Market Overview

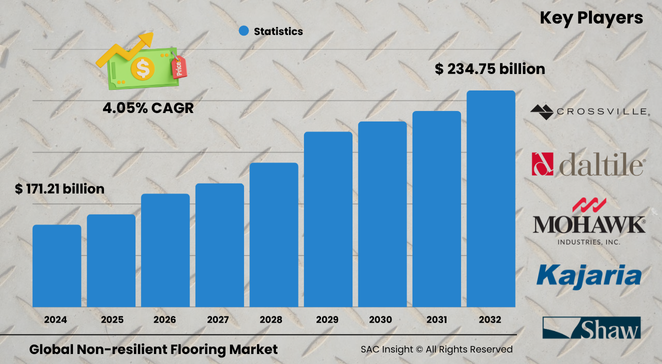

The global non-resilient flooring market size is valued at about US$ 171.21 billion in 2024 and is projected to reach nearly US$ 234.75 billion by 2032, posting an average 4.05% CAGR through the 2025-2032 forecast window. SAC Insight's first-hand industry insights reveal three structural growth engines: accelerating construction in emerging economies, steady uptake of stone and ceramic alternatives for premium aesthetics, and rapid innovation that shortens installation time while extending product life.

SAC Insight's deep market evaluation also shows the United States non-resilient flooring market could approach roughly US$ 28 billion by 2032 as residential remodeling and light-commercial refurbishments intensify.

Summary of Market Trends & Drivers

• Consumers are prioritizing hard-wearing, low-maintenance floors that still offer design flexibility, propelling demand for large-format porcelain tiles, engineered stone, and digitally printed surfaces.

• Urbanisation and a widening middle class in Asia–Pacific are expanding the addressable customer base, while stricter green-building codes worldwide push suppliers toward energy-efficient kilns, recycled feedstocks, and lower-VOC grouts.

• E-commerce channels are shrinking the time from product discovery to installation, supporting faster market growth and broader brand visibility.

Key Market Players

The competitive landscape features a blend of long-established brands and region-specific challengers. Global leaders such as Mohawk Industries, Mannington Mills, Kajaria Ceramics, PORCELANOSA Grupo, and Shaw Industries command substantial market share through vast distribution networks and frequent style refreshes. Meanwhile, specialists including Crossville, Daltile, and Victoria PLC invest heavily in digital inkjet printing, thin-tile formats, and antimicrobial glazes to differentiate on performance as well as design. Frequent mergers, plant expansions, and showroom roll-outs underscore a strategic race to be closest to the customer.

Key Takeaways

• Current global non-resilient flooring market size (2024): about USD$ 171.21 billion

• Projected global market size (2032): nearly USD$ 234.75 billion at a 4.05 % CAGR

• Stone products generated the largest material market share in 2023, while ceramic tiles show the fastest revenue expansion through 2032

• Residential construction accounts for more than half of total demand; industrial settings post the highest relative growth as factories seek durable, chemical-resistant floors

• Asia–Pacific already exceeds one-third of global revenue and maintains the quickest regional CAGR

• Digital printing, extra-large slabs, and easy-click installation systems are reshaping market trends and shortening renovation cycles

Market Dynamics

Drivers

• Rising home-ownership rates and ongoing urban redevelopment boost square-foot demand worldwide

• Durability, scratch resistance, and stone-like visuals enhance value perception, reinforcing market growth

• Continuous product innovation—thin panels, slip-resistant glazes, self-levelling mortars—reduces installation time and labour cost

Restraints

• High initial material cost relative to resilient vinyl and laminate alternatives can deter budget-focused buyers

• Energy-intensive kiln firing exposes producers to fuel-price volatility and carbon-emission scrutiny

Opportunities

• Circular-economy initiatives such as recycled porcelain aggregates and take-back schemes open new revenue streams

• Customisation via on-demand inkjet designs and 3-D textures allows manufacturers to address niche décor trends quickly

Challenges

• Fragmented distribution networks in developing regions complicate last-mile delivery and after-sales service

• Intensifying competition from hybrid rigid-core SPC and engineered wood products could erode future market share if differentiation stalls

Regional Analysis

Asia–Pacific dominates on both volume and value thanks to massive residential construction pipelines in China, India, and Southeast Asia, alongside continuous capacity additions by local tile producers. North America follows, buoyed by home improvement spending, while Europe benefits from stringent sustainability standards that favour long-life, low-VOC flooring solutions.

