Market Overview

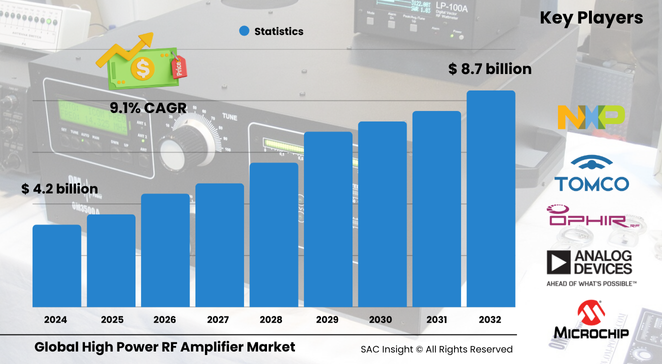

The global high power RF amplifier market size is estimated at roughly US$ 4.22 billion in 2024 and, based on SAC Insight's deep market evaluation, is set to climb to about US$ 8.7 billion by 2032, expanding at a solid 9.15 % CAGR. First-hand industry insights reveal three growth engines: relentless 5G and soon-to-arrive 6G roll-outs, rising defence and space spending that depends on secure wide-band links, and a wave of smart-factory investments demanding low-latency industrial IoT.

Within North America, the United States high power RF amplifier market alone could advance from approximately US$ 700 million in 2024 to nearly US$ 1.44 billion by 2032 as aerospace, telecom, and medical OEMs upgrade to higher output, better-efficiency designs.

Summary of Market Trends & Drivers

• Gallium nitride devices are displacing legacy silicon in new base-station and radar builds, raising power density while shrinking footprints.

• Edge computing and smart-grid projects favour wideband, software-defined radios, pushing demand for broadband amplifiers that simplify multi-band coverage.

• Defence modernisation budgets prioritise electronic-warfare and active-phased-array radar systems, sustaining long-term market growth even when consumer cycles soften.

Key Market Players

Global leadership rests with a mix of diversified semiconductor giants and RF-specialist houses. Companies such as Analog Devices, NXP Semiconductors, Qorvo, Texas Instruments, and Infineon supply high-reliability die and MMICs, while Skyworks, Broadcom, STMicroelectronics, and Maxim Integrated focus on integrated front-end modules for smartphones and Wi-Fi 6E routers. Power-focused innovators like Empower RF, BONN Elektronik, and OPHIR RF target defence and scientific accelerator labs with rack-mount systems capable of kilowatt-class output.

Competitive dynamics pivot on material science and vertical integration. Chipmakers are partnering with packaging houses to co-design thermal substrates, while module vendors acquire filter and antenna start-ups to offer turnkey radio platforms.

Key Takeaways

• Current global market size (2024): USD$ 4.22 billion

• Projected global market size (2032): USD$ 8.7 billion at a 9.15 % CAGR

• The U.S. market is forecast to reach about USD$ 1.44 billion by 2032, buoyed by defence and 5G densification.

• Gallium arsenide and gallium nitride devices collectively command over half the market share due to superior efficiency and heat tolerance.

• Communication infrastructure remains the largest use case, but medical imaging and industrial IoT post the fastest percentage gains.

• Vendors that bundle digital predistortion, advanced cooling, and remote diagnostics earn premium margins.

Market Dynamics

Drivers

• Nationwide 5G mid-band deployments and early 6G trials require high linearity and wide instantaneous bandwidth.

• Growth in satellite broadband and space-based radar lifts demand for radiation-hardened amplifiers.

• Miniaturised MRI and RF ablation systems in healthcare add steady new volume.

Restraints

• High material and fabrication costs for GaN wafers curb adoption in cost-sensitive consumer gear.

• Import tariffs on electronic components raise bill-of-materials for OEMs in Europe and Asia.

• Thermal management challenges limit continuous-wave output in compact form factors.

Opportunities

• Private industrial 5G networks in smart factories need rugged, low-latency RF front-ends.

• Rising interest in edge AI sensors opens niches for ultra-low-noise gain blocks.

• Emerging 6 GHz Wi-Fi 7 allocations spark refresh cycles in routers and access points.

Challenges

• Supply-chain bottlenecks for high-purity silicon carbide substrates delay GaN ramp-up.

• Space-debris mitigation rules increase qualification costs for satellite payload components.

• Growing energy-efficiency mandates force redesign of legacy class-AB architectures.

