Market Overview

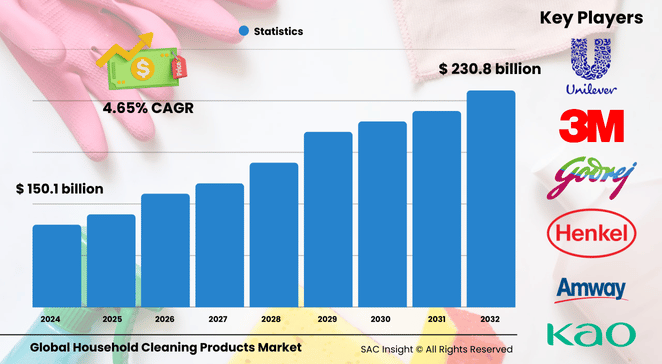

The global household cleaning products market size was valued at US$ 150.19 billion in 2024 and is poised to reach roughly US$ 230.89 billion by 2032, registering a steady 4.65% CAGR over the 2025-2032 forecast window. SAC Insight's deep market evaluation points to three structural growth engines: consumers’ heightened hygiene awareness that lingers after the pandemic, a pronounced shift toward plant-based and low-toxicity formulations, and the convenience of e-commerce channels that shorten the path from discovery to doorstep.

SAC Insight industry insights confirm that premium, fragrance-enhanced offerings are gaining ground, especially in urban areas where disposable income is rising. The U.S. household cleaning products market alone is projected to top US$ 85.22 billion by 2032, reflecting strong adoption of value-added sprays, pods, and wipes that promise both speed and safety.

Market Trends & Drivers

• High-visibility public-health campaigns keep sanitation top-of-mind, driving repeat purchases and larger pack sizes.

• Eco-labels, refill formats, and bio-based surfactants are moving from niche to mainstream as shoppers scrutinize ingredient decks.

• Digital retail is reshaping brand strategy; live-stream demos and social-media micro-influencers now account for a growing share of category sales.

Key Market Players

Global incumbents such as Procter & Gamble, Unilever, Henkel, Reckitt, Colgate-Palmolive, Kao, and The Clorox Company dominate market share through extensive R&D pipelines, broad distribution, and aggressive brand building. Regional specialists – Godrej Consumer Products, Church & Dwight, and Goodmaid Chemicals among others – add competitive pressure by tailoring fragrances, pack sizes, and price points to local preferences. Continuous product refreshes, celebrity tie-ins, and greener formulations are the weapons of choice in this intensely promoted category.

Key Takeaways

• Current market value: USD$ 150.19 billion (2024)

• Projected value: USD$ 230.89 billion by 2032 at a 4.65% CAGR

• Asia Pacific leads with 35.88% market share; Europe follows at 23.5%

• Chemical ingredients still account for 86% of revenue, yet natural alternatives post the fastest gains

• Surface cleaners hold the largest product slice at 55% of revenue, while laundry detergents hold the highest market share in 2024, showcasing continuing market strength

• Online sales are the fastest-growing channel, propelled by smartphones and same-day delivery options

Market Dynamics

Drivers

• Persistent health-and-hygiene mindset reinforces daily cleaning routines, lifting volume growth.

• Rising urban incomes in Asia, Latin America, and parts of Africa expand the addressable consumer base.

• Sustainable packaging commitments and renewable surfactants open premium pricing headroom.

Restraints

• Skin-sensitization concerns linked to aggressive chemistries erode trust and nudge shoppers toward DIY alternatives.

• Raw-material price volatility, especially for petro-derived surfactants and fragrances, squeezes margins.

• Fragmented brand loyalty makes customer retention costly, even for established players.

Opportunities

• Concentrated refills and solid-format detergents slash water weight and shipping emissions, appealing to eco-conscious buyers.

• Antimicrobial add-ons integrated with smart dispensers create scope for connected-home upsells.

• Untapped rural markets in South-East Asia and Sub-Saharan Africa invite sachet and micro-dosing innovations.

Challenges

• Complying with diverging regional chemical-safety regulations raises formulation and labeling complexity.

• Counterfeit products online threaten brand equity and consumer safety.

• Achieving full circularity in plastic supply chains remains technologically and economically demanding.

Regional Analysis

Europe’s long-standing preference for sustainable household care keeps the region at the forefront of low-toxicity innovation, while Asia Pacific’s sheer population density and rapid urbanization anchor the bulk of absolute volume growth. North America maintains high per-capita spend driven by convenience products and subscription deliveries.

