Market Overview

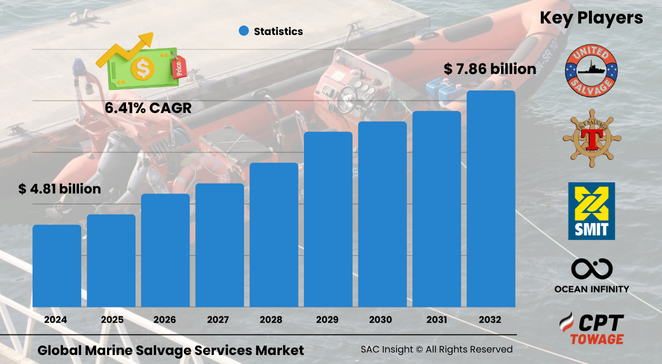

The global marine salvage services market size was valued at roughly US$ 4.812 billion in 2024 and is on track to climb to about US$ 7.866 billion by 2032, reflecting a steady 6.41% CAGR over the 2025-2032 forecast window. SAC Insight's first-hand industry insights point to three structural growth engines: busier global shipping lanes, stricter environmental rules that mandate rapid wreck clearance and spill containment, and faster adoption of advanced underwater robotics that compress salvage timelines.

SAC Insight's deep market evaluation shows the United States marine salvage services market could advance from just under US$ 1.5 billion in 2024 to nearly US$ 2.3 billion by 2032 as insurers, port authorities, and private owners step up preparedness for weather-related incidents.

Summary of Market Trends & Drivers

• Autonomous inspection drones, AI-based risk modelling, and modular lifting systems are shortening project lead times and widening margins.

• Heightened focus on circular economy principles is fueling demand for “green” wreck recycling and fuel-recovery services, underpinning long-term market growth.

Key Market Players

The competitive landscape blends seasoned heavy-lift specialists with agile technology disruptors. Firms such as Donjon Marine, SMIT Salvage, Boluda Towage, T&T Salvage, and Ocean Infinity dominate high-value projects through global fleets, ready-response contracts, and purpose-built heavy-lift assets. Meanwhile, regional players like CPT Towage and Fratelli Neri leverage local port knowledge and cost-effective crews to win short-haul jobs and supplementary pollution-control work.

Strategically, leaders are investing in hybrid ROV-diver teams, AI-driven situational mapping, and joint ventures with insurers to guarantee 24/7 coverage of major chokepoints such as the Strait of Gibraltar, the Malacca Strait, and the U.S. Gulf Coast.

Key Takeaways

• Current global market size (2024): around USD$ 4.812 billion

• Projected global market size (2032): about USD$ 7.866 billion at a 6.41 % CAGR

• Wreck removal commands the largest market share—roughly 40 % of 2024 revenue—thanks to tougher safety and navigation rules

• Emergency response is the fastest-growing service line as port authorities tighten time-to-containment targets for oil and chemical leaks

• Private ship owners account for more than 35 % of total demand, yet insurers represent the quickest-expanding client group

• North America leads technological adoption, while Asia Pacific tops absolute salvage volume on the back of expanding regional trade hubs

Market Dynamics

Drivers

• Rising shipping volumes and aging fleets heighten incident frequency and complexity

• Environmental regulations boost demand for rapid spill containment and hull de-pollution

• Advanced ROVs and 3D seabed mapping cut survey costs and improve project feasibility

Restraints

• High capital expenditure for heavy-lift vessels and specialized gear limits new entrants

• Unpredictable weather windows delay projects and inflate standby charges

• Fragmented international liability frameworks can prolong contract negotiations

Opportunities

• Subscription-based rapid-response packages for smaller coastal operators

• Data-driven salvage planning platforms that integrate AIS, weather, and casualty databases

• Growing offshore wind sector needs specialized removal services for decommissioned assets

Challenges

• Talent shortages in deep-water diving and complex rigging slow mobilisation

• Insurance pressure to cap day-rates squeezes margins on multi-month operations

• Increasing seabed congestion raises legal hurdles around heritage wrecks and protected habitats

Regional Analysis

Europe and North America together capture over half of global revenue, driven by dense traffic lanes, mature insurance ecosystems, and stringent environmental oversight. Asia Pacific, however, records the highest absolute project count as China, India, and Southeast Asian economies expand port capacity and coastal industrial zones.

