Market Overview

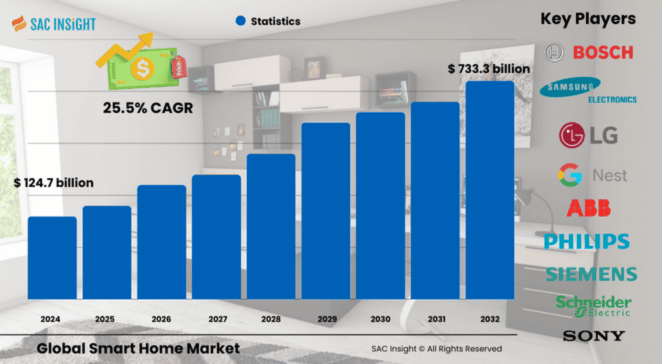

The global smart home market size is valued at roughly US$ 124.70 billion in 2024 and is on course to reach approximately US$ 733.31 billion by 2032, reflecting a powerful 25.05% CAGR from 2025 to 2032. First-hand industry insights point to three structural accelerators: rapid expansion of AI-enabled devices, consumer demand for energy-efficient living, and the widening footprint of high-speed connectivity. SAC Insight's deep market evaluation also shows that North America captured close to 28.62% market share in 2024, underpinned by high disposable income and early adoption of next-gen protocols.

The U.S. smart home market remains the single-largest national market, projected to top US$ 105.25 billion by 2032 as households integrate voice assistants, advanced security, and retrofit upgrades at scale.

Summary of Market Trends & Drivers

• Seamless voice control, Matter-ready ecosystems, and AI-driven learning are moving the category from isolated gadgets to cohesive home platforms.

• Heightened focus on sustainability and real-time energy management is steering investment toward smart thermostats, efficient lighting, and appliance load balancing.

• Rising security concerns are boosting adoption of connected cameras, smart locks, and remote monitoring—often bundled with monthly service subscriptions that improve recurring revenue.

Key Market Players

The global smart home industry leadership is concentrated among diversified technology majors and energy-management specialists. Global electronics brands such as LG Electronics, Samsung, and Sony shape product design and ecosystem reach, while digital giants Amazon and Google supply voice, cloud, and developer tools that anchor platform stickiness. Industrial automation leaders—Siemens, Schneider Electric, ABB, Honeywell, and Bosch—leverage deep expertise in power, HVAC, and building controls to push enterprise-grade reliability into residential spaces. Access-control innovators Assa Abloy and Legrand round out the competitive field with robust lock, switchgear, and wiring-device portfolios that bridge legacy infrastructure with modern IoT requirements.

Key Takeaways

• Market size (2024): USD$ 124.70 billion

• Projected value (2032): USD$ 733.31 billion at a 25.05% CAGR

• Security & access controls led 2024 with just over 29% of revenue; home healthcare devices show the fastest segment growth (> 32% CAGR, 2025-2030).

• Wireless and hybrid protocols dominate connectivity, with Wi-Fi 6 and Thread/Matter boosting device interoperability.

• Retrofit applications account for the largest install base today, while smart-ready new construction posts the steeper growth curve.

• North America holds the largest regional market share; Asia-Pacific is the quickest-growing territory thanks to urbanizing middle-class demand.

Market Dynamics

Drivers

• Mainstream availability of affordable smart speakers, displays, and bundled kits makes entry-level automation accessible to mass markets.

• Government incentives and rising power tariffs encourage consumers to adopt energy-saving HVAC controls and smart meters.

• Integration of AI yields predictive maintenance, personalized routines, and automated load shifting, elevating perceived value and driving market growth.

Restraints

• Persistent cybersecurity risks and data-privacy concerns slow uptake among security-conscious households.

• Fragmented standards force consumers to juggle multiple apps, deterring full-home deployments in some regions.

• High upfront costs for premium systems can lengthen payback periods, especially in price-sensitive emerging markets.

Opportunities

• Voice-first home healthcare, including fall detection and remote vital-sign monitoring, opens a large aging-in-place segment.

• Matter and similar unified frameworks offer device makers a fast lane to cross-brand compatibility and new service layers.

• AI-powered energy orchestration and dynamic tariff optimization create white-label SaaS potential for utilities and telcos.

Challenges

• Supply-chain constraints for semiconductors, sensors, and battery cells may hinder timely product rollouts.

• Evolving building codes require continuous certification updates, adding cost and complexity for manufacturers.

• Consumer education remains uneven; demonstrating tangible ROI is critical to move beyond early adopters.

Regional Analysis

North America leads the market thanks to early-stage ecosystem maturity, strong broadband penetration, and entrenched e-commerce channels. Europe follows closely, driven by stringent energy regulations and a growing retrofit culture, while Asia-Pacific registers the highest absolute unit growth as smart-city initiatives and 5G rollouts expand addressable households.

