Market Overview

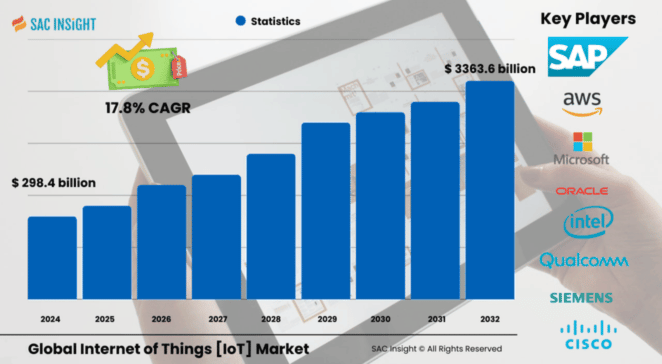

The global internet of things market size was valued at US$ 298.46 billion in 2024 after a steady post-pandemic rebound and is projected to reach roughly US$ 3,363.67 billion by 2032, expanding at a compound annual growth rate of 17.85% during the 2025-2032 forecast window. Hardware still underpins more than half of global revenues, but soaring demand for cloud-native analytics and edge orchestration is tilting value creation toward integrated solutions and services.

First-hand industry insights highlight three structural shifts: rapid 5G rollout, mainstream adoption of AI-enabled predictive maintenance, and governments using smart-city spending to tackle urban efficiency. SAC Insight's deep market evaluation further shows that North America accounted for 36.1% of global revenue in 2024, and The U.S. Internet of Things Market alone is on track to host over US$ 661.95 million cellular IoT connections by 2032—more than 90% of the region’s total.

Summary of Market Trends & Drivers

• Enterprises are shifting from pilot projects to full-scale rollouts, driving multi-year contracts for device management, cybersecurity, and data-monetization services.

• Convergence of generative AI with IoT edge nodes is squeezing latency, boosting anomaly detection, and opening new revenue streams in industrial, mobility, and healthcare settings.

• Decentralized security frameworks—often blockchain-based—are emerging as a pragmatic answer to device authentication and data integrity, especially in logistics and supply-chain applications.

Key Market Players

Leading providers shaping IoT Industry advancement include Amazon Web Services, Microsoft, Qualcomm Technologies, Intel, Cisco Systems, Oracle, SAP, Siemens, General Electric, and PTC. These companies combine large developer ecosystems with aggressive M&A to close capability gaps in AI toolchains, edge security, and low-power connectivity. Start-ups clustered around device OS, Z-Wave home automation, and integrated SIM management continue to supply niche innovations that incumbents either acquire or partner with to accelerate time-to-market.

Key Takeaways

• Global IoT Market value 2024: USD$ 298.46 billion

• Projected value 2032: USD$ 3,363.67 billion at a 17.85% CAGR

• Hardware held 57.4% market share in 2024; solutions & services will command the largest share by 2032

• North America leads today; Asia Pacific shows the fastest market growth thanks to smart-city mandates and rising 5G penetration

• The U.S. is expected to exceed 661.95 million cellular IoT links by 2032

• Wi-Fi dominates home connectivity today, while Z-Wave and low-power wide-area options are gaining ground in high-density deployments

Market Dynamics

Drivers

• Proliferation of 5G and low-latency edge computing that enables real-time analytics for mobility, telemedicine, and factory automation.

• Government-funded smart-city programs accelerating sensor deployments for traffic, waste, and energy management.

• Falling silicon and cloud-storage prices lowering barriers to entry for SMEs seeking outcome-based IoT solutions.

Restraints

• Persistent security and privacy concerns around large-scale data collection, heightened by evolving regulations.

• Legacy IT and OT silos in brownfield industrial facilities slowing full integration and real-time data utilization.

Opportunities

• Generative AI models that create synthetic datasets for predictive maintenance and personalized services.

• Blockchain-enhanced supply-chain visibility solutions that monetize traceability across agriculture, pharma, and cold-chain logistics.

Challenges

• Fragmented connectivity standards complicating global device certification and roaming.

• Scarcity of cross-disciplinary talent able to blend operational technology, cybersecurity, and data science at scale.

Regional Analysis

North America internet of things market currently holds the largest revenue share, driven by advanced cloud infrastructure, early 5G adoption, and high smart-city investment. Europe follows closely on the back of stringent data-protection policies and heavy R&D spending, while Asia Pacific is set for double-digit acceleration through 2032 as megacities invest in sustainable mobility and utilities.

