Market Overview

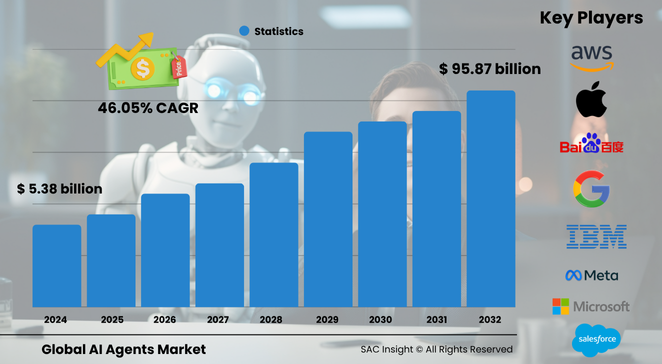

The global AI agents market size was about US$ 5.385 billion in 2024 and, according to SAC Insight’s deep market evaluation, is on track to soar to roughly US$ 95.87 billion by 2032, reflecting a rapid 46.05 % CAGR. First-hand industry insights highlight three structural growth engines: enterprise-wide automation mandates, foundation-model breakthroughs that lift conversational accuracy, and cloud platforms that cut deployment friction. The U.S. AI agents market alone could surge from just over US$ 2 billion in 2024 to around US$ 35 billion by 2032 as businesses embed copilots across CRM, ERP, and developer tooling.

Summary of Market Trends & Drivers

• Multimodal foundation models elevate agent autonomy, letting systems execute multi-step tasks rather than answer single prompts.

• Verticalized solutions for healthcare, finance, and legal accelerate market growth by solving domain-specific pain points and compliance hurdles.

• Subscription-priced, cloud-hosted agents democratize access for small and midsize enterprises, broadening market share beyond tech giants.

Key Market Players

Global leadership rests with a mix of hyperscale cloud providers and specialist vendors. Microsoft, Google, AWS, NVIDIA, and IBM supply model orchestration, GPUs, and enterprise integrations, while Salesforce, Meta, Apple, and Alibaba layer agents into productivity, commerce, and device ecosystems. Challenger brands such as OpenAI, Baidu, Leena AI, Cognigy, and BRYTER build nimble, niche-focused offerings that target legal automation, customer-care orchestration, or no-code agent creation.

Competitive dynamics revolve around three levers: proprietary data pipelines that fine-tune responses, low-code tooling that slashes build time, and ecosystem partnerships that seed agents across SaaS suites. Mergers, joint R&D, and GPU-allocation deals are common as vendors race to lock in training capacity and distribution.

Key Takeaways

• Current global AI agents market size (2024): USD$ 5.385 billion

• Forecast value (2032): USD$ 95.87 billion at a 46.05 % CAGR

• North America holds about 40 % market share, with Asia Pacific showing the fastest percentage gains

• Machine learning remains the largest technology slice; deep learning posts the highest incremental market growth

• Ready-to-deploy agents dominate revenue today, but build-your-own options are the fastest-rising segment as enterprises seek bespoke control

• Customer service and virtual assistants already capture the largest application share and continue to widen the gap

Market Dynamics

Drivers

• Explosive demand for personalized, 24/7 digital engagement pushes companies to embed AI agents in every touchpoint.

• Improvements in large-language-model reasoning and vector databases expand use cases from FAQ bots to full workflow orchestration.

• Cloud consumption pricing reduces upfront cost, speeding adoption among SMEs and emerging-market firms.

Restraints

• High implementation and tuning expenses deter risk-averse sectors with tight IT budgets.

• Data-privacy regulations such as GDPR and HIPAA curb unrestricted model training on sensitive records.

• Limited contextual memory in current models can still yield off-topic answers, slowing mission-critical deployment.

Opportunities

• Vertical AI agents tailored for regulated industries promise premium pricing and high switching costs.

• Coding and software-development agents shorten release cycles, opening new revenue streams for dev-tool vendors.

• Multilingual voice agents unlock underserved non-English customer bases, especially in fast-growing Asia Pacific markets.

Challenges

• Scarcity of GPU capacity and rising inference costs pressure gross margins.

• Ensuring explainability and audit trails in decision-heavy workflows remains a technical hurdle.

• Cyber-attack surfaces expand as autonomous agents gain permission to execute transactions.

Regional Analysis

North America leads thanks to deep cloud penetration, a dense AI startup ecosystem, and heavy federal AI funding. Europe follows, propelled by proactive AI governance and industry-4.0 initiatives, while Asia Pacific posts the quickest growth on the back of digital-first consumers and supportive government policies.

