Market Overview

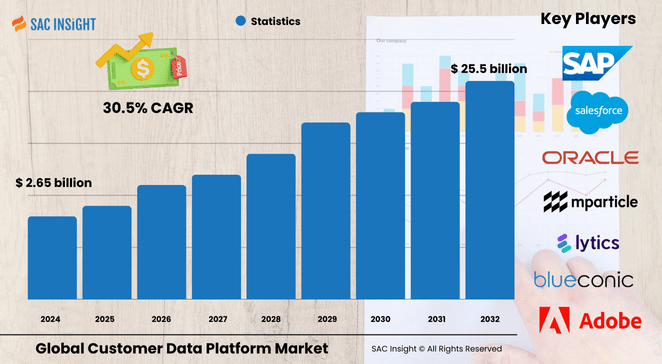

The customer data platform (CDP) market size was roughly US$ 2.65 billion in 2024 and, according to SAC Insight's deep market analysis, is projected to climb to about US$ 25.5 billion by 2032, expanding at a brisk 30.5% CAGR across the 2025-2032 forecast window. First-hand industry insights point to surging demand for unified first-party data, stricter privacy rules that favor in-house data ownership, and rapid adoption of AI-driven personalization.

The U.S. customer data platform (CDP) market alone is set to approach US$ 4.78 billion by 2032, reflecting robust investment from retail, BFSI, and healthcare operators keen to elevate customer experience.

Summary of Market Trends & Drivers

• Brands are shifting budget from third-party cookies to first-party data strategies, accelerating CDP rollouts.

• Cloud-native platforms with built-in machine-learning orchestration now dominate vendor roadmaps, cutting deployment time and boosting ROI on marketing spend.

• Growing digital engagement in emerging economies is pushing vendors to offer modular, pay-as-you-grow subscriptions that fit mid-market budgets.

Key Market Players

Prominent vendors shaping customer data platform market growth include Salesforce, Adobe, Oracle, SAP, Twilio (Segment), Tealium, ActionIQ, and Acquia. These firms compete on data unification accuracy, AI-powered segmentation, and open APIs that plug directly into commerce, adtech, and analytics stacks. Smaller specialists such as BlueConic, Lytics, and mParticle are gaining share by providing lightweight, developer-friendly platforms aimed at fast-growing digital brands.

Key Takeaways

• 2024 global market value: about US$ 2.65 billion

• 2032 forecast value: roughly US$ 25.5 billion at a 30.5% CAGR

• North America captured 38.3% market share in 2023, driven by mature e-commerce ecosystems.

• CDP solutions accounted for 63.3% of 2023 revenue, underscoring the primacy of software over services.

• Retail remains the leading application, while travel and SMEs show the fastest market growth.

• Growing reliance on AI-enhanced identity resolution and real-time decision engines is redefining customer engagement models.

Market Dynamics

Drivers

• Shift to first-party data for privacy compliance and cookie-less marketing.

• AI and machine-learning advances heighten predictive accuracy, lifting conversion rates.

• Explosion of omnichannel interactions fuels need for a single customer view.

Restraints

• Data-privacy regulations add compliance overhead and slow procurement cycles.

• Integration headaches with legacy CRM and marketing clouds can delay time to value.

Opportunities

• Industry-specific CDPs (healthcare, travel, manufacturing) open new revenue streams.

• Partnerships with cloud hyperscalers enable scalable, usage-based pricing attractive to SMEs.

Challenges

• Talent shortages in data engineering make in-house implementations resource-intensive.

• Vendor landscape is fragmenting, complicating buyer evaluations and raising switching costs.

Regional Analysis

North America leads global demand thanks to early adopter marketing teams, well-funded martech budgets, and strict enforcement of consumer-privacy rules that elevate first-party data collection. Europe follows closely; GDPR compliance pushes enterprises to platforms with strong consent-management features. Asia-Pacific is the fastest-growing territory, buoyed by high smartphone penetration, rapid e-commerce expansion, and rising disposable incomes.

