Market Overview

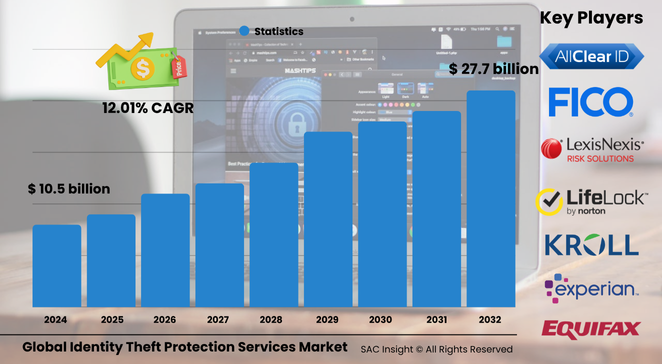

The global identity theft protection services market size is valued at close to US$ 10.57 billion in 2024 and is projected to reach roughly US$ 27.74 billion by 2032, registering a solid 12.01% CAGR. First-hand industry insights highlight three structural growth levers: a surge in remote transactions, relentless data-breach exposure, and rapid AI adoption that strengthens real-time threat detection.

SAC Insight’s deep market evaluation shows the United States identity theft protection services market alone could rise from about US$ 3.8 billion in 2024 to nearly US$ 9.7 billion by 2032 as consumers and enterprises elevate spend on proactive digital-identity safeguards.

Summary of Market Trends & Drivers

• Heightened consumer awareness, reinforced by high-profile breaches, is expanding subscription uptake across credit monitoring and dark-web surveillance packages.

• Financial institutions and retailers are embedding white-label protection services into loyalty programs, creating new B2B revenue streams and accelerating market growth.

• AI-driven analytics, two-factor authentication, and biometric solutions are converging to deliver layered defense, shaping the next wave of market trends.

Key Market Players

The competitive landscape revolves around data-rich credit bureaus, cybersecurity specialists, and emerging fintech vendors. Firms such as Equifax, Experian, TransUnion, and Fair Isaac leverage deep credit files to power continuous monitoring, while NortonLifeLock, McAfee, and Malwarebytes differentiate through multi-device security suites integrating ID insurance. Niche providers like LexisNexis Risk Solutions, AllClearID, and Kroll focus on breach response and fraud resolution for enterprises, intensifying market share jockeying through partnerships and white-label agreements.

Key Takeaways

• Current global market size (2024): about USD$ 10.57 billion

• Forecast global market size (2032): nearly USD$ 27.74 billion at a 12.01 % CAGR

• Credit card fraud remains the dominant type segment, yet bank-fraud protection posts the fastest incremental revenue

• Cloud-based delivery captures more than 60 % market share thanks to quick rollout and lower upfront costs

• AI-powered scam detection and dark-web surveillance are emerging as must-have differentiators in subscription bundles

• North America leads, while Asia Pacific records the swiftest percentage gains fueled by mobile-payment adoption

Market Dynamics

Drivers

• Proliferation of digital payments and open-banking APIs widens the attack surface, elevating demand for continuous identity monitoring.

• Strict data-privacy regulations and mandatory breach-notification rules push enterprises toward comprehensive protection suites.

• Growth of remote and hybrid work models drives corporate spend on employee-identity safeguards.

Restraints

• Per-user subscription prices remain high for small businesses, tempering adoption outside heavily regulated sectors.

• Service overlap with free credit-freeze tools can dilute perceived value among cost-conscious consumers.

Opportunities

• Embedded protection offerings in e-wallets, fintech apps, and BNPL platforms create untapped cross-selling potential.

• Expansion into emerging markets with rising smartphone penetration promises new revenue as cyber-crime awareness climbs.

Challenges

• Evolving synthetic-identity tactics require constant algorithm updates, stretching R&D budgets.

• Fragmented consumer data across jurisdictions complicates unified risk scoring and hampers seamless global coverage.

Regional Analysis

North America dominates on the back of mature credit ecosystems, high breach incidence, and favorable insurance uptake. Europe follows with strict GDPR enforcement driving enterprise investment. Asia Pacific records the fastest CAGR as mobile banking accelerates and governments tighten cybersecurity laws.

• North America – Largest revenue base, boosted by proactive consumer subscriptions and corporate compliance mandates

• Europe – Strong regulatory push and rising e-commerce fuel steady expansion

• Asia Pacific – Highest CAGR driven by booming digital payments in India, China, and Southeast Asia

• Middle East & Africa – Growing internet penetration and fintech growth spur steady adoption

• South America – Expanding online retail and government digital-ID programs underpin gradual market development

Segmentation Analysis

By Type

• Credit Card Fraud – Revenue anchor.

