Market Overview

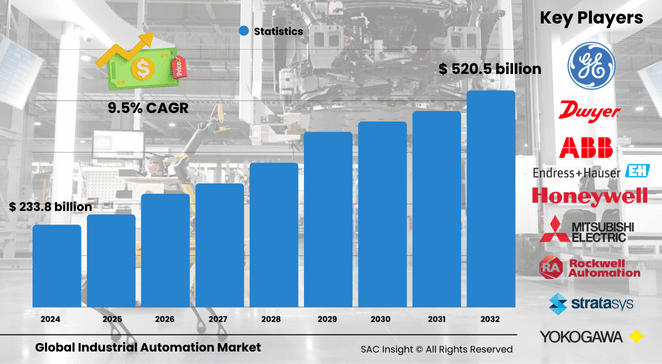

The global industrial automation market size was valued at US$ 233.81 billion in 2024 and is projected to climb to approximately US$ 520.54 billion by 2032, advancing at an average CAGR of about 9.555% during the 2025-2032 forecast window. SAC Insight industry insights highlight three decisive forces behind this market growth: accelerating adoption of Industry 4.0 across factory floors, rapid roll-out of 5G-enabled industrial IoT networks, and sustained investments in robotics to offset labor shortages.

The U.S. industrial automation market alone is poised to approach a significant share by 2032 as manufacturers upgrade legacy control systems and expand real-time analytics.

Summary of Market Trends & Drivers

• Digital twins, augmented-reality work instructions, and edge analytics are shifting automation projects from isolated islands of control to plant-wide, data-driven ecosystems.

• AI-powered predictive maintenance and closed-loop quality control are trimming unplanned downtime and improving first-pass yield, pushing up return on automation spend.

• Partnerships between automation vendors and cloud providers are shortening deployment times and lowering entry barriers for mid-sized manufacturers.

Key Market Players

Global industrial automation market share is concentrated among diversified automation leaders that blend hardware, software, and services into integrated platforms. Companies such as Siemens, ABB, Emerson, Honeywell, Mitsubishi Electric, Omron, Rockwell Automation, Schneider Electric, General Electric, and Yokogawa Electric continue to set the competitive tempo through aggressive R&D spends (often 5% of revenue) and targeted acquisitions in AI, digital twin, and industrial cloud. Smaller specialists in collaborative robots, machine vision, and industrial cybersecurity are being courted for bolt-on deals that fill technology gaps and open niche verticals.

Key Takeaways

• Market value (2024): USD$ 233.81 billion

• Projected value (2032): Approximately USD$ 520.54 billion at a 9.555% CAGR

• Software and analytics represent the fastest-growing component segment as factories move toward data-centric operations.

• Industrial robots are forecast to log a 12% CAGR through 2032, outpacing the broader market.

• Asia-Pacific accounts for roughly 39% of global revenue and will remain the primary demand engine thanks to extensive greenfield capacity additions.

• Sensors command about 23% component market share today, while Distributed Control Systems (DCS) hold approximately 35% of control-system revenue.

Market Dynamics

Drivers

• Industry 4.0 initiatives and government smart-manufacturing incentives are unlocking fresh budgets for automation overhauls.

• Real-time data analysis, enabled by cheaper sensors and edge computing, delivers measurable productivity gains and underpins strong market analysis that favors continued investment.

• Rising labor costs and persistent skills gaps in heavy manufacturing drive demand for autonomous, lights-out production lines.

Restraints

• High upfront capital outlays and uncertain payback timelines can delay projects for small and mid-sized enterprises.

• Fragmented interoperability standards force integrators to juggle multiple protocols, inflating engineering hours and complexity.

Opportunities

• Expansion of 5G private networks opens new real-time control use cases in large-area facilities such as ports and oil refineries.

• Low-cost, plug-and-play robotics kits tailored to SMEs could unlock an under-served but sizeable customer base in emerging economies.

Challenges

• Cyber-security threats aimed at operational technology (OT) systems raise compliance costs and slow cloud migration.

• Trade tensions and component shortages threaten timely delivery of PLCs, drives, and industrial PCs, potentially stalling planned roll-outs.

Regional Analysis

Europe currently leads global market share—roughly one-third of revenue—thanks to the region’s high robot density, strict energy-efficiency mandates, and deep automation know-how. Asia-Pacific, propelled by China’s extensive sensor supply chain and Japan’s robotics leadership, is the fastest-growing territory and will capture additional share through 2032. North America benefits from strong reshoring momentum, while the Middle East pursues automation to maximize asset uptime in oil, gas, and petrochemical complexes.

