Market Overview

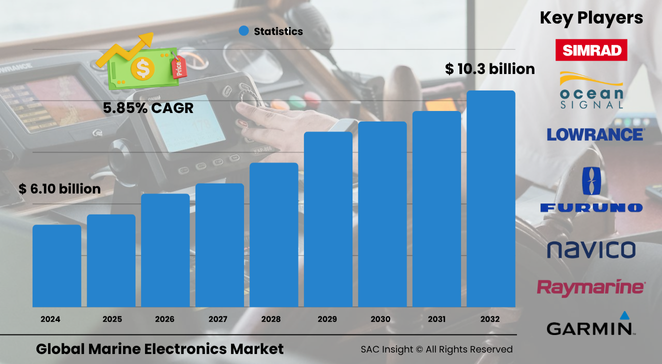

Global market analysis shows the marine electronics market size stood near US$ 6.10 billion in 2023 and is projected to reach roughly US$ 10.03 billion by 2032, expanding at a steady 5.85% CAGR. First-hand industry insights point to accelerating maritime trade, electronics-rich fleet modernisation, and the shift toward autonomous and connected vessels as the core engines of market growth. SAC Insight's deep market evaluation indicates the United States alone could advance from about US$ 2.37 billion in 2024 to around US$ 3.72 billion by 2032 as regulatory focus on safety and sustainability intensifies.

Summary of Market Trends & Drivers

• Smart navigation, satellite-backed communication, and AI-enabled decision support are turning vessels into data hubs, reshaping market trends toward integrated digital bridges.

• Real-time environmental monitoring tools are rising on the back of stricter emissions limits, while recreational boaters demand entertainment and connectivity comparable to shore-based experiences.

Key Market Players

The competitive field blends long-established defence contractors and nimble consumer-electronics leaders. Producers such as Garmin, Furuno Electric, Kongsberg Maritime, Navico Group, Wärtsilä, Thales, and Northrop Grumman command significant market share with broad portfolios spanning radar, sonar, chartplotters, and integrated bridge systems. Alongside, Tokyo Keiki, Teledyne FLIR, L3Harris, Atlas Elektronik, and Japan Radio innovate in thermal imaging, advanced sensors, and cybersecurity-ready communication suites.

Competitive momentum is shifting toward software-centric upgrades, end-to-end data services, and ecosystem partnerships. Recent agreements that bundle navigation, audio, and trolling motors into single-supplier packages illustrate a drive to simplify procurement while locking in multiyear revenue streams.

Key Takeaways

• Current global market size (2023): about USD$ 6.10 billion

• Projected global market size (2032): roughly USD$ 10.03 billion at a 5.85 % CAGR

• Hardware captures the lion’s share today, yet software posts the fastest market growth as analytics and predictive maintenance gain ground

• Merchant vessels account for nearly half of revenue, while recreational boats show the quickest uptake of premium features

• Navigation systems remain the dominant application, but entertainment electronics are the rising niche among leisure craft

• North America leads market share, with Asia-Pacific delivering the highest regional CAGR through 2032

Market Dynamics

Drivers

• Expanding seaborne trade and offshore energy activity demand reliable electronic navigation and vessel-management systems.

• Integration of IoT, AI, and high-bandwidth satellite links enables real-time fleet optimisation and remote diagnostics.

• Defence modernisation programmes fuel spending on advanced sonar, EW, and secure communication gear.

Restraints

• High upfront costs and complex retrofit requirements slow adoption in smaller fleets.

• Cyber-risk concerns necessitate continual software patching and specialised crew training.

• Volatile raw-material prices can inflate costs for precision components and semiconductors.

Opportunities

• Growth in autonomous and semi-autonomous vessels opens new markets for sensor fusion, edge analytics, and remote-command interfaces.

• Rising eco-regulations create demand for emissions-monitoring and energy-efficiency dashboards.

• Expanding leisure-boating culture, particularly in Asia, spurs premium infotainment and smart safety add-ons.

Challenges

• Fragmented regulatory frameworks complicate certification of new electronic systems across jurisdictions.

• Limited satellite bandwidth in polar and remote regions can restrict full-time data streaming.

• Talent shortages in maritime cybersecurity could hamper large-scale digital rollouts.

Regional Analysis

North America commands the biggest market share thanks to deep commercial fleets, strong recreational demand, and an active naval modernisation pipeline. Europe follows with emphasis on eco-friendly electronics, while Asia-Pacific records the fastest market growth tied to expanding shipbuilding hubs and rising disposable incomes among leisure-craft buyers.

• North America – Largest revenue base; stringent safety rules and tech-savvy boaters sustain demand.

• Europe – Focus on sustainable shipping drives uptake of energy-efficient systems.

• Asia-Pacific – Highest CAGR; shipyard expansion and burgeoning yachting communities accelerate sales.

