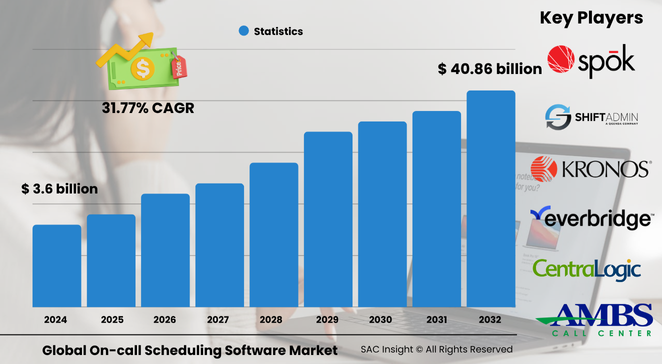

Market Overview

The global on-call scheduling software market size stood at roughly US$ 3.6 billion in 2024 and is projected to soar to around US$ 40.86 billion by 2032, advancing at an average 31.77% CAGR. First-hand industry insights highlight three powerful growth engines: the shift toward real-time workforce coordination, the spread of hybrid work models that demand 24 / 7 coverage, and rising healthcare automation that reduces manual roster errors. SAC Insight's deep market evaluation shows the United States on-call scheduling software market alone could approach nearly US$ 12 billion by 2032 as hospitals, contact centers, and tech teams tighten response times and regulatory compliance.

Summary of Market Trends & Drivers

• Cloud-native platforms with AI-driven staffing recommendations and mobile push alerts are becoming the de-facto standard, shrinking schedule build times from hours to minutes.

• Pandemic-era pressures cemented the value of automated escalation paths and analytics, reinforcing long-term demand across medical, IT service management, and emergency response.

• Budget-conscious mid-market firms are embracing subscription pricing that bundles scheduling, communications, and compliance reporting into a single pane of glass.

Key Market Players

Well-established vendors and agile specialists shape competitive dynamics. Enterprise-focused providers deliver end-to-end workflow orchestration that plugs into HR, EHR, and incident-management stacks, while niche challengers differentiate through low-code configurability and industry-specific rule engines. Continuous product updates—such as hands-free alerting, voice-assistant integration, and predictive load balancing—keep switching costs high and customer loyalty sticky.

Across segments, leading companies concentrate on strategic alliances with communication-platform-as-a-service (CPaaS) firms and clinical collaboration tools to ensure messages hit the right device at the right moment. Rapid feature rollouts, white-glove onboarding, and outcome-based pricing round out their playbooks.

Key Takeaways

• Current global on-call scheduling software market size (2024): USD$ 3.6 billion

• Projected global market size (2032): USD$ 40.86 billion at a 31.77 % CAGR

• Solutions account for more than two-thirds of revenue due to accelerating SaaS adoption

• Medical settings capture nearly half of market share thanks to regulatory urgency and 24 / 7 clinical demands

• Cloud-based deployments are the fastest-growing slice as multi-location enterprises favor zero-maintenance rollouts

• AI-powered forecasting, mobile-first interfaces, and seamless EHR / ITSM integrations are the pivotal market trends defining competitive edge

Market Dynamics

Drivers

• Mandatory response-time SLAs and rising labor-cost pressure push organizations toward automated shift planning and escalation.

• Hybrid work and geographically dispersed teams heighten the need for visibility into staff availability, fueling market growth.

• Healthcare digital transformation drives hospitals to replace spreadsheet-based rotas with interoperable, audit-ready scheduling suites.

Restraints

• Data-privacy concerns and rigid on-premise IT policies can slow cloud migration in highly regulated sectors.

• Integration complexity with legacy HR and paging systems raises deployment timelines for large enterprises.

Opportunities

• Embedding generative AI to suggest optimal hand-offs and reduce alert fatigue opens premium upsell avenues.

• Untapped small-and-medium enterprises in emerging markets seek low-cost, mobile-only tools, providing white-space expansion potential.

Challenges

• Shortage of implementation specialists familiar with healthcare and mission-critical workflows can delay go-lives.

• Price-sensitive buyers may hesitate amid economic uncertainty, pressuring vendors to prove rapid ROI.

Regional Analysis

North America leads the market, driven by advanced IT infrastructure, stringent compliance regimes, and high labor costs that reward automation. Asia-Pacific registers the quickest percentage gains as hospitals and service desks digitize workflows to counter skilled-staff shortages and cost constraints.

• North America – Largest revenue base, strong focus on uptime and SLA compliance

• Europe – Accelerating adoption tied to workforce-mobility rules and data-protection mandates

• Asia-Pacific – Fastest CAGR thanks to cloud readiness among SMEs and expanding private healthcare

• Latin America – Growing call-center outsourcing and public-health digitization stimulate demand

• Middle East & Africa – Early-stage uptake as multi-site hospitals and utilities modernize duty rosters

Segmentation Analysis

By Component

• Solutions – Revenue cornerstone, commanding the dominant share.

Solutions bundle rules-based scheduling, multi-channel notifications, and real-time analytics, eliminating spreadsheet chaos and cutting administrative workload by double-digit percentages.

• Services – High-growth support layer.

Implementation, managed escalation, and 24 / 7 customer success teams help organizations tailor workflows, ensuring rapid time-to-value and strong user adoption.

By Deployment

• On-premise – Favored by security-sensitive institutions.

Local hosting grants full data control and deep customization, sustaining steady demand among government agencies and large hospitals with strict IT policies.

• Cloud-based – Fastest-rising choice.

Scalable pay-as-you-go models let multi-location firms roll out updates without downtime. Built-in disaster recovery and API-level integrations make cloud deployments the go-to option for agile teams.

By Application

• Medical – Core demand engine.

Automated on-call rotas reduce clinician burnout, streamline hand-offs, and align with patient-safety standards. Mobile dashboards give physicians instant roster visibility and cut paging delays.

• Business – Rapid adoption curve.

IT operations, DevOps, and customer-support teams deploy scheduling platforms to meet always-on service commitments and curb costly overtime.

• Others – Niche but expanding.

Utilities, public safety, and facilities management adopt the software to maintain round-the-clock coverage and coordinate emergency response efficiently.

Industry Developments & Instances

• June 2024 – A leading observability provider embedded native on-call schedules into its incident-management suite, unifying alerting with performance metrics.

• February 2024 – A top healthcare workforce vendor earned industry accolades for nurse and staff scheduling excellence, underscoring the criticality of on-call automation in hospitals.

• August 2023 – A major US health system rolled out integrated physician and nurse rostering across 23 hospitals, linking duty schedules to payroll and credentialing systems.

• 2023 – Cloud hyperscale platforms introduced turnkey schedule-rotation services, lowering entry barriers for small DevOps teams.

Facts & Figures

• Optimized on-call rotas can lift staff productivity by 10 - 15 % while cutting labor costs up to 12 %.

• Nearly one-third of hospitals now route critical test results through integrated on-call alerts, reducing average response time by over 50 %.

• Mobile responsiveness eclipses 90 % within five minutes when push alerts replace voice paging.

• Cloud deployments account for more than 60 % of new contracts signed in 2024 versus under 40 % three years earlier.

• AI-assisted scheduling is expected to cover roughly 25 % of all on-call shifts by 2028, up from less than 5 % today.

Analyst Review & Recommendations

Market analysis confirms a decisive pivot from manual spreadsheets to intelligent, interoperable scheduling ecosystems. Vendors that fuse AI-powered forecasting, low-code workflow design, and seamless communications will outrun average market growth. Buyers should prioritize platforms offering open APIs, in-app analytics, and proven migration paths to protect future flexibility and demonstrate quick ROI.