Market Overview

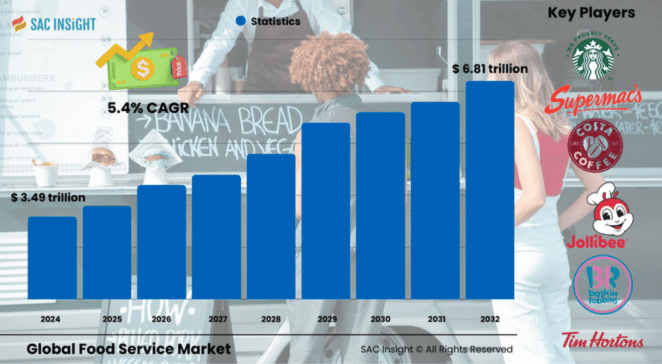

The global food service market size was valued at US$ 3.49 trillion in 2024 and is projected to reach about US$ 6.81 trillion by 2032, expanding at an average CAGR of 5.4% during 2026‑2032. First‑hand industry insights also confirm a post‑pandemic rebound in on‑premise dining, yet delivery and takeaway channels continue to outpace dine‑in traffic. The U.S. food service market is on track to approach US$ 1.71 trillion by 2032, buoyed by fast‑food expansion and premium coffee chains.

SAC Insight analysis points to four structural tailwinds:

• Urbanisation that concentrates demand for prepared meals.

• A decisive consumer shift toward convenience and digital ordering.

• Rising middle‑class incomes in Asia–Pacific.

• Renewed investment in automation that lowers front‑of‑house labour needs.

Summary of Market Trends & Drivers

-Health‑centric menus and transparent sourcing are now baseline expectations, prompting operators to reformulate with plant‑based proteins and locally sourced produce.

-Cloud kitchens and delivery‑only formats are scaling quickly, supported by venture funding and favourable unit economics.

-Robotics and AI‑assisted cooking reduce wait times and improve consistency, enhancing customer satisfaction and margins.

Key Market Players

The food service market report profiles leading multinationals alongside agile regional brands. Global quick‑service giants, premium coffee houses, and diversified restaurant groups dominate market share through extensive footprints and relentless menu innovation. Meanwhile, a cohort of tech‑forward independents is carving out niche segments with hyper‑local concepts and data‑driven customer engagement.

Key Takeaways

• 2024 market size: ~US$ 3.49 trillion

• 2032 forecast: ~US$ 6.81 trillion at a 5.4% CAGR

• Asia–Pacific commands ~46% market share, driven by youthful demographics and app‑based ordering.

• Full‑service restaurants still generate the largest revenue slice (~49%), but quick‑service outlets log the fastest unit growth.

• Independent operators hold >70% of outlets worldwide, underscoring the sector’s fragmentation.

• Delivery is the highest‑growth service mode, underpinned by smartphone penetration and aggregator partnerships.

Market Dynamics

Drivers

• Rising disposable incomes and dual‑income households boost spending on meals away from home.

• Mobile apps, digital wallets, and loyalty platforms streamline ordering and payment, fuelling market growth.

• Continuous product innovation—plant‑based items, limited‑time offers—keeps menus fresh and footfall steady.

Restraints

• Labour shortages and wage inflation pressure margins, especially for full‑service operators.

• Quality control challenges in long‑distance delivery can erode brand equity.

• Heightened regulatory scrutiny on nutrition labelling and single‑use plastics adds compliance costs.

Opportunities

• Expanding into tier‑2 and tier‑3 cities where organised food service penetration is low.

• Leveraging kitchen automation and predictive analytics to cut waste and optimise staffing.

• Developing subscription‑based meal plans to lock in recurring revenue.

Challenges

• Intense competition keeps average ticket prices in check.

• Supply‑chain disruptions—from climate events to geopolitical tensions—raise input volatility.

• Balancing dine‑in ambience investments with the capital needed for last‑mile delivery infrastructure.

Regional Analysis

North America and Europe remain mature, high‑value markets, but Asia–Pacific is the clear growth engine thanks to its large population, rapid urbanisation, and digital adoption. Latin America shows promise in casual dining concepts, while the Middle East & Africa benefit from tourism‑driven demand.

• North America: Premium coffee, fast‑casual bowls, and AI‑enabled drive‑thrus gain traction.

• Europe: Health‑conscious menus and strict sustainability standards shape product offerings.

• Asia‑Pacific: QSR localisation (e.g., spicy variants, rice bowls) accelerates unit rollout.

• Latin America: Full‑service restaurants dominate, yet aggregator‑led delivery is rising fast.

• Middle East & Africa: Upscale franchises thrive in retail malls; cloud kitchens bridge cuisine gaps.

Segmentation Analysis

By Establishment Type

Full‑Service Restaurants – Experience‑driven dining, largest revenue share.

Their broad menus and emphasis on ambience attract families and business diners alike, sustaining nearly half of global sales.

Quick‑Service Restaurants – Speed‑centric, fastest unit expansion.

Standardised menus, lower price points, and delivery friendliness make QSRs the go‑to for time‑pressed consumers.

Street Food & Cafés/Bars – Culture‑rich, high footfall.

Street stalls and cafés cater to local tastes and social occasions, providing flexible formats that thrive in dense urban settings.

Institutes & Others – Stable, contract‑based demand.

Corporate cafeterias, schools, and hospitals secure predictable volumes through long‑term agreements.

By Ownership Model

Independent Operators – 70%+ market share, hyper‑local appeal.

Owner‑run outlets innovate quickly and forge strong community ties, driving repeat visits.

Chain Restaurants – Higher CAGR (~3.5%), brand‑led scalability.

Franchised or company‑owned networks leverage centralised supply chains and marketing to ensure uniform quality and rapid market penetration.

By Service Mode

Delivery – Double‑digit growth, aggregator‑fuelled reach.

Smartphone ordering and real‑time tracking make delivery the preferred option for convenience‑seekers.

Takeaway – Steady volumes, low overhead.

Grab‑and‑go formats suit commuters and office workers, particularly in transit hubs.

Dine‑In – Experiential focus, post‑pandemic recovery.

Operators enhance décor and table tech (e‑menus, contactless pay) to entice guests back on‑site.

Industry Developments & Instances

Jan 2024: A leading quick‑service holding company agreed to acquire a 1,000‑unit franchisee, strengthening vertical integration.

Sep 2023: A polished‑casual group bought a 60‑location smokehouse chain for US$ 30 million to diversify its portfolio.

Mar 2023: A global coffee brand announced 100 new U.K. stores and a three‑year refurbishment programme.

Jun 2023: A pizza major debuted single‑serve “melts,” targeting the snacking occasion.

Feb 2022: A burger chain expanded kitchen robotics to 100 additional sites after productivity gains in pilot stores.

Facts & Figures

• Asia–Pacific captured ~46% market share in 2024.

• Full‑service restaurants generated 48.9% of global revenue in 2023.

• Independent outlets accounted for 71.5% of sales in 2023.

• Average digital order frequency rose 28% between 2021 and 2024.

• Cloud kitchens are expected to exceed US$ 120 billion in revenue by 2032.

• Kitchen automation can trim labour costs by up to 20% according to early adopters.

Analyst Review & Recommendations

SAC Insight evaluation indicates that sustained market growth will hinge on blending tech‑enabled convenience with authentic culinary experiences. Operators should double‑down on data‑driven menu engineering, invest in small‑footprint delivery kitchens for urban cores, and pilot robotics where wage pressure is acute. Chains that localise flavours and independents that embrace digital ordering are both well‑positioned to capture incremental demand through 2032."