Market Overview

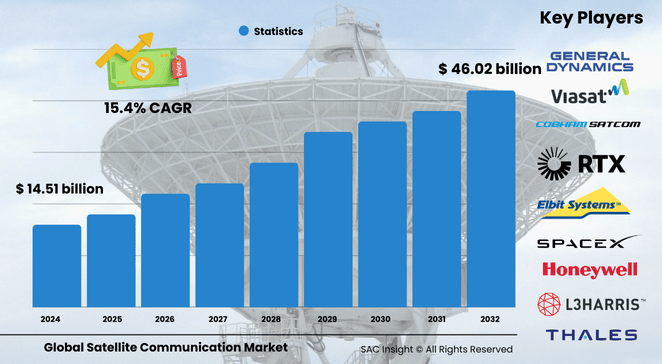

The global satellite communication market size was valued at US$ 14.51 billion in 2024 and is projected to reach roughly US$ 46.02 billion by 2032, registering a robust 15.4% CAGR during 2025-2032. SAC Insight industry insights indicate three structural drivers: relentless demand for connectivity beyond terrestrial reach, the roll-out of affordable low-earth-orbit (LEO) constellations, and the digital transformation of aviation, maritime, and remote industrial operations.

SAC Insight's deep market evaluation shows North America captured about 36% market share in 2024, while the U.S. satellite communication market alone is on track to hit around US$ 22.20 billion by 2032 on the back of broadband expansion programs and defense modernization.

Summary of Market Trends & Drivers

Rising data consumption in rural and maritime zones, the shift toward software-defined payloads that improve bandwidth flexibility, and integration with 5G backhaul are accelerating market growth. At the same time, governments are lifting spectrum caps and subsidizing universal service, spurring private investment in multi-orbit networks and IoT-ready gateways.

Key Market Players

Tier-one operators such as Starlink, SES, Viasat, Intelsat, and Eutelsat anchor the competitive landscape with global fleets and vertically integrated broadband offerings. They are joined by focused specialists—Iridium Communications in narrowband M2M, Hughes Network Systems in consumer VSAT, and Telesat in enterprise GEO/LEO hybrids—whose differentiated capacity models shape pricing and service quality.

Key Takeaways

• Market value (2024): USD$ 14.51 billion

• Projected value (2032): USD$ 46.02 billion at a 15.4% CAGR

• North America leads with 36% market share; Asia-Pacific is the fastest-growing region with a projected CAGR above 19%

• Direct-to-Home (DTH) broadcasting holds the largest revenue slice today, while enterprise data links show the quickest uptake

• Defense & security applications command roughly 25% of spending, underscoring heightened geopolitical surveillance needs

• LEO capacity launches passed 5,000 units in 2024, cutting average bandwidth costs by more than 30% year on year

Market Dynamics

Drivers

• Growing need for reliable voice and data links in remote or underserved geographies

• Surge in maritime and aviation connectivity requirements for safety, real-time telemetry, and passenger services

• Government initiatives backing digital inclusion and resilient critical-communications infrastructure

Restraints

• Spectrum allocation bottlenecks and divergent national licensing regimes slow global service roll-outs

• Latency and bandwidth constraints in legacy GEO systems limit uptake for real-time applications

• High initial capital outlay for constellation deployment and ground-segment upgrades

Opportunities

• Expansion of satellite broadband to complement 5G backhaul and private campus networks

• Integration with IoT and edge-analytics platforms to unlock new industrial automation use cases

• Rising demand for secure communication channels in defense, disaster recovery, and cyber-resilient networks

Challenges

• Launch-vehicle congestion and finite orbital slots raise collision-avoidance and space-debris concerns

• Competitive pressure from fiber and high-altitude platform stations (HAPS) in densely populated corridors

• Continuous need for technological updates to keep pace with compression standards and user-equipment miniaturization

Regional Analysis

North America dominates on the strength of advanced space infrastructure, supportive regulatory frameworks, and sustained defense spending. Europe follows, driven by coordinated spectrum policy and growing maritime surveillance programs. Asia-Pacific, however, delivers the fastest market growth as governments invest heavily in rural broadband and disaster-monitoring satellites.

