Market Overview

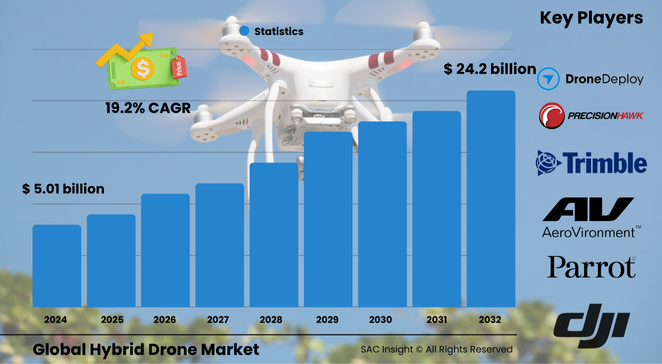

The global hybrid drone market size stood at roughly US$ 5.01 billion in 2024 and is on track to soar to nearly US$ 24.28 billion by 2032, reflecting a brisk 19.25% CAGR. First-hand industry insights show three clear catalysts: the need for longer-endurance platforms that cut refuelling downtime, rapid gains in hybrid propulsion efficiency, and expanding civil and military budgets for autonomous aerial monitoring.

SAC Insight's deep market evaluation suggests the United States hybrid drone market alone is set to advance from about US$ 2.69 billion in 2024 toward the upper single-digit billions by 2032 as agriculture, infrastructure, and defense agencies accelerate fleet upgrades.

Summary of Market Trends & Drivers

• High-density batteries paired with lightweight combustion engines are stretching flight times past six hours, unlocking new cargo, mapping, and coast-guard missions.

• Regulatory sandboxes in North America and Europe are easing beyond-visual-line-of-sight (BVLOS) restrictions, fuelling market growth for long-range inspection and delivery routes.

• Precision agriculture and smart-city surveillance remain the fastest-growing applications as end users seek data-rich, real-time analytics from multi-sensor payloads.

Key Market Players

Leading innovators include DJI, Parrot, 3D Robotics, PrecisionHawk, AeroVironment, and Skyfront. These firms leverage integrated design, proprietary flight-control software, and strong dealer networks to defend market share. Close behind, AscTec, Latitude Engineering, Gadfin, Quaternium, and Advanced Aircraft Company compete on endurance and payload flexibility, often partnering with telecom carriers and defense ministries to run pilot projects that prove large-scale viability.

Competitive dynamics center on range-extension modules, AI-enabled flight autonomy, and bundled data-analytics subscriptions. Incumbents are acquiring battery-management start-ups and hybrid power-train specialists to tighten control over critical components, while newcomers court regional distributors with aggressive pricing and open-architecture platforms.

Key Takeaways

• Current global market size (2023): about USD$ 5.01 billion

• Projected global market size (2032): roughly USD$ 24.28 billion at a 19.25 % CAGR

• The United States already claims close to one-half of North American revenue and remains the reference market for BVLOS operations

• Filming & photography still leads single-application market share, yet agriculture and logistics show the quickest uplift in unit demand

• Multi-rotor hybrids dominate shipments by volume, but fixed-wing hybrids generate higher average selling prices thanks to their 150 km-plus range

• Fuel-cell powertrains are emerging as the premium option for endurance missions, though battery-plus-gasoline systems remain the mainstream choice on cost grounds

Market Dynamics

Drivers

• Longer flight endurance and heavier payload thresholds expand mission portfolios across inspection, mapping, and emergency response.

• Falling sensor prices and cloud-based analytics boost return on investment for commercial buyers.

• Government funding for advanced air mobility and unmanned logistics corridors accelerates fleet orders.

Restraints

• High upfront costs for hybrid power modules and certified autopilots deter price-sensitive small operators.

• Patchy airspace integration rules create deployment uncertainty, especially for cross-border services.

• Limited hybrid-specific maintenance infrastructure raises lifecycle costs outside major hubs.

Opportunities

• 5G-enabled real-time data streaming opens premium subscription revenues for platform vendors.

• Smart-city projects in Asia-Pacific and the Middle East offer first-mover advantages for public-safety and traffic-monitoring solutions.

• Hydrogen fuel-cell hybrids present a gateway to zero-emission long-haul drone logistics.

Challenges

• Battery supply-chain volatility and rare-earth material shortages can inflate production costs.

• Cyber-security threats to command-and-control links demand continuous software hardening.

• Public perception and privacy concerns may slow urban deployment without clear community engagement.

Regional Analysis

North America holds the largest market share thanks to a mature regulatory framework, strong venture funding, and robust defense procurement. Europe follows, driven by cross-border infrastructure inspection and environmental monitoring mandates, while Asia-Pacific records the fastest percentage growth as agriculture, forestry, and e-commerce players embrace longer-range drones.

• North America – Leadership in market size, propelled by defense, energy, and agriculture demand

• Europe – Rapid adoption in inspection, aided by unified airspace corridors and green subsidy programs

• Asia-Pacific – Fastest CAGR; large-scale precision farming and parcel delivery pilots underpin uptake

• Middle East & Africa – Infrastructure surveillance and oil-field monitoring stimulate niche orders

• Latin America – Emerging logistics and environmental projects along remote corridors fuel early growth

Segmentation Analysis

By Type

• Fixed-Wing Hybrid Drones – Endurance leaders.