• North America – Strong regulatory enforcement and hurricane-prone coasts sustain premium pricing

• Europe – Strict environmental directives and advanced tech adoption support steady market growth

• Asia Pacific – Fastest incident volume growth; governments invest in domestic salvage fleets

• Latin America – Offshore oil activity in Brazil and Mexico lifts demand for heavy-lift capacity

• Middle East & Africa – Strategic shipping channels and megaproject build-outs drive emergency-response contracts

Segmentation Analysis

By Services

• Wreck Removal – Largest revenue contributor, driven by busy trade corridors.

Sunken hulls obstruct navigation and trigger hefty penalties, making swift clearance a top priority for port authorities and ship owners.

• Emergency Response – Fastest-growing slice as spill-response time limits tighten.

Demand for 24-hour mobilisation teams equipped with booms, skimmers, and firefighting tugs is surging across hurricane- and typhoon-exposed regions.

• Pollution Control – Compliance-led niche moving up the agenda.

Integrated oil-spill mitigation and hazardous-cargo decontamination now feature in most tender specifications, favouring operators with ISO-certified processes.

• General Salvage – Steady, opportunistic work restoring propulsion, patching hull breaches, or refloating grounded vessels.

These jobs keep regional fleets busy during off-peak seasons.

• Cargo Recovery – Small but valuable; pays off when high-value or environmentally sensitive loads sink.

Enhanced sonar and grab systems are expanding recovery rates for containerised goods and project cargo.

By End-User

• Private Ship Owners – Core demand engine.

Fleet operators contract salvage firms to minimise downtime, avoid escalating port fines, and meet charter-party obligations.

• Insurance Companies – Rapidly rising share as underwriters pre-arrange response agreements.

Bundled service contracts reduce claim costs and accelerate settlement timelines.

• Government Agencies – Regulatory enforcer and last-resort payer.

Navies and coastguards fund complex wreck removals that threaten safety or heritage sites.

• Shipping Companies – Integrated liners seek global framework contracts that guarantee response across their trade network.

Combined buying power pushes providers toward multi-year, performance-based agreements.

By Technology

• Remote Operated Vehicles – Backbone of modern deep-water operations.

High-definition cameras and manipulator arms allow precision cutting and rigging at 3 000 m depths.

• Underwater Robotics Swarms – Emerging for rapid survey tasks.

Multiple micro-ROVs map wrecks in hours, informing lift-plan simulations.

• 3D Scanning & Mapping – Standard tool for project scoping and stakeholder briefings.

Digital twins optimise lift points and reduce unplanned downtime.

• Salvage Tugs with Dynamic Positioning – Ensure stable station-keeping during heavy lifts in adverse seas.

Fuel-efficient engines and hybrid powertrains are lowering operating costs.

• Drones – Aerial eyes for real-time situational awareness and crew-safety monitoring.

Thermal imaging identifies hidden fires and volatile cargo hotspots before divers deploy.

Industry Developments & Instances

• February 2024 – Boluda Towage acquired Resolve Salvage & Fire (Gibraltar) to extend coverage across the Strait of Gibraltar and Red Sea gateway.

• October 2023 – Ocean Infinity launched its Armada fleet of uncrewed surface vessels, cutting survey time by up to 40 %.

• June 2023 – Donjon Marine completed the rapid refloat of a grounded bulk carrier in the Saint Lawrence River within eight days, avoiding channel closure fines.

• March 2023 – SMIT Salvage introduced an AI-powered casualty-risk dashboard for underwriters, integrating live AIS and weather feeds.

Facts & Figures

• Wreck removal services captured roughly 40 % of global market revenue in 2024.

• Average mobilisation time for top-tier emergency-response teams has fallen below 12 hours at major transhipment hubs.

• Modern ROV deployment cuts initial survey costs by up to 35 % compared with diver-only methods.

• Insurance-backed salvage retainers now cover nearly 60 % of container ship tonnage worldwide.

• Hybrid-powered salvage tugs can slash fuel consumption by 15-20 % during station-keeping operations.

Analyst Review & Recommendations

Current market analysis underscores a decisive pivot from ad-hoc contracting toward data-driven, pre-arranged response packages. Providers that pair heavy-lift capacity with AI-enabled planning tools and verified environmental credentials will outpace average market growth. Salvage firms should prioritise crew-training partnerships, invest in modular robotics fleets, and pursue multi-region alliances that guarantee rapid coverage of high-risk chokepoints while spreading capital costs.