Market Overview

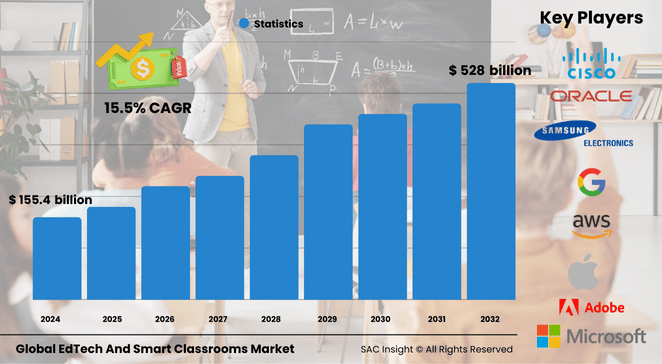

The global EdTech and smart classrooms market size was valued at approximately US$ 155.4 billion in 2024 and is projected to reach about US$ 528 billion by 2032, reflecting a robust 15.05% CAGR over the 2025–2032 forecast window. First-hand industry insights attribute this market growth to an unparalleled surge in mobile learning, wider cloud availability, and sustained investment in digital infrastructure.

SAC Insight's deep market evaluation also highlights rapid normalization after pandemic disruptions, with remote and hybrid learning now firmly embedded in institutional strategies. The U.S. EdTech and smart classrooms market is forecast to top roughly US$ 160 billion by 2032, underpinned by high technology spending and strong policy support for distance learning.

Summary of Market Trends & Drivers

- Mobile-first learning models and gamified content are accelerating learner engagement and platform stickiness.

- Cloud-native learning management systems are displacing legacy on-premise solutions, cutting IT overhead for schools and universities.

- Interactive hardware—particularly projectors and whiteboards—anchors blended classrooms, supporting collaborative, multimodal instruction.

Key Market Players

Leading participants include global EdTech and smart classrooms technology giants and specialist education providers with significant market share, such as Apple, Cisco, Google, Microsoft, IBM, Dell EMC, Oracle, SAP, and Lenovo. Complementing these are focused EdTech innovators including Blackboard, Instructure, Anthology, Smart Technologies, 2U, Cornerstone OnDemand, and D2L. Collectively, these firms set the competitive tempo through aggressive platform enhancements, strategic M&A, and partnerships with public-sector education agencies.

Key Takeaways

- Market size (2024): USD$ 155 billion

- Projected market size (2032): USD$ 528 billion at a 15.05% CAGR

- Mobile learning and cloud deployment models command the fastest market share expansion

- Interactive projectors and whiteboards remain essential hardware for smart classroom rollouts

- North America leads revenue, while Asia Pacific posts the highest market growth rate

- Rising data-security spending is reshaping procurement criteria for K-12 and higher-ed buyers

Market Dynamics

Drivers

- Rising penetration of affordable mobile devices makes anytime, anywhere learning feasible for large student populations.

- Government funding programs and private capital inflows continue to boost digital classroom transformation.

Restraints

- Sophisticated cyberattacks on education networks elevate concerns over student data privacy and system downtime.

- High upfront costs for advanced classroom hardware and skilled IT staff hinder adoption among resource-constrained institutions.

Opportunities

- Personalized learning powered by AI and big-data analytics enables adaptive content pathways, increasing retention and outcomes.

- Untapped demand in low-income regions—supported by subsidized connectivity—offers headroom for scalable user acquisition.

Challenges

- Uneven broadband coverage leaves millions of learners without reliable access, widening the digital divide.

- Rapid product cycles demand continuous professional development for educators to extract full value from new tools.

Regional Analysis

The North America EdTech and smart classrooms industry currently dominates revenue owing to mature infrastructure, high device saturation, and strong institutional budgets. Asia Pacific, however, is the fastest-growing region, driven by large youth demographics, proactive government digitization programs, and expanding mobile broadband. Europe maintains steady demand for interactive hardware, while the Middle East & Africa and South America witness incremental gains as public-private partnerships finance classroom technology upgrades.