• North America – Dominant revenue base, strong enterprise cloud spend

• Europe – Rapid uptake aided by harmonized AI regulation and manufacturing digitalization

• Asia Pacific – Fastest CAGR; SMEs deploy agents for ecommerce and fintech

• Latin America – Growing call-center automation and retail chatbots

• Middle East & Africa – Early gains in smart-city traffic control and public-sector service desks

Segmentation Analysis

By Technology

• Machine Learning – Market backbone, widest adoption.

Algorithms parse historical data to fine-tune agent recommendations, driving steady revenue leadership.

• Natural Language Processing – Conversational core.

Advanced NLP powers human-like chat, crucial for customer-facing use cases across banking and retail.

• Deep Learning – Fastest CAGR.

High-parameter neural nets boost vision and speech accuracy, expanding multimodal agent roles.

• Computer Vision – Emerging niche.

Vision-enabled agents monitor physical assets, adding preventive-maintenance value in factories.

• Others – Hybrid techniques.

Graph networks and reinforcement learning address planning, routing, and game-AI scenarios.

By Agent System

• Single Agent Systems – Quick to deploy.

Enterprises favor single agents for narrow tasks such as invoice triage where speed and cost-control matter most.

• Multi Agent Systems – Rising for complex missions.

Coordinated agents tackle logistics, emergency response, and large-scale simulations by sharing context in real time.

By Type

• Ready-to-Deploy Agents – Largest revenue slice.

Plug-and-play packages let firms launch virtual help-desks within days, cutting labor overhead.

• Build-Your-Own Agents – Highest growth trajectory.

Custom stacks integrate legacy data lakes and security policies, appealing to finance and healthcare CIOs.

By Application

• Customer Service and Virtual Assistants – Core demand engine.

Always-on chat and voice bots deflect routine queries, lifting satisfaction while trimming costs.

• Robotics and Automation – Plant-floor ally.

Software agents synchronize robots, sensors, and ERP for hands-off manufacturing lines.

• Healthcare – Diagnostic lift.

Triage bots, scheduling aides, and medication-reminder agents ease clinician workloads.

• Financial Services – Risk watchdog.

Agents scan transactions for fraud and auto-generate compliance reports.

• Security and Surveillance – Real-time alerting.

Vision-based agents flag anomalies across retail stores and smart cities.

• Gaming and Entertainment – Dynamic NPCs.

Adaptive dialogue and quest generation deepen player immersion.

• Marketing and Sales – Hyper-personalization.

AI agents craft tailored offers and email cadences, raising conversion rates.

• Human Resources – Talent concierge.

Chat-first onboarding and policy FAQ agents elevate employee experience.

• Legal and Compliance – Document wizard.

Agents draft contracts, summarize case law, and surface regulatory gaps.

• Others – Research, education, and logistics.

Bespoke agents support literature reviews, tutoring, and route optimization.

By End-Use

• Consumer – Voice assistants in devices expand household adoption.

Smartphone and smart-home penetration keeps consumer demand climbing.

• Enterprise – Biggest spender.

Agents knit together siloed data, driving cross-department market analysis and decision support.

• Industrial – Fastest relative gains.

Predictive-maintenance and supply-chain agents boost uptime and efficiency.

Industry Developments & Instances

• Apr 2025 – Google added contextual code suggestions inside Gemini Code Assist for VS Code and IntelliJ.

• Feb 2025 – GitHub rolled out Agent Mode, letting Copilot iterate, test, and fix code autonomously.

• Feb 2025 – Salesforce and Google partnered to blend Agentforce with multimodal Gemini APIs for richer customer-support agents.

• Jan 2025 – NVIDIA launched AI Blueprints so enterprises can spin up domain-tuned “knowledge robots” on-prem or in cloud.

• Jan 2025 – OpenAI introduced ChatGPT Gov via Azure Government, targeting secure federal workloads.

• Sept 2024 – Microsoft unveiled Copilot agents that orchestrate tasks across Microsoft 365 and third-party apps.

Facts & Figures

• Customer-service deployments account for more than 30 % of current global revenue.

• Machine-learning-driven agents captured roughly 30.5 % market share in 2024.

• Ready-to-deploy packages can cut customer-support labor costs by up to 60 %.

• Multi-agent evacuations simulations improve crowd-flow predictions by nearly 20 % over single-agent models.

• Deep-learning workloads on AI-specific GPUs train up to 7 × faster than on general-purpose chips.

• Asia Pacific SMEs adopting agents grew at an estimated 55 % year-on-year in 2024.

Analyst Review & Recommendations

AI agents are shifting from chatbots to full digital coworkers, underpinned by rapid model-quality gains and falling inference latency. Vendors that marry proprietary data with low-code orchestration will capture outsized market growth, while laggards risk relegation to commodity tooling. Near-term priorities: secure GPU access, embed privacy-by-design, and pilot vertical agents in high-stakes domains where ROI is easiest to prove.