Market Overview

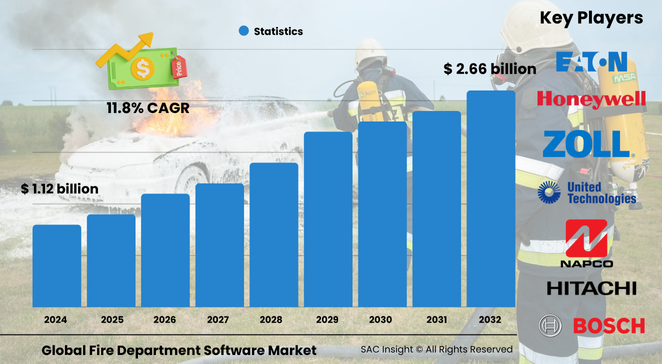

The global fire department software market size stands at roughly US$ 1.12 billion in 2024 and is on track to climb to almost US$ 2.66 billion by 2032, expanding at an average 11.8% CAGR. SAC Insight's first-hand industry insights reveal three forces powering this market growth: a surge in government funding for digital incident management, rising cybersecurity standards that push legacy systems toward cloud or secure on-premise upgrades, and the steady shift to data-driven resource planning. SAC Insight's deep market evaluation indicates the United States fire department software market alone could move from just under USD$ 300 million in 2024 to more than US$ 680 million by 2032 as federal grants and insurance incentives accelerate modernisation across city and county departments.

Summary of Market Trends & Drivers

• Cloud deployments with subscription pricing dominate new contracts, while hybrid architectures gain favour where data-sovereignty rules apply.

• Real-time analytics and GIS-enabled consoles are redefining dispatch efficiency, cutting average response times by up to 15 % in early adopters.

• Regulatory mandates—such as digitised NFPA compliance checks and electronic patient-care reporting—are pushing fire agencies toward fully integrated software suites.

Key Market Players

The competitive landscape blends specialist vendors and diversified safety-technology leaders. Companies such as ESO Solutions, Vector Solutions, Tyler Technologies, Accela, ZOLL Medical, ImageTrend, FirePrograms Software, StationSmarts, Honeywell, Bosch, Siemens, Johnson Controls, and Halma provide platforms that span incident reporting, inventory, crew scheduling, and analytics. Smaller entrants focus on SaaS-only modules for inspections or training, partnering with larger firms to widen market reach. Continuous product updates—ranging from AI-assisted video detection to VR-based training—keep competitive intensity high and shorten upgrade cycles.

Key Takeaways

• Current global fire department software market size (2024): about US$ 1.12 billion

• Projected global market size (2032): US$ 2.66 billion at an 11.8% CAGR

• Cloud solutions capture more than 60% market share and are still gaining ground

• Fire detection software holds the largest revenue slice, exceeding 40% of total sales

• Asia Pacific posts the quickest market growth, averaging 12% per year through 2032

• Deep market analysis suggests on-premise deployments remain relevant for agencies with strict data-control mandates

Market Dynamics

Drivers

• Increasing urban density raises incident complexity, fuelling demand for integrated dispatch and situational-awareness tools.

• National modernisation programmes fund software rollouts and create clear procurement pipelines.

• Insurance firms reward departments that adopt data-backed risk analysis, strengthening the business case for investment.

Restraints

• Upfront integration costs and change-management hurdles slow adoption among smaller districts.

• Cybersecurity concerns can delay cloud migration where secure network infrastructure is lacking.

Opportunities

• AI-enabled predictive maintenance and wildfire risk modelling open premium software niches.

• Drone and IoT sensor data streams create new value-added modules for real-time mapping and crew safety monitoring.

Challenges

• Interoperability gaps between legacy CAD systems and next-generation software hinder seamless data exchange.

• Budget pressures in smaller municipalities may extend replacement cycles beyond ideal upgrade timelines.

Regional Analysis

North America dominates the market thanks to high technology readiness, robust grant programmes, and an active vendor ecosystem. Europe follows, driven by stringent safety directives and cross-border mutual-aid networks, while Asia Pacific registers the fastest percentage gains as rapid urbanisation and industrial expansion intensify focus on fire resilience.