Mass issuance of payment cards and instant checkout options keep credit card data a prime target, necessitating always-on monitoring and rapid alerting.

• Bank Fraud – Fastest growth.

Instant account-to-account transfers and open banking APIs raise risks of unauthorized withdrawals and account takeovers, driving demand for transaction-level analytics.

• Phone or Utility Fraud – Persistent niche.

Fraudsters exploit high churn in telecom accounts to open lines or reroute calls; protection plans now bundle SIM-swap alerts to curb losses.

• Employment or Tax-Related Fraud – Emerging awareness.

Stolen personal identifiers used for bogus tax returns and benefit claims prompt consumers to add IRS and payroll monitoring to their service stack.

By Service

• Credit Monitoring – Core entry product.

Automated bureau checks detect score swings, new inquiries, and tradeline changes, forming the backbone of most subscription tiers.

• Identity Monitoring – Broader data sweep.

Social-media, public-record, and dark-web scans surface compromised identifiers beyond credit files, enhancing threat visibility.

• Fraud Resolution – High-touch differentiator.

Concierge specialists manage paperwork, liaise with lenders, and restore records, adding tangible value for premium users.

• Insurance – Risk-transfer add-on.

Coverage for stolen-fund reimbursement and legal costs mitigates financial fallout, increasingly bundled at mid-tier price points.

• Others – VPN and password-manager tie-ins.

Complementary security tools boost stickiness and average revenue per user.

By Deployment

• Cloud-Based – Scalability leader.

Subscription portals and API integrations allow rapid feature rollouts and lower IT overhead, making cloud the preferred model for SMEs and partners.

• On-Premise – Compliance-driven holdout.

Highly regulated banks and government agencies keep sensitive processes in-house to meet data-residency and audit requirements.

By End-User

• Consumers – Volume driver.

Growing online presence and do-it-yourself investing push individuals to safeguard digital footprints.

• Businesses – Rising strategic spend.

Enterprises adopt bulk licenses and employee-protection bundles to reduce fraud liability and boost workforce confidence.

By Organization Size

• Large Enterprises – Early adopters.

Global footprints and heavy data volumes necessitate multilayered protection and dedicated incident-response contracts.

• SMEs – High upside.

As affordable per-seat cloud packages emerge, smaller firms can now justify proactive coverage.

By Industry Vertical

• Financial Services – Security frontrunner.

Regulatory scrutiny and direct monetary exposure keep spending high on advanced fraud analytics and identity assurance.

• Healthcare – Sensitive-data guardian.

Medical-record theft commands premium black-market prices, prompting hospitals to extend monitoring to patients and staff.

• Retail – E-commerce catalyst.

Merchants integrate checkout-level fraud screening and loyalty-account safeguards to protect revenue and brand trust.

• Government – Public-sector focus.

Agencies fortify citizen portals and benefits systems against credential stuffing and synthetic IDs, spurring contract demand.

Industry Developments & Instances

• February 2024 – A leading consumer-security vendor introduced a dark-web monitoring suite that alerts users within minutes of credential exposure.

• October 2023 – An endpoint-protection specialist launched an identity-theft add-on combining credit, social-media, and crypto-wallet surveillance.

• September 2023 – An AI-powered scam-prevention module debuted, blocking phishing links across SMS and messaging apps at the network level.

• January 2023 – A major provider unveiled a family plan covering up to six members under one dashboard, targeting the growing household segment.

Facts & Figures

• More than 42 million identity-theft victims were recorded in the United States in 2022.

• Credit monitoring accounts for roughly 45 % of total service revenue worldwide.

• Cloud deployments surpass 60 % adoption, up from 48 % in 2021.

• North America held about 42 % market share in 2023, reflecting high subscription penetration.

• AI-driven alert systems can cut average fraud-detection time by over 70 % compared with legacy rule-based tools.

Analyst Review & Recommendations

Data-driven analysis confirms identity theft protection is shifting from reactive recovery to proactive, AI-enabled monitoring embedded across financial and consumer apps. Providers that fuse real-time behavioral analytics, comprehensive breach response, and frictionless user experience will capture outsized market share. Strategic priorities include expanding white-label partnerships, investing in synthetic-ID detection, and tailoring price tiers for SMEs and emerging markets to unlock the next phase of sustainable market growth.