• North America – Strong renovation cycle, rising popularity of quartz-based surfaces

• Europe – Eco-labels and energy-efficient retrofits sustain steady demand

• Asia–Pacific – Fastest market analysis growth, driven by urbanisation and industrial parks

• Latin America – Gradual rebound tied to infrastructure upgrades and tourism projects

• Middle East & Africa – Hospitality and commercial hubs adopt premium marble-look porcelain for heat resistance

Segmentation Analysis

By Material Type

• Stone – Broadest revenue share, prized for heritage appeal.

Stone commands lasting value in luxury homes, corporate lobbies, and high-traffic corridors because it withstands heavy loads and retains finish for decades.

• Ceramic – Fastest-growing slice, fuelled by versatile designs.

Glazed and full-body porcelain tiles mimic concrete, terrazzo, or wood without the maintenance headaches, making them popular for new builds and kitchen remodels.

• Cement – Industrial favourite, gaining decorative flair.

Polished cement and micro-topping floors bridge the gap between rugged factory floors and minimalist retail spaces, aided by stain-proof sealers and integral colourants.

By Format

• Tiles – Core format, unrivalled design range.

Square and rectangular pieces dominate market share because they suit both small bathrooms and sprawling malls; large slabs reduce grout lines for a seamless look.

• Planks – Rising in open-plan housing.

Wood-look porcelain planks replicate hardwood warmth while resisting moisture, a strong selling point in kitchens and basements.

• Sheets – Smaller niche, mainly commercial.

Monolithic terrazzo and engineered stone sheets simplify installation over wide areas, especially in hospitals seeking fewer seams for hygiene.

By Application

• Residential – Over half of market revenue, boosted by DIY channels.

Homeowners gravitate toward slip-resistant, stain-resistant floors that elevate resale value and cut upkeep.

• Commercial – Offices, retail, and hospitality focus on brand aesthetics.

Durable thin-tile façades and large-format lobby floors project modernity while lowering lifetime maintenance budgets.

• Industrial – Quickest CAGR, prioritising durability.

Factories, logistics hubs, and cleanrooms require non-porous, chemical-resistant surfaces able to withstand forklifts and spills.

By Surface Finish

• Glossy – Visual punch, reflective boost.

High-shine finishes amplify natural light, making small interiors feel larger but require regular cleaning to hide footprints.

• Matte – Contemporary favourite.

Low-sheen textures mask smudges and create a relaxed ambience, especially in open-concept living spaces.

• Textured – Safety-first selection.

Raised profiles enhance grip in wet zones such as pool decks, industrial wash-down areas, and entryways subject to rain or snow.

By Density

• Non-Porous – Premium choice, low water absorption.

Porcelain and engineered quartz block stains and bacteria, ideal for healthcare, food service, and spa environments.

• Semi-Porous – Balanced performance.

Granite and dense limestone offer strength with modest breathability, suitable for upscale residential floors.

• Porous – Rustic appeal.

Travertine and clay-based terracotta provide natural patina but demand periodic sealing to maintain longevity.

Industry Developments & Instances

• July 2024 – CNW Quartz Stone launched an advanced quartz collection aimed at luxury residential and boutique shopfitters.

• May 2024 – RAK Ceramics opened an interactive experience centre in Karnataka, India to speed up architect specification cycles.

• March 2024 – SOMANY introduced a glazed-vitrified range positioned for rapid-install commercial fit-outs.

• January 2023 – Daltile rolled out designer stone-look mosaics targeting North American kitchen showrooms.

• June 2023 – Crossville debuted a graphic geometric wall-tile line for personalised hospitality interiors.

Facts & Figures

• Stone products captured roughly 66 % of global revenue in 2023.

• Residential flooring accounted for about 55 % of market share last year.

• Asia–Pacific held close to 36 % of total revenue in 2023 and is set to expand above 5 % CAGR through 2032.

• Easy-click installation systems can cut labour time by up to 30 % versus traditional mortar-set methods.

• Large-format porcelain slabs (greater than 1.2 × 2.4 metres) grew at more than 7 % year-on-year in 2024 as architects pursue seamless aesthetics.

• Digital inkjet printing now decorates over 90 % of newly produced ceramic tiles, enabling limitless patterns without inventory overload.

Analyst Review & Recommendations

Market analysis indicates a decisive pivot toward performance-driven, design-forward non-resilient floors that satisfy both style and sustainability criteria. Producers that invest in energy-efficient kilns, recycled raw materials, and modular thin-tile lines are poised to outpace average market growth. Distributors should strengthen e-commerce fulfilment and in-store visualisation tools to shorten buyer journeys, while contractors can gain share by mastering rapid-lay systems and low-VOC setting materials.