Fixed-wing hybrids combine aerodynamic lift with parallel power-trains, enabling six-hour sorties at over 150 km range. They appeal to pipeline inspectors and coast-guard agencies needing wide-area coverage.

• Multi-Rotor Hybrid Drones – Workhorse class.

Vertical-take-off capability and simplified training make multi-rotors the preferred choice for surveyors, firefighters, and photographers who value hover stability and agile maneuvering.

• Single-Rotor Hybrid Drones – Heavy-lift niche.

Helicopter-style rotors deliver high-torque lift for payloads above 20 kg, supporting telecom tower rebuilds and military resupply in confined zones.

By Power Source

• Battery-Powered Hybrids – Mainstream option.

Readily available lithium packs keep capital costs low and simplify field swaps, suiting commercial filming and short-haul delivery.

• Fuel-Cell Hybrids – Premium endurance.

Hydrogen stacks slash emissions and double flight time, attracting utilities and coast-guard operators targeting green credentials.

• Solar-Assisted Hybrids – Range extenders.

Lightweight solar skins trickle-charge batteries in daylight, boosting patrolling and environmental research missions in sunny regions.

By Application

• Agriculture – Fastest-growing segment.

Variable-rate spraying, crop-health mapping, and yield prediction drive farm adoption, cutting chemical use and boosting returns.

• Logistics & Transportation – Emerging revenue engine.

Hybrid drones bridge the middle-mile gap, ferrying medical supplies and high-value parts across rough terrain at lower cost than crewed aircraft.

• Surveillance & Monitoring – Core defense demand.

Persistent ISR (intelligence, surveillance, reconnaissance) missions benefit from hybrids’ long dwell times and multi-sensor payloads.

• Environmental Monitoring & Inspection – Regulatory pull.

Wildlife protection agencies and utilities deploy hybrids to track deforestation, inspect power lines, and survey wind farms without manned helicopters.

• Filming & Photography – Established stronghold.

Cinematic firms rely on hybrid stability and extended airtime for complex tracking shots and live broadcast coverage.

By End-Use Industry

• Defense & Security – Largest spender.

Budgets prioritize autonomous border patrol and tactical resupply, underpinning steady volume contracts.

• Agriculture & Forestry – Rapid civilian adoption.

Farmers embrace data-driven precision to cut inputs and protect margins.

• Construction & Infrastructure – Rising inspection need.

Site planners and asset managers use hybrids for digital twins and structural health monitoring.

• Energy & Utilities – Safety imperative.

Oil, gas, and power companies rely on long-range hybrids to inspect remote assets, reducing downtime and crew risk.

• Entertainment & Media – Niche but visible.

Sports broadcasters and filmmakers push the envelope on immersive aerial content.

By Range

• Short Range (< 20 km) – Urban operations.

Ideal for last-mile delivery and event coverage inside populated zones.

• Medium Range (20-80 km) – Regional missions.

Covers most agricultural fields and infrastructure corridors without mid-mission refuel.

• Long Range (80-140 km) – Utility patrol.

Favored for pipeline, rail, and coastal surveys.

• Extended Range (> 140 km) – Strategic ISR.

Targets defense, disaster-relief, and cross-border logistics where crewed flights are costly or risky.

Industry Developments & Instances

• March 2025 – A leading drone maker launched a fuel-cell hybrid with a record 12-hour endurance, triggering pre-orders from telecom and coast-guard agencies.

• December 2024 – A North American logistics start-up received aviation authority approval for BVLOS hybrid cargo routes spanning 60 km.

• August 2024 – An EU-funded consortium completed trials of solar-assisted hybrids for Mediterranean wildfire monitoring.

• May 2024 – A major defense contractor partnered with a hybrid drone OEM to supply long-endurance ISR platforms for border security.

• January 2024 – An agriculture co-op in Brazil deployed 100 multi-rotor hybrids, cutting fertilizer use by 20 % within the first season.

Facts & Figures

• Multi-rotor hybrids accounted for about 55 % of unit shipments in 2024.

• Fixed-wing hybrids commanded roughly 48 % of revenue, reflecting higher average selling price.

• Average hybrid drone flight time has climbed from 90 minutes in 2020 to nearly 240 minutes in 2024.

• Around 35 % of newly certified commercial BVLOS routes in 2024 relied on hybrid propulsion.

• Fuel-cell system costs dropped by approximately 12 % year-on-year, narrowing the price gap with gasoline hybrids.

Analyst Review & Recommendations

Market analysis indicates a decisive shift toward endurance-focused platforms paired with real-time analytics. Vendors that integrate modular hybrid power-trains, secure data links, and subscription-based analytics will outpace average market growth. To mitigate supply-chain risk, firms should diversify battery chemistries and invest in local assembly hubs. Early engagement with regulators on BVLOS safety cases will accelerate deployment in high-value logistics and inspection corridors, securing first-mover advantage as skies open further.