Market Overview

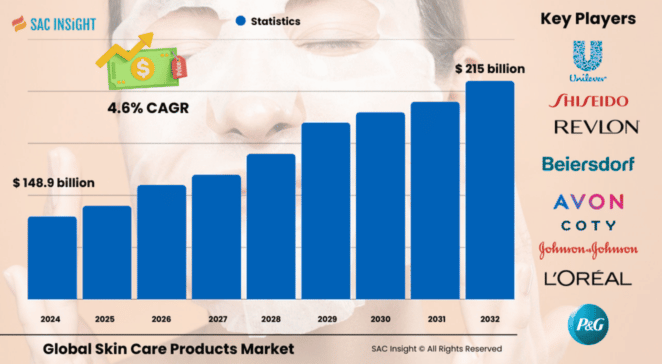

The global skin care products market size was estimated at around US$ 148.9 billion by 2024. It is set to reach roughly US$ 215.0 billion by 2032, registering a steady 4.695% CAGR over the 2025-2032 forecast window. SAC Insight industry insights highlight three structural forces behind this market growth: rising demand for naturally derived formulations, surging online sales that shorten the path to purchase, and new celebrity or influencer-led labels that broaden consumer reach.

SAC Insight's deep market evaluation shows a full rebound from pandemic-era store closures, with spending now well above 2019 levels. The U.S. skin care products market alone is expected to top US$ 60 billion by 2032 as shoppers pay premium prices for science-backed, dermatologist-tested lines.

Summary of Market Trends & Drivers

Consumer migration toward vegan, cruelty-free, and “clean beauty” portfolios is reshaping product pipelines and marketing messages. Skinimalism—fewer steps, multifunctional products—is pushing brands to develop high-performance hybrids combining sun protection, hydration, and active botanicals in a single SKU. Precision skin care powered by AI-based diagnostics and DNA or microbiome testing is opening the door for personalized regimens delivered direct-to-consumer.

Key Takeaways

- Asia Pacific commands the largest regional market share at 39.65% and remains the hub for K-beauty and ingredient innovation.

- Face creams & moisturizers contribute the biggest product slice, accounting for 42.11% of global revenue.

- Female consumers still account for 61.66% of spending, yet the men’s segment is the fastest-growing at about 5% CAGR.

- Supermarkets & hypermarkets dominate physical retail, but pure-play online platforms are capturing incremental gains through subscription models and influencer storefronts.

Key Market Players

Global leadership rests with diversified giants that blend mass-market reach and research muscle. Companies such as L’Oréal, Unilever, Procter & Gamble, and Johnson & Johnson continue to invest heavily in R&D and digital shelf visibility. Around them, challenger brands like Shiseido’s Humanrace, Beiersdorf’s NIVEA Accelerator alumni, and fast-growing disruptors acquired by strategic buyers (e.g., SkinBetter Science, Youth to the People, Tula) inject fresh concepts and ingredient stories that keep the competitive tempo high. Strategic partnerships with e-commerce platforms and dermatologist networks underpin their expanding skin care products market share.

Market Dynamics

Drivers

Expanding middle-class income in emerging markets supports premiumisation and routine-based purchases. Growing awareness of photo-aging and pollution-induced damage drives uptake of SPF-infused and anti-pollution lines.

Restraints

Ingredient transparency demands and evolving clean-label regulations raise formulation costs and time-to-market. Counterfeit products on informal online channels erode brand trust and compress margins.

Opportunities

Bio-fermented actives and upcycled botanical extracts offer new functional claims and circular-economy narratives. AI-powered skin analysis apps paired with refillable packaging present a path to recurring revenue and lower environmental impact.

Challenges

Intense competition leads to shorter product life cycles and higher marketing spend to retain consumer mindshare. Supply-chain disruptions for specialty ingredients (e.g., niacinamide, hyaluronic acid) can stall new launches and limit scale-up.

Regional Analysis

Asia Pacific continues to set the pace, propelled by K-beauty influence, a vibrant chemical industry for raw materials, and increasing male grooming adoption. North America posts solid single-digit growth on the back of science-driven brand storytelling, while Europe benefits from strict regulatory standards that reassure ingredient-conscious consumers.

Asia Pacific – Largest market; strong domestic manufacturing in China and South Korea supports export-ready innovation.

