Market Overview

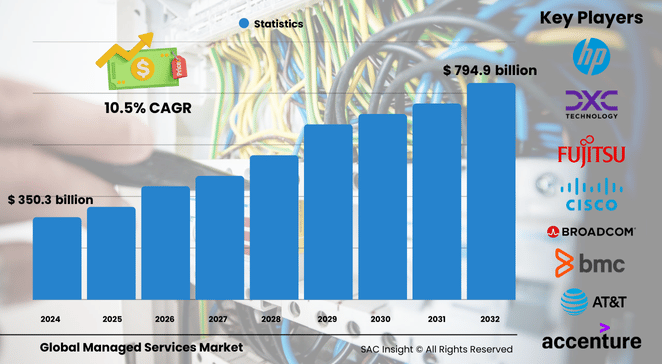

The global managed services market size was valued at US$ 350.35 billion in 2024 and is projected to reach roughly US$ 794.99 billion by 2032, registering a 10.5% CAGR over the 2025-2032 forecast window. First-hand industry insights highlight four structural growth engines: relentless cloud and hybrid-infrastructure adoption, rising cyber-threat complexity, pressure to trim IT operating costs, and growing demand for 24/7 expert support.

SAC Insight's deep market evaluation shows North America continues to hold the largest market share, while Asia Pacific is setting the pace for market growth. The U.S. managed services market alone is expected to surpass US$ 250 billion by 2032 as enterprises double down on multi-cloud optimization and managed security services.

Summary of Market Trends & Drivers

• Enterprises are moving mission-critical workloads to multi-cloud and hybrid architectures, driving steady demand for managed cloud, data-center, and network services.

• The spike in ransomware and regulatory scrutiny is accelerating adoption of managed security offerings that bundle real-time threat detection, incident response, and compliance reporting.

• Automation, AI, and predictive analytics are woven into next-generation service contracts, improving uptime and freeing internal teams to focus on core innovation.

Key Market Players

Global incumbents such as Accenture, IBM, Cisco, Fujitsu, HCL Technologies, and Hewlett Packard Enterprise shape competitive dynamics with broad solution portfolios and deep vertical expertise. A second tier—including Aryaka Networks, Atera, Rackspace Technology, DXC Technology, and NTT DATA—differentiates through software-defined networking, secure access service edge (SASE) platforms, and subscription-based cloud operations. Aggressive partnerships and selective M&A remain central levers as providers race to bundle networking, security, and unified communications into single-pane-of-glass offerings.

Key Takeaways

• Market value 2024: USD$ 350.35 billion

• Projected value 2032: USD$ 794.99 billion at a 10.5% CAGR

• North America commands about one-third of global revenue; Asia Pacific posts the fastest gains

• Managed data-center services hold the largest solution slice (16% share), while managed security services record the quickest climb

• Business-process outsourcing captures roughly 40% of managed information service revenue

• Large enterprises generate over 60% of spending today, yet SME demand is accelerating on the back of flexible, pay-as-you-grow contracts

Market Dynamics

Drivers

• Ongoing digital transformation pushes companies to outsource complex IT stacks for agility and cost predictability

• Escalating cyber-attacks heighten the appeal of managed detection and response and round-the-clock SOC coverage

• Cloud migration and modernization mandates create steady pipelines for managed infrastructure and application services

Restraints

• Shortage of skilled IT talent raises delivery costs for providers and can squeeze service margins

• Legacy system integration remains cumbersome, delaying modernization projects and adding technical debt

Opportunities

• Multi-cloud management, FinOps, and AI-powered observability tools open new service-line revenue streams

• Emerging economies are scaling connectivity rollouts, presenting green-field demand for network and security outsourcing

Challenges

• Price competition from regional MSPs pressures global vendors to re-engineer value propositions

• Compliance with varying data-sovereignty rules complicates cross-border service delivery

Regional Analysis

The North America managed services market maintains a leading market share thanks to the region’s cloud maturity, concentration of hyperscalers, and high security spend. Europe follows, propelled by stringent data-protection regulations and multi-cloud strategies. Asia Pacific delivers the quickest expansion as governments drive digital-economy programs and enterprises leapfrog to cloud-native platforms.

• North America – Largest revenue contributor; strong uptake of managed security and hybrid-cloud optimization

• Europe – Robust growth on GDPR-driven security demand and rising interest in sovereign-cloud services

• Asia Pacific – Fastest CAGR, underpinned by massive cloud adoption in China, India, and ASEAN

• Latin America – Solid double-digit gains as telecom operators bundle managed connectivity and security for SMEs

• Middle East & Africa – Growing government cloud initiatives and cybersecurity mandates spur managed services adoption

Segmentation Analysis

By Solution

• Managed Data Center – Cornerstone of hybrid strategies

Enterprises rely on managed data-center hubs to orchestrate workloads across on-premises, private, and public clouds, ensuring consistent performance, security, and governance.