• North America – Leadership in military satcom modernization and rural broadband subsidies

• Europe – Strong policy support for maritime security, climate monitoring, and 5G backhaul

• Asia-Pacific – Highest CAGR, fueled by large-scale national connectivity projects and expanding airline fleets

• Latin America – Rising DTH and enterprise VSAT demand in energy and mining belts

• Middle East & Africa – Steady uptake for navigation, oil & gas field connectivity, and humanitarian response

Segmentation Analysis

By Type

• Telecommunication Services – Core bandwidth backbone

Telecommunication services, spanning video, voice, and data trunking, remain the revenue cornerstone as enterprises and carriers lease capacity for global reach.

• Broadcasting Services – Dominant DTH segment

High-definition and ultra-HD television channels delivered via DTH continue to command the largest single segment, supported by consistent subscription renewals.

• Data Communication Services – Fast-growing enterprise link

Demand for secure, high-throughput data links in energy, aviation, and government accelerates this segment, with software-defined networks enhancing flexibility.

By Application

• Critical Communication – Backbone for emergency and defense links

Secure, resilient channels underpin national security operations and disaster-response coordination, sustaining premium pricing.

• Navigation – Precise positioning and timing services

Augmentation signals and SBAS overlays improve GPS accuracy for aviation, maritime, and autonomous systems.

• Direct-to-Home (DTH) – Largest consumer revenue stream

Continuous migration to HD and 4K content, coupled with bundled broadband, keeps household uptake high.

• Internet of Things (IoT) – Emerging mass-market driver

Low-power satellite terminals push asset tracking, smart farming, and environmental sensing into areas beyond cellular reach.

• Satellite Broadband – High-throughput consumer and enterprise access

Rapid LEO deployment is cutting latency below 50 ms, making satellite broadband a viable alternative for cloud workloads and real-time collaboration tools.

By End-User

• Consumer – DTH and residential broadband mainstay

Household demand for video and internet access anchors baseline capacity utilization.

• Enterprise – Fastest-growing category

Industrial sites, shipping fleets, airlines, and oil rigs adopt satcom for real-time telemetry, remote operations, and crew welfare, driving double-digit revenue growth.

By Enterprise Vertical

• Telecom – Uses satellite backhaul to extend 4G/5G coverage cost-effectively

• Media & Entertainment – Relies on satellite uplink for live sports and global events

• Maritime – Depends on broadband-at-sea for navigation, safety, and crew connectivity

• Government & Defense – Requires encrypted links and resilient command networks

• Energy & Utilities – Monitors offshore rigs, pipelines, and smart grids in harsh terrain

• Aviation – Provides in-flight Wi-Fi, flight-path optimization, and real-time diagnostics

• Transportation & Logistics – Tracks assets, optimizes routes, and ensures cold-chain integrity

• Others – Education, humanitarian aid, and research installations leveraging turnkey satcom packages

Industry Developments & Instances

• May 2024 – Intelsat signed a multi-year servicing deal to extend the usable life of two GEO satellites by at least four years, lowering replacement capex.

• April 2024 – Virgin Media O2 partnered with Starlink to trial rural backhaul in the UK, accelerating fibre-equivalent speeds to remote villages.

• April 2024 – CelcomDigi and SES agreed to jointly deliver multi-orbit connectivity to Malaysian enterprises and communities.

Facts & Figures

• LEO constellations accounted for over 70% of all satellite launches in 2024.

• Average satellite broadband latency fell from 600 ms (GEO) to below 50 ms on new LEO networks.

• Roughly 24,000 commercial vessels subscribed to VSAT services in 2024, a 12% year-on-year rise.

• Enterprise satcom deployments in mining and oil & gas grew by 18% in 2024, reflecting automation uptake.

• Remote education roll-outs added more than 80,000 satellite-connected classrooms worldwide in the past two years.

Analyst Review & Recommendations

Satellite communication is shifting from capacity-led leasing to solution-oriented partnerships that blend multi-orbit bandwidth, edge computing, and managed cybersecurity. Operators that bundle flexible service plans with ground-segment virtualization will outpace competitors as enterprises migrate mission-critical workloads off-grid. New entrants should target underserved industrial corridors with pay-as-you-grow contracts, while incumbents must accelerate in-orbit servicing and spectrum coordination to protect long-term asset value and sustain market growth.