Market Overview

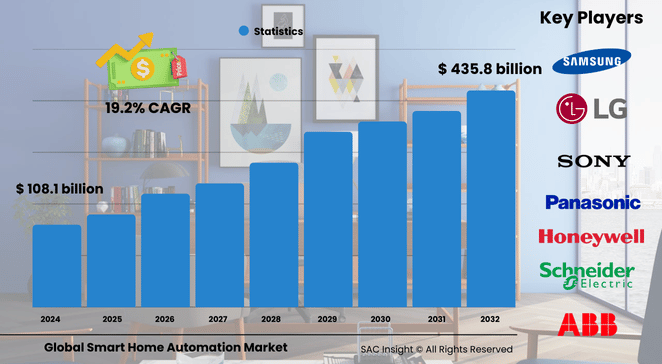

The global smart home automation market size is estimated at roughly US$ 108.1 billion in 2024 and is set to reach about US$ 435.8 billion by 2032, reflecting a healthy 19.2% CAGR across the 2025-2032 forecast window. First-hand industry insights show three core demand accelerators: rapid household adoption of connected voice assistants, steady drops in device prices, and rising expectations for energy-efficient living spaces.

SAC Insight's deep market analysis indicates that North America keeps its early-mover advantage, but Asia Pacific is narrowing the gap as broadband coverage climbs and local manufacturing scales. The U.S. smart home segment alone is on track to approach US$ 120 billion by 2032, on the back of retrofit activity and continued premiumization of security bundles.

Summary of Market Trends & Drivers

• Momentum is shifting from single-point devices to unified ecosystems that blend lighting, HVAC, and security into one mobile dashboard.

• Wireless protocols such as Wi-Fi, ZigBee, Bluetooth, and emerging Matter standards are trimming installation time and fueling market growth in multi-dwelling units.

• Rising disposable incomes, especially among first-time homeowners in China and India, are translating into double-digit demand upticks for affordable smart appliances.

Key Market Players

Established automation names and agile consumer-tech entrants vie for market share through ecosystem lock-ins and subscription services. Global incumbents—ranging from diversified industrials to specialist control brands—continue to innovate around AI-enabled energy management and ultra-secure access solutions. Meanwhile, niche lighting and sensor start-ups are rapidly scaling via partnerships with platform providers, expanding the breadth of plug-and-play devices available to consumers. Prominent participants covered in the report include ABB Ltd., Johnson Controls, Schneider Electric, Siemens AG, Honeywell International, Crestron Electronics, Control4 Corporation, Legrand SA, Leviton Manufacturing, Lutron Electronics, and Savant Systems.

Key Takeaways

• 2024 market value: USD$ 108.1 billion; projected 2032 value: USD$ 435.8 billion at a 19.2 percent CAGR

• Hardware/products command the highest market share, led by lighting control and security devices

• Security & safety remains the top-earning application, while smart kitchen solutions show the fastest market growth

• Wireless technology outpaces wired alternatives; hybrid solutions still deliver the largest revenue slice

• Retrofit installations make up most current deployments, but new construction is the quickest-growing fitment category

• North America holds around 36 percent of global revenue; Asia Pacific delivers the strongest CAGR through 2032

Market Dynamics

Drivers

• Expanding broadband and IoT penetration enables seamless device-to-device communication

• Consumer preference for energy savings and remote monitoring pushes adoption of connected thermostats and lighting

• Competitive pricing and bundled service models lower entry barriers for mid-income households

Restraints

• Up-front product costs remain high for price-sensitive segments despite dropping component prices

• Persistent interoperability gaps between proprietary ecosystems deter some mass-market consumers

Opportunities

• Voice-controlled assistants and Matter-compliant hubs open fresh integration avenues for device makers

• Edge-analytics firmware and AI-driven predictive maintenance services can unlock new recurring-revenue streams

Challenges

• Cyber-security concerns around connected door locks and cameras may dampen trust if not addressed proactively

• Varying regional regulations on data privacy and wireless spectrum usage complicate global roll-outs

Regional Analysis

North America leads thanks to early adoption, strong retail channels, and high disposable income. Yet Asia Pacific is the fastest-advancing arena, buoyed by urbanization, manufacturing scale, and government smart-city initiatives. Europe follows closely, driven by stringent energy-efficiency standards.

