Market Overview

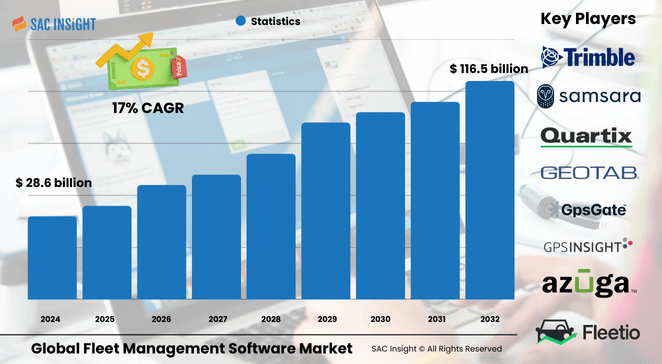

The global fleet management software market size was valued at approximately US$ 28.6 billion in 2024 and is projected to hit around US$ 116.56 billion by 2032, expanding at a 17% CAGR over the 2025-2032 forecast window. First-hand industry insights point to three structural growth engines: rapid electrification of commercial fleets, tougher compliance rules that make electronic logging devices mandatory, and a shift toward data-driven mobility-as-a-service (MaaS) business models. SAC Insight's deep market evaluation also shows that cloud-native platforms and generative AI analytics are now essential for major buyers, driving a visible upgrade cycle across logistics, manufacturing, and last-mile delivery networks.

The U.S. fleet management software market alone is forecast to surpass US$ 18 billion by 2032, with shippers rushing to optimise asset utilisation and address persistent driver shortages.

Summary of Market Trends & Drivers

• Generative AI copilots, deployed by leading vendors since late 2023, are turning raw telematics feeds into proactive maintenance and safety recommendations in plain language for dispatchers.

• Accelerating electric vehicle (EV) adoption and carbon-reduction targets are pushing fleets to seek unified platforms that blend route optimisation with charge management.

• Heightened demand for mobility-as-a-service in urban areas is fuelling subscription models, lowering upfront costs, and broadening market reach.

Key Market Players

Established telematics leaders and tire makers are doubling down on software. Companies such as Geotab, Verizon Connect, Bridgestone’s Webfleet, and Trimble continue to command substantial market share by pairing hardware reliability with large, AI-ready data lakes. Fast-growing challengers—including Samsara, Motive, and several regional specialists—differentiate through verticalised dashboards, open APIs, and rapid feature releases targeting EV uptime, cold-chain monitoring, and real-time carbon reporting.

Key Takeaways

• Current global market valuation (2024): about USD$ 28.6 billion.

• Projected global value (2032): roughly USD$ 116.56 billion, reflecting 17% CAGR market growth.

• Operation management modules hold the largest market share, driven by demand for live tracking, geofencing, and smart routing.

• The retail and e-commerce sector is the fastest-growing end user as same-day delivery becomes the norm.

• Cloud deployments are scaling twice as fast as on-premises installations, aided by lower capital outlay and seamless over-the-air updates.

• Generative AI, 5G, and IoT sensors are the top three technology trends shaping product roadmaps.

Market Dynamics

Drivers

• Rising focus on operational efficiency and cost control, especially fuel spend and unplanned downtime.

• Stricter electronic logging and emission standards worldwide, compelling fleets to adopt digital compliance tools.

• Proliferation of EVs and government incentives, creating a need for integrated charge scheduling and range analytics.

Restraints

• Intermittent GPS connectivity in dense urban cores or remote areas can limit real-time accuracy.

• Employee pushback and change-management hurdles in organisations new to telematics can delay full ROI.

Opportunities

• Untapped small-fleet segment in emerging markets where smartphone-centric SaaS models can leapfrog hardware-heavy installs.

• Advanced driver-assistance add-ons—video AI for distraction detection and real-time coaching—offer high-margin upsell potential.

Challenges

• Inaccurate geocoding and address ambiguity can still cause route deviations and service-level penalties.

• Multi-country data privacy regulations increase integration complexity for global fleet operators.