Regional Analysis

North America dominates thanks to robust telecom infrastructure, deep defence budgets, and clusters of RF research centres. Europe follows, driven by coordinated 5G corridors and aerospace programmes, while Asia-Pacific shows the quickest market growth as China, South Korea, and Japan race to localise compound-semiconductor production.

• North America – Largest revenue base; strong defence and telecom pull.

• Europe – Accelerating 5G corridors, strict energy standards favour efficient amplifiers.

• Asia-Pacific – Fastest CAGR on the back of consumer-electronics manufacturing and smart-city investment.

• Latin America – Upgrades to broadcast networks and new satellite gateways spur moderate demand.

• Middle East & Africa – Growing airport radar and oil-&-gas telemetry projects create niche opportunities.

Segmentation Analysis

By Type

• Broadband Amplifiers – Wideband backbone.

These units cover multiple bands with one box, slashing spare-parts inventory for telecom and test-equipment operators.

• Band-Specific Amplifiers – Precision performance.

Optimised narrow-band designs deliver higher gain and lower noise where spectral purity outweighs flexibility, common in satcom earth stations.

• Gain Block & Low-Noise Amplifiers – Signal integrity champions.

Used up-front in receivers and lab analysers, they ensure minimal distortion before heavy amplification stages.

• Bi-Directional & Hi-Rel Amplifiers – Mission-critical workhorses.

Military radios and space payloads rely on these ruggedised blocks for simultaneous transmit-receive or extreme reliability under radiation and vibration.

By Frequency

• < 10 GHz – Volume driver.

Dominates cellular, Wi-Fi, and ISM applications where cost and mature silicon processes matter.

• 10 – 30 GHz – 5G and radar sweet spot.

Mid-band 5G, automotive radar, and point-to-point microwave links fuel strong demand for GaAs and GaN parts.

• > 30 GHz – Millimetre-wave frontier.

Essential for 6G, V-band backhaul, and high-resolution imaging; players focusing here gain early-mover advantage.

By Material

• Gallium Arsenide – Versatile and proven.

Favoured in handsets and VSAT modems for its balance of efficiency and cost.

• Gallium Nitride – High-power star.

Superior breakdown voltage and thermal performance make GaN the go-to for base-stations, radar, and solid-state RF cookers.

• Silicon Germanium and Others – Niche enablers.

Used where mixed-signal integration or ultra-high-frequency performance outweighs raw power.

By Use Case

• Communication Infrastructure – Core revenue engine.

Massive MIMO and small-cell roll-outs demand compact, efficient PAs to meet spectral-mask rules.

• Automotive & Industrial – Emerging high-growth lane.

24/77 GHz radar, vehicle-to-everything links, and predictive-maintenance sensors drive incremental volume.

• Smart Technologies & Others – Long-tail adopters.

Home robots, drones, and VR headsets integrate low-power linear drivers to extend battery life without sacrificing range.

Industry Developments & Instances

• May 2025 – A leading chipmaker unveiled a 400-W GaN pallet targeting 8T8R 5G macro radios.

• January 2025 – A U.S. defence contractor secured a multimillion contract to supply solid-state pulse amplifiers for next-generation airborne radar.

• September 2024 – European research consortium demonstrated liquid-metal cooling for kilowatt-class amplifiers, cutting junction temperature by 15 °C.

• March 2024 – Start-up Falcomm announced an ultra-efficient CMOS-GaN hybrid PA for Wi-Fi 7 routers, claiming 38 % power-added efficiency at 6 GHz.

Facts & Figures

• Communication infrastructure captures roughly 40 % of current market revenue.

• Gallium nitride devices grow at close to 14 % annually, outpacing the overall market growth.

• Average power-added efficiency of new-generation base-station PAs exceeds 45 %, up from 30 % five years ago.

• Over 65 cities worldwide now run private industrial 5G networks that specify high-power outdoor amplifiers.

• Thermal-design-power densities in GaN MMICs have surpassed 5 W/mm, halving device count in high-power racks.

Analyst Review & Recommendations

Our market analysis signals a decisive shift toward efficient, software-definable RF front-ends. Vendors that integrate GaN dies, advanced digital predistortion, and smart cooling will outpace average market growth. We recommend prioritising supply-chain resilience for compound-semiconductor substrates, partnering with system integrators on turnkey 5G and radar projects, and investing in AI-driven health monitoring that reduces downtime and boosts total cost-of-ownership value propositions.