Market Overview

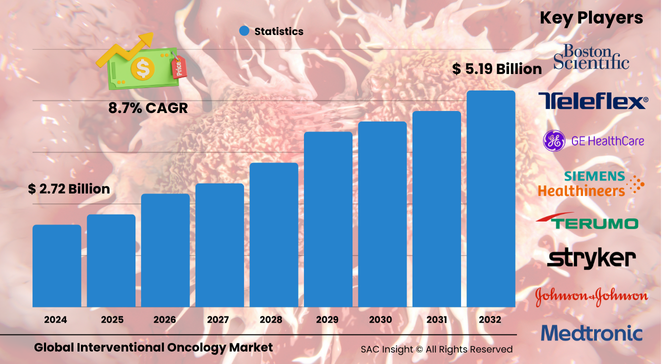

The global interventional oncology market size sits at about US$ 2.72 billion in 2024 and, on current trajectories, is forecast to almost double to roughly US$ 5.19 billion by 2032. That marks an average 8.78% CAGR over the 2025-2032 forecast window. First-hand industry insights point to three clear growth engines: rising cancer prevalence, steady migration toward minimally invasive care, and a pipeline of image-guided devices that shorten recovery times.

SAC Insight analysis suggests the U.S. interventional oncology market alone could pass US$ 2 billion by 2032 as hospitals expand image-guided suites and payers reward outpatient procedures.

Summary of Market Trends & Drivers

• Procedure volumes are shifting from open surgery to catheter-based ablation and embolization, trimming length-of-stay and total cost of care.

• Artificial-intelligence planning tools and drug-eluting consumables are improving targeting accuracy and patient outcomes, accelerating market growth.

• Capital investment is flowing into dedicated interventional oncology programs, particularly for liver and lung indications where systemic options are limited.

Key Market Players

Global leadership rests with a mix of diversified med-tech groups and focused device specialists. Companies such as Medtronic, Boston Scientific, Johnson & Johnson (Ethicon), Siemens Healthineers, Terumo, Cook Medical, and Stryker collectively command the largest market share through portfolios spanning ablation probes, embolic microspheres, and advanced imaging platforms.

Competitive dynamics increasingly revolve around technology refresh and therapy ecosystem deals. Large players are pairing hardware with software-guided workstations and, in several cases, acquiring AI or ambient-intelligence firms to create closed-loop, data-rich treatment pathways that strengthen switching costs for hospitals.

Key Takeaways

• Current global market size (2024): US$ 2.72 billion

• Projected global market size (2032): US$ 5.19 billion at an 8.78% CAGR

• North America holds the largest regional market share, near 42% of revenue

• Ablation therapies account for the single biggest technique segment with about 37% market share

• Hospitals capture over half of all procedure revenue, but specialty clinics are showing the fastest percentage gains

• AI-enabled planning and dual-modality imaging are the top technology trends shaping future adoption

Market Dynamics

Drivers

• Expanding cancer patient pool and earlier detection are pushing demand for localized, organ-sparing treatments.

• Continuous innovation in catheter design, energy delivery, and imaging guidance lifts efficacy and reduces complications.

Restraints

• High upfront device costs and the need for hybrid operating suites can slow adoption in budget-constrained centers.

• Shortage of skilled interventional radiologists in emerging economies limits procedure availability.

Opportunities

• Emerging economies are upgrading oncology infrastructure, opening new revenue streams for mid-tier device lines.

• Integration of immunotherapy with locoregional ablation offers a pathway to combination protocols.

Challenges

• Reimbursement disparities between inpatient and outpatient settings create planning uncertainty.

• Demonstrating long-term survival advantage over systemic therapies remains essential for wider payer acceptance.

Regional Analysis

The North America interventional oncology market dominates current market growth thanks to broad insurance coverage, high procedure awareness, and a dense network of cancer centers. Europe follows, supported by national screening programs and rigorous adoption of minimally invasive standards. Asia-Pacific shows the fastest percentage gains as large urban hospitals adopt image-guided oncology suites and government initiatives expand cancer care access.

• North America – Largest revenue base; strong clinical evidence and payer support.

• Europe – Solid share; aging population and technology grants drive upgrades.

• Asia-Pacific – Fastest-growing; high cancer incidence and rising healthcare spend.

• Latin America – Gradual uptake; private-sector hospital chains lead demand.

• Middle East & Africa – Early stage; flagship centers in Gulf states spearhead adoption.

Segmentation Analysis

By Technique

• Ablation Therapies – Workhorse modality.

Precise energy delivery through radiofrequency, microwave, cryo, or irreversible electroporation allows outpatient tumor destruction with minimal collateral damage, keeping ablation in the lead for small-to-midsize lesions.

• Embolization Therapies – Targeted ischemia, accelerating uptake.

Transarterial chemoembolization and radioembolization cut off blood supply while delivering drug or isotope payloads, gaining traction for liver-dominant disease where surgery is untenable.

By Procedure

• Vascular Interventions – Largest revenue slice.

Techniques such as TACE and TARE benefit from refinements in cone-beam CT guidance and drug-eluting beads, supporting precise, repeatable treatments for hepatocellular carcinoma.

• Tumor Ablation – Fastest CAGR.

Microwave and cryo platforms now treat lung, kidney, and bone metastases, aided by thermometry and robotic navigation that improve consistency and safety.

By Application

• Liver Cancer – Core demand engine.

Roughly one-quarter of all interventional oncology revenue stems from hepatocellular carcinoma, underpinned by high prevalence in viral-hepatitis and NASH populations.

• Lung Cancer – Rapid expansion.

Percutaneous microwave ablation offers a lifeline for non-surgical candidates, with growing clinical data supporting local control in early-stage tumors.

By End-use

• Hospitals – Primary setting.

Comprehensive imaging suites and multidisciplinary tumor boards keep hospitals central to complex case management and high-volume delivery.

• Specialty Clinics – Rising share.

Outpatient centers leverage shorter recovery times and favorable reimbursement to attract patients seeking same-day care.

Industry Developments & Instances

• December 2024 – AngioDynamics secured FDA clearance for its NanoKnife system in prostate applications, extending non-thermal ablation indications.

• September 2024 – Stryker acquired an AI workflow firm to embed ambient-intelligence into interventional oncology suites.

• February 2024 – Profound Medical partnered with Siemens Healthineers to integrate MRI-guided ultrasound ablation with next-gen scanners.

• November 2023 – Terumo introduced Occlusafe embolization catheters and LifePearl drug-eluting beads in India, expanding emerging-market reach.

• August 2022 – Boston Scientific bolstered its embolization portfolio through the takeover of a hydrogel microsphere specialist.

Facts & Figures

• Hospitals command roughly 55 % of global revenue, but specialty clinics are growing above 9 % annually.

• Ablation therapies held about 37 % market share in 2024.

• North America generated close to USD$ 1.14 billion in 2024 interventional oncology sales.

• Average length of stay after ablation is under 24 hours, compared with three to five days for open surgery.

• More than 70 % of new ablation systems shipped in 2024 featured real-time temperature monitoring.

Analyst Review & Recommendations

Market growth over the next decade hinges on marrying precision devices with data-guided workflows. Vendors that bundle ablation or embolization hardware with AI planning, intra-op imaging, and post-procedure analytics will capture outsize share. For providers, investing early in cross-trained interventional teams and outpatient-friendly equipment can unlock higher throughput and payer incentives. Long term, combination regimens that pair locoregional therapies with systemic immuno-oncology agents are poised to redefine standard of care and expand addressable market size.