Market Overview

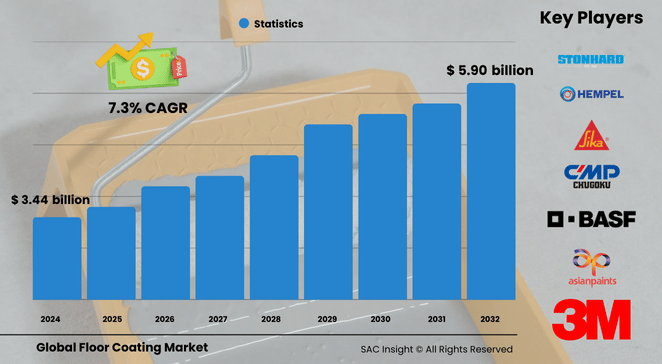

The global floor coating market size is valued at roughly US$ 3.44 billion in 2024 and is projected to reach approximately US$ 5.90 billion by 2032, expanding at a 7.35% CAGR across the 2025-2032 forecast window. First-hand industry insights highlight three structural growth engines: a global construction up-cycle, tougher hygiene, and safety regulations in industrial settings, and rapid product innovation that cuts installation downtime.

SAC Insight's deep market evaluation shows that non-residential re-fit work in North America and fast urbanization in Asia Pacific are converging to lift volumes. The U.S. floor coating market alone is on track to top roughly US$ 1.1 billion by 2032, driven by expansion projects in logistics hubs and battery gigafactories.

Summary of Market Trends & Drivers

• Accelerating demand for epoxy and polyaspartic systems that cure in hours, not days, is reshaping installation schedules and lowering plant shutdown costs.

• A clear market trend toward low-VOC, bio-based formulations is gathering pace as green-building mandates tighten across Europe and parts of Asia.

• Data-driven analysis shows that factories adding electrostatic-discharge (ESD) and anti-microbial coatings gain measurable reductions in product rejects and workplace incidents, reinforcing adoption.

Key Market Players

Global leadership rests with diversified chemical groups and specialty formulators that combine broad distribution with application know-how. Large integrated companies leverage backward linkages in resins and pigments to manage input costs, while nimble mid-sized firms win share by tailoring fast-curing or high-build products for niche jobs. All major contenders—BASF SE, Akzo Nobel, Sherwin-Williams, PPG Industries, Sika Group, Axalta Coating Systems, Jotun, and Asian Paints—continue to expand regional manufacturing and offer on-site technical services to lock in repeat business. Recent partnerships with flooring contractors and equipment makers underline a market dynamic that rewards turnkey, value-added solutions over commodity gallons.

Key Takeaways

• 2024 market value: USD$ 3.44 billion

• 2032 market value: approximately USD$ 5.90 billion at a 7.35% CAGR

• Asia Pacific holds the largest market share at about 42%, fueled by infrastructure spending in China and India.

• Epoxy dominates the resin mix, claiming about 41% of total revenue thanks to its durability and versatility.

• Concrete remains the core application, accounting for nearly half of all coated surfaces.

• Fast-curing polyaspartic and water-borne polyurethane systems are the quickest-growing segments as specifiers push for shorter project cycles and lower emissions.

Market Dynamics

Drivers

• Rising investments in warehousing, food processing, and EV battery plants demand chemical-resistant, easy-clean floors.

• Government-backed green-building programs encourage low-VOC and bio-based coating adoption, propelling market growth.

• The shift toward aesthetic, designer flooring in retail and residential renovations broadens the customer base.

Restraints

• Improper surface preparation leads to premature failures, increasing warranty claims and denting customer confidence.

• Volatile raw-material prices for key resins and additives pressure margins, especially for smaller formulators.

Opportunities

• Smart coatings with embedded sensors that monitor wear or static build-up open new revenue streams.

• Localized production in Latin America and the Middle East can cut lead times and import costs, unlocking untapped demand.

Challenges

• Skilled-applicator shortages and inconsistent workmanship in emerging markets hinder consistent quality.

• Evolving regulatory frameworks on VOC limits require continual reformulation and capital outlays for R&D.

Regional Analysis

The Asia Pacific floor coating market is the undisputed demand engine, thanks to sustained construction spending, a burgeoning manufacturing base, and rising income levels that push decorative upgrades. In North America, refurbishments of legacy industrial facilities underpin steady gains, while Europe benefits from stimulus-backed energy-efficient retrofits. Momentum is building in Central & South America as economic recovery and foreign direct investment boost infrastructure, and the Middle East & Africa are seeing pockets of high-value growth tied to mega projects.

