Key Market Insights

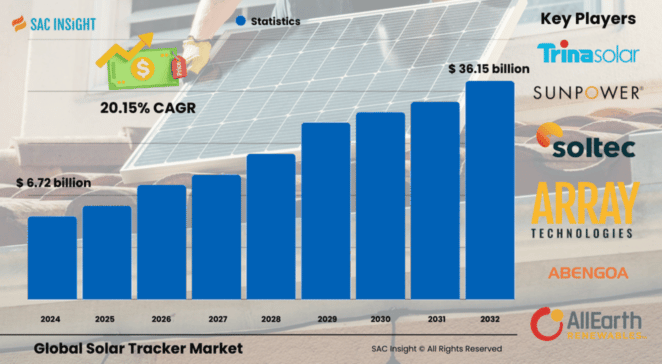

The global solar tracker market size reached an estimated US$ 6.72 billion in 2024 and is projected to climb to roughly US$ 36.15 billion by 2032, reflecting brisk market growth at a compound annual rate of about 20.15% during the 2026-2032 forecast window. First-hand industry insights point to three structural tailwinds driving this expansion: sharply falling photovoltaic module prices, ambitious national decarbonization mandates, and steady performance gains from software-enabled tracking systems. SAC Insight evaluation also highlights the sector’s rapid post-pandemic rebound, with annual installations now comfortably surpassing 2019 levels. The U.S. solar tracker market is on track to approach US$ 9.6 billion by 2032, buoyed by federal tax incentives and strong utility procurement pipelines.

Summary of Market Trends & Drivers

• Artificial-intelligence control algorithms and high-resolution satellite data are boosting energy yields, cutting downtime, and lowering lifetime operating costs.

• Intensifying “green energy” targets across North America, Europe, and the Middle East are accelerating utility-scale solar build-outs, lifting demand for single- and dual-axis tracker arrays.

• Declining steel prices after 2024’s volatility are easing capital-cost pressures, reopening stalled projects, and reinforcing positive market trends.

Key Market Players

Leading manufacturers such as NEXTracker, Array Technologies, Trina Solar, PV Hardware, Soltec, Solar Steel, and AllEarth Renewables dominate the competitive landscape. Their strategies revolve around securing multi-gigawatt framework agreements, expanding regional assembly lines, and layering proprietary software onto mechanical platforms to capture higher margins. A growing cohort of regional specialists—particularly in India, Spain, and Saudi Arabia—is also scaling rapidly, leveraging localized supply chains and government-backed clean-energy programs to win market share.

Key Takeaways

• Market value (2024): USD$ 6.72 billion

• Projected value (2032): USD$ 36.15 billion at a 20.15% CAGR

• North America accounted for roughly 56.9% of global revenue in 2024, reflecting strong policy support and robust utility pipelines.

• Dual-axis designs delivered just over 50% market share in 2024, yet single-axis systems remain the preferred choice for cost-sensitive utility projects.

• Utility-scale installations generated more than 85% of 2024 tracker revenue, underscoring the segment’s dominance.

• Ongoing R&D in AI-driven angle optimisation can lift plant output by up to 7% compared with conventional backtracking algorithms.

Market Dynamics

Drivers

• Aggressive renewable portfolio standards and feed-in tariff schemes are propelling large-scale solar deployment worldwide.

• Steep reductions in module and tracker capex are narrowing the levelized-cost gap with conventional power, accelerating adoption.

• Software integration—ranging from predictive maintenance to weather-adaptive positioning—is lifting performance and investor confidence.

Restraints

• Tracker installations remain capital-intensive; steel accounts for more than 65% of bill-of-materials costs, making projects vulnerable to commodity swings.

• Complex terrain and land-scarcity issues limit tracker feasibility for many commercial and residential sites.

• Dual-axis systems carry higher maintenance requirements, tempering penetration outside high-irradiance regions.

Opportunities

• Rapid grid-parity progress in Africa, Latin America, and South-East Asia opens new high-irradiance markets ripe for tracker deployment.

• Integration of battery storage with utility-scale PV plants adds revenue certainty, strengthening the tracker value proposition.

• Emerging hydrogen-production hubs seek ultra-low-cost renewable power, creating demand for maximized solar output via advanced tracking.

Challenges

• Interconnection bottlenecks and permitting delays can push project timelines, affecting revenue recognition for tracker suppliers.

• Skill-gaps in installation and O&M crews, especially in newer solar regions, heighten downtime risks.

• Heightened cyber-security requirements for utility SCADA systems add compliance complexity and cost.

