresh CHIPS-act funding

• AI accelerators, advanced packaging, and wide-bandgap power devices headline technology investments

MARKET DYNAMICS

Drivers

• Explosive data-center build-out and AI inference at the edge require faster, denser logic and memory chips

• Consumer appetite for connected devices boosts demand for advanced SoCs, sensors, and power regulators

• Government incentives and reshoring programs shorten supply chains and spur domestic fabs

Restraints

• High capital outlay for sub-5 nm nodes raises break-even thresholds and limits new entrants

• Inventory drawdowns and pricing swings in memory segments can distort quarterly earnings

Opportunities

• Wide-bandgap semiconductors (SiC, GaN) for EV traction inverters and fast chargers offer strong margin potential

• Advanced heterogeneous packaging enables chiplets and system-in-package solutions for space-constrained designs

Challenges

• Geopolitical trade restrictions and export controls complicate cross-border equipment and talent flows

• Skilled-labor shortages in photolithography, metrology, and process integration lengthen ramp-up timelines

REGIONAL ANALYSIS

Asia Pacific remains the undisputed production hub, benefiting from densely clustered fabs, robust subcontract assembly, and a deep component ecosystem. North America follows with a fast-growing manufacturing base catalyzed by federal incentives, while Europe focuses on automotive and industrial specialties, and the Middle East & Africa and Latin America build demand on rising device penetration.

• Asia Pacific – Dominant capacity, 50%+ revenue share, leadership in cutting-edge nodes

• North America – Rapid fab expansions, strong R&D spend, resilient downstream demand

• Europe – Automotive silicon leadership, emphasis on power and analog specialties

• Middle East & Africa – Gradual uptake driven by digital infrastructure and Industry 4.0 investments

• Latin America – Growing consumer electronics and data-center footprints lift import volumes

SEGMENTATION ANALYSIS

By Component

• Memory Devices – Fastest growth, led by NAND and DRAM for AI and high-bandwidth workloads

Next-generation DDR5, HBM, and 3D NAND deliver higher throughput and lower latency, underpinning AI model training and real-time analytics.

• Logic Devices – Workhorse compute engines for CPUs, GPUs, and custom accelerators

Shrinking geometries and chiplet designs boost instructions per watt, essential for cloud hyperscalers.

• Analog IC – Vital for power management and RF signal conditioning

Demand rises as 5G radios, EV drivetrains, and industrial automation require precise control and efficiency.

• Discrete Power Devices – SiC and GaN surge on EV, solar, and fast-charge growth

Wide-bandgap devices cut switching losses, increasing system efficiency and shrinking thermal design envelopes.

• Sensors – Moderate uptick tied to automotive ADAS and smart-home devices

CMOS image sensors and MEMS motion sensors expand as edge AI adds local inference.

• MCU and MPU – Steady demand in embedded and IoT endpoints

MCUs integrate wireless stacks and security, while MPUs target gateway compute and lightweight AI tasks.

By Application

• Networking & Communications – Largest slice, driven by smartphone radios and fiber backbone gear

High-speed SerDes, RF front-end modules, and switch ASICs support rising data traffic.

• Data Centers – High-value node, fueled by cloud, AI training, and hyperscale colocation

Custom accelerators and high-bandwidth memory drive robust silicon orders.

• Consumer Electronics – Smartphones, wearables, and smart TVs sustain unit volumes

Design wins hinge on power efficiency, integrated connectivity, and cost control.

• Automotive – Rapid electronic content growth in EVs, ADAS, and infotainment

Functional safety and wide temperature tolerances shape chip qualifications.

• Industrial – Gradual adoption of Industry 4.0 automation and predictive maintenance

Rugged MCUs, industrial Ethernet PHYs, and motor-control ICs address harsh environments.

• Government – Stable but modest spend on defense, aerospace, and secure communications

Radiation-hardened and long-lifecycle components dominate procurement.

INDUSTRY DEVELOPMENTS & INSTANCES

• March 2023 – A leading memory manufacturer committed US$ 230 billion to build a cluster of advanced fabs over 20 years

• February 2023 – A top wireless chipset vendor unveiled Wi-Fi 7 silicon targeting multi-gigabit home gateways

• January 2023 – A U.S. design house taped out a 5 nm AI accelerator boasting advanced security hardening

• August 2022 – An ethernet switch supplier launched a 51.2 Tbps device to double backbone capacity

• April 2022 – A national economic ministry partnered with a global chipmaker to strengthen local supply chains

FACTS & FIGURES

• Integrated circuits are projected to generate USD$ 1.2 trillion in 2032 revenue

• Asia Pacific shipped over USD$ 346 billion worth of semiconductors in 2024 alone

• Average annual capex across leading fabs hit USD$ 190 billion in 2022, up 24% year on year

• Wide-bandgap power devices are forecast to achieve 35% CAGR through 2030

• An estimated 75% of global data passes through silicon manufactured in East Asia

ANALYST REVIEW & RECOMMENDATIONS

The semiconductor landscape is entering a capital-intensive yet opportunity-rich phase. Players that marry leading-edge process nodes with advanced packaging and tight vertical integration will capture outsized value. Diversifying supply chains, investing in workforce development, and prioritizing wide-bandgap and AI-centric products are top strategic imperatives. With balanced market analysis pointing to durable double-digit gains, firms that execute on time-to-yield and ecosystem partnerships are positioned to outpace peers throughout the forecast horizon.