Regional Analysis

North America currently leads the market thanks to early technology adoption, large commercial vehicle populations, and aggressive sustainability mandates. Europe ranks second, buoyed by Germany’s automotive strength and widespread CO2 reporting rules, while Asia Pacific is registering the fastest absolute unit growth on the back of exploding e-commerce volumes and expanding ride-hail fleets.

• North America – High telematics penetration, tight driver market, projected to reach around US$ 21.97 billion by 2032.

• Europe – Strong regulatory push for CO2 reduction, growing interest in pay-per-use fleet services.

• Asia Pacific – Rapid urbanisation and radio-cab expansion drive double-digit gains, particularly in India and China.

• Latin America – Gradual shift from basic GPS to full software suites as cross-border trade intensifies.

• Middle East & Africa – Early-stage adoption centred on oil-and-gas logistics and cold-chain agriculture exports.

Segmentation Analysis

By Type

• Operation Management – Largest revenue contributor

Real-time vehicle tracking, geofencing, and dynamic routing cut idle miles and boost on-time performance, making this module indispensable for most fleets.

• Vehicle Maintenance & Diagnostics – Fast uptake in predictive programs

Embedded sensors stream engine data to cloud analytics, spotting faults before roadside breakdowns and extending asset life.

• Performance Management – Growing focus on driver and fuel analytics

Dashboards rating acceleration, braking, and idling behaviour help reduce accidents and shave up to 12% off fuel bills.

• Fleet Analytics & Reporting – Key to ESG compliance

Custom KPIs, carbon dashboards, and automated regulatory filings turn raw telematics into strategic insights for C-suite decisions.

• Compliance Management – Essential in ELD-mandated regions

Automated hours-of-service logging and inspection workflows keep fleets audit-ready and fine free.

By Fleet Type

• Commercial – Dominant segment

Trucking, delivery, and field-service operators rely heavily on software to keep supply chains moving and margins healthy.

• Passenger Vehicles – Rising importance in ride-hail and corporate mobility pools

Real-time booking integration and utilisation analytics maximise seat occupancy and minimise wait times.

By Deployment

• On-premises – Favoured by large enterprises needing direct data control

Upfront investment is higher but integrates tightly with legacy ERP and warehouse systems.

• Cloud – Highest CAGR, low entry barrier

Subscription pricing, rapid updates, and remote access suit small-to-mid fleets and multigeography operators alike.

By Industry

• Manufacturing – Uses precise scheduling to cut plant downtime and buffer inventory.

• Logistics & Transportation – Core demand engine for long-haul and last-mile optimisation.

• Oil & Gas, Chemical – Prioritises safety, hazardous-load monitoring, and regulatory documentation.

• Others – Public sector, utilities, and construction increasingly deploy software for asset visibility.

Industry Developments & Instances

• January 2024 – An AI-powered EV transition platform integrated its reimbursement tool on a leading telematics marketplace, easing payroll for mixed-fuel fleets.

• September 2023 – A major freight-tech player partnered with a TMS provider to embed smart tendering and lane-matching features inside dispatch flows.

• December 2022 – Two top fleet lessors merged their North American operations, creating a 400,000-vehicle managed base and accelerating platform harmonisation.

• August 2021 – A tire manufacturer acquired a telematics firm, signalling broader convergence between connected tires and fleet data ecosystems.

Facts & Figures

• Average fuel-expense reduction after software adoption: 10-15%.

• Fleets using predictive maintenance report up to 25% fewer roadside breakdowns.

• Cloud deployments account for roughly 60% of new contracts signed in 2024, up from 42% in 2020.

• Commercial vehicles represent nearly 75% of total installed units, but passenger-car subscriptions are rising at over 20% a year.

• More than 80% of Fortune 2000 companies now rely on fleet data for route, safety, or sustainability decisions.

Analyst Review & Recommendations

The fleet management software landscape is shifting from basic tracking to holistic, AI-driven decision support. Vendors that combine open, cloud-first architecture with domain-specific analytics—especially for EV range, driver safety, and carbon metrics—will outpace rivals. For new entrants, lightweight SaaS offerings targeting underserved small fleets in emerging economies provide the quickest road to scale. Incumbents should double down on ecosystem partnerships and modular add-ons to deepen wallet share and reinforce long-term customer trust.