Regional Analysis

North America remains the largest regional market thanks to generous tax credits, streamlined permitting in key states, and a robust utility pipeline. Europe follows, rejuvenated by higher feed-in premiums and energy-security priorities, while Asia Pacific anchors global manufacturing capacity and shows expanding demand in India, China, and Australia.

• North America – Policy tailwinds and utility PPAs underpin market leadership.

• Europe – FIT revisions and corporate sustainability targets spur steady growth.

• Asia Pacific – China’s scale and India’s tender programs drive manufacturing and deployment.

• Latin America – Brazil and Mexico tap abundant solar resources to diversify generation.

• Middle East & Africa – Mega-projects in Saudi Arabia and the UAE propel the fastest percentage growth globally.

Segmentation Analysis

By Technology

• Photovoltaic (PV) – Workhorse platform, over 90% share

PV trackers interface seamlessly with standard modules, need fewer design adjustments, and capture cost savings from mass-production. This compatibility keeps PV firmly at the center of tracker demand.

• Concentrated Solar Power (CSP) – High-temperature niche

CSP plants rely on mirrors and thermal storage, making dual-axis trackers essential but limiting volume to a handful of high-DNI regions. Despite smaller scale, CSP’s ability to deliver dispatchable renewable power keeps interest alive.

• Concentrated Photovoltaic (CPV) – Emerging contender

CPV systems shrink active cell area through intense light concentration, lowering material costs. While still nascent, CPV trackers could gain traction as optical efficiency improves and balance-of-system costs fall.

By Movement

• Single Axis – Economic benchmark

Single-axis trackers follow the sun east-to-west, boosting energy harvest by roughly 20% over fixed-tilt systems at a modest premium. Their favourable cost-performance ratio drives the majority of utility-scale purchasing decisions. Single-axis mechanisms are mechanically simpler, easier to maintain, and forgiving on uneven ground, making them the default for large ground-mounted arrays.

• Dual Axis – Performance maximiser

Dual-axis platforms adjust both azimuth and elevation, capturing 8-10% more energy than single-axis and over 30% versus static racks. They excel in high-irradiance, land-constrained sites where every extra kilowatt-hour counts. The added complexity and O&M costs limit dual-axis adoption to select utility builds, premium commercial rooftops, and CSP fields where precise sun-tracking is non-negotiable.

By Application

• Utility – Core demand engine

More than four-fifths of global tracker revenue stems from utility-scale projects as grid operators chase low-carbon capacity additions and long-term power-purchase agreements. Utility developers value the higher capacity factors, bankability, and predictable returns that tracking delivers.

• Non-utility – Selective growth

Commercial, industrial, and agricultural users adopt trackers when land is ample and energy demand justifies the premium. Residential uptake remains minimal due to roof-space limits and cost sensitivity.

Industry Developments & Instances

• April 2025 – A top U.S. tracker supplier announced plans to double Indian manufacturing capacity to 10 GW, citing strong domestic tender momentum.

• February 2025 – A European firm broke ground on what will become the world’s largest tracker plant, targeting 25 GW of annual output.

• February 2024 – Solar Steel secured a 21 MW tracker contract for Poland’s largest sun-tracking project, highlighting Central Europe’s rising interest.

• December 2023 – A major U.S. utility selected 1 GW of single-axis trackers for the Gemini solar-plus-storage project, cementing one of the country’s biggest tracker deals to date.

• April 2023 – AI-enabled stow algorithms were rolled out across 2 GW of existing tracker fleets, cutting wind-risk downtime by 40%.

Facts & Figures

• Utility projects accounted for 85.56% of tracker revenue in 2024.

• Dual-axis systems held 50.83% market share that year, yet single-axis remains dominant in new bids.

• Trackers typically raise annual energy output by 20-30% versus fixed-tilt arrays.

• Steel comprises more than 65% of total tracker hardware cost, tying project budgets to commodity cycles.

• North America captured approximately 56.9% of global tracker revenue in 2024.

• AI-driven angle optimisation has demonstrated up to 7% incremental yield versus static backtracking in pilot studies.

Analyst Review & Recommendations

Solar trackers have evolved from mechanical add-ons to digitally optimised performance platforms. Vendors that combine robust structural design with smart software, localised production, and full-life O&M support will outpace rivals as markets scale. Utility developers should favour single-axis systems for cost-weighted projects, reserving dual-axis for land-constrained or CSP builds. Emerging-market opportunities—especially in high-irradiance regions that offer policy clarity—justify strategic localisation to trim logistics costs and hedge currency risk. Overall, sustained market analysis indicates a healthy runway for value-engineered trackers that balance capex discipline with yield-boosting intelligence.