Market Overview

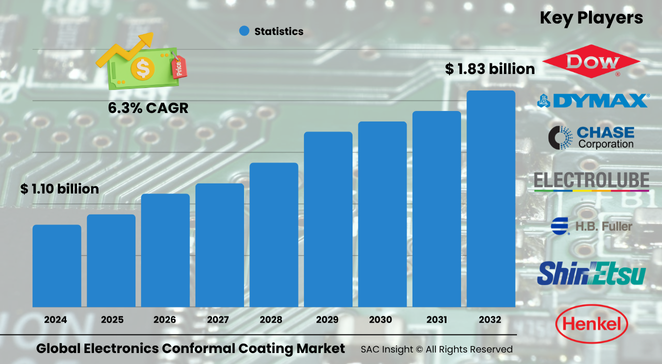

The global electronic conformal coatings market size is valued at roughly US$ 1.10 billion in 2024 and, according to SAC Insight’s deep market evaluation, is on track to reach about US$ 1.83 billion by 2032, advancing at an average 6.3% CAGR. SAC Insight's first-hand industry insights point to three decisive growth engines: the surge in miniaturized consumer devices, a pivot toward connected and electrified vehicles, and tighter reliability standards across aerospace and medical electronics.

The United States electronic conformal coatings market alone could rise from nearly US$ 238 million in 2024 to around US$ 394 million by 2032 as OEMs upgrade printed-circuit protection to counter moisture, salt-spray, and thermal shock failures.

Summary of Market Trends & Drivers

• Automotive electrification and ADAS roll-outs are pushing up board counts per vehicle, lifting coating volumes and driving market growth.

• Wearables, 5G phones, and IoT sensors rely on ultra-thin films that cure quickly and fluoresce for automated inspection, reshaping market trends toward room-temperature, UV-dual-cure chemistries.

• Manufacturers are vertically integrating resin synthesis and dispensing equipment to secure supply and capture higher market share.

Key Market Players

Industry leadership rests with Henkel, Dow, Shin-Etsu, and H.B. Fuller, each leveraging global resin production, application labs, and distribution networks. These incumbents face nimble competition from regional specialists such as Chase Corporation, Electrolube, Europlasma, MG Chemicals, and Dymax, which differentiate through low-VOC formulations and selective automation partnerships. Competitive dynamics are increasingly shaped by investments in AI-assisted defect detection, raw-material backward integration, and acquisitions of niche coating start-ups to broaden product portfolios.

Key Takeaways

• Current global market size (2024): about USD$ 1.10 billion

• Projected global market size (2032): roughly USD$ 1.83 billion at a 6.3 % CAGR

• U.S. market analysis shows expansion from USD$ 238 million to nearly USD$ 394 million by 2032

• Acrylics remain the dominant product, exceeding 45 % market share thanks to fast cure and easy rework

• Consumer electronics holds more than 40 % revenue share, while automotive is the fastest-growing end-user segment

• UV-dual-cure and solvent-free coatings are gaining traction as sustainability regulations tighten

Market Dynamics

Drivers

• Rising shipment volumes of smartphones, wearables, and gaming devices require reliable PCB protection against humidity and sweat.

• Electric-vehicle battery packs and power electronics generate additional heat and vibration, boosting demand for high-temperature-stable silicone and urethane films.

• Airlines and defense agencies specify conformal coatings for flight-critical avionics, sustaining baseline demand even in economic downturns.

Restraints

• Process complexity—incorrect viscosity, cure parameters, or contamination—can trigger delamination and costly rework.

• Volatile raw-material prices for specialty polymers and solvents challenge margin preservation for small and mid-tier producers.

Opportunities

• Medical implants and hearing aids need ultra-clean, biocompatible parylene coatings, opening premium niches.

• AI-driven inspection systems that identify voids and bubble defects in real time allow coaters to guarantee near-zero field failures, creating service add-on revenue.

Challenges

• Increasing component density leaves limited standoff for coating flow, forcing manufacturers to fine-tune rheology and dispense paths.

• Global chip-supply disruptions can delay electronics output, indirectly softening coating demand cycles.

Regional Analysis

Asia-Pacific dominates with just over half of global revenue, propelled by China’s vast PCB fabrication base and India’s fast-rising smartphone production. North America follows, driven by high-reliability aerospace and defense contracts, while Europe benefits from EV battery gigafactory investments.

• Asia-Pacific – Largest share; strong consumer-electronics clustering in China, South Korea, Taiwan, and Japan.

