Market Overview

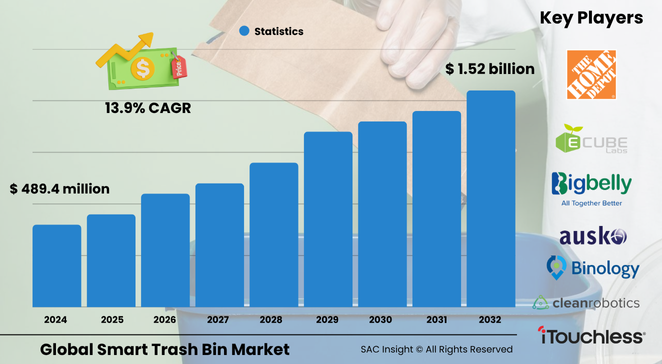

The global smart trash bin market size is valued at roughly US$ 489.4 million in 2024 and is projected to climb to about US$ 1.52 billion by 2032, expanding at a healthy 13.9% CAGR. SAC Insight's first-hand industry insights reveal three growth pillars: rising smart-city investments, tighter waste-reduction mandates, and rapid IoT adoption that turns ordinary bins into data-rich assets.

SAC Insight's deep market evaluation suggests the United States smart trash bin market could approach US$ 478 million by 2032 as municipalities and facility managers prioritize touch-free, sensor-driven waste solutions.

Summary of Market Trends & Drivers

• End-users favour contactless, hygienic disposal—an imperative magnified by recent public-health events.

• Cloud-linked fill-level sensors and AI-based route optimization cut collection costs up to 40 %, driving market growth across dense urban corridors.

• Smart-city funding packages now bundle intelligent waste infrastructure with energy, lighting, and traffic systems, accelerating adoption.

Key Market Players

Industry leadership features a mix of consumer-electronics specialists and waste-tech innovators. Companies such as iTouchless, EcubeLabs, Nine Stars, Simplehuman, and Ausko compete on sensor accuracy, battery life, and mobile-app integration, while facility-service giants pilot networked bin fleets to secure recurring software revenues. Competitive dynamics increasingly revolve around strategic partnerships—hardware makers pair with platform providers to deliver end-to-end waste analytics and secure bigger market share in commercial accounts.

Key Takeaways

• Current global market size (2024): USD$ 489.4 million

• Projected global market size (2032): USD$ 1.52 billion at a 13.9 % CAGR

• North America leads today; East Asia shows the fastest percentage gains through 2032

• Automatic models command more than half of 2024 revenue as touchless convenience becomes standard

• Multi-compartment designs hold the largest compartment market share, supporting on-site recycling goals

• Real-time market analysis indicates online sales channels gaining momentum, though brick-and-mortar outlets remain influential for high-ticket units

Market Dynamics

Drivers

• Government smart-city budgets and recycling incentives spur large-scale deployments.

• AI-enabled fill-level data delivers measurable ROI by reducing truck mileage and overflow incidents.

Restraints

• Up-front unit costs remain higher than conventional bins, slowing uptake in budget-constrained municipalities.

• Limited consumer awareness outside major metro areas curbs residential demand.

Opportunities

• Subscription-based software dashboards open new recurring-revenue streams for hardware vendors.

• Integration with building-management systems offers bundled energy-and-waste efficiency packages for commercial towers.

Challenges

• Battery maintenance and network connectivity gaps in older city districts can hinder consistent data flows.

• Fragmented procurement standards complicate large multi-city rollouts.

Regional Analysis

North America currently dominates thanks to high purchasing power, favourable smart-city grants, and a mature waste-management ecosystem eager for route-optimization data. Europe follows closely, propelled by stringent landfill-diversion targets, while East Asia posts the quickest market growth on the back of dense urbanization and government tech spending.

• North America – Largest revenue base; tech-savvy cities drive early adoption.

• Europe – Sustainability regulations fuel demand for multi-compartment, recycling-ready bins.

