Market Overview

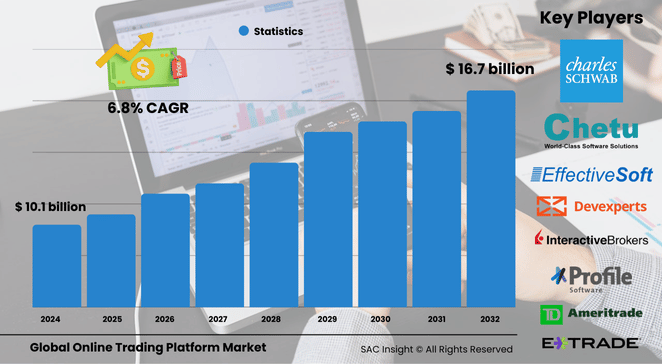

The global online trading platform market size was valued at US$ 10.15 billion in 2024 and is projected to reach roughly US$ 16.71 billion by 2032, registering a 6.85% CAGR over the 2025-2032 forecast window. SAC Insight's deep market analysis shows momentum coming from mobile-first investing, AI-powered decision tools, and a surge of self-directed retail traders entering equity, crypto, and derivative markets.

SAC Insight industry insights also highlight the U.S. as a growth anchor: the country is on track to top over US$ 6 billion by 2032, supported by a resilient financial infrastructure and a clear regulatory roadmap. This figure reflects 36.6% of the anticipated global market value of US$ 16.71 billion in 2032.

Summary of Market Trends & Drivers

• Friction-free mobile apps and zero-commission models are broadening access for younger, tech-savvy investors.

• Advanced analytics, robo-advisory engines, and generative-AI chat assistants are shifting platforms from execution hubs to holistic investing ecosystems.

• Cloud-native architectures are cutting latency and scaling capacity during peak volatility, keeping user experience stable even when trading volumes spike.

Key Market Players

Global competition revolves around feature depth, cost efficiency, and brand trust. Established brokers such as Interactive Brokers, Charles Schwab (including the TD Ameritrade heritage platform), and Saxo Bank leverage deep liquidity pools and multi-asset coverage to retain high-net-worth and institutional clients. Meanwhile, challenger brands like Robinhood, eToro, and Plus500 focus on intuitive UX, social-trading communities, and aggressive marketing to grow retail market share. MetaQuotes Software, IG Group, and CMC Markets differentiate through white-label technology, advanced charting, and professional-grade analytics that appeal to both brokers and active traders.

Key Takeaways

• The global online trading platform market value (2024): US$ 10.15 billion

• Projected value (2032): US$ 16.71 billion at a 6.85% CAGR

• North America holds the largest regional market share at roughly 36.6%.

• Platform solutions generated about 66% of 2024 revenue, reflecting heavy reinvestment in UX and AI tooling. However, the platform segment growth or potential changes in share by 2032 remain an area for further exploration.

• Commission-driven pricing remains dominant, but transaction-fee models are gaining traction as trading volumes rise. Specific growth projections for transaction fees through to 2032 could strengthen this insight.

• Cloud deployment is the default choice for scalability, yet on-premise installations persist among high-frequency desks seeking ultra-low latency.

Market Dynamics

Drivers

• Persistent retail engagement, amplified by social media communities and real-time education content.

• Wider 5G and fiber penetration enabling always-on trading and rich data streams.

• Ongoing innovation in AI, machine learning, and natural-language interfaces that simplify complex strategies.

Restraints

• Escalating cyber-security threats increase compliance costs and can deter risk-averse users.

• Varying global regulations on crypto and leverage products create fragmentation and limit cross-border offerings.

Opportunities

• White-label platforms for regional banks and fintechs looking to launch branded trading apps quickly.

• Expansion into emerging markets where smartphone adoption outpaces traditional brokerage penetration.

• Integrating environmental, social, and governance (ESG) analytics to capture values-driven investors.

Challenges

• Intense price competition compresses spreads and fee income, pressuring profitability.

• Regulatory scrutiny on payment-for-order-flow and gamification features may force business-model pivots.

• Need for continuous investment in scalable cloud infrastructure to manage volatility-driven traffic surges.