• North America – Early-adopter enterprises, mature venture funding, rapid edge-to-cloud rollouts

• Europe – Strong regulatory backing for data sovereignty, robust industrial IoT pilots in Germany and the Nordics

• Asia Pacific – Highest CAGR, propelled by urbanization and national smart-city blueprints in China and India

• Latin America – Gradual uptake in agriculture and utilities with pay-as-you-grow connectivity models

• Middle East & Africa – Smart-infrastructure spending in GCC states offsets slower broader enterprise adoption

Segmentation Analysis

By Component

• Hardware – Foundation layer with sensors, gateways, and edge processors Hardware continues to dominate spend thanks to ongoing retrofits in manufacturing, utilities, and consumer devices, yet profit pools are shifting to firmware updates, security chips, and AI accelerators.

• Software – Middleware, analytics, and application enablement As enterprises demand vendor-agnostic orchestration, software platforms that normalize device data and deliver API-ready insights are gaining traction, especially in the industrial and healthcare verticals.

• Services – Integration, managed services, and consulting Service revenue is climbing fastest as businesses seek outcome-driven engagements covering deployment, cybersecurity, and lifecycle management.

By Deployment

• On-Premise – Low-latency control and data-sovereignty assurance Industries with mission-critical processes—manufacturing, energy, defense—favor on-premise gateways to meet sub-millisecond latency and local-regulation requirements.

• Cloud – Elastic compute for analytics and scale-out architectures Cloud deployment supports dynamic scaling, global device management, and AI model updates, positioning it as the default choice for consumer, retail, and cross-geography use cases.

By Connectivity

• Wi-Fi – Ubiquitous link for smart-home ecosystems Its cost advantage and easy setup keep Wi-Fi dominant in residential and small-office automation, though congestion prompts a shift to mesh-capable protocols.

• Bluetooth – Short-range, low-energy leader for wearables and peripherals BLE chips drive health monitors, earbuds, and asset tags where battery life is critical and bandwidth demands are modest.

• Z-Wave – Secure mesh for home automation, rising CAGR Interoperability across certified devices and low interference make Z-Wave attractive for professional installers and multi-vendor smart-home platforms.

• Other Protocols – Zigbee, LPWANs, cellular NB-IoT/LTE-M, satellite IoT LPWAN and satellite links extend coverage to rural agriculture, oil & gas, and maritime tracking where terrestrial networks are sparse.

By Enterprise Type

• Large Enterprises – End-to-end adoption with ERP and CRM integration They leverage dedicated IT teams to embed IoT data into existing workflows, pushing vendors for custom SLAs and multi-cloud interoperability.

• SMEs – Highest CAGR via pay-as-you-go platforms and low-code dashboards SMEs focus on fast ROI, selecting modular solutions for inventory, fleet, or energy monitoring without heavy capex.

By Industry

• Healthcare – Remote patient monitoring, asset tracking, and smart wards Hospitals integrate IoT with AI diagnostics and electronic health records to cut readmissions and optimize equipment utilization.

• Manufacturing – Predictive maintenance and digital twins Industry 4.0 retrofits reduce downtime, improve OEE, and enable just-in-time logistics.

• Agriculture – Precision farming, smart irrigation, and drone analytics Connected sensors drive water savings and yield gains, while satellite IoT bridges connectivity gaps in remote fields.

• Transportation – Fleet telematics, autonomous logistics, and smart traffic Real-time analytics reduce fuel costs and improve safety, with 5G enabling vehicle-to-everything communication.

• Retail, BFSI, Government, Sustainable Energy, IT & Telecom, Others – Each leveraging tailored IoT use cases from smart shelves and digital tellers to grid optimization and network slicing.

Industry Developments & Instances

• November 2024 – A global telecom provider launched an AI-ready industrial IoT backbone to boost factory yield and uptime.

• June 2024 – Cisco introduced an intelligent industrial network to prepare brownfield plants for ML-driven optimization.

• October 2023 – SoftBank expanded IoT services across 19 Asia Pacific markets, bundling edge analytics with unified billing.

• January 2023 – PTC acquired a field-service software specialist to fuse AR work instructions with real-time IoT diagnostics.

• December 2022 – Deloitte unveiled a multibillion-dollar cloud fund targeting IoT, 5G, and AI co-innovation projects.

Facts & Figures

• 57.4% hardware market share in 2024; services segment CAGR forecast to exceed 20% through 2032

• 661.95 million U.S. cellular IoT connections expected by 2032

• 36.1% of global IoT revenue originated in North America in 2024

• Smart-home devices accounted for nearly half of consumer IoT shipments last year

• Average 30% drop in sensor costs over the past five years accelerated SME adoption

Analyst Review & Recommendations

IoT market analysis shows a decisive pivot from device counts to data value. Vendors that pair secure, hardware-agnostic platforms with domain-specific AI services will capture the lion’s share of upcoming spend. We recommend focusing on verticalized solutions—healthcare, industrial automation, and smart infrastructure—while investing in zero-trust security and seamless edge-to-cloud orchestration. With market growth forecast at nearly 18% annually and capital flowing toward AI-enhanced use cases, the competitive race now hinges on who can translate raw sensor data into reliable, actionable insights faster and at scale.