Key Market Insights

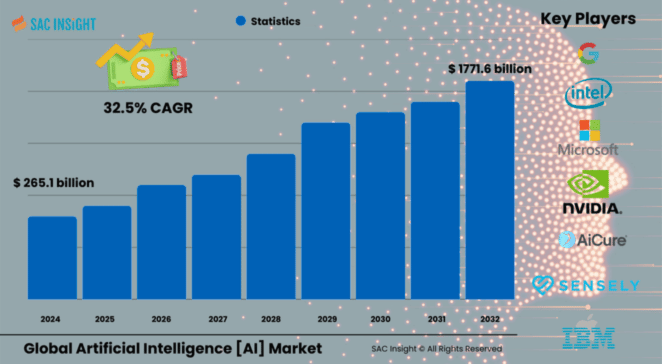

The Global artificial intelligence [AI] market is set to continue its rapid growth trajectory. With the global market size estimated at USD$ 265.12 billion in 2024, our analysis expects the sector to reach USD$ 1,771.62 billion by 2032, advancing at a powerful 32.55% CAGR over the forecast period. The widespread adoption of AI technology is driven by increased enterprise use of generative models, the expansion of cloud deployments, and substantial government investments. In North America, the U.S. artificial intelligence [AI] market alone is anticipated to grow from US$ 23.8 billion in 2025 to approximately US$ 399.22 billion by 2032, as businesses aim to integrate intelligent automation into their operations.

Summary of Market Trends & Drivers

• Generative AI tools are evolving from experimental to production stages, promoting their use in marketing content, coding assistance, and design simulation.

• The convergence of edge and cloud computing is gaining momentum, as real-time use cases in autonomous vehicles, predictive maintenance, and smart retail demand immediate data processing.

• Significant investments in AI supercomputers as-a-service are shortening model-training cycles and making AI more accessible to midsize enterprises.

Key Market Players

Global artificial intelligence [AI] market leaders such as Microsoft, Amazon, Alphabet (Google), IBM, NVIDIA, and Intel dominate the market in hardware accelerators, software platforms, and AIaaS offerings. These companies are setting the competitive pace through ongoing research and development as well as strategic mergers and acquisitions. Emerging companies, including Baidu, H2O.ai, Clarifai, and AiCure, are specializing in niche, vertical-specific solutions from autonomous driving to medical adherence analytics and are gaining market share through innovation and strategic partnerships.

Key Takeaways

• 2024 global AI market size: USD$ 265.12 billion

• 2032 forecast value: USD$ 1.771 trillion at a 32.55% CAGR

• Software captures the largest product market share with 35% of 2025 revenue, with cloud deployment leading all delivery models.

• North America holds 29.5% of global revenue, while Asia-Pacific is on track for the fastest regional growth through 2032.

• Machine learning and deep learning continue to be core technologies, with machine vision showing the steepest growth trajectory.

• Generative models and quantum AI are poised to shape competitive differentiation in the next decade.

Market Dynamics

Drivers

• The enterprise-wide drive for intelligent automation aims to reduce costs and unlock new revenue streams.

• The explosion of unstructured data, coupled with cheaper storage and computing, fuels AI adoption.

• Government stimulus packages and national AI strategies are accelerating R&D funding.

Restraints

• There is a shortage of skilled AI talent, particularly in emerging economies.

• The perception of AI as a black box and related ethical concerns limit user trust and regulatory approval.

• The high upfront investment required for training large models in specialized domains can be prohibitive.

Opportunities

• AI supercomputers offered as a service lower capital expenditure barriers for mid-tier firms.

• Breakthroughs in quantum AI are expected to open new frontiers in drug discovery, climate modeling, and encryption.

• Demand for explainable and responsible AI solutions creates avenues for niche platforms and consulting practices.

Challenges

• A fragmented global regulatory landscape increases compliance complexity.

• Rapidly increasing compute requirements raise sustainability and cost issues.

• Data sovereignty laws impose restrictions on cross-border model training and deployment.

Regional Analysis

The AI market in North America leads the charge due to robust venture funding, extensive cloud infrastructure, and early enterprise adoption. Europe follows, driven by strong public sector digitization and stringent AI governance frameworks. Asia-Pacific is the fastest-growing region, with China, India, and Southeast Asia ramping up AI investments to enhance manufacturing productivity and digital services.

