Market Overview

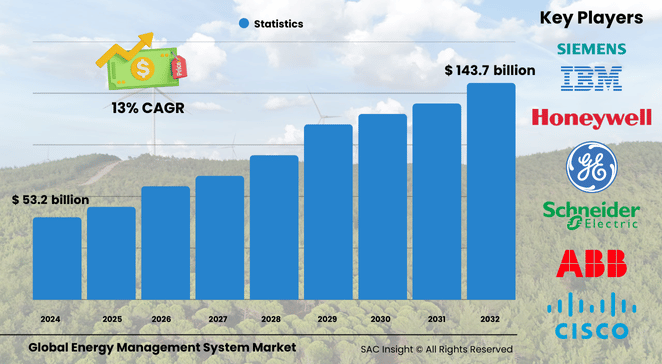

The global energy management system market size was valued at US$ 53.26 billion in 2024 and is projected to reach roughly US$ 143.07 billion by 2032, expanding at a 13.0% CAGR over the 2025-2032 forecast window. This market growth is fueled by rising electricity costs, stricter decarbonization targets, and a sweeping shift toward data-driven energy optimization across industry, buildings, and homes.

SAC Insight's deep market evaluation shows that digital twins, AI-enabled forecasting, and integrated demand-response programs are reshaping how organizations measure, control, and monetize their energy footprints. First-hand industry insights indicate the U.S. energy management system market alone could approach US$ 40 billion by 2032, reflecting robust uptake of cloud-based platforms and smart-grid incentives.

Summary of Market Trends & Drivers

• Industrial decarbonization, net-zero pledges, and ESG reporting standards are pushing enterprises to adopt real-time energy intelligence for both compliance and cost savings.

• Rapid deployment of IoT sensors, smart meters, and edge analytics is turning legacy facilities into connected assets that self-optimize around dynamic tariffs.

• Growing EV penetration and distributed renewables are creating new demand for holistic platforms that orchestrate storage, charging, and bidirectional power flows.

Key Market Players

Established multinational vendors dominate market share through broad portfolios that blend hardware, software, and services. Leaders such as Schneider Electric, Siemens, Honeywell, and ABB differentiate via AI-driven analytics and open APIs that plug into wider building-automation or industrial-control stacks. Alongside them, specialist firms—including IBM, Johnson Controls, Cisco, GridPoint, and C3.ai—are carving out niches in cloud orchestration, predictive maintenance, and grid-interactive demand response. Collectively, these companies shape competitive dynamics through frequent software releases, strategic partnerships, and customized service bundles that lower barriers to adoption.

Key Takeaways

• Current market value: USD$ 53.26 billion (2024)

• Projected market value: USD$ 143.07 billion by 2032 at a 13.0% CAGR

• North America leads with about 35.6% market share, while Asia-Pacific is the fastest-growing region

• Industrial energy management systems (IEMS) command over 73% of revenue, reflecting heavy-industry demand for process-level optimization

• Hardware—sensors, controllers, and smart meters—remains the largest component slice, yet cloud software is the quickest-expanding layer

• Market trends point to rising integration of EV charging, behind-the-meter storage, and AI-powered load shifting

Market Dynamics

Drivers

• Escalating electricity prices and penalty-laden carbon regulations are prompting enterprises to track and trim consumption.

• Digitization of the grid and wider availability of smart meters supply the granular data streams EMS platforms require.

• Corporate ESG mandates elevate energy performance to board-level priority, unlocking budget for analytics and automation.

Restraints

• High upfront integration costs and legacy system lock-in delay upgrades, especially in price-sensitive SMEs.

• Data-security concerns push certain operators—defense, banking—to favor slower on-premises deployments.

• Limited in-house expertise can stall analytics projects, raising reliance on external consultants.

Opportunities

• AI-driven predictive maintenance modules promise measurable OPEX savings, making ROI cases clearer.

• Smart-home proliferation and government rebates open a sizeable residential segment hungry for user-friendly dashboards.

• EV infrastructure rollouts require load-balancing software that existing EMS vendors are well placed to supply.

Challenges

• Fragmented regional standards complicate global platform roll-outs and raise certification costs.

• Talent shortages in data science and OT-IT convergence can slow project timelines.

• Volatile raw-material prices for semiconductors and sensors put pressure on hardware margins.

