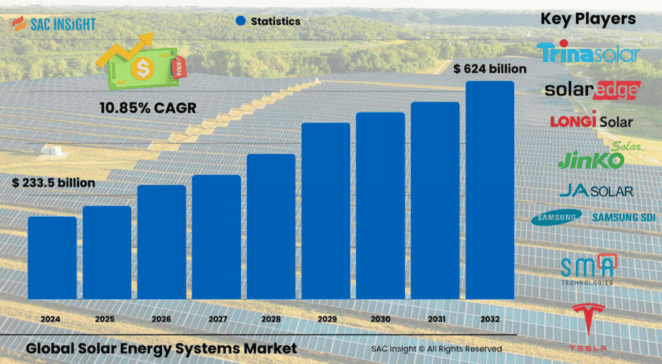

Market Overview

The global solar energy systems market size was valued at US$ 233.5 billion in 2024. SAC Insight evaluation indicates the sector is on track to reach about US$ 624 billion by 2032, expanding at an averaged 10.85% CAGR during the forecast window. First-hand industry insights point to three structural tailwinds: sharply falling component costs, ambitious decarbonisation targets, and a surge in behind-the-meter storage that lifts the business case for rooftop arrays. The U.S. solar energy systems market is projected to approach US$ 104 billion by 2032, underpinned by extended investment tax credits and record utility-scale auction pipelines.

Summary of Market Trends & Drivers

• Rising demand for renewable baseload capacity is putting solar-plus-storage at the centre of resource-planning models.

• Policy momentum—from feed-in tariffs in Europe to production-linked incentives in Asia—continues to compress payback periods and drive market growth.

• Rapid advances in high-efficiency N-type cells, smart inverters, and lithium-iron-phosphate batteries are redefining performance benchmarks and slashing levelised costs.

• Increasing emphasis on circular-economy practices prompts innovation in module recycling and reusability.

Key Market Players

Global competition is intense yet fragmented. Module powerhouses such as Jinko Solar, LONGi, Trina Solar, JA Solar, and First Solar focus on higher-efficiency wafers and TOPCon technologies to defend market share. On the power-electronics front, Huawei, SMA Technologies, Fimer Group, Delta Electronics, and SolarEdge lead the smart-inverter race, bundling advanced monitoring software with rapid-shutdown compliance. Battery specialists—Tesla, BYD Company, Samsung SDI, and Enersys—are investing heavily in longer-cycle chemistries to unlock residential and commercial storage demand. Integrated system providers like Sungrow and Schneider Electric offer turnkey packages that stitch these components together for developers and EPCs.

Key Takeaways

• Current market value: ~USD$ 233.5 billion; projected value 2032: ~USD$ 624 billion at 10.85% CAGR

• Solar panels retain the largest product market share at just over 41% of 2024 revenue

• Utility-scale deployments dominate demand; they account for roughly two-thirds of installed capacity

• Asia Pacific remains the demand engine, holding close to 60% regional market share in 2024

• New installations contribute nearly 97% of annual revenue; the MRO segment is a fast-emerging aftermarket

• Ongoing cell-efficiency gains and smarter inverters are key market trends improving project economics

Market Dynamics

Drivers

• Accelerated phase-out of coal and gas assets pushes utilities toward large-scale solar build-outs

• Declining capex for modules, inverters, and balance-of-system lowers the cost hurdle for residential and C&I adopters

• Robust policy frameworks—net-metering, green bonds, carbon pricing—propel investment flows into renewables

Restraints

• Supply-chain volatility and polysilicon price spikes can delay projects and compress installer margins

• Grid-interconnection bottlenecks and curtailment risk hamper optimal asset utilisation in high-penetration markets

• Up-front capital requirements remain a hurdle in price-sensitive emerging economies

Opportunities

• Adoption of next-generation batteries and vehicle-to-grid integration can unlock lucrative ancillary-service revenues

• Agri-solar and floating PV open fresh siting possibilities while improving land-use efficiency

• Digital twins and AI-driven O&M analytics promise to cut downtime and extend asset life, creating new service revenue pools

Challenges

• Heightened trade tensions and anti-dumping tariffs pose procurement uncertainty for developers

• Differing building codes and permitting rules complicate rapid rooftop rollouts across jurisdictions

• End-of-life module recycling infrastructure is still nascent, raising long-term sustainability and liability questions

Regional Analysis

The solar energy systems market in Asia Pacific leads global installations on the back of strong manufacturing ecosystems and aggressive national solar auctions, while North America is entering a steady build cycle supported by long-dated tax credits and grid-modernisation spending. Europe maintains a robust retrofit market as households hedge against volatile gas prices. The Middle East & Africa and Latin America are moving from pilot projects to gigawatt-scale developments thanks to high insolation and supportive tender frameworks.