• North America – Innovation hub with 29.5% 2025 market share and strong enterprise penetration

• Europe – Regulatory frontrunner prioritizing ethical AI and sector-specific initiatives in finance and healthcare

• Asia-Pacific – Experiencing a double-digit surge powered by smart-city developments and consumer-facing super-apps

• Latin America – Steady adoption in BFSI and retail, driven by increasing cloud connectivity

• Middle East & Africa – Early-stage adoption with a focus on smart-government and energy optimization projects

Segmentation Analysis

By Component

• Software – Represents 35% market share, the backbone of model development

Software platforms streamline data ingestion, model training, and deployment, positioning them at the heart of enterprise AI strategies. Expanding libraries and no-code builders enhance access beyond data science teams.

• Hardware – Accelerators and high-bandwidth memory keep inference fast

AI-optimized chips (GPUs, ASICs, FPGAs) and advanced interconnects enhance throughput for complex models in data centers and edge devices.

• Services – Fastest-growing segment as firms seek integration expertise

Managed and professional services fill skill gaps, guide responsible AI rollouts, and provide ongoing model monitoring.

By Deployment

• Cloud – Dominant and expanding

Pay-as-you-go GPU clusters and pre-trained APIs allow for rapid experimentation and global scaling, establishing cloud as the go-to deployment option.

• On-Premise – A resilient niche for data-sensitive industries

Heavily regulated sectors and latency-critical applications favor onsite clusters or hybrid architectures for compliance and performance needs.

By Technology

• Machine Learning – The backbone of predictive analytics

Machine learning is crucial for applications like credit-risk assessment and demand forecasting, utilizing both supervised and unsupervised techniques.

• Deep Learning – Essential for processing speech, vision, and text

Neural networks excel at identifying patterns in large datasets and remain central to autonomous systems.

• Natural Language Processing – Fuels conversational AI

Applications like chatbots, summarization, and sentiment analysis are transforming customer support and knowledge management.

• Machine Vision – Expected to have the highest CAGR

Technologies like 3D imaging and structured light propel automated inspections, medical diagnostics, and mixed-reality applications.

• Generative AI – Blends creativity with productivity

Text-to-image, code generation, and large language models are revolutionizing content workflows and driving new monetization avenues.

By Function

• Operations – The core productivity engine

Predictive maintenance, logistics optimization, and process automation minimize downtime and costs.

• Sales & Marketing – Intelligent growth strategies

AI-driven lead scoring, personalized offers, and dynamic pricing boost conversion rates.

• Service Operation – Transforming customer care

Conversational agents manage routine queries, while agent-assist tools reduce call handling times and improve satisfaction rates.

By Industry

• Healthcare – Adoption led by diagnostic imaging, virtual nursing, and drug discovery

• BFSI – Fraud detection, algorithmic trading, and risk analytics provide financial stability

• Retail – Enhances customer experience through personalized recommendations and inventory prediction

• Automotive & Transportation – ADAS and autonomous driving technologies enhance safety

• IT & Telecom – Network optimization and AI-powered service desks improve uptime and customer loyalty

Industry Developments & Instances

• March 2025 – ServiceNow launched AI Agent Studio and Orchestrator, enabling the no-code creation of custom AI agents for enterprise workflows.

• March 2025 – Commonwealth Bank of Australia strengthened its partnership with Anthropic to integrate responsible AI in retail banking.

• March 2025 – NTT DATA and CrowdStrike collaborated to deliver AI-native cybersecurity services via the Falcon platform.

• October 2024 – Amazon Ads introduced AI Creative Studio and Audio Generator to streamline diverse ad production formats.

• July 2024 – H2O.ai unveiled the Danube3 small language model series, making NLP accessible in resource-constrained environments.

Facts & Figures

• Global software accounts for a 35% share of 2025 revenue, with cloud deployments supporting over 60% of new AI workloads.

• Enterprises adopting AI have reported an average 25% reduction in operational costs within two years of implementation.

• About 87% of Indian companies classify as Enthusiast or Expert adopters, indicating strong growth momentum in the Asia-Pacific region.

• Investment in generative AI startups totaled US$ 25.2 billion in 2023, an eight-fold increase from the previous year.

• Funding for quantum AI consortium initiatives has grown at an annual rate of 40% since 2021, highlighting future research priorities.

Analyst Review & Recommendations

Our comprehensive market analysis indicates that the AI market is entering a scale-up phase where competitive advantage increasingly relies on domain-specific data, responsible governance, and edge-to-cloud orchestration. Vendors should prioritize developing explainability toolkits, energy-efficient hardware, and industry-specific solutions to capture untapped enterprise budgets. Early adopters that partner with cloud hyperscalers and build ecosystem loyalty are likely to secure substantial market shares as AI becomes an integral part of digital strategies worldwide.