• North America – Advanced production techniques, sizable retrofit spending, and supportive industrial-IoT frameworks

• Europe – Highest robot density and stringent safety/emissions regulations driving continuous upgrades

• Asia-Pacific – Rapid factory expansion, Make in India and China Plus One strategies, and a vibrant component ecosystem

• Middle East & Africa – Energy, mining, and water-treatment projects adopt smart-plant technologies

• South America – Gradual uptake as automotive and food-processing sectors modernize

Segmentation Analysis

By Component

• Software – Core of modern automation architectures

Manufacturing-execution systems, SCADA, and industrial IoT platforms streamline decisions, cut paperwork, and widen adoption of closed-loop control.

• Hardware – Essential building blocks for real-time control

Sensors, PLCs, HMIs, servos, laser markers, safety light curtains, drives, and an expanding array of industrial robots deliver the physical layer that runs automated lines.

• Motors – DC motors dominate high-torque tasks, while AC motors gain traction for low-maintenance, energy-efficient drives.

By Control System

• Distributed Control Systems (DCS) – Backbone of process industries, holding 35% control-system revenue

DCS platforms orchestrate complex, continuous operations in oil & gas, chemicals, and power, offering high availability and intrinsic safety.

• Programmable Logic Controllers (PLC) – Workhorse in discrete automation

PLCs remain the go-to choice for fast, deterministic machine control, especially in automotive and packaging lines that demand millisecond response times.

• SCADA – Supervisory oversight and remote asset management

Modern SCADA suites combine historian functions with web-based dashboards, enabling multi-site visibility from a single pane of glass.

By Deployment

• Industrial Robots – 12% CAGR leader

Collaborative and mobile robots are extending automation to small-batch, high-mix environments, reducing changeover downtime.

• Machine-Vision Systems – Rapidly rising quality-assurance tool

Edge AI algorithms embedded in smart cameras catch defects early, cutting scrap and warranty claims.

• Field Instruments & Industrial Sensors – Ubiquitous data collectors

With 23% component market share, sensors supply the raw inputs needed for condition monitoring and advanced process control.

By Industry

• Discrete Automation – Automotive, electronics, heavy equipment, packaging

High-volume lines lean on robots, PLCs, and AGVs to push throughput and ensure repeatability.

• Process Automation – Oil & gas, chemicals, pulp & paper, mining & metals, healthcare

Industry Developments & Instances

• July 2021 – Major automation provider teamed with a product-traceability platform to deliver cloud-based supply-chain visibility from raw materials to point of sale.

• June 2021 – Leading vendor acquired a cloud-native smart-manufacturing software firm for USD$ 2.22 billion, expanding its industrial-cloud footprint.

• July 2021 – Top robotics supplier and an ERP giant deepened collaboration to stitch digital twins across the asset lifecycle, linking design, production, and service.

• May 2020 – Multinational manufacturer launched a fast-track automation program to speed COVID-19 vaccine and therapy production.

• April 2020 – Global industrial group granted free access to SaaS tools during lockdowns to keep plants running with minimal on-site staff.

Facts & Figures

• Average robot density in Western Europe reached 225 units per 10,000 employees versus the global average of 126.

• Sensors account for roughly 23% of total component revenue, driven by demand for real-time process visibility.

• Industrial IoT deployments can reduce unplanned downtime by up to 30% and increase OEE by 5-8%.

• Collaborative robots now represent nearly 10% of annual robot shipments, a share expected to double by 2030.

• Software and services already command about 35% of project budgets, compared with 25% five years ago, underscoring the pivot to data-centric value.

Analyst Review & Recommendations

The industrial automation landscape is moving swiftly from hardware-centric upgrades to holistic, data-driven ecosystems that blend edge intelligence, AI, and secure cloud connectivity. Vendors that couple robust control platforms with open APIs, best-in-class cybersecurity, and slick low-code analytics should outpace rivals. For manufacturers, prioritizing projects that deliver quick, visible wins—predictive maintenance, energy management, and cobot deployments—can fund broader digital-factory roadmaps and build internal confidence. Overall market analysis suggests a sustained, high-single-digit growth runway through 2032, provided stakeholders tackle integration complexity and talent shortages head-on.