- North America – Largest share, driven by cloud adoption and cybersecurity spend

- Europe – Strong interactive hardware uptake and digital-literacy initiatives

- Asia Pacific – Highest CAGR, propelled by massive K-12 deployments in China and India

- Middle East & Africa – Growth tied to national e-learning strategies and telecom support

- South America – Moderate expansion as private universities invest in hybrid learning models

Segmentation Analysis

By Instructional Aid

- Mobile Learning – Fastest expansion, enabled by smartphone ubiquity

Mobile learning solutions cater to flexible study schedules and bite-sized content, making them indispensable for distance learners and working professionals alike.

- Smart Classroom – Core infrastructure for blended learning

Smart classrooms integrate interactive screens, sensors, and management software to create engaging, collaborative physical spaces that seamlessly bridge in-person and remote instruction.

By Smart Classroom Hardware

- Interactive Projectors – High engagement at an attractive cost-to-coverage ratio

These devices turn any flat surface into a touch-enabled display, supporting group activities and annotations without the need for dedicated interactive panels.

- Interactive Whiteboards – Feature-rich focal points for collaborative lessons

Whiteboards combine multi-touch input, cloud connectivity, and content capture, helping educators switch between lecture, discussion, and assessment modes with minimal friction.

- Others (Displays, Audio Systems, Tables) – Supporting ecosystem for immersive learning

Complementary tools such as ultra-short-throw displays and classroom audio arrays round out the digital environment, ensuring clear visuals and sound for every participant.

By Educational Tool

- Learning Management Tools – AI-enabled personalization drives fastest uptake

Cloud-based LMS platforms deliver course content, track performance, and generate analytics, allowing institutions to tailor interventions and boost completion rates.

- Administration Tools – Streamlined operations reduce overhead

Enterprise-grade ERPs cover admissions, finance, and scheduling, freeing staff to focus on student support and curriculum design.

- Admission Automation, Alumni, Library, Placement, and Other Tools – Holistic campus digitization

These modules create a data-rich backbone connecting students, faculty, and employers, enabling seamless lifelong learning pathways.

By End-user

- Higher Education – Largest spending pool fueled by blended degree programs

Universities leverage EdTech to attract international learners, scale short courses, and improve research collaboration.

- K-12 – Rapid adoption as schools roll out one-to-one device initiatives

Interactive content and gamified assessments address varied learning styles and accelerate foundational skill acquisition.

- Kindergarten – Emerging niche focused on safe, intuitive interfaces

Age-appropriate tablet apps and touch-friendly displays introduce digital literacy at the earliest stages.

By Deployment

- Cloud – Preferred model for scalability and lower total cost of ownership

Institutions rely on Software-as-a-Service to avoid hardware refresh cycles and maintain flexible user licenses.

- On-Premises – Chosen where stringent data-governance or connectivity constraints prevail

Local installations give administrators direct control over sensitive records and custom integrations.

Industry Developments & Instances

- May 2022 – A major credentials-management acquisition integrated end-to-end digital badging into a leading LMS.

- October 2021 – A landmark EdTech merger created a unified learning and analytics ecosystem spanning K-12 and higher-ed.

- August 2020 – A state government partnered with a global cloud provider to supply free classroom software and video tools to more than 20 million public-school users.

- April 2021 – An online primary-education platform secured USD$ 1 million in angel funding to expand AI-guided Maths and Logic courses.

- March 2021 – A telecom-hardware firm launched a smart classroom bundle featuring IdeaHub boards and cloud collaboration services.

Facts & Figures

- Mobile devices now reach over 33% of U.S. high-school students via school-issued programs.

- More than 855 publicly disclosed cyber incidents have hit U.S. K-12 districts since 2016.

- Gamified learning boosts student motivation for 83% of users, according to recent surveys.

- Around 5 million U.S. households with school-age children still lack home broadband, underscoring access gaps.

- Cloud-based deployments account for roughly two-thirds of new EdTech contracts signed in 2024.

Analyst Review & Recommendations

EdTech is shifting from isolated products to integrated learning ecosystems that blend hardware, software, and data-driven insights. Vendors that pair intuitive mobile platforms with secure, cloud-native back-ends will outpace rivals, particularly in fast-growing Asia Pacific markets. Institutions should prioritize solutions offering robust cybersecurity, adaptive content, and straightforward teacher training to maximize return on investment and safeguard learning continuity through 2032.