• Latin America – Offshore energy projects and coastal tourism underpin moderate growth.

• Middle East & Africa – Naval procurements and port upgrades stimulate selective high-spec purchases.

Segmentation Analysis

By Component

• Hardware – Core revenue engine.

Radar, GPS, and sonar arrays dominate budgets as operators prioritise situational awareness and collision avoidance. Continuous miniaturisation and power savings keep hardware investment high.

Hardware remains indispensable: even the most advanced software depends on robust antennas, sensors, and processors that can survive salt, shock, and vibration at sea.

• Software – Fastest-growing slice.

Fleet-wide analytics platforms, ECDIS updates, and AI-driven routing software deliver measurable fuel savings and lower downtime.

The jump from stand-alone boxes to cloud-linked dashboards means owners pay for licences and updates that extend equipment life and unlock new features without dry-dock visits.

• Services – Stable, recurring stream.

Installation, calibration, and lifecycle support ensure systems comply with evolving rules and maintain cyber integrity.

As crews shrink, outsourced maintenance contracts and 24/7 remote support centres become essential to keep electronics operational across oceans.

By Vessel Type

• Merchant Vessels – Workhorse segment.

Container ships and tankers rely on integrated bridges, voyage data recorders, and E-navigation aids to meet global trade timetables and regulatory audits.

Compliance-driven retrofits, particularly around GMDSS upgrades and fuel-efficiency monitoring, underpin steady spending.

• Fishing Vessels – Tech-enabled catch.

High-definition sonar and mapping tools boost catch rates while minimising by-catch, making electronics a cost-effective investment for operators facing quota pressures.

Government grants and sustainable-fishing certifications encourage adoption of gear that verifies catch provenance and real-time location.

• Recreational Boats – Lifestyle drivers.

Touch-screen chartplotters, multimedia hubs, and wireless engine data appeal to owners seeking automotive-level convenience on the water.

Rising disposable income and pandemic-era interest in outdoor leisure have sparked record boat sales, translating into brisk aftermarket electronics demand.

• Others – Special-purpose craft.

Tugs, research vessels, and offshore service ships require bespoke packages combining DP systems, specialised sensors, and rugged communication links.

Mission-critical roles push suppliers to tailor solutions for extreme environments and unique operational profiles.

By Application

• Navigation Systems – Largest slice.

GPS, radar, and ECDIS collectively anchor bridge operations, delivering precision routing and regulatory compliance.

Upgrades focus on sensor fusion and augmented-reality overlays that shorten reaction times and cut crew workload.

• Communication Systems – Lifeline at sea.

VSAT, cellular-backhaul, and two-way AIS solutions keep crews connected and enable remote monitoring by shore-side teams.

Bandwidth-hungry applications such as telemedicine and video inspection make high-speed links a strategic necessity.

• Entertainment Systems – Rapid-growth niche.

High-fidelity audio, streaming video, and smart-home-style controls transform the onboard experience for charter guests and private owners.

Expect integration with mobile apps and voice assistants as tech-savvy consumers bring land-based expectations aboard.

• Others – Safety and monitoring.

Fire detection, engine-room sensors, and emissions trackers round out the electronics suite, driven by insurance requirements and environmental targets.

With regulators tightening oversight, these systems shift from optional extras to mandatory installs.

Industry Developments & Instances

• February 2025 – A five-year sole-supplier deal positions a leading manufacturer as the exclusive electronics provider for a consortium representing over a quarter of new US-built boats.

• December 2024 – Major European shipbuilder selected an integrated bridge and energy-monitoring package for its next LNG-powered container series.

• August 2024 – Defence ministry signed a multiyear contract for advanced sonar arrays and combat-system upgrades on coastal patrol vessels.

• May 2024 – Partnership launched a cloud-based service that merges engine data with weather routing, promising up to 8 % fuel savings across bulk-carrier fleets.

Facts & Figures

• Hardware captured roughly 63.9 % market share in 2023.

• Software is forecast to log about 7.4 % CAGR from 2024-2030, outpacing other components.

• Merchant vessels represented nearly 47 % of global revenue in 2023.

• Navigation systems accounted for approximately 43 % of total spend last year.

• North America held close to 36.7 % market share, reflecting robust commercial and leisure fleets.

• Average satellite-communication bandwidth per vessel has doubled since 2020, enabling real-time video diagnostics.

• Thermal-imaging adoption on recreational craft grew more than 20 % year on year, driven by night-boating safety.

Analyst Review & Recommendations

The marine electronics market growth narrative now pivots on digital integration and sustainability. Suppliers that combine rugged hardware with subscription-based analytics and airtight cybersecurity will command premium margins. Owners should prioritise modular, software-upgradable systems that extend asset life and streamline compliance. Looking ahead, autonomous-ready sensors, green-shipping dashboards, and immersive user interfaces will differentiate leaders as the industry steers toward a connected, low-carbon future."