Regional Analysis

North America dominates thanks to sophisticated exchanges, high investor awareness, and a supportive regulatory framework. Europe follows, fueled by cross-border passporting and appetite for multi-asset diversification. Asia-Pacific is the fastest-growing region as mobile savings apps convert first-time traders into active investors, particularly in India and Southeast Asia.

• North America – Mature market, 36.6% share, leadership in platform innovation and regulatory clarity.

• Europe – Rising demand for global asset access, strong growth in contract-for-difference (CFD) trading hubs.

• Asia-Pacific – Highest market growth, propelled by smartphone penetration and fintech adoption.

• Latin America – Expanding retail investor base as inflation-hedging drives interest in equities and crypto.

• Middle East & Africa – Gradual uptake via digital-bank partnerships and Sharia-compliant trading products.

Segmentation Analysis

By Component

• Platform – Takes the lion’s share, thanks to end-to-end functionality and continuous feature rollouts.

• Services – Fastest-growing as AI chatbots, advisory add-ons, and API integrations deepen client engagement.

By Type

• Commissions – Largest revenue contributor in 2024; high-value trades from institutions and affluent investors sustain this model.

• Transaction Fees – Rising quickly on the back of soaring retail trade counts and micro-lot investing.

By Deployment

• Cloud – Preferred for elasticity, global reach, and rapid feature deployment. Cloud hosting lets platforms spin up capacity during market shocks without heavy capex.

• On-Premise – Niche but vital for latency-sensitive quantitative houses. Co-located servers at exchange data centers shave microseconds, a decisive edge for high-frequency strategies.

By Interface Type

• Desktop – Remains the workhorse for professional traders needing multi-monitor charting and deep customization. Downloadable terminals support hotkeys, algorithm plugins, and complex order types not always practical on mobile.

• Web-Based – Browser access combines convenience with broad device compatibility. Institutions use it for quick oversight, while casual users appreciate no-install simplicity.

• Mobile App – Fastest-growing channel, mirroring the shift toward anytime trading. Push notifications, biometric login, and social-feed integration have turned smartphones into pocket trading desks.

By End-User

• Institutional Investors – Demand robust APIs, low latency, and cross-asset coverage for portfolio-scale execution. Their need for integrated risk dashboards and custom reporting keeps platform ARPU high.

• Retail Investors – Driving headline user growth through intuitive UX, fractional shares, and educational gamification. Accessible design bridges the knowledge gap, converting followers into active account holders.

• Banking & Financial Institutions – Deploy white-label solutions to retain deposits and diversify fee income. In-app trading keeps customers within the bank’s ecosystem instead of migrating to standalone fintechs.

• Brokers & Others – Adopt modular systems to broaden product ranges and automate back-office processes. API-ready stacks cut integration time and support rapid expansion into new asset classes.

Industry Developments & Instances

• June 2024 – A leading global bank rolled out a multi-asset WorldTrader app spanning 77 exchanges, underscoring the shift toward borderless investing.

• December 2023 – A pan-European broker enabled AI-based strategy automation, letting users create code-free trading bots.

• December 2023 – A prominent fintech launched crypto trading in the EU, pairing zero-commission equities with 25+ digital currencies.

• November 2023 – A U.K. broker unveiled a cloud-native terminal for U.S. options, blending advanced Greeks analytics with real-time volatility surfaces.

• October 2023 – India’s premier commodity exchange migrated to a new web platform, boosting throughput ahead of retail derivatives expansion.

Facts & Figures

• Retail trading apps added an estimated 35 million new accounts worldwide between 2021 and 2024.

• Platform revenues tied to AI-driven premium features are growing at roughly 20% annually.

• Cloud deployments process up to 2 million orders per second during peak U.S. market opens.

• North American users spend an average of 7 hours per week on trading-related mobile apps, up from 4 hours in 2021.

• Institutional trades above USD$ 5 million still account for more than 60% of total commission income.

Analyst Review & Recommendations

Momentum in the online trading platform space is shifting from fee disruption toward feature depth. Providers that balance low-cost access with sophisticated AI, robust cyber defenses, and seamless multi-asset coverage will capture the next wave of market growth. Strengthening cloud resiliency, doubling down on user education, and pre-empting regulatory changes around data privacy and order-flow transparency should top the strategic agenda for both incumbents and challengers through 2032.