• North America – Largest revenue pool, retrofit-heavy, strong subscription uptake

• Europe – Energy compliance drives HVAC and lighting automation demand

• Asia Pacific – Highest CAGR, local device production keeps prices competitive

• Latin America – Gradual growth as broadband widens and utility costs rise

• Middle East & Africa – Emerging opportunity zones linked to new construction and luxury real-estate projects

Segmentation Analysis

By Component

• Hardware – Lighting, security, HVAC, entertainment, and smoke detectors dominate volume. Hardware accounts for most spending because consumers typically begin automation journeys with tangible devices that deliver immediate convenience or safety benefits.

• Software & Solutions – Centralized operating systems and analytics layers. As households accumulate multiple devices, intuitive dashboards and AI-powered routines become essential for friction-less control.

• Services – Installation, integration, and ongoing maintenance. Professional installers bridge knowledge gaps and keep complex multi-protocol setups running smoothly.

By Technology

• Wireless – Fastest-growing connectivity mode. Low-power radios shorten installation time and support flexible device placement, lifting adoption in rental properties.

• Hybrid – Largest revenue contributor. Combining wired reliability with wireless reach ensures minimal downtime in larger homes or buildings.

• Cellular & Other – Niche deployments. Specialty use cases such as vacation homes rely on cellular or power-line links where Wi-Fi coverage is patchy.

By Application

• Security & Access – Revenue leader. Smart locks, video doorbells, and motion sensors address rising homeowner safety concerns and insurance incentives.

• Smart Kitchen – Rapid-growth niche. Connected appliances and voice-guided cooking solutions resonate with busy urban dwellers seeking convenience.

• Lighting, HVAC & Energy Management – Core efficiency drivers. Dynamic scheduling and occupancy sensors cut energy bills by up to 20 percent.

• Entertainment & Other Appliances – Lifestyle enhancers. Integrated speaker-TV hubs and wellness monitoring devices round out the modern connected home.

By Fitment

• Retrofit – Largest installed base. An estimated 2.3 billion existing homes worldwide create a vast upgrade market for battery-powered, peel-and-stick devices.

• New Construction – Quickest-rising segment. Builders increasingly pre-wire or embed automation backbones to boost property value and meet smart-home-ready expectations.

Industry Developments & Instances

• March 2023 – A major building-controls vendor rolled out an affordable all-in-one security and smart-home panel aimed at entry-level buyers.

• August 2023 – A leading automation platform launched Home OS 4, expanding interoperability with third-party sensors and Matter devices.

• March 2023 – A telecom-to-energy collaboration debuted an enterprise smart-building bundle targeting net-zero commitments.

• December 2022 – A global electrical specialist partnered with a property developer to deliver turnkey 360-degree home automation in new housing projects.

• November 2022 – Portable, sensor-rich smart lights hit the Indian market, signaling growing demand for flexible, scene-based lighting controls.

Facts & Figures

• Roughly 14.4 billion consumer IoT devices were online in 2022; the figure is expected to hit 27 billion by 2025.

• India counted 336.6 million urban internet subscribers in 2022, underlining retrofit potential in emerging economies.

• Wireless smart-lighting shipments grew 30 percent year over year in 2024, driven by color-tunable LED strip kits.

• North America captures about 36.1 percent of global smart home automation revenue.

• Retrofit projects account for more than 60 percent of today’s installations, reflecting the vast existing housing stock.

Analyst Review & Recommendations

Smart home automation is moving from gadget novelty to household utility. Vendors that blend rock-solid security, open-standard interoperability, and subscription-based energy insights will outpace rivals locked in single-device silos. Near-term priorities include hardening cyber-defenses, simplifying DIY onboarding, and localizing content for high-growth Asia Pacific markets. Over the long haul, edge-AI analytics and demand-response partnerships with utilities represent promising paths to sticky recurring revenue and sustained market growth.