Market Overview

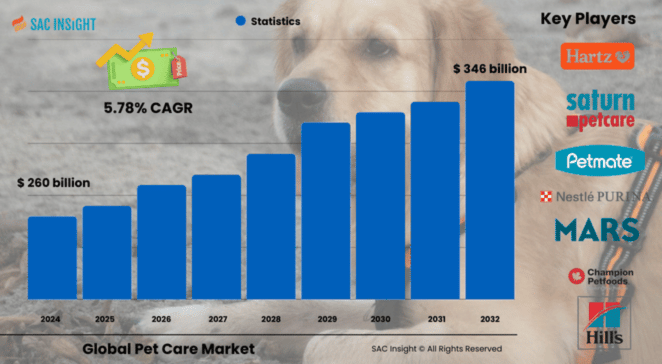

The global pet care market size is estimated at roughly US$ 260 billion in 2024 and is set to climb to about US$ 346 billion by 2032, expanding at a 5.78% CAGR over the 2025-2032 forecast window. First-hand industry insights indicate three structural engines behind this market growth: rising pet humanization that blurs the line between “owner” and “pet parent,” sustained premiumization in nutrition and accessories, and a wave of digital veterinary and e-commerce models that make care more convenient.

SAC Insight's deep market analysis also shows North America firmly in the lead, while Asia-Pacific delivers the fastest incremental gains. The U.S. pet care market alone is projected to exceed US$ 116 billion by 2032 as younger households channel more disposable income toward companion-animal wellness.

Summary Of Market Trends & Drivers

• Dietary upgrades, functional treats, and sustainable packaging are reshaping everyday purchasing decisions, pushing brands toward transparent labeling and carbon-neutral formulations.

• Tele-veterinary services, smart feeders, GPS wearables, and subscription commerce are redefining how care is delivered and monetized.

• Preventive health awareness is rising, prompting higher spending on insurance, diagnostics, and routine check-ups.

Key Takeaways

• Current market value (2024): about USD$ 260 billion

• Projected value (2032): roughly USD$ 346 billion at a 5.78% CAGR

• North America holds the largest regional market share at nearly 38%

• Dog products contribute the greatest revenue share (39%)

• Product sales (food, litter, toys, grooming) represent just over half of global revenues

• Online channels are compounding in double digits, outpacing brick-and-mortar pet stores

Key Market Players

Global pet care market share remains concentrated among diversified food and healthcare majors. Mars, Nestlé Purina, Hill’s Pet Nutrition, and Spectrum Brands continue to command shelf space through broad product portfolios and aggressive R&D. They are flanked by fast-growing specialists such as Champion Petfoods, SCHELL & KAMPETER, Unicharm, Ancol, and Tail Blazers that leverage niche positioning in premium treats, raw diets, or eco-friendly accessories. Private-label offerings from retailers and direct-to-consumer startups add competitive tension by targeting price-sensitive and digitally native customers.

Market Dynamics

Drivers

• Pet humanization and single-person households boost willingness to spend on premium care

• Rapid growth of e-commerce and subscription models widens market reach

• Rising preventive healthcare awareness fuels veterinary visits and insurance uptake

Restraints

• High price points for top-tier nutrition and tech devices limit adoption in lower-income segments

• Regulatory hurdles on labeling, ingredient claims, and cross-border shipments can slow product launches

Opportunities

• Plant-based and insect-protein diets appeal to sustainability-minded owners

• AI-enabled wellness platforms and home-testing kits can unlock recurring revenue streams

• Emerging markets in Asia and Latin America present sizable untapped pet owner bases

Challenges

• Fragmented supply chains and raw-material inflation pressure margins

• Workforce shortages in veterinary services risk longer wait times and reduced access

Regional Analysis

North America dominates thanks to high disposable incomes, strong retail infrastructure, and entrenched culture of treating pets as family. Europe follows closely, supported by robust veterinary networks and rising pet insurance penetration. Asia-Pacific is the pacesetter in market growth, driven by expanding middle-class populations in China and India.

• North America – Premiumization and insurance adoption underpin steady gains

• Europe – Mature but resilient, buoyed by stringent welfare standards

• Asia-Pacific – Fastest growth on the back of urbanization and rising incomes

• Latin America – Growing pet populations and expanding modern retail channels

• Middle East & Africa – Gradual uptake, led by affluent urban clusters

Segmentation Analysis

By Product Type

• Pet Food Products – Core revenue engine

Functional ingredients, grain-free kibble, and freeze-dried raw options keep this segment at the center of household spend, with subscription delivery accelerating repeat sales.

• Veterinary Care – Fastest-growing spend category

Preventive screenings, chronic disease management, and tele-vet consultations push care expenditures beyond episodic clinic visits.

• Others (Grooming, Hygiene, Toys, Wearables) – Expanding lifestyle segment

Smart collars, DNA tests, eco-friendly litter, and spa-grade shampoos turn discretionary items into mainstream essentials as owners seek holistic wellness.

By Pet Type

• Dog – Largest companion segment

Dogs account for the lion’s share of market revenue, reflecting high feed volumes, premium treats, and demand for outdoor accessories.

• Cat – Accelerating ownership among urban singles

Compact living spaces and lower maintenance needs make cats popular, driving steady 5%-plus growth in litter, treats, and specialized nutrition.

• Others (Fish, Birds, Small Animals, Reptiles) – Niche but stable

Specialty feeds and habitat products maintain engagement among hobbyists and aquaculture enthusiasts.

By Distribution Channel

• Offline – Brick-and-mortar dominance but shifting footprints

Supermarkets, pet specialty chains, and veterinarians still anchor trust, especially for first-time purchases and bulky items.

• Online – Double-digit digital capture

One-click reordering, customizable meal plans, and home delivery continue to pull share from physical stores, aided by social-commerce influencers.

Industry Developments & Instances

• November 2022: Nylabone rolled out a new line of enrichment toys aimed at reducing canine anxiety.

• November 2022: Mars finalized the acquisition of Champion Petfoods to broaden its premium portfolio.

• August 2022: Wiggles introduced gluten- and sugar-free dog foods to meet rising demand for clean-label diets.

• December 2021: Unilever debuted its pet-care brand in Brazil, spanning shampoos, wipes, and disinfectants.

• January 2021: Paws Inc. acquired a leading UK e-tailer to accelerate European expansion.

Facts & Figures

• Average global CAGR 2025-2032: 5.78%

• Consolidated 2032 market size forecast: US$ 346 billion

• North America accounts for roughly 38% of global revenues in 2023

• Dog products command about 39% of total revenue, while product sales overall hold 54% share

• Cat segment set to register a 5.3% CAGR through 2030

• U.S. market expected to surpass US$ 116 billion by 2032

Analyst Review & Recommendations

Data-driven market analysis underscores an industry shifting from commodity products to connected, health-oriented ecosystems. Companies that pair premium nutrition with digital monitoring tools and sustainable packaging will capture outsized market share. New entrants should target mid-priced, plant-based diets in Asia-Pacific for rapid scale, while incumbents ought to deepen tele-vet services and loyalty programs to lock in recurring revenue. Overall, sustained market growth looks assured as pets cement their place at the very center of household spending.