North America – Fastest revenue expansion; high consumer willingness to pay for dermatologist-endorsed formulations.

Europe – Mature but resilient; sustainability and packaging regulations shape product design.

Latin America – Rising urbanization and social-media penetration fuel demand for affordable premium lines.

Middle East & Africa – Gradual uptake aided by expanding modern retail and rising tourism-driven luxury spending.

Segmentation Analysis

By Product

Face Creams & Moisturizers – High stickiness, dominant share

These everyday staples offer hydration plus active benefits, making them the cornerstone of most routines. Continued innovation in lightweight textures and plant-based emulsifiers keeps this segment in the lead.

Cleansers & Face Wash – Essential gateway category

With consumers washing more frequently to remove pollution and SPF, gentle surfactant systems and microbiome-friendly formulas are in demand.

Sunscreen – Preventive focus, double-digit momentum

Broad-spectrum and blue-light-shielding variants gain traction as skin-cancer awareness rises and hybrid products merge SPF with makeup or serum benefits.

Body Creams & Moisturizers – Daily use, rising naturals mix

Shea-butter and ceramide-rich lotions find favor among consumers tackling dryness from climate extremes and indoor heating.

Shaving Lotions & Creams – Corporate grooming driver

More professionals aim for irritation-free shaving; botanically enriched and alcohol-free options are expanding shelf space.

Others – Niche boosters and masks

Fast-acting ampoules, sleep masks, and spot-correcting patches satisfy targeted concerns and social-media-driven experimentation.

By Gender

Female – Core revenue engine

Women maintain skincare as self-care, embracing active-rich serums and multi-step rituals that drive basket size.

Male – Quickest growth path

Men shift beyond basic cleansers toward anti-aging, oil-control, and sun-protection solutions, supported by gender-neutral branding and influencer advocacy.

By Distribution Channel

Supermarkets & Hypermarkets – High visibility, value appeal

One-stop convenience and promotional pricing secure broad penetration for mass and masstige labels alike.

Convenience Stores – On-the-go replenishment

Small-format shops benefit from travel-size SKUs that cater to impulse purchases and commuter traffic.

Pharmacy & Drugstore – Trust-based positioning

Dermocosmetic lines leverage pharmacist endorsement and in-store skin diagnostics to win loyalty.

Online – Double-digit surge

Live-stream shopping, subscription kits, and AI-driven quizzes personalize the journey and boost conversion.

Others – Salons, department stores, specialty boutiques

Experiential merchandising and professional recommendations reinforce premium and spa-grade offerings.

Industry Developments & Instances

July 2021 – Launch of a next-generation power-infusing serum by a leading Japanese brand, available in 380 domestic stores and online.

June 2021 – Expansion of a German-based accelerator into China, partnering with a major e-commerce platform to incubate indie beauty tech startups.

June 2021 – Introduction of a six-SKU dermatologist-designed range in U.S. pharmacy chains, bringing mid-priced clinical care to mass retail.

September 2022 – Acquisition of a physician-dispensed anti-aging specialist by a global beauty conglomerate, strengthening its premium professional portfolio.

January 2022 – A multinational consumer goods group purchased a probiotic-powered clean skincare label to enhance its science-backed natural offerings.

December 2021 – Agreement to acquire a California-based vegan superfood brand, broadening access to Gen-Z consumers seeking nutrient-dense formulas.

Facts & Figures

- Current market size (2024): US$ 148.9 billion

- Projected 2032 value: US$ 215.0 billion at a 4.695% CAGR

- Asia Pacific holds 39.65% market share, led by China, South Korea, and India

- Face creams & moisturizers account for 42.11% of global revenue

- Female consumers generate 61.66% of sales, while men’s products lead in market growth at 5% CAGR

- Supermarkets & hypermarkets capture 43.72% of distribution share, yet online sales are growing twice as fast

Analyst Review & Recommendations

Robust consumer appetite for transparent labels, science-validated actives, and tailored regimens continues to power the skin care products market. Brands that marry clean-ingredient narratives with measurable efficacy—and deliver them through frictionless e-commerce experiences—stand to capture outsized market share. Investment in AI-driven diagnostics, refillable packaging, and regional micro-influencer partnerships will be key levers for sustained market analysis-driven expansion.