Market Overview

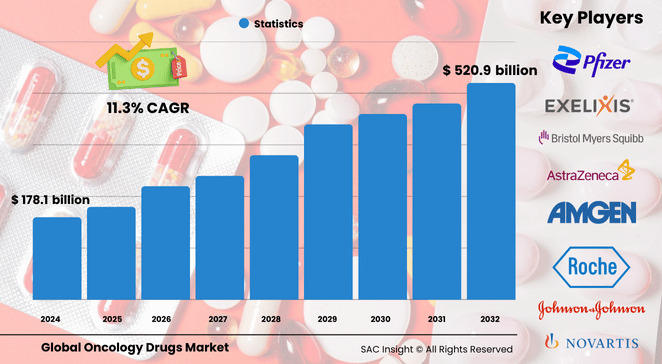

The global oncology drugs market size was valued at US$ 178.11 billion in 2024 and is projected to reach US$ 520.93 billion by 2032, expanding at an 11.355% CAGR over the 2025-2032 forecast period. Robust market growth is fueled by rising cancer incidence, a strong pipeline of precision therapies, and faster regulatory approvals that translate laboratory breakthroughs into commercial products. First-hand industry insights confirm a decisive shift toward targeted and immune-based regimens, while SAC Insight's deep market evaluation shows steady recovery from pandemic-related slowdowns in clinical trials.

The U.S. oncology drugs market is on track to top roughly US$ 206.62 billion by 2032, supported by high treatment penetration and sustained payer coverage.

Summary of Market Trends & Drivers

• Targeted and immune-checkpoint agents continue to outpace traditional cytotoxics, reflecting the push toward personalized medicine and better quality-of-life outcomes.

• Rapid uptake of biosimilars is widening patient access and creating price pressure, yet overall spending remains buoyant thanks to high-value biologics and combination protocols.

• Digital pathology, AI-driven trial matching, and real-world evidence programs are accelerating drug development timelines and sharpening market analysis for new indications.

Key Market Players

Global oncology drugs market share is concentrated among a dozen innovators with broad portfolios and aggressive development budgets. F. Hoffmann-La Roche, AbbVie, Novartis, Pfizer, Bristol Myers Squibb, AstraZeneca, Eli Lilly, Merck & Co., Sanofi, Bayer, and GlaxoSmithKline anchor the competitive landscape. These firms leverage scale, data assets, and strategic acquisitions to secure priority review vouchers, fast-track designations, and front-of-class launches. Meanwhile, new entrants specializing in cell and gene therapies are carving out high-growth niches by partnering with larger incumbents to reach global distribution.

Key Takeaways

• Market value (2024): USD$ 178.11 billion

• Projected value (2032): USD$ 520.93 billion at an 11.355% CAGR

• North America commands roughly 45.46% of 2024 market share, with the U.S. alone worth US$ 70.66 billion.

• Targeted therapy holds around 50% of global revenue, the largest product class in 2024.

• Injectable biologics dominate dosage form preferences as manufacturers prioritize high-potency monoclonal antibodies and antibody-drug conjugates.

• Online pharmacies are the fastest-growing channel, driven by patient demand for home delivery and chronic-care convenience.

Market Dynamics

Drivers

• Rising global cancer prevalence and earlier screening, which expand the treatable patient pool.

• Strong R&D investment in precision oncology, supported by breakthrough designations and orphan-drug incentives.

• Wider reimbursement for innovative therapies, especially in North America and Western Europe.

Restraints

• High therapy costs and uneven insurance coverage in emerging economies.

• Adverse effects such as bone-marrow suppression and neuropathy that can limit adherence.

• Patent expiries and biosimilar erosion that pressure branded revenues.

Opportunities

• Cell-based and in-situ CAR-T platforms promise durable responses in hematologic and solid tumors.

• Growth of real-world data networks enables post-market surveillance and label expansion.

• Digital companion tools—dose trackers, symptom apps—can boost patient engagement and differentiate brands.

Challenges

• Intensifying competition in crowded indications such as breast and lung cancer.

• Regulatory complexity as agencies tighten evidence requirements for long-term safety and value.

• Supply-chain vulnerabilities for complex biologics and specialty APIs.

Regional Analysis

The North America leads the market thanks to high diagnosis rates, early adoption of cutting-edge therapies, and substantial healthcare spending. Europe follows, propelled by universal coverage and large oncology cohorts. Asia-Pacific is the fastest-growing region, where expanding healthcare infrastructure and rising incomes are translating into higher drug uptake.

• North America – Largest market; strong payer support and frequent product launches.

• Europe – Second in market share; centralized assessments drive rapid guideline inclusion.

• Asia-Pacific – Double-digit growth as China and India scale up oncology centers.