• Asia Pacific – Largest market; policy-backed mega-projects and domestic manufacturing scale drive dominance

• North America – Rapid growth fuelled by federal incentives and expanding community-solar programmes

• Europe – Mature rooftop sector, strong corporate PPA momentum, and repowering of early-generation parks

• Middle East & Africa – High-irradiation sites and sovereign-backed tenders underpin double-digit growth rates

• Latin America – Competitive auctions in Chile, Brazil, and Mexico accelerate greenfield utility pipelines

Segmentation Analysis

By Product

• Solar Panels – Conversion backbone with over 40% revenue share

High-efficiency mono-PERC and TOPCon modules continue to command premiums as developers chase higher yields and lower levelised costs.

• Charge Controllers – Niche but essential for off-grid and hybrid systems

While unit prices have stabilised, smarter MPPT designs improve battery longevity, sustaining demand in remote micro-grids and telecom towers.

• Batteries – Fastest-growing product segment through 2032

Lithium-iron-phosphate packs dominate new tenders, enabling time-shifting of excess generation and grid-services revenue stacking.

• Inverters – Critical interface between DC generation and AC consumption

Advanced string and central inverters with embedded cybersecurity features are gaining traction as grid codes tighten.

• Others (racking, mounting, wiring) – Stable, low-margin segment

Standardised designs and commoditised supply keep price growth muted, but volume rises in tandem with new build activity.

By End-Use

• Utility – Core demand engine at roughly two-thirds of global capacity

Gigawatt-scale solar parks achieve unbeatable economies of scale, enticing IPPs and sovereign wealth funds.

• Industrial – Fastest-growing end-use thanks to decarbonisation pledges and rising electricity tariffs

Factories in APAC and MEA deploy on-site PV plus storage to hedge energy costs and meet ESG targets.

• Residential – Strong uptake driven by falling rooftop costs and smart-home integration

Battery-backed rooftop arrays give homeowners resilience against grid outages and escalating retail tariffs.

• Commercial – Stable growth as retailers, data centres, and campuses lock in long-term power-purchase agreements

On-site generation paired with EV-charging infrastructure is emerging as a differentiator for corporate sustainability branding.

By Source

• New Installation – Accounts for nearly 97% of annual revenue

Ongoing greenfield build-outs, particularly in emerging markets, dominate procurement pipelines.

• MRO – Rapidly evolving aftermarket

Component lifespan disparities—such as 10-15-year inverters versus 25-year panels—drive steady replacement demand and retrofit sales.

Industry Developments & Instances

• July 2022: A leading module manufacturer unveiled a 10-year-warranty residential battery line ranging from 2.56 kWh to 25.6 kWh, signalling vertical integration into storage.

• March 2022: A U.S.-based technology firm introduced a 430-W smart panel optimised for module-level power electronics, targeting high-shade urban rooftops.

• January 2022: A global IPP acquired an 84 MWp project in southern Europe under a 10-year PPA, illustrating growing appetite for merchant-risk assets.

• November 2020: The U.S. Department of Energy committed US$ 130 million toward silicon-cell reliability research, accelerating commercialisation of long-life modules.

• 2020-2023: Multiple governments removed rooftop capacity caps and extended net-metering schemes, broadening residential addressable markets.

Facts & Figures

• Solar panels captured roughly 41% of global product revenue in 2024.

• Utility-scale projects accounted for about 66% of installed capacity, reflecting strong economies of scale.

• Asia Pacific held close to 60% regional market share last year, led by China, Japan, and India.

• New installations represented nearly 97% of 2024 revenue; MRO demand is set to grow as early-generation assets age.

• Average module prices have fallen over 80% in the past decade, reducing levelised cost of electricity below US$ 0.03 /kWh in top solar regions.

• Battery energy-storage costs dropped more than 50% between 2018 and 2024, bolstering solar-plus-storage economics.

Analyst Review & Recommendations

Solar energy systems are graduating from subsidy-driven niche to mainstream power asset class. To capture the next wave of market growth, suppliers should double down on vertically integrated offerings that bundle high-efficiency modules, AI-enabled inverters, and durable storage. Developers need to hedge supply-chain volatility with multi-sourcing strategies and prioritise grid-friendly technologies to expedite interconnection approvals. Finally, investing early in recycling and circular-economy solutions will strengthen ESG credentials and future-proof project portfolios as markets scale toward the US$ 600-billion mark by 2032.