Regional Analysis

The North America energy management system market continues to dominate thanks to mature smart-grid investments, stringent energy-efficiency codes, and generous utility incentives. Europe follows, propelled by the Green Deal’s aggressive carbon-reduction timetable, while Asia-Pacific registers the steepest trajectory as China, India, and Southeast Asian nations embed EMS into massive industrial corridors and smart-city programs.

• North America – Early adopter of cloud EMS, strong demand-response markets, rising retrofit activity in commercial real estate

• Europe – Strict carbon pricing, high renewables penetration, rapid BEMS uptake in green buildings

• Asia-Pacific – Fastest CAGR; urbanization, heavy industrial build-out, and national energy-efficiency mandates drive volume

• Latin America – Incremental progress driven by utility digitalization and commercial-building energy codes

• Middle East & Africa – Select high-tech projects in data centers and utilities showcase EMS value, but broader rollout remains nascent

Segmentation Analysis

By System Type

• Industrial Energy Management Systems – Cornerstone of heavy-industry decarbonization

IEMS dominate revenue because energy-intensive sectors—steel, cement, chemicals—gain immediate bottom-line impact from plant-wide optimization and predictive maintenance.

• Building Energy Management Systems – Rapidly scaling across smart offices and retail chains

BEMS adoption accelerates as property owners chase lower operating costs, healthier indoor climates, and green-building certifications that lift asset value.

• Home Energy Management Systems – Emerging but gaining traction with smart-home adoption

HEMS solutions bundle user-friendly apps, thermostat controls, and PV-battery optimization, giving households a tangible tool to offset rising utility bills.

By Component

• Hardware – Sensors, controllers, smart meters underpin granular monitoring

Hardware remains the market’s largest slice because connected devices supply the high-resolution data streams that analytics engines rely on.

• Software – Cloud platforms, AI algorithms, and digital twins see fastest growth

Software converts raw signals into actionable insights, enabling predictive control, automated reporting, and multi-site benchmarking on a subscription basis.

• Services – Consulting, integration, and lifecycle support secure recurring revenue

Services close the skills gap, tailoring deployments, training staff, and fine-tuning algorithms to evolving load patterns.

By Deployment

• Cloud – Preferred for scale, remote visibility, and lower capex

Cloud EMS lets enterprises manage dispersed facilities in real-time, leverage continuous updates, and pay only for what they use.

• On-Premises – Favored by data-sensitive sectors seeking full control

On-premises installs remain common where latency, customization, or regulatory constraints outweigh the benefits of public-cloud elasticity.

By Vertical

• Manufacturing – Largest spender as process industries chase efficiency gains

Plants deploy EMS to monitor furnaces, compressors, and HVAC, shaving energy intensity while meeting ISO 50001 requirements.

• Energy & Power – Utilities integrate EMS to balance grids, cut losses, and monetize flexibility

Grid operators use advanced platforms to orchestrate storage, renewables, and demand-response portfolios in real-time.

• Residential – Growing segment driven by smart-home devices and solar-plus-storage adoption

Homeowners receive app-based insights that automate HVAC, lighting, and EV charging schedules for lower bills.

Industry Developments & Instances

• September 2024 – A major regional grid operator in Southern India commissioned a multi-site EMS project covering twelve dispatch centers, aiming for real-time load balancing.

• June 2024 – A global automation group released an AI-powered upgrade that forecasts demand, generation, and pricing to minimize imbalance penalties.

• May 2024 – A leading consultancy and a top EMS vendor launched an integrated command-center solution combining IoT hardware with advanced analytics for large campuses.

Facts & Figures

• Industrial systems account for roughly 73% of global EMS revenue.

• Hardware captured the largest component market share in 2024, fueled by widespread smart-meter roll-outs.

• North America held about 35.6% of global revenue in 2024, equal to nearly USD$ 19 billion.

• Global cloud deployments are growing at double the pace of on-premises installs, driven by multi-site enterprises.

• AI-based forecasting modules can cut energy imbalance penalties by up to 20%, according to pilot studies.

Analyst Review & Recommendations

The global energy management system market analysis underscores a decisive pivot from isolated, facility-level controls toward integrated, cloud-native platforms that unify generation, storage, and consumption under one pane of glass. Vendors that bundle robust hardware with easy-to-deploy analytics and strong cybersecurity will outpace peers. For new entrants, niche opportunities lie in AI-driven load forecasting and EV-charging orchestration. Established players should deepen service offerings and open their APIs to capitalize on the growing ecosystem of smart-building and industrial-IoT partners.