Market Overview

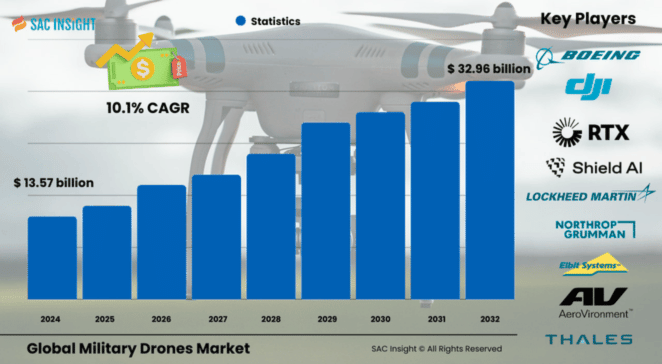

The global military drones market size was valued at roughly US$ 13.57 billion in 2024 and is projected to reach about US$ 32.96 billion by 2032, registering a compound annual growth rate of close to 10.1 percent during the 2025-2032 forecast window. SAC Insight's deep market evaluation shows three structural forces behind this market growth: rising geopolitical tensions that demand persistent intelligence, the steady shift from remotely piloted to AI-enabled autonomous systems, and sustained defense-budget expansion across major economies. First-hand industry insights also highlight a surge in unit demand—global fleet volumes are on track to climb from around 35,000 platforms in 2024 to more than 52,000 by 2028.

The U.S. military drones market is forecast to approach US$ 13.01 billion by 2032, reflecting both replacement of aging unmanned aerial vehicles (UAVs) and fresh procurement of longer-endurance systems.

Summary of Market Trends & Drivers

Artificial intelligence, swarming algorithms, and modular payload bays are redefining how armed forces deploy unmanned systems, pushing the market toward smarter, multi-mission aircraft. At the same time, favorable procurement policies and domestic-production mandates in countries such as India, Spain, and Ukraine are nurturing local champions and shortening supply chains. Meanwhile, lower composite-airframe prices and compact turboprop engines are extending flight hours, turning fixed-wing drones into the backbone of next-generation surveillance and strike doctrines.

Key Market Players

The global military drones industry leaders such as Northrop Grumman, General Atomics Aeronautical Systems, and Israel Aerospace Industries dominate the high-altitude, long-endurance segment with proven platforms that combine stealth shaping, satellite communications, and precision-guided munitions integration. Close behind, Raytheon Technologies, Boeing, and Lockheed Martin are expanding into autonomous teaming, offering software suites that let crewed fighters direct multiple loyal-wingman drones in contested airspace.

At the tactical and nano-drone end of the spectrum, AeroVironment, Teledyne FLIR, and SAAB are fighting for share by rolling out lightweight airframes equipped with thermal sensors, man-portable launch options, and encrypted data links. These companies set the competitive tempo through rapid block upgrades, export-friendly variants, and collaboration with indigenous suppliers.

Key Takeaways

• Market value (2024): USD$ 13.57 billion

• Projected value (2032): USD$ 32.96 billion at a 10.1 percent CAGR

• North America accounts for roughly 36 percent of global market share, led by the U.S.

• Fixed-wing platforms hold the largest product share thanks to long endurance and heavy payload capacity.

• Remotely operated drones remain mainstream, but autonomous modes are the fastest-growing technology segment.

• Intelligence, Surveillance, Reconnaissance, and Targeting (ISRT) applications generate the bulk of current revenue, while combat-ready loitering munitions show double-digit gains.

Market Dynamics

Drivers

• Escalating asymmetric warfare and cross-border tensions heighten demand for rapid, high-fidelity situational awareness.

• Advances in avionics, lightweight composites, and AI-driven mission systems boost endurance, precision, and survivability.

• Government incentives and offset agreements encourage domestic production, trimming import dependency.

Restraints

• Limited flight time for battery-powered variants constrains persistence in long-duration missions.

• Concerns over fully autonomous lethal systems spark regulatory scrutiny and calls for human-in-the-loop safeguards.

• Strict export-control regimes and the Missile Technology Control Regime (MTCR) complicate cross-border sales.

Opportunities

• Swappable payload architectures open new revenue streams in electronic warfare, communications relay, and medical resupply.

• Upgrades to secure identification and anti-jamming technologies can unlock defense budgets focused on cyber-resilient platforms.

• Partnerships between emerging drone hubs—such as Turkey-Ukraine and Spain-Colombia—create fresh markets for subsystems and joint production.

Challenges

• Ensuring robust cybersecurity to prevent hijacking or data exfiltration in contested networks.

• Balancing weight, power consumption, and cost while integrating higher-resolution sensors and advanced munitions.

• Navigating diverging international norms on autonomous-weapons ethics and compliance.

Regional Analysis

North America commands the largest market share, underpinned by deep R&D spending and a mature defense-industrial base. Europe is accelerating procurement to strengthen border surveillance and NATO readiness, while the Asia-Pacific region posts the fastest growth amid territorial disputes and indigenous drone programs.

• North America – Dominant position driven by high defense budgets and large-scale fleet renewals.

• Europe – Robust demand for tactical and MALE (medium-altitude long-endurance) drones to bolster ISR and deterrence.

