Market Overview

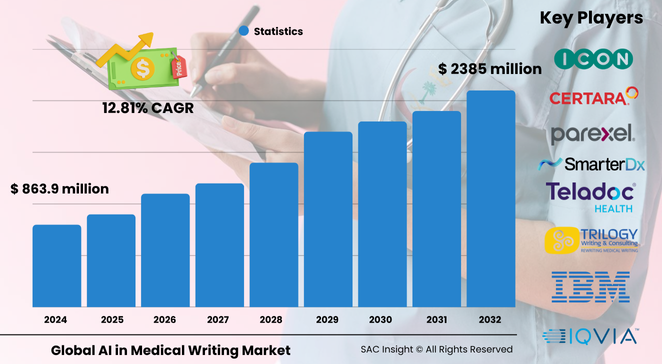

The global AI in medical writing market size stands at roughly US$ 863.95 million in 2024 and is on track to hit about US$ 2,385.06 million by 2032, advancing at an average 12.81% CAGR. SAC Insight's first-hand industry insights reveal three strong growth engines: the constant need for faster, error-free regulatory documentation, an explosion of clinical data that demands automated narrative generation, and rising adoption of cloud-hosted natural language processing in life-science workflows.

SAC Insight's deep market evaluation also shows the United States AI in medical writing market alone could climb from nearly US$ 318.28 million in 2024 to around US$ 878.7 million by 2032 as drug developers mainstream generative AI to shorten approval cycles.

Summary of Market Trends & Drivers

• AI platforms are moving from template helpers to end-to-end content creators that pull structured data directly from EDC systems, shrinking clinical study report timelines by more than half.

• Cloud-native deployments with multilingual support let globally dispersed teams co-author in real time, accelerating market growth across emerging research hubs.

• A tightening regulatory climate makes consistency checks, traceability, and audit trails non-negotiable, pushing buyers toward AI suites with built-in compliance engines.

Key Market Players

Industry leadership rests with a mix of specialist vendors and full-service CROs. Parexel, IQVIA, ICON, and Syneos Health leverage vast trial datasets to train proprietary large language models, while Cactus Communications, Trilogy Writing & Consulting, and GENINVO focus on agile authoring tools for mid-size sponsors. Technology providers such as Certara, Yseop, IBM, and NVIDIA supply the generative AI backbone, offering APIs that power custom document automation.

Competitive dynamics increasingly revolve around strategic alliances. Recent tie-ups—Certara’s CoAuthor launch, Yseop’s partnership with Cognizant, and Springer Nature’s in-house assistant—showcase a rush to bundle AI with domain expertise, locking in market share through integrated platforms and “human-in-the-loop” safeguards.

Key Takeaways

• Current global market size (2024): about USD$ 863.95 million

• Projected global market size (2032): roughly USD$ 2.39 billion at a 12.81 percent CAGR

• Asia Pacific commands the highest regional market share at just over 30 percent, driven by booming trial activity and talent shortages

• Typewriting tools still lead with nearly 33 percent revenue share, but clinical writing solutions are the fastest-growing slice

• Cloud-based deployments already account for more than half of total spending and are widening the gap each year

• Early adopters report 60-70 percent reductions in writer hours on complex clinical study reports

Market Dynamics

Drivers

• Growing pressure to cut submission cycles and reduce costly rework spurs investment in AI-driven automation.

• Surging trial volumes across oncology, rare diseases, and personalized medicine multiply documentation load.

• Multilingual NLP widens access to non-English research communities, fuelling global demand.

Restraints

• Data-privacy laws and sponsor hesitancy toward cloud storage slow adoption in highly regulated jurisdictions.

• Limited availability of annotated medical corpora can hamper model accuracy in niche therapeutic areas.

Opportunities

• Integration of AI analytics with real-time trial dashboards offers dynamic, data-linked narratives for living regulatory submissions.

• Custom GPTs tailored to company style guides create new revenue streams for service providers.

Challenges

• Over-reliance on auto-generated text raises quality-control risks if human review is bypassed.

• Fragmented regional guidance on AI transparency could lead to documentation rejections.

Regional Analysis

North America currently leads revenue thanks to a deep clinical-research ecosystem, but Asia Pacific shows the quickest percentage gains as sponsors in China, India, and Japan embrace cloud AI to bridge medical-writer shortfalls. Europe follows closely, with strong uptake in the UK and Germany driven by digital-health incentives.

• North America – Largest revenue base, robust compliance expertise

• Europe – High adoption of AI review assistants to meet multilingual submission needs

• Asia Pacific – Fastest growth; national R&D incentives boost trial counts

• Latin America – Rising clinical outsourcing drives demand for Spanish-language AI tools

• Middle East & Africa – Early stage but expanding as regional trial sites proliferate

Segmentation Analysis

By Type

• Clinical Writing – Fastest-growing, high regulatory impact.

Clinical modules auto-draft protocols, investigator brochures, and CSR narratives, cutting cycle times and easing reviewer workload.

• Regulatory Writing – Compliance stronghold.

Tools embed agency templates and guideline checkers that flag inconsistencies before submission, minimizing refusal-to-file risks.

• Scientific Writing – Research-communication enabler.

NLP engines turn raw results into journal-ready manuscripts, helping researchers accelerate publication and boost citation potential.

• Patient Documentation – Engagement driver.

Conversational AI recasts complex data into plain-language leaflets and informed-consent forms that meet health-literacy standards.

By Deployment Mode

• Cloud-based – Dominant and scaling fast.

Subscription models give sponsors elastic capacity and automatic updates, making remote collaboration seamless.

• On-premises – Security-driven niche.

Large pharma with strict data-sovereignty mandates keep sensitive datasets inside firewalls, favouring containerized local installs.

By End Use

• Pharmaceutical & Biotechnology Companies – Core demand engine.

Extensive R&D pipelines and global submission footprints necessitate scalable AI authoring to manage concurrent indications.

• Medical Device Companies – Rapid CAGR leader.

Frequent design iterations and post-market surveillance reports push device firms toward AI for continuous documentation.

• Academic & Research Institutes – Adoption on the rise.

Grant-funded studies use AI to streamline ethics submissions and knowledge dissemination.

• Others – CROs, health-tech start-ups, and consulting boutiques.

These players integrate white-label AI modules to widen service offerings without heavy infrastructure spend.

Industry Developments & Instances

• June 2024 – Certara launched CoAuthor, blending generative AI with structured authoring for faster regulatory submissions.

• July 2024 – Yseop partnered with Cognizant to embed its Copilot platform in large-scale pharma content operations.

• October 2023 – Springer Nature unveiled Curie, an AI assistant aimed at reducing manuscript preparation time for non-native English scientists.

• August 2023 – Celegence introduced CAPTIS Copilot to automate medical-device compliance documents.

Facts & Figures

• Asia Pacific captured about 30.41 percent of 2024 revenue.

• Typewriting solutions generated nearly one-third of total 2024 sales.

• Cloud deployments represented roughly USD$ 445 million in 2023 and are widening their lead.

• AI-enabled CSR tools can trim writer effort by up to 70 percent.

• More than 750 custom GPTs were created inside a single pharma enterprise within six months of rollout.

Analyst Review & Recommendations

Market analysis underscores a shift from isolated AI pilots to enterprise-wide platforms that weave authoring, data extraction, and compliance into one workflow. Vendors that couple large language models with domain-specific ontologies and maintain a clear human-review layer will capture outsized market share. Buyers should prioritise solutions offering audit trails, multilingual output, and seamless integration with clinical-data clouds to future-proof their documentation pipeline.