Market Overview

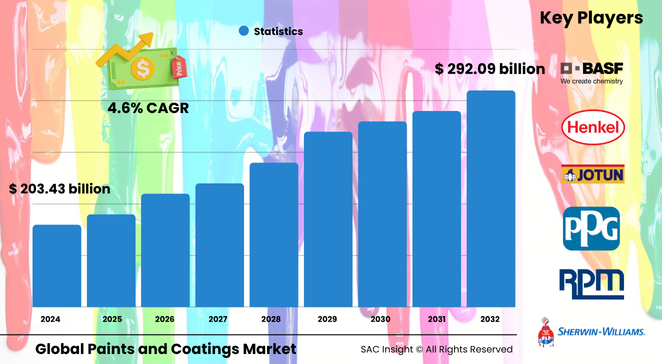

The global paints and coatings market size is currently valued at US$ 203.43 billion (2024) and is projected to reach approximately US$ 292.09 billion by 2032, reflecting a steady 4.6% CAGR across the 2025‑2032 forecast window. First‑hand industry insights point to three structural drivers: a resurgence in construction spending, rising demand for low‑VOC formulations, and ongoing automotive recovery. SAC Insight market evaluation shows that volumes have surpassed pre‑pandemic levels, supported by robust renovation activity and an accelerated shift toward sustainable chemistries. The U.S. market for paints and coatings is on track to top roughly US$ 43.4 billion by 2032, buoyed by infrastructure upgrades and stricter environmental codes.

Summary of Market Trends and Drivers

-Rapid urbanization in Asia and Latin America is lifting architectural demand, while OEMs are specifying high‑performance, corrosion‑resistant coatings to extend vehicle life cycles.

-Sustainability mandates are steering market growth toward waterborne, powder, and UV‑curable systems that slash VOC emissions and energy use.

-Digital color‑matching and smart factory adoption are trimming lead times and unlocking mass‑customized finishes for consumer goods and industrial parts.

Key Market Players

The report profiles global paints and coatings market leaders such as PPG Industries, AkzoNobel, Sherwin‑Williams, Axalta, BASF, Jotun, Nippon Paint Holdings, and RPM International. These companies combine large‑scale resin production, integrated supply chains, and aggressive RandD pipelines to defend market share. Recent moves—ranging from powder‑coating acquisitions in Europe to fire‑protective launches in North America—highlight their focus on eco‑efficient technologies and high‑value niches.

Key Takeaways

• Paints and coatings indsutry value (2024): US$ 203.43 billion

• Projected value (2032): ~US$ 292.09 billion at a 4.6% CAGR

• Asia Pacific remains the demand hub, accounting for about 40.50% of global revenue.

• Waterborne coatings lead the product mix (~40.8% share) thanks to low VOC content and fast‑drying performance.

• Automotive OEM and refinish segments are rebounding, helped by electric‑vehicle investments and aftermarket growth.

• Powder and UV‑curable systems are the fastest‑growing technologies, each posting high‑single‑digit annual gains.

Market Dynamics

Drivers

• Construction super‑cycle: Government‑backed housing and infrastructure programs in China, India, the U.S., and the Middle East continue to lift architectural volumes.

• Environmental regulation: Stricter VOC limits in the U.S., EU, and parts of Asia are accelerating the switch from solvent‑borne to waterborne and powder alternatives.

• Automotive electrification: Battery‑electric platforms require advanced coatings for thermal management and corrosion protection, opening new revenue streams.

Restraints

• Volatile raw‑material prices: Fluctuations in titanium dioxide, epoxy, and acrylic feedstocks squeeze margins for formulators.

• Technical limits of thin powder films: Achieving ultra‑smooth finishes below 50 µm remains challenging, restricting powder uptake in certain decorative segments.

Opportunities

• Bio‑based resins and additives: Plant‑derived binders and crosslinkers can cut carbon footprints by up to one‑third, appealing to ESG‑focused buyers.

• Smart and functional coatings: Demand is rising for anti‑microbial, self‑healing, and heat‑reflective products in healthcare, electronics, and energy applications.

Challenges

• Complex regulatory landscape: Divergent regional standards for VOCs, REACH compliance, and waste disposal raise compliance costs.

• Capacity rationalization: Over‑supply in commoditized solvent‑borne lines may trigger plant closures and consolidation, pressuring smaller players.

Regional Analysis

Asia Pacific dominates due to outsized construction pipelines, expanding automotive output, and favorable manufacturing economics. Europe follows, driven by automotive and industrial coatings with a sustainability premium, while North America benefits from infrastructure stimulus and renovation spending.

• Asia Pacific: Massive housing demand, vehicle production rebounds, and government incentives for green buildings.