• North America – Large basket sizes, strong brand loyalty, quick uptake of disinfecting wipes

• Europe – Robust regulatory framework pushes green cleaning; consumers favor recycled cartons and refill pouches

• Asia Pacific – Fastest market growth; government cleanliness drives such as India’s Swachh Bharat spur demand

• Latin America – Gradual expansion; value packs and powder detergents dominate price-sensitive segments

• Middle East & Africa – Rising middle class fuels surface-cleaner and laundry-detergent adoption, albeit from a low base

Segmentation Analysis

By Ingredients

• Chemical – Holds roughly 86% revenue share, prized for fast action and broad antimicrobial spectrum Chemical formulations—bleaches, solvents, and surfactants—remain the workhorse thanks to proven efficacy and established supply chains, but face scrutiny over health and environmental impact.

• Natural – Highest-growth bracket, clocking a 7%-plus CAGR Plant-derived acids, essential oils, and bio-enzymes satisfy demand for gentler, biodegradable options and attract premium shelf placement.

By Product

• Surface Cleaners – Command 55% of revenue; targeted formulas for wood, glass, and stone gain traction Consumers view clean countertops and floors as the first line of defense against pathogens, making surface sprays and liquids the backbone of daily routines.

• Laundry Detergents – Category heavyweight and volume driver Enzyme-rich liquids, pods, and fragrance-boosted powders address efficiency and sensory appeal, keeping washday a cornerstone of market growth.

• Dishwashing Products – Benefiting from single-dose tablets and plant-based concentrates In-machine tablets with rinse-aid boosters and compact liquid formats elevate convenience in busy kitchens.

• Toilet Cleaners – Fastest-growing sub-segment at over 5% CAGR Thick gels and rim-block innovations promise lasting freshness and germ kill, resonating with hygiene-focused households.

• Glass & Specialty – Niche but rising alongside modern interior designs that feature more glass and stainless steel Streak-free, ammonia-free blends meet aesthetic needs in both homes and offices.

By Distribution Channel

• Offline – Still captures the lion’s share through supermarkets, hypermarkets, and neighborhood stores In-aisle promotions and bundle deals remain powerful triggers for impulse buys.

• Online – Double-digit growth as mobile apps and quick-commerce players slash delivery times Product reviews, subscription discounts, and targeted ads sway purchase decisions among digitally savvy consumers.

Industry Developments & Instances

• January 2023 – Cascade introduced Platinum Plus pods designed to eliminate the need for pre-rinse, highlighting water-saving benefits.

• January 2023 – Henkel and Shell initiated a five-year agreement to replace 200,000 tons of fossil feedstock with renewables in surfactant production.

• February 2022 – Henkel announced the merger of its laundry and beauty businesses to create a unified consumer-brands platform.

• January 2022 – Henkel raised post-consumer recycled content in toilet-cleaner bottles to as much as 75%.

• December 2021 – Unilever rolled out a dishwashing liquid made entirely from naturally derived ingredients and packaged in fully recyclable bottles.

• April 2021 – Unilever, LanzaTech, and India Glycols launched the first laundry capsule using surfactants made from captured industrial emissions.

• April 2021 – Godrej Consumer Products debuted a 2-in-1 liquid detergent under Ezee to tap India’s growing machine-wash market.

• August 2018 – A germ-killing kitchen spray under the Lizol brand was unveiled with chef-led promotion to boost penetration in India’s premium segment.

Facts & Figures

• Average global household spends about USD$ 48 per year on branded cleaning products.

• Online purchases now represent nearly 17% of category sales, up from 10% in 2019.

• Recycled or recyclable packaging features in roughly 42% of new product launches.

• Enzyme-boosted detergents cut wash temperature by up to 15 °C, saving an estimated 0.3 kWh per load.

• Over 60% of surveyed consumers check ingredient lists before buying, a rise of 12 percentage points since 2020.

• Marketplace counterfeits account for an estimated USD$ 3 billion in lost legit brand sales annually.

Analyst Review & Recommendations

The market analysis underscores a clear pivot toward safer, greener, and smarter cleaning solutions without compromising efficacy. Brands that integrate renewable surfactants, transparent labeling, and refillable packs can capture premium market share while meeting emerging regulatory and consumer expectations. Investment in digital engagement—particularly through quick-commerce partnerships and influencer-led demos—will be pivotal to sustaining market growth and defending shelf space in an increasingly crowded landscape.