• Asia-Pacific – Fastest CAGR as smart-city pilots in China, Japan, and South Korea scale commercially.

• Latin America – Gradual uptake tied to tourism hubs upgrading public infrastructure.

• Middle East & Africa – Select Gulf smart-city megaprojects spark pockets of high-value installations.

Segmentation Analysis

By Capacity

• 14-23 Gallon – Workhorse segment, widest product range.

Popular in hotels, hospitals, and airports where larger volumes accumulate quickly. Operators appreciate fewer collection cycles and robust pedal-free lids.

• 8-13 Gallon – Fastest CAGR.

Compact automatic units fit kitchens, office cubicles, and hotel rooms, benefiting from declining sensor costs and growing home-automation bundles.

• Above 23 Gallon – Niche but rising for transit hubs.

Bulk-capacity bins integrate solar-powered compactors, extending emptying intervals in high-footfall zones like campuses and stadiums.

By Sales Channel

• Offline – Still edges online in revenue.

Show-room demos let buyers test lid speed, noise levels, and build quality before purchase.

• Online – Quickest growth via e-commerce majors.

Wide assortment and detailed reviews sway digitally savvy buyers, while direct-to-consumer brands leverage subscription liner services.

By End-user

• Commercial – Commands over 60 % market share.

Smart bins slash janitorial labour and provide ESG audit data, making them popular with corporate campuses.

• Residential – Rapidly widening adoption curve.

Voice-assistant compatibility and odour-control features resonate with tech-oriented households upgrading kitchens.

By Operation

• Automatic – Dominant, hygiene-first choice.

Infrared or motion sensors eliminate touch points and automate compaction or bag sealing.

• Semi-Automatic – Value-oriented alternative.

Foot-pedal or hand-wave opening with limited connectivity suits price-sensitive settings.

By Compartment

• Multi-Compartment – Leading share.

Built-in sorting enables immediate separation of recyclables, organics, and landfill waste, aligning with corporate zero-waste targets.

Separate lids and colour-coded indicators guide users, improving recycling rates without extra staffing.

• Single – Preferred for dedicated-waste streams.

Ideal for paper-only offices, textile bins in hotels, or hazardous-material stations.

By Shape

• Rectangular – Space-efficient favourite.

Flat backs line up against walls, maximizing hallway clearance in commercial buildings.

• Oval – Premium household aesthetic.

Smooth curves and fingerprint-proof steel appeal to design-conscious consumers.

• Round – Practical for central lobbies.

360-degree access and swing lids accommodate high multi-directional traffic.

Industry Developments & Instances

• March 2025 – A leading IoT platform provider launched an API that links smart trash data with citywide traffic dashboards, unifying fleet routing and congestion management.

• November 2024 – An auto-compaction specialist unveiled a solar-powered bin that triples holding capacity without external wiring, targeting parks and beach promenades.

• July 2024 – A regional waste hauler partnered with a sensor manufacturer to retrofit 5,000 conventional bins, demonstrating payback within 18 months through optimized collection runs.

Facts & Figures

• Automatic models represent roughly 55 % of 2024 unit shipments.

• Multi-compartment bins account for nearly 60 % of commercial installations.

• Smart-bin data analytics can cut municipal collection costs by as much as 30-40 %.

• Online channels captured about 44 % of global sales in 2024, up five percentage points year on year.

• Fill-level sensors typically alert haulers when capacity hits 80 %, reducing overflow events by over 70 %.

Analyst Review & Recommendations

Market analysis points to a decisive shift from standalone hardware toward connected, service-oriented ecosystems. Vendors that bundle robust sensors, low-friction mobile apps, and analytics dashboards will secure outsized returns as cities seek data-driven efficiencies. To stay competitive, prioritize battery-efficient designs, open APIs for integration with broader smart-city platforms, and flexible financing models that convert capital expenditure into manageable service fees.