• North America – Energy-efficiency rebates and strong DIY culture accelerate adoption.

• Europe – Carbon-reduction mandates and aging residential stock drive demand for lighting and heating controls.

• Asia-Pacific – Rising urban middle class, supportive smart-city policies, and 5G coverage fuel double-digit gains.

• Latin America – Gradual adoption led by security bundles and mobile-centric control apps.

• Middle East & Africa – Premium deployments in new luxury developments and government-backed energy-management programs.

Segmentation Analysis

By Product

• Security & Access Controls – Market-leading share above 29%

Consumers prioritize peace of mind, adopting smart locks, cameras, and AI-enabled intrusion alerts that can be monitored from a phone. New facial recognition and package-protection features strengthen value perception.

• Smart Entertainment Devices – Account for roughly one-third of connected home shipments

Smart displays, streaming sticks, and voice-interactive speakers create the entertainment hub that often serves as the first on-ramp for additional devices. Larger screens and spatial audio upgrades keep replacement cycles brisk.

• Lighting Control – Rapidly expanding retrofit favorite

Smart bulbs, occupancy sensors, relays, and dimmers offer quick energy wins and dynamic ambience without heavy electrical work. Matter support simplifies onboarding for non-tech users.

• HVAC – Essential for energy-savings ROI

Smart thermostats, vents, and environmental sensors fine-tune comfort, cut utility bills, and integrate with renewable generation or EV charging routines.

• Smart Kitchen Appliances – Emerging convenience wave

Wi-Fi refrigerators, adaptive ovens, and connected dishwashers enable predictive maintenance and grocery management. Voice recipes and auto-restock partnerships extend stickiness.

• Home Appliances & Other Devices – Growing all-in-one ecosystems

From autonomous vacuum cleaners to smart furniture with built-in charging, these products widen the ecosystem and collect data to refine predictive algorithms long term.

By Protocol

• Wireless – Dominant connectivity layer, fastest-growing segment

Wi-Fi 6/6E, Bluetooth Low Energy, Zigbee, Z-Wave, Thread, and Matter offer flexible installs and cloud hand-off for analytics. Upgradable firmware keeps devices current.

• Hybrid – Largest share in 2024

Combines wired reliability with wireless reach, often using powerline communication for back-haul to avoid extra routers while maintaining stable mesh links.

• Wired – Preferred in high-security or bandwidth-intensive installations

Ethernet and CAN-bus-style lines power advanced camera arrays and legacy automation panels where latency tolerance is low.

By Application

• Retrofit – Largest revenue contributor in 2024

Consumers upgrade thermostats, lighting, and security without structural changes, focusing on quick wins and modular expansion. Lower entry price and DIY kits power volume.

• New Construction – Highest CAGR through 2032

Builders pre-wire homes with centralized hubs, PoE cameras, and EV-ready panels to meet buyer expectations for future-proof stock and energy codes.

Industry Developments & Instances

• February 2025 – A leading e-commerce platform launched a generative-AI upgrade to its voice assistant, enabling multi-step task automation and proactive maintenance scheduling.

• September 2024 – A top energy-management brand rolled out an AI-powered feature that optimizes electric-vehicle charging and water-heater usage based on tariff data and weather forecasts.

• August 2024 – A global electronics company unveiled an AI Home Hub at IFA, serving as a whole-home command center with personalized routines.

• January 2023 – A major component supplier introduced a modular energy-storage and smart-panel solution controllable via a single app.

• October 2022 – A streaming pioneer partnered with a mass-market retailer to debut an own-brand line of smart cameras, plugs, and bulbs across 3,500 stores.

Facts & Figures

• Average worldwide market size in 2024: USD$ 124.70 billion

• Forecast value by 2032: nearly USD$ 733.31 billion

• Average CAGR 2025-2032: 25.05%

• North America captured 28.62% of global revenue in 2024

• Security & access controls commanded over 29% segment share in 2024

• Smart entertainment shipments represent 32.5% of connected-device volume, while smart speakers account for 12.5%

• Home healthcare devices expect > 32% CAGR through 2030, driven by aging-in-place use cases

Analyst Review & Recommendations

Our market analysis confirms that interoperability, energy intelligence, and AI-powered personalization set the competitive tempo for the next decade. Vendors should double-down on secure, Matter-compliant firmware and leverage first-party usage data to launch subscription-based energy and security services. For manufacturers eyeing breakout growth, pairing value-priced wireless kits with clear ROI calculators will resonate strongly in Asia-Pacific and Latin America. Overall, sustained market growth hinges on demonstrating tangible cost savings, airtight data security, and a frictionless user journey from install to daily use.