• North America – Robust aerospace and EV adoption spur steady volume growth.

• Europe – Automotive electrification and medical device hubs in Germany and the Nordic region boost demand.

• Latin America – Gradual uptake in automotive electronics assembly lines in Mexico and Brazil.

• Middle East & Africa – Niche opportunities tied to regional aircraft maintenance and telecom infrastructure upgrades.

Segmentation Analysis

By Product

• Acrylic – Quick cure, easy rework.

Acrylics top the list due to forgiving processing windows, low cost, and balanced moisture resistance, making them the everyday choice for consumer and industrial boards.

• Silicone – Wide-temperature stability.

Silicones safeguard high-power modules and LED lighting against -55 °C to +200 °C swings, critical for automotive under-hood and avionics.

• Urethane – Tough, chemical-resistant.

Preferred in fuel-vapor zones and harsh industrial plants where aggressive solvents threaten circuitry.

• Epoxy – Rigid, abrasion-resistant.

Used in white goods and power tools where boards face mechanical wear.

• Parylene – Ultra-thin, pinhole-free.

Vacuum-deposited parylene serves implantables and MEMS sensors that demand biostability and sub-micron coverage.

By Operation Method

• Spray Coating – High throughput.

Automated selective-spray systems dominate modern SMT lines, delivering uniform films on complex geometries with minimal overspray.

• Dip Coating – Complete coverage.

Ideal for simple board shapes or high-volume commodity gadgets where every edge must be sealed.

• Brush Coating – Field repair and prototyping.

Used for low-volume refinishing and conformal-touch-ups during maintenance.

• Chemical Vapor Deposition – Precision parylene.

CVD produces conformal, defect-free layers for mission-critical and medical devices.

By Technology

• Solvent-based – Legacy workhorse.

Offers wide material choices and proven performance, though emissions regulations drive gradual migration.

• Water-based – Low-VOC alternative.

Environmental compliance and easier factory ventilation make water dispersions attractive for high-volume plants.

• UV-cured – Fast takt times.

Dual-cure (UV + moisture) chemistries slash cure cycles from hours to seconds, aligning with just-in-time board assembly.

By End-User

• Consumer Electronics – Core demand engine.

Miniaturization and short product lifecycles keep volumes high, especially for smartphones, earbuds, and wearables.

• Automotive – Fastest-growing.

Connected cockpits, battery-management systems, and ADAS modules require robust protection for 15-year vehicle lifespans.

• Medical – High-margin niche.

Device makers value ultra-clean, biocompatible coatings that can survive sterilization and body fluids.

• Aerospace & Defense – Reliability-first.

Long qualification cycles lock in steady orders for silicone and urethane grades that meet MIL-spec standards.

• Industrial & Others – PLCs, smart meters, and robotics.

Factory automation expansion feeds consistent baseline demand for coatings that withstand oil mist and vibration.

Industry Developments & Instances

• October 2024 – A leading EMS player installed nine selective-spray lines for UV-dual-cure coatings at its Vietnam mega-site to support smartphone OEM contracts.

• July 2024 – Dow introduced a solvent-free CC-8000 series that cures under UV-LED, trimming energy use by up to 60 % versus thermal ovens.

• March 2024 – Henkel invested in a Massachusetts start-up specializing in AI-powered bubble detection to accelerate zero-defect initiatives.

• January 2024 – Europlasma unveiled a plasma-activated nanocoating service aimed at waterproofing smartwatches without adding bulk.

Facts & Figures

• Acrylic products capture roughly 47 % of 2024 revenue.

• Asia-Pacific’s electronic conformal coatings demand is projected to exceed USD$ 1 billion by 2032.

• UV-dual-cure formulations have grown at more than 12 % annually since 2020.

• Average coating thickness ranges from 25 µm to 250 µm, with parylene below 5 µm.

• Automated selective-spray systems can process up to 1,200 boards per hour, reducing labor by 30 %.

Analyst Review & Recommendations

Market analysis indicates a clear pivot from solvent-heavy legacy chemistries to low-VOC, high-throughput alternatives. Suppliers that pair material innovation with in-line defect-detection and turnkey application equipment will capture outsized market share. We recommend focusing R&D on UV-dual-cure silicones for EV power modules, expanding plasma-prep services for wearables, and forging partnerships with AI vision vendors to deliver verified zero-bubble solutions that resonate with automotive and medical-device quality mandates.