Market Overview

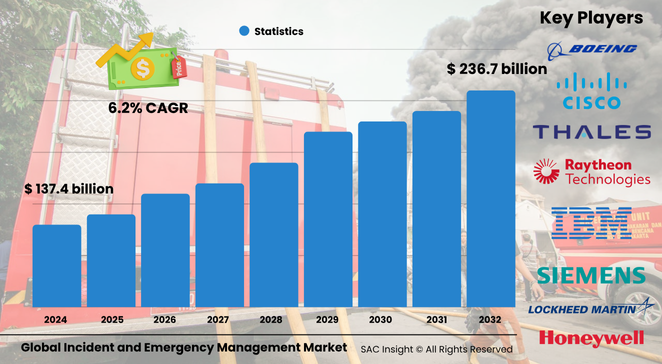

The global incident and emergency management market size stands at about US$ 137.45 billion in 2024 and is set to climb to nearly US$ 236.76 billion by 2032, reflecting a steady 6.25% CAGR. First-hand industry insights highlight three growth pivots: climate-driven natural catastrophes, rising urban security threats, and rapid adoption of AI-enabled command platforms.

SAC Insight's deep market evaluation shows the United States incident and emergency management market alone could expand from roughly US$ 48.1 billion in 2024 to around US$ 82.7 billion by 2032 as federal, state, and private entities modernize readiness infrastructure.

Summary of Market Trends & Drivers

• Governments are linking satellite, 5 G, and IoT sensors into unified control rooms for faster, data-rich response.

• Enterprises shift from standalone alarms to cloud-based resilience suites that bundle mass notification, real-time analytics, and business-continuity orchestration, pushing market growth beyond public-sector budgets.

Key Market Players

Global leadership rests with a mix of diversified industrial majors and niche digital specialists. Honeywell, Johnson Controls, and Siemens supply integrated building-to-city safety platforms, while Lockheed Martin, Motorola Solutions, and Collins Aerospace leverage defense-grade situational awareness for civilian use. IBM, Hexagon, and Esri embed geospatial and cognitive analytics into decision support; AT&T, NEC, and Eaton round out the ecosystem with hardened communications and power continuity solutions. Competitive dynamics revolve around AI partnerships, acquisitions of software innovators, and region-specific regulatory alignments.

Key Takeaways

• Current global market size (2024): USD$ 137.45 billion

• Projected market size (2032): USD$ 236.76 billion at 6.25 % CAGR

• Emergency/Mass Notification remains the largest solution slice, accounting for more than one-quarter of market revenue

• Services segment posts the fastest market growth as organizations outsource 24/7 monitoring, simulation, and system upgrades

• Asia Pacific outpaces the global average with an 8 % CAGR, topping roughly USD$ 52 billion by 2032

• False-alarm rates exceeding 70 % drive demand for AI-based verification and analytics modules

Market Dynamics

Drivers

• Escalating climate volatility and urban density raise the frequency and impact of disasters.

• AI, predictive analytics, and drone surveillance enhance early warning and resource allocation.

• Strict safety mandates and insurance incentives boost investment in integrated resilience architectures.

Restraints

• High initial outlay and integration complexity discourage small municipalities and SMEs.

• Data-privacy concerns limit adoption of continuous tracking and biometric monitoring in some regions.

• Skilled-labor shortages slow deployment and maintenance of advanced platforms.

Opportunities

• Smart-city programs embed incident management nodes into transport, energy, and healthcare networks.

• Mobile-first notification apps extend reach to peri-urban and rural zones at low incremental cost.

• Green, energy-resilient command centers align with sustainability funding and carbon-reduction goals.

Challenges

• Persistent false alarms waste resources and desensitize responders.

• Cyberattacks on emergency networks threaten public trust and operational continuity.

• Interoperability gaps between legacy radio systems and next-gen IP networks complicate multi-agency coordination.

Regional Analysis

North America commands the largest market share thanks to mature regulatory frameworks, substantial federal grants, and active private-sector modernization. Europe accelerates as climate resilience rules tighten, while Asia Pacific posts the quickest market growth on the back of urbanization, government disaster-readiness budgets, and widespread mobile connectivity.

• North America – Dominant revenue hub, heavy focus on multi-hazard command systems

• Europe – Rapid upgrades to flood, wildfire, and CBRN preparedness infrastructure

• Asia Pacific – Fastest CAGR, buoyed by smart-city rollouts and high natural-disaster exposure

• Middle East & Africa – Investment in crowd-management and critical-infrastructure protection around mega-events

• Latin America – Growing adoption of satellite-linked early-warning networks for earthquakes, floods, and civil unrest

Segmentation Analysis

By Component

• Web-based Emergency Management Systems – Central nervous system for command operations.