• Managed Security – Rapidly scaling line of defense

Always-on SOCs, AI-driven analytics, and zero-trust frameworks position managed security as the fastest-growing solution set, particularly for ransomware mitigation.

• Managed Network – Software-defined boost

SD-WAN and Unified SASE platforms cut latency and simplify policy enforcement across distributed sites, fueling demand for fully managed connectivity.

• Managed Mobility, Backup & Recovery, Communication, Infrastructure, and Information Services – Expanding support stack

These offerings smooth device management, bolster business continuity, and unify collaboration tools under service-level guarantees.

By Managed Information Service

• Business Process Outsourcing – Value beyond labor arbitrage

Automation and analytics-infused BPO accounts for around 40% of MIS revenue, enabling smarter, faster transaction processing.

• Business Support Systems – Cloud-native shift

Telecoms and digital-service providers hand off billing and subscriber management to MSPs for agility and regulatory compliance.

• Project & Portfolio Management and Other Services – Specialized expertise

Providers supply governance and PMO capabilities that keep digital-transformation roadmaps on track.

By Deployment

• Hosted/Cloud – Flexibility first

Subscription pricing and elastic scaling make hosted deployments the preferred model for new workloads and cost-sensitive SMEs.

• On-Premise – Control and compliance

With over 51% share in 2024, on-premise deployments persist where data-sovereignty, latency, or regulatory mandates demand in-house control.

By Enterprise Size

• Large Enterprises – Scale and complexity

Global footprints, M&A, and regulatory pressure drive large organizations to standardized managed-service contracts spanning multiple geographies.

• Small & Medium Enterprises – Fast movers

SMEs adopt managed packages for enterprise-grade security and cloud tools without hefty CAPEX or specialist headcount.

By End Use

• BFSI – Data-intensive front-runner

Banks and insurers leverage managed analytics and security to combat fraud and streamline customer experience, capturing roughly 19% of market revenue.

• Healthcare – Telehealth catalyst

Remote-care platforms and stringent privacy rules make healthcare the highest-growth vertical for MSPs.

• IT & Telecom, Government, Manufacturing, Retail, Media & Entertainment, and Others – Diverse adoption

Each sector outsources to sharpen focus on core innovation while meeting industry-specific compliance needs.

Industry Developments & Instances

• October 2024 – Logicalis launched an Intelligent Connectivity suite featuring SASE, SD-WAN, and Private 5G, co-developed with Cisco.

• September 2024 – TCS and Google Cloud introduced AI-powered cybersecurity solutions targeting predictive threat prevention.

• September 2024 – IBM partnered with NTT DATA on SimpliZCloud, a fully managed LinuxONE platform for financial institutions.

• June 2024 – DXC Technology and Dell unveiled Enterprise Intelligence Services combining AI, data analytics, and multi-cloud management.

• April 2024 – Lumen Technologies secured a USD$ 73.6 million U.S. federal contract to modernize network services.

• January 2024 – Accenture strengthened its North American footprint by acquiring NaviSite, expanding application and infrastructure management capabilities.

• 2023 – Rackspace, Logicalis, Cloud5 Communications, and Aeries Technology each launched new managed or security services, underscoring provider focus on cloud resilience and cyber defense.

Facts & Figures

• Average global market size 2024: USD$ 350.35 billion

• Projected global value 2032: USD$ 794.99 billion

• Average CAGR 2025-2032: 10.5%

• North America’s market share 2024: approximately 33%

• Managed data-center services held 16% of total revenue in 2024

• Business process outsourcing generated roughly 40% of MIS revenue in 2024

• Large enterprises contributed over 60% of spending, but SME contracts are climbing at a double-digit clip

• BFSI vertical accounted for about 19% of end-use revenue in 2024

• Asia Pacific market growth projected at more than 15% annually through 2032

Analyst Review & Recommendations

Continued cloud migration, tougher cyber-risks, and the need for airtight compliance ensure a robust outlook for managed services. Providers that pair multi-cloud optimization with AI-driven security, transparent FinOps, and flexible consumption models will capture outsized share. Enterprises should prioritize MSPs offering integrated network-security stacks and demonstrable automation capability, while vendors must deepen talent pipelines and expand regional footprints to keep pace with accelerating demand.