• Asia Pacific – Largest market share; double-digit growth in China, India, and Southeast Asia

• North America – Strong non-residential renovation pipeline; high uptake of fast-return-to-service products

• Europe – Energy-efficient building codes and factory modernization sustain demand

• Central & South America – Rising GDP and manufacturing reshoring support new capacity additions

• Middle East & Africa – Mega-projects in Saudi Arabia and the UAE drive niche, high-specification orders

Segmentation Analysis

By Resin

• Epoxy – Workhorse resin with roughly 41% share Epoxy balances cost, chemical resistance, and mechanical strength, making it the default choice for warehouses, hospitals, and showrooms. Its ability to bond to old or new concrete underpins widespread acceptance.

• Polyaspartic – Rapid-cure specialist, fastest growth Polyaspartic chemistry slashes downtime to a single shift and withstands abrasion and spills, appealing to automotive workshops and cold-storage facilities where every hour counts.

• Polyurethane – Colour-stable, flexible performer Polyurethane floors resist UV and maintain gloss, suiting commercial spaces and manufacturing lines that need a stable, easy-to-clean surface.

• Acrylic and Others – Niche applications Acrylics find favor in decorative or light-duty areas, while methyl methacrylate targets extreme cold installs where conventional resins struggle to cure.

By Component

• Single-component – Convenience leader Ready-to-apply formulations simplify logistics for small jobs and maintenance crews, especially in parking areas and basements.

• Double-component – Industrial backbone Mix-on-site systems marry resin and hardener for superior hardness and chemical resistance, dominating heavy-traffic factories.

• Triple-component – High-performance niche Three-part blends deliver peak compressive strength and anti-bacterial surfaces in clean-rooms and pharma plants, albeit at higher cost.

By Application

• Concrete – Core demand engine Concrete substrates house everything from logistics centers to retail outlets, and coatings extend their life, reduce dusting, and improve safety.

• Wood – Growing decorative segment Residential remodels and boutique hotels value clear or pigmented coatings that protect wood while showcasing natural grain.

• Terrazzo and Others – Specialty uses Premium chip and aggregate floors benefit from clear, high-gloss seals that magnify color depth and resist staining.

By End-Use

• Industrial – Largest contributor Food, chemical, and electronics plants specify coatings for hygiene, ESD control, and spill protection, driving continuous innovation.

• Commercial – Fastest-expanding slice Malls, offices, and airports seek designer finishes and quick turnarounds to minimize revenue loss during refurbishments.

• Residential – Rising interest Garages, basements, and indoor recreational areas adopt DIY-friendly kits as homeowners prioritize low-maintenance, slip-resistant surfaces.

Industry Developments & Instances

• July 2024 – A leading global supplier launched a floor-system line for EV gigafactories featuring electrostatic-dissipative and moisture-control layers that halve start-up lead time.

• April 2023 – A specialty formulator introduced a breathable epoxy system that vents trapped moisture, reducing blistering in humid climates.

• 2023 – A multinational chemicals group acquired a regional building-products firm to integrate advanced resins and widen its construction footprint.

• 2023 – A Scandinavian manufacturer expanded its fire-protection coating R&D facility, targeting higher-temperature performance standards.

Facts & Figures

• Epoxy maintains about 41% global market share and is forecast to exceed USD$ 2.4 billion by 2032.

• Concrete applications capture nearly 48% of revenue, reflecting their prevalence in industrial and commercial builds.

• Asia Pacific commands roughly 42% of global demand, while North America and Europe each hover around the 20% mark.

• Fast-cure polyaspartic systems can reduce installation time by up to 70%, saving an estimated USD$ 3–5 per square meter in lost production.

• Moisture-related coating failures account for nearly 80% of warranty claims, underscoring the importance of proper substrate testing.

Analyst Review & Recommendations

Floor coatings are shifting from basic protection toward multifunctional surfaces that slash downtime, enhance safety, and meet strict environmental rules. Suppliers that combine low-carbon raw materials, rapid-cure chemistries, and application support will outpace commodity players. In the near term, targeting Asia Pacific’s mid-tier industrial customers with convenient, single-day systems offers the quickest route to scale, while deepening contractor training in surface prep will guard brand reputation and unlock sustainable market growth.