• Europe: Automotive lightweighting, energy‑efficient refurbishments, and powder‑coating adoption underpin growth.

• North America: Infrastructure bills, commercial real‑estate refurbishments, and a strong DIY culture sustain demand.

• Latin America: Rising disposable incomes and OEM expansions in Brazil and Mexico boost architectural and automotive volumes.

• Middle East and Africa: Oil and gas megaprojects and healthcare investments lift protective and marine coatings consumption.

Segmentation Analysis

By Product

• Waterborne Coatings – Low‑VOC workhorse, ~40.8% share.

These formulations dry quickly, emit minimal solvents, and excel in confined spaces, making them the go‑to choice for interior walls, OEM plastics, and metal packaging. Stringent U.S. and EU VOC caps will keep momentum strong.

• Powder Coatings – Durable and eco‑friendly, fastest‑growing.

Free of solvents and highly recyclable, powder systems deliver thick, chip‑resistant films for appliances, furniture, and automotive wheels. As energy‑efficient curing ovens spread, powder’s appeal widens.

• Solvent‑borne Coatings – Legacy segment, still critical in harsh settings.

Despite VOC concerns, these coatings offer unrivaled adhesion and moisture tolerance for heavy‑duty equipment, marine topsides, and infrastructure steel where humidity is high.

• Radiation‑Cured (UV/EB) Coatings – Niche but rising.

Instant curing, low energy consumption, and compact footprint make UV/EB systems attractive for electronics, wood flooring, and high‑speed packaging lines.

By Resin

• Acrylic – Versatile and cost‑effective leader.

Acrylics provide color retention and quick dry times, dominating architectural and DIY markets. Acrylic demand is tied closely to renovation cycles and consumer preferences for easy‑to‑apply emulsions that resist chalking and fading.

• Epoxy – High‑performance barrier.

Epoxies deliver chemical and abrasion resistance for floor, pipeline, and marine primers. Industrial facilities choose epoxy primers to extend maintenance intervals and cut downtime, despite higher upfront costs.

• Polyurethane – Scratch‑proof finish.

PU resins combine gloss, flexibility, and UV stability, winning share in automotive clearcoats and industrial wood. As automakers push for showroom‑quality finishes, PU demand is projected to climb steadily.

• Alkyd and Polyester – Decorative staples.

Used in economy gloss paints and coil coatings, these resins remain relevant where cost sensitivity outweighs premium performance.

By Application

• Architectural – Largest volume consumer.

Exterior and interior paints safeguard buildings from weathering and boost curb appeal; urban housing drives continuous demand.

• Automotive OEM and Refinish – Technology showcase.

Multilayer systems enhance aesthetics, corrosion resistance, and aerodynamics; EV battery enclosures add new functional requirements.

• Protective and Marine – Critical asset shield.

Intumescent and anti‑fouling coatings extend service life of offshore rigs, bridges, and ships amid harsher operating environments.

• General Industries and Coil – Process‑driven efficiency.

Pre‑coated metal sheets for appliances and HVAC units rely on uniform, high‑throughput coatings that cut fabrication steps.

Industry Developments and Instances

• Feb 2023: PPG rolled out an epoxy‑based intumescent line targeting architectural steel fire protection.

• May 2023: Arkema acquired a specialty battery‑adhesive producer, expanding its functional coatings portfolio.

• Jun 2023: AkzoNobel completed a South American paints manufacturer takeover, strengthening its regional footprint.

• Feb 2024: A major U.S. player launched low‑bake powder clearcoats designed for electric‑vehicle substrates.

• Sep 2024: European regulators tightened VOC thresholds for decorative paints, accelerating formulation shifts across the bloc.

Facts and Figures

• Waterborne technologies account for ~40.8% market share and are growing 5% annually.

• Powder coatings can reduce manufacturing VOC emissions by up to 95% versus solvent‑borne alternatives.

• Asia Pacific added >60 million m² of new residential floor space in 2023 alone.

• Average repaint cycle for commercial buildings in North America dropped from 8 years to 6 years, boosting volume demand.

• Electric‑vehicle production growth of 25% YoY is lifting specialty coating consumption per unit by roughly 15%.

Analyst Review and Recommendations

The paints and coatings landscape is migrating from commodity volume to value‑added performance. Producers that pair bio‑based resins, low‑energy curing, and digital color‑matching with agile supply chains will outpace competitors. Near‑term strategy should prioritize powder and UV‑curable capacity in Asia and the U.S., where environmental regulation and labor savings intersect. Longer term, functional coatings—anti‑microbial, self‑healing, and heat‑dissipating—represent the most attractive pockets for differentiated market growth, particularly in electronics, EV, and healthcare verticals.