• Latin America – Steady gains from public tender programs and biosimilar entry.

• Middle East & Africa – Modest growth constrained by affordability but improving with multinational partnerships.

Segmentation Analysis

By Drug Class

• Targeted Drugs – About 50% market share, dominant segment

Targeted agents home in on molecular drivers of cancer, delivering higher efficacy with fewer off-target effects. Their success has spurred heavy investment in next-generation kinase inhibitors and PARP modulators.

• Cytotoxic Drugs – Declining yet essential

Traditional chemotherapies remain integral for combination regimens and low-resource settings, though growth lags as newer options emerge.

• Hormonal Drugs – Core pillar in hormone-receptive cancers

Endocrine therapies continue to anchor breast and prostate cancer protocols, often used in long-term maintenance.

• Others – Including supportive care and radionuclide conjugates

Niche agents address specific genetic aberrations and rare tumors, offering high value in tailored treatment pathways.

By Therapy

• Targeted Therapy – Leading share and broad label expansion

Clinicians favor targeted therapy for its precision and manageable toxicity profiles, particularly in metastatic settings.

• Immunotherapy – Fastest-growing, transformational outcomes

Checkpoint inhibitors and novel bispecifics harness the immune system, driving durable remissions and premium pricing.

• Chemotherapy – Foundational backbone

Despite side-effects, cytotoxics remain indispensable for tumor debulking and multimodal strategies, especially where biomarkers are absent.

By Indication

• Lung Cancer – Largest revenue contributor

High incidence and multiple actionable mutations sustain demand for successive lines of therapy.

• Breast Cancer – Rapidly rising prevalence

Adoption of CDK4/6 inhibitors and antibody-drug conjugates is widening treatment windows and boosting segment growth.

• Colorectal, Prostate, Stomach, Others – Significant cumulative volume

Evolving biomarker testing and real-world evidence support label expansions across these cancers.

By Dosage Form

• Injectable – Preferred for biologics and high-dose regimens

Single-use prefilled syringes and on-body devices improve adherence and reduce clinic time.

• Solid – Oral tablets and capsules

Convenience drives stable uptake, especially in maintenance therapy for chronic cancers.

• Liquid – Limited share

Used mainly for pediatric formulations and dose-flexible settings.

By Distribution Channel

• Hospital Pharmacies – Primary dispensing hub

Complex infusion protocols and reimbursement processing anchor hospital dominance.

• Retail Pharmacies – Growing for oral agents

Expanded specialty pharmacy programs facilitate chronic prescription fulfillment.

• Online Pharmacies – Highest CAGR

Tele-oncology and home delivery models accelerate digital channels, especially in urban Asia.

Industry Developments & Instances

• February 2025: AbbVie acquired ImmunoGen, deepening its antibody-drug conjugate franchise.

• February 2025: Novartis purchased MorphoSys to strengthen late-stage oncology pipeline assets.

• January 2025: AbbVie and Umoja Biopharma partnered to advance in-situ CAR-T technologies.

• December 2024: AstraZeneca acquired Gracell to scale cell-therapy capabilities.

• June 2024: Genentech secured U.S. approval for Columvi in diffuse large B-cell lymphoma.

• May 2024: AbbVie gained FDA clearance for EPKINLY in relapsed/refractory DLBCL.

• March 2024: Pfizer moved to acquire Seagen, expanding its oncology biologics portfolio.

• December 2023: FDA approved Lunsumio, a bispecific antibody, for follicular lymphoma.

Facts & Figures

• Targeted therapy accounted for roughly one in two oncology prescriptions worldwide in 2024.

• North America captured 45.46% global market share last year, underscoring its role as revenue anchor.

• About 20 million new cancer cases were diagnosed globally in 2023; projections show 35 million by 2050.

• Immune-based agents formed 48% of FDA oncology approvals in 2024, up from 41% in 2021.

• Average R&D spend among the top ten manufacturers exceeded 25% of oncology revenue in 2025.

• Injectable biologics generated more than 60% of total oncology sales in 2024.

• Biosimilars trimmed frontline therapy costs by up to 30% in Europe, driving higher treatment penetration.

Analyst Review & Recommendations

Market growth remains robust as precision oncology and immune modulation redefine the standard of care. Companies that pair high-impact therapeutics with companion diagnostics, evidence-rich real-world data, and digital adherence tools will outpace peers. For new entrants, niche genetic targets and adaptive trial designs offer a swift route to differentiation. Established players should continue to diversify pipelines through selective acquisitions and strengthen manufacturing resilience to mitigate biosimilar competition. Overall, the oncology drugs market is set for sustained expansion as breakthrough science translates into broader patient benefit.