• Asia-Pacific – Rapid capacity build-up in China, India, South Korea, and Australia, fostering local assembly lines.

• Middle East & Africa – Steady uptake of armed drones for counter-insurgency and border security.

• Latin America – Early-stage adoption focused on coastal patrol and anti-narcotics surveillance.

Segmentation Analysis

By Product Type

• Fixed Wing – Long endurance, highest payload share

Fixed-wing drones dominate strategic missions thanks to efficient aerodynamics and the ability to loiter for 24 hours or more. Militaries favor them for broad-area surveillance, maritime patrol, and precision strikes.

• Rotary Wing – Vertical lift, agile in tight spaces

Capable of hovering and VTOL operations, rotary-wing drones excel in urban ISR, shipborne missions, and resupply to forward bases where runways are scarce.

• Hybrid Wing – Blended lift, emerging niche

Hybrid designs combine fixed-wing cruise efficiency with rotary lift motors, enabling runway-free launch without sacrificing range—an attractive choice for special-operations forces.

By Range

• Extended Visual Line of Sight (EVLOS) – Fastest growth segment

EVLOS platforms link to airborne or satellite relays, making them ideal for electronic warfare, target designation, and deep-strike scouting beyond 50 kilometres.

• Visual Line of Sight (VLOS) – Second largest share

VLOS drones support disaster response, base perimeter security, and training missions where real-time operator control is essential.

• Beyond Line of Sight (BLOS) – Strategic reach

BLOS drones leverage satellite command-and-control to deliver supplies or conduct ISR hundreds of kilometres from ground stations, supporting expeditionary operations.

By Technology

• Remotely Operated – Workhorse of today

These systems combine cost-effective command links with proven ground-control stations, suiting both combat and survey roles across defense branches.

• Semi-Autonomous – Transitional step

Flight computers manage take-off, cruise, and landing while operators handle rules of engagement, balancing oversight with reduced workload.

• Autonomous – Double-digit CAGR

AI-driven navigation, obstacle avoidance, and target identification allow drones to operate in GPS-denied environments and coordinate in swarms, reshaping battlefield tactics.

By System

• Airframe – Largest revenue component

High-strength composites and stealth shaping reduce radar cross-section and boost endurance, making airframes the costliest hardware element.

• Avionics – Rapid innovation cluster

Advanced flight computers, redundant datalinks, and AI accelerators underpin autonomous functions and secure communications.

• Propulsion – Turboprop engines gaining share

Fuel-efficient turboprops and hybrid-electric units extend range while meeting acoustic-signature limits.

• Payload – Mission-tailored edge

Electro-optical/infrared cameras, synthetic-aperture radar, and lightweight precision munitions turn a generic airframe into a role-specific asset.

• Software – Digital backbone

Ground-station suites, cyber-hardening modules, and open-architecture APIs enable rapid updates and multi-platform control.

By Application

• Intelligence, Surveillance, Reconnaissance, Targeting (ISRT) – Core demand engine

Persistent ISR remains the primary mission, delivering real-time situational awareness, pattern-of-life analysis, and precision target cues.

• Combat Operations – Growing offensive role

Armed drones conduct close-air support, loitering strikes, and swarm attacks, reducing risk to pilots and ground troops.

• Battle Damage Management – Niche but rising

Post-strike assessments using high-resolution imaging shorten kill-chain loops and inform follow-on missions.

• Logistics & Transportation – Emerging frontier

VTOL and cargo drones carry medical supplies, ammunition, and spare parts to forward operating bases in austere terrain.

Industry Developments & Instances

• December 2023 – A leading U.S. manufacturer secured a US$ 389 million contract to supply modernized extended-range Gray Eagle systems to the Army.

• June 2023 – An aerospace prime delivered six additional high-altitude Triton surveillance drones to a key Pacific-region ally.

• February 2023 – The Indian Army issued a tender for 850 indigenous nano-drones to bolster counter-terrorism units.

• February 2023 – A coastal-security agency ordered multirotor VTOL drones from a domestic start-up to expand maritime patrol coverage.

• October 2023 – Front-line use of loitering munitions in Eastern Europe underscored the tactical value of inexpensive, expendable drones for precision strikes.

Facts & Figures

• Average annual growth (2025-2032): 10.1 percent

• Global fleet forecast: 52,000 platforms by 2028, up from 35,000 in 2024

• Fixed-wing drones account for more than 55 percent of 2024 platform revenue

• North America holds about 36 percent market share, led by sustained U.S. procurement

• U.S. market projected to hit roughly US$ 13.01 billion by 2032

• Battery-powered mini-drones currently average 45-minute endurance; hybrid-electric concepts target 3-hour flight times

Analyst Review & Recommendations

Robust demand, technology leaps, and supportive procurement policies position military drones for resilient double-digit expansion through 2032. Suppliers that pair open-architecture airframes with AI-enabled autonomy, secure datalinks, and modular payloads will outpace rivals. For investors, hybrid-wing VTOL platforms and drone-specific smart munitions present the most compelling near-term upside, while integrators should prioritize cyber-resilience and compliance with evolving autonomous-weapons norms to safeguard long-term growth.