• North America – early adoption, 38.3% share in 2023, strong cloud uptake

• Europe – GDPR-driven platform upgrades and competitive retail digitisation

• Asia-Pacific – double-digit market growth sparked by mobile-first consumers

• Latin America – expanding fintech sector boosts data-driven engagement

• Middle East & Africa – gradual adoption in telecom and government digital services

Segmentation Analysis

By Component

• Solutions – Core revenue engine

Solutions deliver real-time identity resolution, segmentation, and activation, making them indispensable for marketing teams seeking a unified profile across channels.

• Services – Fastest-growing adjunct

Integration, training, and managed-service packages complement software deployments, especially for firms with lean IT resources.

By Enterprise Size

• Large Enterprises – Early adopters, deep data lakes

Large organisations leverage CDPs to personalise at scale and ensure regulatory compliance across multiple business units.

• Small & Medium-Sized Enterprises – Rapid traction

SMEs embrace cloud-based CDPs that bundle data ingestion, analytics, and visual dashboards without heavy CapEx, leveling the playing field against bigger rivals.

By Deployment

• Cloud – Preferred model

Elastic infrastructure, automatic upgrades, and native AI services position cloud CDPs as the default choice for agile marketing.

• On-Premises – Niche but resilient

Verticals handling highly sensitive data or with strict sovereignty rules opt for on-prem deployments to maintain full control over information assets.

By Type

• Analytics – Largest share

Predictive scoring, cohort analysis, and journey mapping help marketers fine-tune offers and optimise spend, anchoring CDP value propositions.

• Access – Fastest CAGR

APIs that expose unified profiles to downstream apps enable real-time personalisation at every touchpoint, driving adoption across product teams.

• Campaign – Steady demand

Built-in orchestration tools simplify multichannel campaign execution for brands seeking an all-in-one stack.

By End Use

• Retail & E-commerce – Biggest spender

CDPs power personalised recommendations, loyalty programmes, and omnichannel inventory visibility, directly lifting average order value.

• BFSI – Intensifying focus on privacy-safe personalisation

Banks and insurers employ CDPs to reconcile siloed transactional data, improve fraud detection, and surface timely cross-sell offers.

• TMT (Technology, Media & Telecom) – Content targeting at scale

Publishers and telcos rely on unified profiles to serve relevant content and curb churn in subscription models.

• Travel & Hospitality – Fastest-growing adopter

Real-time journey data helps airlines and hotels tailor dynamic offers, boosting ancillary revenue streams.

• Healthcare – Compliance-driven deployment

HIPAA-aligned CDPs empower providers and payers to tailor outreach while protecting patient data.

• Discrete Manufacturing & Others – Emerging users

Industrial brands tap CDPs to synchronise dealer data, streamline parts marketing, and improve after-sales service experiences.

Industry Developments & Instances

• July 2024 – A leading vendor signed a multi-year collaboration with a major cloud provider to accelerate AI-powered CDP solutions for regulated industries.

• March 2023 – A top digital-experience vendor rolled out enhanced real-time CDP features that serve 600 billion predictive insights annually.

• February 2023 – A CDP specialist partnered with a hyperscaler to offer joint go-to-market bundles targeting omnichannel retailers.

• December 2022 – A telecom giant invested in a regional CDP start-up to build the country’s largest first-party data hub.

Facts & Figures

• CDP solutions captured 63.3% of total revenue in 2023.

• Retail accounted for the largest application share in 2023, with travel registering the fastest CAGR through 2032.

• North America held 38.3% market share in 2023.

• Average global CAGR across 2025-2032 is 30.5%.

• The U.S. market is expected to reach about US$ 4.78 billion by 2032.

Analyst Review & Recommendations

The CDP landscape is moving from martech luxury to operational necessity. Vendors that combine rock-solid identity resolution with embedded AI and open integration layers will outpace rivals. Buyers should prioritise platforms offering transparent consent management, low-code connectors, and clear upgrade paths from analytics to activation. Given sustained 30%-plus market growth, early adopters stand to lock in competitive advantage as privacy rules tighten and third-party data options dwindle.