Cloud-native dashboards stitch together sensor feeds, GIS layers, and responder status, shrinking decision cycles and enabling remote collaboration.

• Emergency / Mass Notification Systems – Largest revenue contributor.

Multi-channel alerts (SMS, push, siren) ensure timely instruction during fires, cyber incidents, or health crises, making them a foundational investment across sectors.

• Disaster Recovery & Business Continuity Platforms – Rising compliance driver.

Integrated workflows automate impact assessment, backup activation, and post-event reporting to minimize downtime and regulatory penalties.

• Geospatial & Perimeter Detection Solutions – Precision situational insight.

AI-enhanced mapping, video analytics, and ground sensors provide early anomaly detection for campuses, transport nodes, and industrial sites.

By Services

• Consulting & Risk Assessment – Entry point for tailored roadmaps.

Specialists benchmark current readiness, quantify gaps, and design phased adoption strategies that fit budget and threat profiles.

• EOC Design & Integration – High-value turnkey projects.

Vendors deliver end-to-end control rooms, linking radio, cellular, and satellite assets into ergonomic command spaces.

• Training & Simulation – Skills pipeline.

Immersive VR and scenario engines keep responders sharp and validate new SOPs under realistic stress conditions.

• Public Information Services – Community engagement.

Outsourced hotlines and social-media monitoring enhance rumor control and bolster public trust during emergencies.

By Communication System

• First Responder Tools – Rugged, interoperable devices.

Wearables and body-cams feed live video and vitals to command posts, raising responder safety and situational clarity.

• Satellite-Assisted Equipment – Coverage where terrestrial networks fail.

Portable terminals sustain voice and data links during hurricanes or remote-area operations, critical for continuity.

• Vehicle Gateways & Emergency Radars – Mobile hubs.

On-board routers and compact radar units turn patrol cars and fire trucks into rolling sensor platforms, extending network reach.

By Simulation

• Incident & Evacuation Models – Fastest-growing simulation class.

3D crowd-flow and hazard-spread engines help cities validate evacuation corridors and refine signage before real-world stress tests.

• Hazard Propagation Tools – Critical for chemical, wildfire, or flood scenarios.

GIS-driven models forecast plume or water rise, informing targeted alerts and resource staging.

• Traffic Simulation – Keeps lifelines moving.

Dynamic routing minimizes gridlock, ensuring ambulances and supply convoys reach impact zones quickly.

By Vertical

• Government & Public Sector – Core buyer.

National and local agencies mandate interoperable systems for homeland security and civil protection.

• Healthcare & Lifesciences – Fastest vertical CAGR.

Hospitals deploy surge-capacity dashboards, cyber incident playbooks, and patient-tracking to maintain care continuity.

• Energy & Utilities – Grid resilience imperative.

Operators integrate SCADA alarms with physical security feeds to counter cascading blackouts.

• Defense & Military, Transportation & Logistics, Commercial & Industrial, and Others – Diverse but converging needs.

All seek unified threat awareness, regulatory compliance, and minimal downtime.

Industry Developments & Instances

• November 2024 – LogicGate launched a banking-focused incident hub to streamline cyber-incident reporting.

• July 2024 – Motorola Solutions acquired Noggin, adding cloud event-management to its safety portfolio.

• April 2024 – Johnson Controls renewed its pact with Everbridge, fusing building data with mass-alert orchestration.

• June 2023 – Honeywell led a multi-firm coalition to push real-time incident data to first-responder apps.

Facts & Figures

• Over 30 000 disaster-related fatalities in 2022 underline the urgency of robust response systems.

• False alarms exceed 70 % of activations, driving AI verification demand.

• Services segment is projected to outpace solutions with an 8 % CAGR through 2032.

• Asia Pacific could capture roughly 22 % market share by 2032, up from 17 % in 2024.

• Emergency/Mass Notification deployments can cut average evacuation time by up to 35 %.

Analyst Review & Recommendations

Market analysis indicates a pivot from siloed alarms to holistic resilience platforms that fuse sensors, analytics, and communications. Vendors that couple AI-driven threat validation with flexible, subscription-based services will capture outsized market share. Buyers should prioritize open APIs for multi-agency interoperability, invest in continuous staff training, and embed cybersecurity from the outset to safeguard mission-critical networks amid rising digital threats.