• North America – Largest revenue base; strong federal and state funding streams

• Europe – Steady upgrades tied to EN standards and smart-city initiatives

• Asia Pacific – Fastest market growth; rising infrastructure spend and digital transformation efforts

• Latin America – Growing adoption in major metros; public-private partnerships ease financing

• Middle East & Africa – Early-stage but accelerating, centred on new industrial hubs and megaprojects

Segmentation Analysis

By Software Type

• Fire Detection – Largest share, mission-critical analytics.

Modern computer-vision and machine-learning engines flag smoke, flame, or heat anomalies within seconds, allowing command centres to deploy crews sooner and reduce false alarms.

• Fire Response & Dispatch – Backbone of incident command.

These modules integrate CAD, AVL, and GIS layers to route the nearest apparatus, optimise station coverage, and capture response metrics for continuous improvement.

• Fire Risk Analysis – Fastest-rising demand.

Predictive models score building inventories, seasonal weather, and occupancy patterns, enabling departments to pre-plan tactics and support insurers with granular risk profiles.

• Others – Training, asset management, and inspection tools.

Supplementary modules manage certifications, track equipment life-cycles, and streamline code-enforcement workflows, rounding out all-in-one suites.

By Deployment

• Cloud-Based – Dominant and still expanding.

Subscription models cut upfront capital outlay, provide automatic updates, and enable remote access—an attractive formula for agencies with lean IT staff.

• On-Premise – Niche but necessary.

Departments that handle sensitive data or lack reliable broadband favour on-site installations, valuing full control over servers and cybersecurity protocols.

By Enterprise Size

• Small & Medium Enterprises – Quickest uptake.

Volunteer and small municipal departments embrace SaaS to digitise records, automate payroll, and meet reporting mandates without heavy infrastructure investment.

• Large Enterprises – Significant revenue contributor.

Metropolitan fire services deploy full-featured platforms that integrate dispatch, EMS, haz-mat, and mutual-aid coordination under one dashboard, demanding robust customisation.

By End User

• Building Owners & Property Managers – Compliance-driven adopters.

Inspection scheduling and digital logbooks reduce regulatory penalties and insurance costs while boosting occupant safety.

• Fire Departments & Emergency Responders – Core customer base.

Real-time incident data, crew tracking, and after-action analytics enhance operational efficiency and firefighter safety.

• Insurance Companies – Data-hungry partners.

Underwriters leverage system outputs to refine premium models and incentivise mitigation measures.

• Regulatory Bodies – Oversight and standard-setting.

Agencies use aggregated incident data to craft policy, allocate funding, and audit departmental performance.

• Others – Utilities, airports, and industrial facilities.

Specialised response teams employ adapted versions of the software for site-specific risk profiles and emergency protocols.

Industry Developments & Instances

• November 2024 – A national emergency-response information platform launched in the United States, offering local departments plug-and-play data reporting and analytics.

• June 2024 – An Oregon fire district invested USD$ 50 000 in VR-based training software to improve decision-making under stress.

• October 2021 – A strategic partnership between an inventory-management vendor and a medical-supply distributor streamlined automated restocking for fire and EMS agencies.

Facts & Figures

• Cloud deployments account for roughly 63 % of global revenue in 2024.

• Fire detection modules reduce nuisance alarm rates by up to 40 % when paired with AI analytics.

• Departments using integrated inventory software report 25 % lower equipment downtime.

• Real-time GIS routing has cut average turnout-to-arrival times by approximately 30 seconds in early-adopter cities.

• Asia Pacific’s share of global market revenue is projected to rise from 22 % in 2024 to nearly 27 % by 2032.

Analyst Review & Recommendations

Market analysis confirms a decisive shift toward comprehensive, data-centric platforms that unify detection, dispatch, and post-incident review. Vendors that combine open-API architectures with AI-driven analytics and tight cybersecurity will outpace general market growth. Departments planning upgrades should pursue phased rollouts beginning with cloud-ready dispatch modules, then layer on risk analysis and asset-management tools to maximise ROI while easing change management.